Your What shifts the supply of loanable funds images are ready in this website. What shifts the supply of loanable funds are a topic that is being searched for and liked by netizens today. You can Download the What shifts the supply of loanable funds files here. Find and Download all free photos.

If you’re searching for what shifts the supply of loanable funds pictures information connected with to the what shifts the supply of loanable funds topic, you have pay a visit to the right site. Our website always gives you hints for seeing the maximum quality video and picture content, please kindly search and locate more informative video content and graphics that match your interests.

What Shifts The Supply Of Loanable Funds. Capital money can be invested as either a means to purchase assets or stock or loanable funds to a business that might accom. The supply for loanable funds shifts right and the demand shifts left. B quantity of loanable funds supplied exceeds the quantity of loanable funds demanded. When a foreign investor chooses to increase their purchase of domestic assets like bonds that places more money into the banking system and increases the supply of loanable funds.

Loanable Funds Market Ppt Download From slideplayer.com

Loanable Funds Market Ppt Download From slideplayer.com

So when taxes are increased the real interest rate associated with the loanable funds increases. The loanable funds market illustrates the interaction of borrowers and savers in the economy. The aggregate loanable fund supply curve SL also slopes upwards to the right showing the greater supply. This is why the supply curve in the loanable funds framework slopes upwards in a graph with interest rates on the vertical axis and the quantity of loanable funds on the horizontal axis. Anything which increases national savings other than a decrease in the real interest. Decreases in income more people in midlife more retired people increases in wealth increases in time preferences Drag appropriate answers here Decreases.

The Demand and Supply of Loanable Funds.

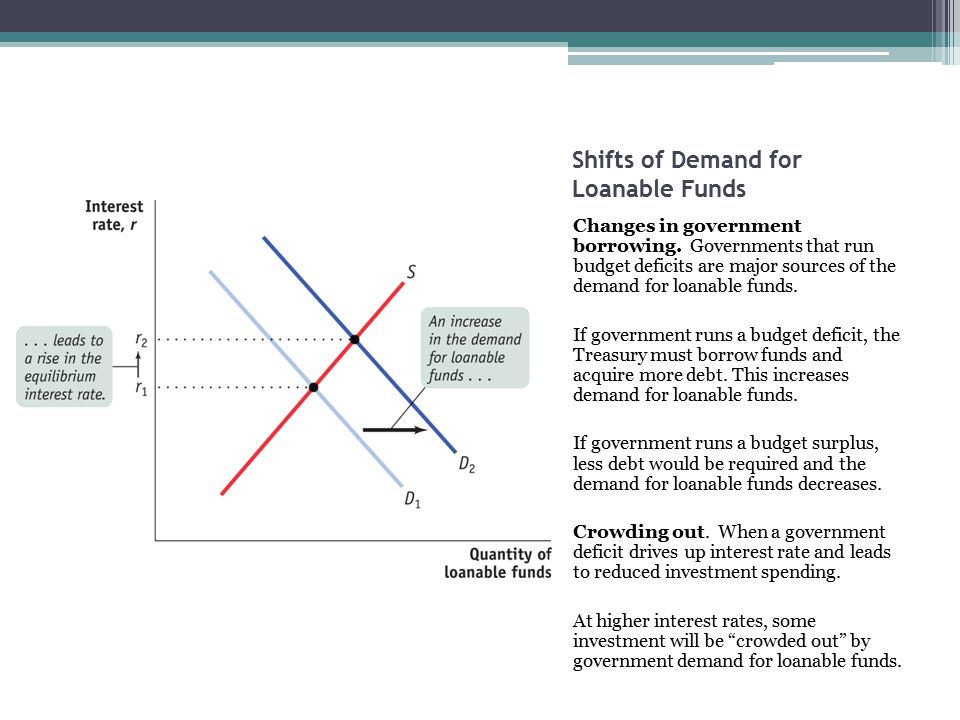

Say the government increases the budget deficit. The increase in deficit prompted the government to increase the demand for loanable funds on the financial market. Foreign Purchases of Domestic Assets direct International investments 4. Meanwhile two factors that cause the demand for loanable funds to shift are. The quantity of loanable funds supplied decreases and the quantity demanded rises as the interest rate falls to equilibrium. In the long run real GDP falls back to its original level as wages and other nominal prices rise.

THE INTEREST RATE IN THE LONG RUN In the loanable funds market an increase in the money supply leads to a short-run rise in real GDP and shifts the supply of loanable funds rightward. It is a variation of a market model but what is being bought and sold is money that has been saved. The supply of loanable funds will decreaseshift to left increasing interest rate. 1 Factors Causing Shifts in Supply and Demand Curves for Loanable Funds Fin. It would depend on what the owners of the capital wanted to do with the money and perhaps what the relevant interest rate was compared to the ROI rate.

Source: slidetodoc.com

Source: slidetodoc.com

Willingness to save will increase. C demand for loanable funds exceeds supply of loanable funds. The quantity of loanable funds supplied decreases and the quantity demanded rises as the interest rate falls to equilibrium. A Supply and demand for loanable funds determines the real interest rate B Savers and lenders supply money to the loanable funds market C Government firms and individuals make up the demand in the loanable funds market D The supply of loanable funds is vertical and is set by the Federal Reserve government lowers corporate taxes to. A change in disposable income expected future income wealth or default risk changes the supply of loanable funds.

Source: slideplayer.com

Source: slideplayer.com

Federal Reserve Lending direct Lending via discount window 3. For example if you have an extra 5000 in your checking account and you see that. The supply of loanable funds will increaseshift to right so will the demand. Borrowers demand loanable funds and savers supply loanable funds. The loanable funds market is like any other market with a supply curve and demand curve along with an equilibrium price and quantity.

Source: macro.shawnzhong.com

Source: macro.shawnzhong.com

D Neither curve shifts. The supply of loanable funds is generally upward-sloping. Foreign Purchases of Domestic Assets direct International investments 4. The market is in equilibrium when the real interest rate has adjusted so. D supply of loanable funds curve shifts rightward.

Source: opentextbooks.org.hk

Source: opentextbooks.org.hk

For example if you have an extra 5000 in your checking account and you see that. When the disposable income of people falls savings fall too. For example if you have an extra 5000 in your checking account and you see that. The supply of loanable funds will decreaseshift to left increasing interest rate. A change in disposable income expected future income wealth or default risk changes the supply of loanable funds.

Source: slideplayer.com

Source: slideplayer.com

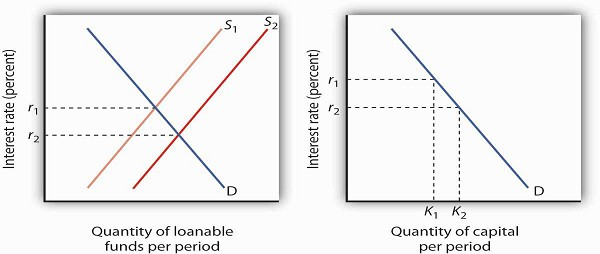

Expectations For Future Economy direct Anticipation of economic performance. Here a decrease in consumer saving causes a shift in the supply of loanable funds from S1 to S2 in Panel a. The supply of loanable funds will decreaseshift to left increasing interest rate. Borrowers demand loanable funds and savers supply loanable funds. In the loanable funds market a shortage of loanable funds occurs when the.

Source: welkerswikinomics.com

Source: welkerswikinomics.com

B quantity of loanable funds supplied exceeds the quantity of loanable funds demanded. Increase in supply Rightward shift in SLF curve Real interest rates decrease Quantity of investment increases. It is a variation of a market model but what is being bought and sold is money that has been saved. Federal Reserve Lending direct Lending via discount window 3. Identify whether the following factors that shift the supply of loanable funds increase or decrease the supply of loanable funds.

Source: khanacademy.org

Source: khanacademy.org

A change that begins in the loanable funds market can affect the quantity of capital firms demand. For example if you have an extra 5000 in your checking account and you see that. So when taxes are increased the real interest rate associated with the loanable funds increases. The Demand and Supply of Loanable Funds. The quantity of loanable funds supplied decreases and the quantity demanded rises as the interest rate falls to equilibrium.

Source: slideshare.net

Source: slideshare.net

This is why the supply curve in the loanable funds framework slopes upwards in a graph with interest rates on the vertical axis and the quantity of loanable funds on the horizontal axis. When the disposable income of people falls savings fall too. The demand for loanable funds is downward-sloping. If the government has a budget surplus it increases the supply of loanable funds the real interest rate falls which decreases household saving and decreases the quantity of private funds supplied. I had just one question regarding government and loanable funds.

Source: slideplayer.com

Source: slideplayer.com

Say the government increases the budget deficit. Identify whether the following factors that shift the supply of loanable funds increase or decrease the supply of loanable funds. D supply of loanable funds curve shifts rightward. The supply for loanable funds shifts left and the demand shifts right. Willingness to save will increase.

Source: econ101help.com

Source: econ101help.com

Federal Reserve Lending direct Lending via discount window 3. A Change in the Loanable Funds Market and the Quantity of Capital Demanded. If the government has a budget surplus it increases the supply of loanable funds the real interest rate falls which decreases household saving and decreases the quantity of private funds supplied. The Savings Rate direct Consumer or corporate savings levels 2. The loanable funds market is like any other market with a supply curve and demand curve along with an equilibrium price and quantity.

Source: courses.lumenlearning.com

Source: courses.lumenlearning.com

The market is in equilibrium when the real interest rate has adjusted so. Federal Reserve Lending direct Lending via discount window 3. The loanable funds market illustrates the interaction of borrowers and savers in the economy. This is why the supply curve in the loanable funds framework slopes upwards in a graph with interest rates on the vertical axis and the quantity of loanable funds on the horizontal axis. If the government has a budget surplus it increases the supply of loanable funds the real interest rate falls which decreases household saving and decreases the quantity of private funds supplied.

Source: slidetodoc.com

Source: slidetodoc.com

Identify whether the following factors that shift the supply of loanable funds increase or decrease the supply of loanable funds. What makes this market different is the axis labels and the determinants that shift both curves. Increases Supply of Loanable Funds Drag appropriate answers here. The Savings Rate direct Consumer or corporate savings levels 2. So drawing it and manipulating it isnt too difficult if you remember a few key things.

Source: courses.lumenlearning.com

Source: courses.lumenlearning.com

Decreases in income more people in midlife more retired people increases in wealth increases in time preferences Drag appropriate answers here Decreases. The aggregate loanable fund supply curve SL also slopes upwards to the right showing the greater supply. Expectations For Future Economy direct Anticipation of economic performance. The quantity of loanable funds supplied decreases and the quantity demanded rises as the interest rate falls to equilibrium. THE INTEREST RATE IN THE LONG RUN In the loanable funds market an increase in the money supply leads to a short-run rise in real GDP and shifts the supply of loanable funds rightward.

Source: youtube.com

Source: youtube.com

A Change in the Loanable Funds Market and the Quantity of Capital Demanded. The supply for loanable funds shifts right and the demand shifts left. Increase in supply Rightward shift in SLF curve Real interest rates decrease Quantity of investment increases. The Fed sells bonds. Borrowers demand loanable funds and savers supply loanable funds.

Source: slidetodoc.com

Source: slidetodoc.com

So drawing it and manipulating it isnt too difficult if you remember a few key things. If the government has a budget surplus it increases the supply of loanable funds the real interest rate falls which decreases household saving and decreases the quantity of private funds supplied. Ive seen other questions that ask what happens to supply and demand for loanable funds in government increases spending and increases deficit. So when taxes are increased the real interest rate associated with the loanable funds increases. Federal Reserve Lending direct Lending via discount window 3.

Increases Supply of Loanable Funds Drag appropriate answers here. Supply of Loanable Funds. C The supply of loanable funds shifts left and demand shifts right. This video explains why the supply curve for loanable funds increases. Capital money can be invested as either a means to purchase assets or stock or loanable funds to a business that might accom.

Source: slideplayer.com

Source: slideplayer.com

For example if you have an extra 5000 in your checking account and you see that. Unemployment rate is 6 and CPI is inc. For example if you have an extra 5000 in your checking account and you see that. The loanable funds market illustrates the interaction of borrowers and savers in the economy. The demand for loanable funds is downward-sloping.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what shifts the supply of loanable funds by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.