Your What would happen in the market for loanable funds images are available in this site. What would happen in the market for loanable funds are a topic that is being searched for and liked by netizens now. You can Get the What would happen in the market for loanable funds files here. Find and Download all free images.

If you’re searching for what would happen in the market for loanable funds pictures information linked to the what would happen in the market for loanable funds topic, you have visit the right blog. Our website always gives you suggestions for seeing the highest quality video and picture content, please kindly hunt and find more informative video articles and images that match your interests.

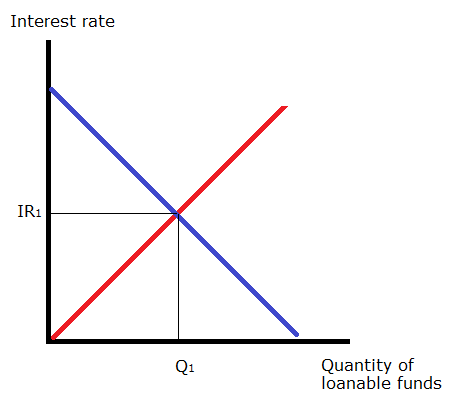

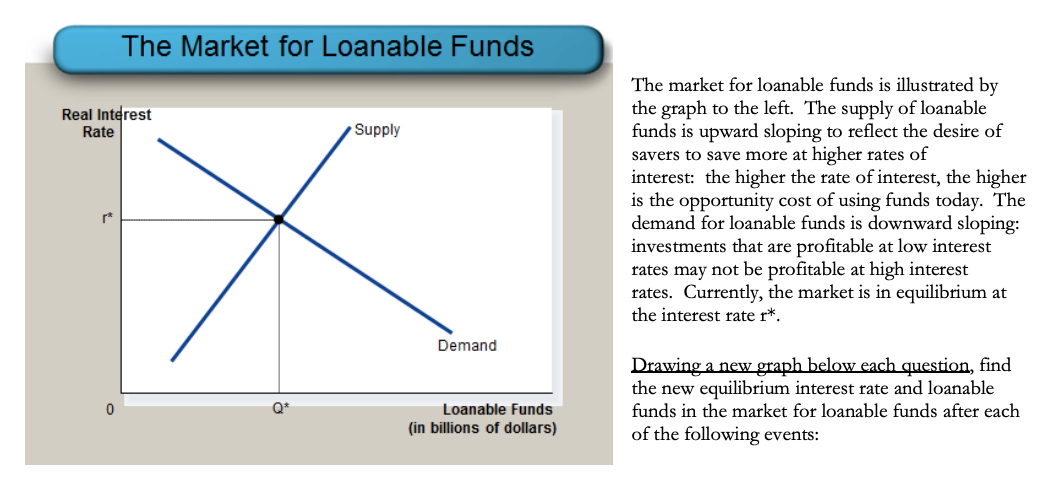

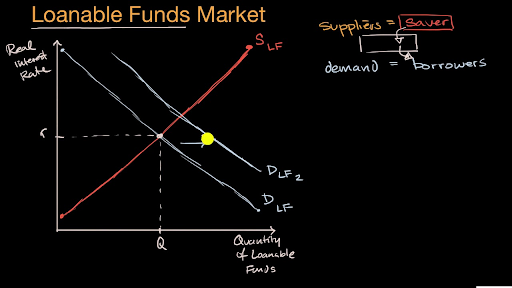

What Would Happen In The Market For Loanable Funds. For each of the given scenarios adjust the appropriate curve on the graph to help you complete the questions that follow. The loanable funds demand is higher than the supply. If people trust the government and trust that the borrowed money will be used productively the D LF curve moves rightward and interest rates are. An upward shift in the demand curve for loanable funds increases the real interest rate from r to r 1.

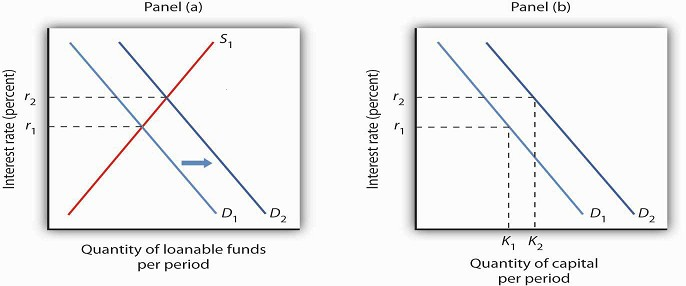

Events in the loanable funds market can also affect the quantity of capital firms will hold. Supply increases O D. R 10 12000Q where r is the real interest rate expressed as a percent eg if r 10 then the interest rate is 10 and Q is the quantity. What would happen in the market for loanable funds if the government were to increase the tax on interest income. The demand for loanable funds would shift left. What occurs in the loanable funds market.

Neither curve shifts but the quantity of loanable funds supplied increases and the quantity demanded decreases as the interest rate rises to equilibrium.

The demand for loanable funds would shift left. This raises the real interest rate thus reducing net capital outflow. What would happen in the market for loanable funds. What would happen in the market for loanable funds if the government were to decrease the tax rate on interest income. Demand decreases O c. Interest rates would rise B.

Source: freeeconhelp.com

Source: freeeconhelp.com

Additionally what shifts supply of loanable funds. Changes in the Loanable Funds Market and the Demand for Capital. What happens in the loanable funds market if the government borrows money is context-dependent. Events in the loanable funds market can also affect the quantity of capital firms will hold. The demand for loanable funds would shift right.

![]() Source: policonomics.com

Source: policonomics.com

If there is an increase in savings by the private sector the supply of loanable funds increases shifts right causing the real interest rate to fall. The effect on the interest rate is uncertain. The supply of loanable funds would shift right. What occurs in the loanable funds market. The decline in net capital outflow reduces the supply of dollars in the market for foreign exchange raising the real exchange rate.

What occurs in the loanable funds market. The demand for loanable funds would shift left. Supply increases O D. R 10 12000Q where r is the real interest rate expressed as a percent eg if r 10 then the interest rate is 10 and Q is the quantity. When the money supply increases the supply of loanable funds increases Thus the interest rate will decrease.

Source: econ101help.com

Source: econ101help.com

The following graph shows the market for loanable funds. The following graph shows the market for loanable funds. The quantity of loanable funds traded to increase. Tax reforms encouraged greater saving or the budget deficit became smaller. Suppose for example that consumers decide to increase current consumption and thus to supply fewer funds to the loanable funds market at any interest rate.

Interest rates would fall as the supply of loanable funds increased. The quantity of loanable funds traded to increase. A higher interest rate increases the domestic savings of. Neither curve shifts but the quantity of loanable funds supplied increases and the quantity demanded decreases as the interest rate rises to equilibrium. If the market rate is below the equilibrium interest rate the market faces excess demand.

Source: opentextbooks.org.hk

Source: opentextbooks.org.hk

What would happen in the market for loanable funds if the government were to decrease the tax rate on interest income. If there is an increase in savings by the private sector the supply of loanable funds increases shifts right causing the real interest rate to fall. If the current market interest rate for loanable funds is below the equilibrium level which of the following is most likely to happen. Debt-to-GDP ratio typically increases during war time. Interest rates would be unaffected C.

Source: slideplayer.com

Source: slideplayer.com

QUESTION 19 2 points If the government runs a budget deficit what would happen to the market for loanable funds. Tax reforms encouraged greater saving or the budget deficit became smaller. What would happen in the market for loanable funds if the government were to increase the tax on interest income. If the market rate is below the equilibrium interest rate the market faces excess demand. Neither curve shifts but the quantity of loanable funds supplied increases and the quantity demanded decreases as the interest rate rises to equilibrium.

Source: economics.stackexchange.com

Source: economics.stackexchange.com

What would happen in the market for loanable funds. Because interest rates are higher borrowing costs are more expensive. Changes in the demand for capital affect the loanable funds market and changes in the loanable funds market can affect the quantity of capital demanded. When the money supply increases the supply of loanable funds increases Thus the interest rate will decrease. The supply of loanable funds shifts leftward.

Source: econ101help.com

Source: econ101help.com

AThe quantity of loanable funds demanded will exceed the quantity of loanable funds supplied and the interest rate will rise. The loanable funds market illustrates the interaction of borrowers and savers in the economy. The following graph shows the market for loanable funds. A Supply and demand for loanable funds determines the real interest rate B Savers and lenders supply money to the loanable funds market C Government firms and individuals make up the demand in the loanable funds market D The supply of loanable funds is vertical and is set by the Federal Reserve government lowers corporate taxes to. If people trust the government and trust that the borrowed money will be used productively the D LF curve moves rightward and interest rates are.

Source: slideplayer.com

Source: slideplayer.com

Raises the interest rate and reduces investment. What would happen to the market for loanable funds if the government runs a large budget deficit. AThe quantity of loanable funds demanded will exceed the quantity of loanable funds supplied and the interest rate will rise. The following graph shows the market for loanable funds. Interest rates would fall as the supply of loanable funds increased.

The following graph shows the market for loanable funds. If savers were to increase the level of savings in an economy what would happen in the loanable funds market. An upward shift in the demand curve for loanable funds increases the real interest rate from r to r 1. What would happen in the market for loanable funds if the government were to increase the tax on interest income. Supply increases O D.

Source: chegg.com

Source: chegg.com

If people trust the government and trust that the borrowed money will be used productively the D LF curve moves rightward and interest rates are. The demand and supply of loanable funds would shift right. Raises the interest rate and reduces investment. The demand and supply of loanable funds would shift left. The loanable funds market illustrates the interaction of borrowers and savers in the economy.

Source: slidetodoc.com

Source: slidetodoc.com

Neither curve shifts but the quantity of loanable funds supplied increases and the quantity demanded decreases as the interest rate rises to equilibrium. The trade balance also moves toward deficit because net capital outflow hence net exports is lower. For each of the given scenarios adjust the appropriate curve on the graph to help you complete the questions that follow. There would be an increase in the amount of loanable funds borrowed. If there is a shortage in loanable funds then a.

The supply of loanable funds shifts leftward. The demand for loanable funds would shift left. The supply for loanable funds shifts left and the demand shifts right. If the market rate is below the equilibrium interest rate the market faces excess demand. The supply of loanable funds would shift right.

Source: khanacademy.org

Source: khanacademy.org

When the real interest rate decreases investment spending increases. The quantity of loanable funds traded to increase. AThe quantity of loanable funds demanded will exceed the quantity of loanable funds supplied and the interest rate will rise. What would happen in the market for loanable funds if the government were to decrease the tax rate on interest income. The demand for loanable funds would shift left.

What would happen to the market for loanable funds if the government runs a large budget deficit. The quantity demanded is greater than the quantity supplied and the interest rate will rise. What happens in the loanable funds market if the government borrows money is context-dependent. Neither curve shifts but the quantity of loanable funds supplied increases and the quantity demanded decreases as the interest rate rises to equilibrium. The supply of loanable funds would shift to the right if either.

Source: courses.lumenlearning.com

Source: courses.lumenlearning.com

What would happen to the market for loanable funds if the government offered tax breaks for companies building new factories. What occurs in the loanable funds market. The trade balance also moves toward deficit because net capital outflow hence net exports is lower. The demand and supply of loanable funds would shift right. There would be an increase in the amount of loanable funds borrowed.

Source: slidetodoc.com

Source: slidetodoc.com

The demand for loanable funds would shift left. Demand decreases O c. The following graph shows the market for loanable funds. QUESTION 19 2 points If the government runs a budget deficit what would happen to the market for loanable funds. This causes the demand for loanable funds to decrease.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what would happen in the market for loanable funds by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.