Your What shifts the money supply curve images are available in this site. What shifts the money supply curve are a topic that is being searched for and liked by netizens today. You can Get the What shifts the money supply curve files here. Download all royalty-free images.

If you’re searching for what shifts the money supply curve pictures information connected with to the what shifts the money supply curve topic, you have come to the ideal blog. Our website frequently provides you with suggestions for viewing the maximum quality video and image content, please kindly surf and locate more informative video articles and images that match your interests.

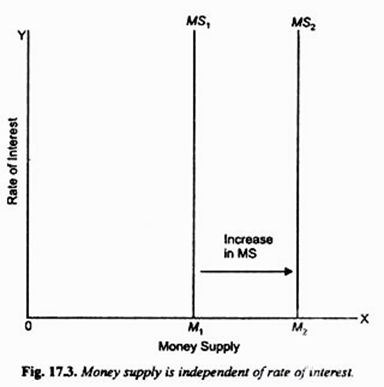

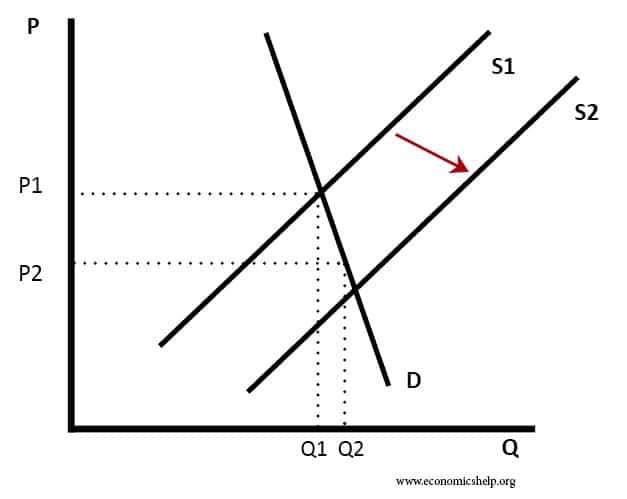

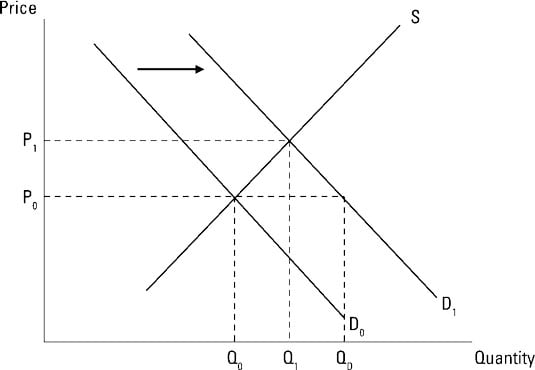

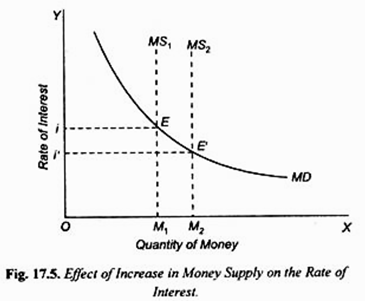

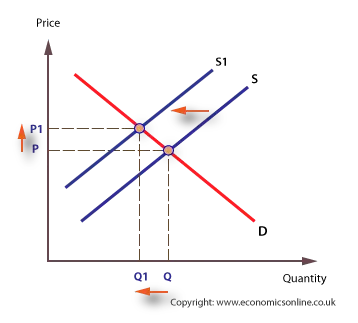

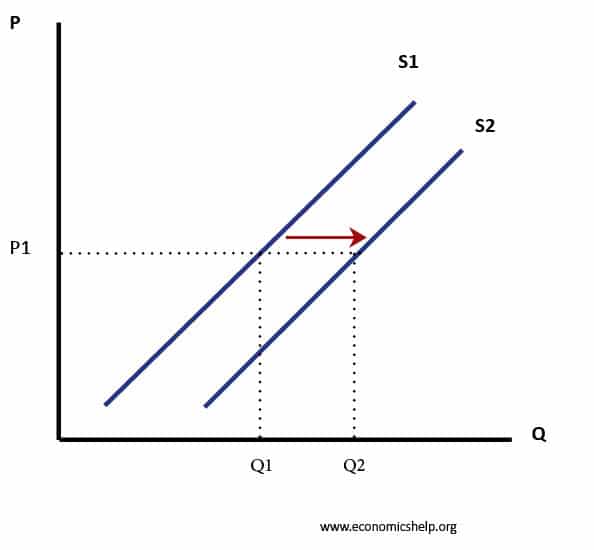

What Shifts The Money Supply Curve. The curve shifts to the right if the determinant causes demand to increase. When the central monetary authority of the government or the country adopts an easy expansionary monetary policy the supply of money increases in the economy and the LM curve shifts right. This occurs because people need more money to pay the higher prices but the higher resulting interest rates lower the demand for money. When the economy is booming buyers incomes will rise.

Unemployment and inflation that arise in the short run as aggregate demand shifts the economy along the short-run aggregate supply curve. When money demand increases the demand curve for money shifts to the right which leads to a higher nominal interest rate. The money supply shifts right prices rise demand curve shifts left. The increase in money supply due to the governments monetary expansion policy shifts the LM curve rightwards. According to AHA there was a downward trend in health spending growth in 2002 due to a decline in utilization. B sale of Treasury bills.

Suppose the money supply curve shifts to the left.

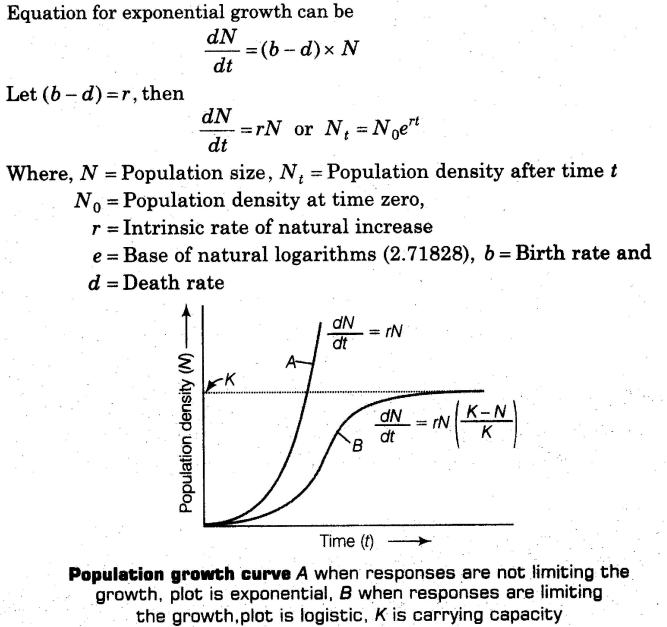

To see why the interest rate falls. Provide at least one 1 example showing the manner in which the cost curve shifts in your response. At higher price levels or higher interest rates the purchasing power or real wealth of consumers reduces since they have to spend more to acquire each unit of a commodity. If the money supply increases decreases ceteris paribus the interest rate is lower higher at each level of Y or in other words the LM curve shifts right left. Similarly an increase in the demand for money for instance raises the rate of interest by shifting the LM curve leftward Fig16. Changes in money demand and changes in the money supply.

Source: analystprep.com

Source: analystprep.com

A decrease in the price level shifts the money supply curve right. The money supply shifts right the interest rate falls investment increases and the aggregate demand curve shifts right. B sale of Treasury bills. A decrease in nominal wages results in a shift of the aggregate supply curve to the right. Similarly an increase in the demand for money for instance raises the rate of interest by shifting the LM curve leftward Fig16.

Source: economicsdiscussion.net

Source: economicsdiscussion.net

If the price level declines the LM curve shifts right. Theyll buy more of everything even though the price hasnt changed. The increase in money supply due to the governments monetary expansion policy shifts the LM curve rightwards. Explain the impact of the Feds action from part A. When the central monetary authority of the government or the country adopts an easy expansionary monetary policy the supply of money increases in the economy and the LM curve shifts right.

Source: economicshelp.org

Source: economicshelp.org

The money supply shifts right the interest rate rises investment decreases and the aggregate demand curve shifts left. The curve shifts to the right if the determinant causes demand to increase. If the price level declines the LM curve shifts right. If the money supply increases decreases ceteris paribus the interest rate is lower higher at each level of Y or in other words the LM curve shifts right left. When the central monetary authority of the government or the country adopts an easy expansionary monetary policy the supply of money increases in the economy and the LM curve shifts right.

Source: toppr.com

Source: toppr.com

The slope is downward because of the following effects. When the economy is booming buyers incomes will rise. Changes in Money Supply. If the price level declines the LM curve shifts right. If the Fed sells bonds then the money supply curve shifts right.

Source: econindepth.weebly.com

Source: econindepth.weebly.com

To see why the interest rate falls. From the e-Activity compare the healthcare-based factors in the issues that you reviewed that in your opinion cause the cost curve of healthcare to shift. Explain the impact of the Feds action from part A. If the Fed purchases bonds then the money supply curve shifts right. A purchase of Treasury bills.

Source: dummies.com

Source: dummies.com

The factors that cause aggregate supply curve short-run shifts include. The money supply shifts right the interest rate rises investment decreases and the aggregate demand curve shifts left. The curve shifts to the right if the determinant causes demand to increase. A change in the price level does not shift the money supply curve. A decrease in the price level shifts the money supply curve right.

When the economy has high and rising inflation it is. A decrease in nominal wages results in a shift of the aggregate supply curve to the right. In the late 1960s economist Edmund Phelps published a paper that. From the e-Activity compare the healthcare-based factors in the issues that you reviewed that in your opinion cause the cost curve of healthcare to shift. The most likely cause for this shift is the FOMCs open-market.

Source: economicsdiscussion.net

Source: economicsdiscussion.net

Similarly an increase in the demand for money for instance raises the rate of interest by shifting the LM curve leftward Fig16. Real GDP and the price level that arise in the short run as short-run aggregate supply shifts the economy along the aggregate demand curve. The money supply shifts right the interest rate falls investment increases and the aggregate demand curve shifts right. We can see that the interest rate will fall to r 2. Suppose the money supply curve shifts to the left.

If the money supply increases decreases ceteris paribus the interest rate is lower higher at each level of Y or in other words the LM curve shifts right left. B sale of Treasury bills. When money demand increases the demand curve for money shifts to the right which leads to a higher nominal interest rate. A change in the price level does not shift the money supply curve. Real GDP and the price level that arise in the short run as short-run aggregate supply shifts the economy along the aggregate demand curve.

Source: financetrain.com

Source: financetrain.com

Consumer wealth responds inversely to changes in price. The money supply shifts right the interest rate rises investment decreases and the aggregate demand curve shifts left. A decrease in the price level shifts the money supply curve right. Changes in money demand and changes in the money supply. When the Fed sells bonds the supply curve of bonds shifts to the right and the price of bonds falls.

Source: economicsonline.co.uk

Source: economicsonline.co.uk

When the economy is booming buyers incomes will rise. A change in the price level does not shift the money supply curve. When the economy is booming buyers incomes will rise. Explain the impact of the Feds action from part A. Real GDP and the price level that arise in the short run as short-run aggregate supply shifts the economy along the aggregate demand curve.

A decrease in the price level shifts the money supply curve right. Investment falls and so income. The money supply shifts right the interest rate rises investment decreases and the aggregate demand curve shifts left. This occurs because people need more money to pay the higher prices but the higher resulting interest rates lower the demand for money. The money supply shifts right the interest rate falls investment increases and the aggregate demand curve shifts right.

Source: investopedia.com

Source: investopedia.com

A change in the overall price level P. In the late 1960s economist Edmund Phelps published a paper that. When the economy is booming buyers incomes will rise. According to AHA there was a downward trend in health spending growth in 2002 due to a decline in utilization. If the price level rises the LM curve shifts left.

Source: ifioque.com

Source: ifioque.com

An increase in nominal wages increases production costs hence a leftward shift in the aggregate supply curve. When the economy is booming buyers incomes will rise. On the interest rate and on aggregate demand. The bond sales lead to a reduction in the money supply causing the money supply curve to shift to the left and raising the equilibrium interest rate. Changes in Money Supply.

Source: rhayden.us

Source: rhayden.us

If the money supply increases decreases ceteris paribus the interest rate is lower higher at each level of Y or in other words the LM curve shifts right left. When the central monetary authority of the government or the country adopts an easy expansionary monetary policy the supply of money increases in the economy and the LM curve shifts right. Panel a shows that the money demand curve shifts to the left to D 2. A purchase of Treasury bills. A decrease in nominal wages results in a shift of the aggregate supply curve to the right.

If the Fed purchases bonds then the money supply curve shifts right. Unemployment and inflation that arise in the short run as aggregate demand shifts the economy along the short-run aggregate supply curve. A money market is an economic model for describing a countrys money supply and demand while a demand curve denotes the quantity of money demanded at. An increase in nominal wages increases production costs hence a leftward shift in the aggregate supply curve. If the price level rises the LM curve shifts left.

Source: web.mnstate.edu

Source: web.mnstate.edu

This occurs because people need more money to pay the higher prices but the higher resulting interest rates lower the demand for money. If the Fed sells bonds then the money supply curve shifts right. The money supply shifts right the interest rate rises investment decreases and the aggregate demand curve shifts left. To see why the interest rate falls. B sale of Treasury bills.

Source: economicshelp.org

Source: economicshelp.org

That is because at any given level of output Y more money less money. On the interest rate and on aggregate demand. B sale of Treasury bills. Real GDP and the price level that arise in the short run as short-run aggregate supply shifts the economy along the aggregate demand curve. This raises investment in the commodity market.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what shifts the money supply curve by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.