Your What shifts supply of loanable funds images are ready. What shifts supply of loanable funds are a topic that is being searched for and liked by netizens today. You can Find and Download the What shifts supply of loanable funds files here. Find and Download all royalty-free photos and vectors.

If you’re searching for what shifts supply of loanable funds pictures information connected with to the what shifts supply of loanable funds topic, you have come to the ideal blog. Our site frequently gives you hints for refferencing the maximum quality video and picture content, please kindly search and locate more enlightening video articles and graphics that match your interests.

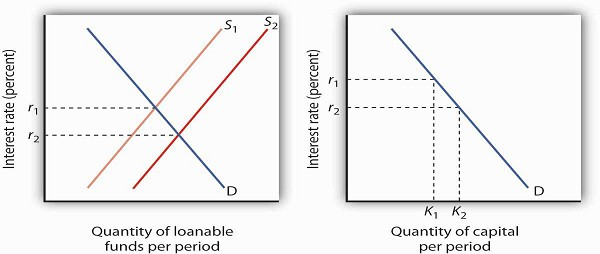

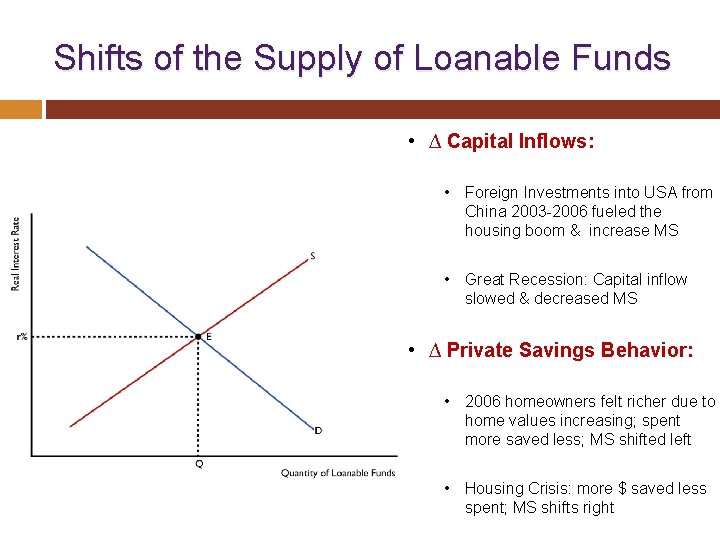

What Shifts Supply Of Loanable Funds. Foreign Purchases of Domestic Assets direct International investments 4. Please log in or register to answer this question. Capital money can be invested as either a means to purchase assets or stock or loanable funds to a. Changes in the demand for capital affect the loanable funds market and changes in the loanable funds market affect the quantity of capital demanded.

The Market For Loanable Funds From econ101help.com

The Market For Loanable Funds From econ101help.com

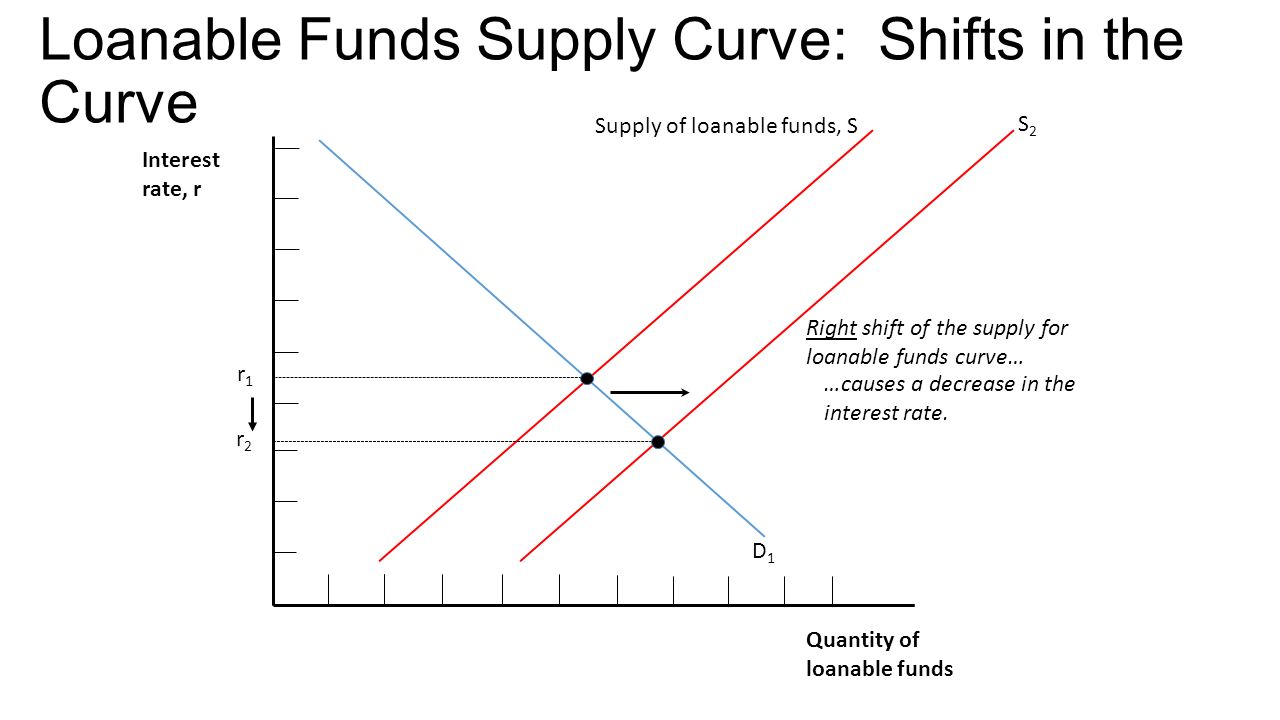

An increase in disposable income shifts the supply of loanable funds curve. Anything which decreases national savings other than an increase in the real interest rate will shift the supply curve of loanable funds to the left. Demand for Loanable Funds. The Savings Rate direct Consumer or corporate savings levels 2. E quantity of loanable funds demanded exceeds the quantity of loanable funds supplied. 325 Factor Affect on Affect on Impacting Supply Demand Wealth Income Increase NA As wealth and income increase funds suppliers are more willing to supply funds to.

The loanable funds theory views the level of interest rates as resulting from factors that affect the supply of and demand for loanable funds.

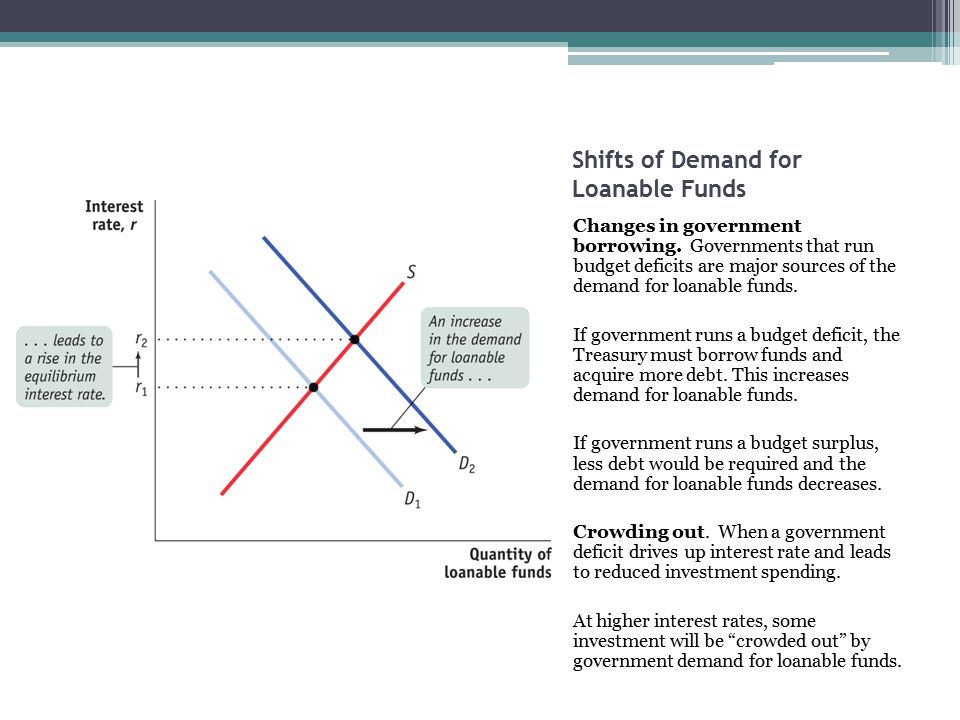

Changes in government spending. Say the government increases the budget deficit. The interest rate is determined in the market for loanable funds. The increase in deficit prompted the government to increase the demand for loanable funds on the financial market. Here a decrease in consumer saving causes a shift in the supply of loanable funds from S1 to S2 in Panel a. A change that begins in the loanable funds market can affect the quantity of capital firms demand.

Source: courses.lumenlearning.com

Source: courses.lumenlearning.com

A Supply and demand for loanable funds determines the real interest rate B Savers and lenders supply money to the loanable funds market C Government firms and individuals make up the demand in the loanable funds market D The supply of loanable funds is vertical and is set by the Federal Reserve government lowers corporate taxes to. Expectations For Future Economy direct Anticipation of economic performance. 1 Factors Causing Shifts in Supply and Demand Curves for Loanable Funds Fin. B leftward and increases the real interest rate. What factors shift the demand for loanable funds.

Source: khanacademy.org

Source: khanacademy.org

The interest rate is determined in the market for loanable funds. An increase in the budget surplusa. The Savings Rate direct Consumer or corporate savings levels 2. The interest rate is determined in the market for loanable funds. What factors shift the demand for loanable funds.

Source: econ101help.com

Source: econ101help.com

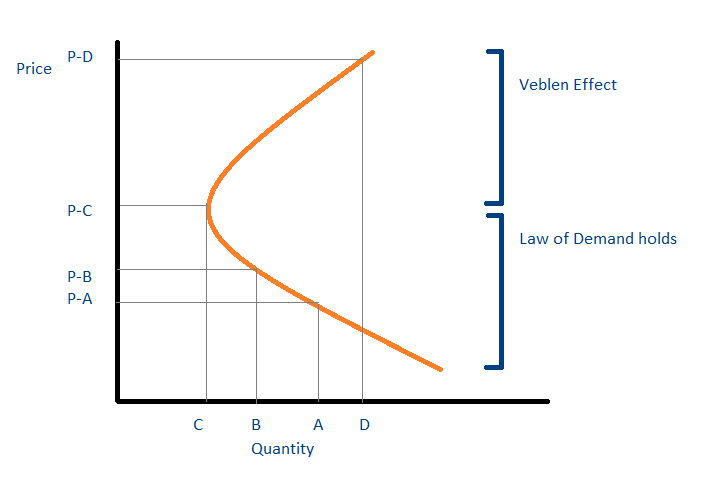

Consumption smoothing is another factor that shifts the loanable funds supply. The supply curve has a positive slope. Expectations For Future Economy direct Anticipation of economic performance. The demand curve for loanable funds has a negative slope. Supply of loanable funds shifts left.

Source: economics.stackexchange.com

Source: economics.stackexchange.com

Say the government increases the budget deficit. Here a decrease in consumer saving causes a shift in the supply of loanable funds from S1 to S2 in Panel a. Figure 134 A Change in the Loanable Funds Market and the Quantity of Capital Demanded. A change that begins in the loanable funds market can affect the quantity of capital firms demand. A Change in the Loanable Funds Market and the Quantity of Capital Demanded.

Capital money can be invested as either a means to purchase assets or stock or loanable funds to a. It would depend on what the owners of the capital wanted to do with the money and perhaps what the relevant interest rate was compared to the ROI rate. Supply of loanable funds shifts left. Anything which increases national savings other than a decrease in the real interest. C rightward and decreases the real interest rate.

Source: courses.lumenlearning.com

Source: courses.lumenlearning.com

E quantity of loanable funds demanded exceeds the quantity of loanable funds supplied. Anything which increases national savings other than a decrease in the real interest. This decreases real interest rates. A Change in the Loanable Funds Market and the Quantity of Capital Demanded. B leftward and increases the real interest rate.

Source: slidetodoc.com

Source: slidetodoc.com

Anything which increases national savings other than a decrease in the real interest rate will shift the supply curve of loanable funds to the right. Anything which increases national savings other than a decrease in the real interest rate will shift the supply curve of loanable funds to the right. E quantity of loanable funds demanded exceeds the quantity of loanable funds supplied. The increase in deficit prompted the government to increase the demand for loanable funds on the financial market. Capital money can be invested as either a means to purchase assets or stock or loanable funds to a.

Source: brainly.com

Source: brainly.com

E quantity of loanable funds demanded exceeds the quantity of loanable funds supplied. A change that begins in the loanable funds market can affect the quantity of capital firms demand. Answer 1 of 3. Capital productivity is the main determinant of the demand for loanable funds. Consumption smoothing is another factor that shifts the loanable funds supply.

Source: slideplayer.com

Source: slideplayer.com

Here a decrease in consumer saving causes a shift in the supply of loanable funds from S1 to S2 in Panel a. Anything which increases national savings other than a decrease in the real interest rate will shift the supply curve of loanable funds to the right. The Savings Rate direct Consumer or corporate savings levels 2. Capital productivity is the main determinant of the demand for loanable funds. Changes in the demand for capital affect the loanable funds market and changes in the loanable funds market affect the quantity of capital demanded.

Source: opentextbooks.org.hk

Source: opentextbooks.org.hk

The supply curve has a positive slope. The increase in deficit prompted the government to increase the demand for loanable funds on the financial market. Demand for Loanable Funds. The aggregate loanable fund supply curve SL also slopes upwards to the right showing the greater supply of loanable funds at higher rates of interest. Shifts the demand for loanable funds to the right and increases the real interest rateb.

Source: macro.shawnzhong.com

Source: macro.shawnzhong.com

Study Guide for Mankiws Principles of Macroeconomics 7th Edition Edit edition Solutions for Chapter 13 Problem 20MCQ. Supply of loanable funds shifts left. A leftward and decreases the real interest rate. C rightward and decreases the real interest rate. This decreases real interest rates.

Source: slideplayer.com

Source: slideplayer.com

C rightward and decreases the real interest rate. Anything which decreases national savings other than an increase in the real interest rate will shift the supply curve of loanable funds to the left. It leads the demand curve to shift to the right and causes the economys interest rates to rise. The supply curve has a positive slope. C rightward and decreases the real interest rate.

Source: slideplayer.com

Source: slideplayer.com

Consumption smoothing is another factor that shifts the loanable funds supply. Consumption smoothing is another factor that shifts the loanable funds supply. An increase in the budget surplusa. Expectations For Future Economy direct Anticipation of economic performance. Here a decrease in consumer saving causes a shift in the supply of loanable funds from S1 to S2 in Panel a.

Source: slidetodoc.com

Source: slidetodoc.com

Here a decrease in consumer saving causes a shift in the supply of loanable funds from S1 to S2 in Panel a. The supply of loanable funds is the quantity of credit provided at every real interest rates by banks and other lenders in an economy. C rightward and decreases the real interest rate. Supply of loanable funds shifts left. Shifting the supply of loanable funds rightward and increasing investment.

Source: slideshare.net

Source: slideshare.net

The aggregate loanable fund supply curve SL also slopes upwards to the right showing the greater supply of loanable funds at higher rates of interest. Asked Jul 6 2016 in Economics by VespaKid. Neither curve shifts but the quantity of loanable funds supplied increases and the quantity demanded decreases as the interest rate rises to equilibrium. A Change in the Loanable Funds Market and the Quantity of Capital Demanded. A Supply and demand for loanable funds determines the real interest rate B Savers and lenders supply money to the loanable funds market C Government firms and individuals make up the demand in the loanable funds market D The supply of loanable funds is vertical and is set by the Federal Reserve government lowers corporate taxes to.

Source: youtube.com

Source: youtube.com

Here a decrease in consumer saving causes a shift in the supply of loanable funds from S1 to S2 in Panel a. Here a decrease in consumer saving causes a shift in the supply of loanable funds from S1 to S2 in Panel a. Supply of loanable funds shifts left. C rightward and decreases the real interest rate. We can obtain the total supply curve of loanable funds by a lateral summation of the curves of saving S dishoarding DH bank money BM and disinvestment DI.

Source: slidetodoc.com

Source: slidetodoc.com

The supply curve has a positive slope. It leads the demand curve to shift to the right and causes the economys interest rates to rise. Foreign Purchases of Domestic Assets direct International investments 4. An increase in disposable income shifts the supply of loanable funds curve. Shifting the supply of loanable funds rightward and increasing investment.

Source: econ101help.com

Source: econ101help.com

The supply for loanable funds shifts left and the demand shifts right. Here a decrease in consumer saving causes a shift in the supply of loanable funds from S1 to S2 in Panel a. Net capital outflow and increase the quantity of loanable funds demanded. It leads the demand curve to shift to the right and causes the economys interest rates to rise. The interest rate is determined in the market for loanable funds.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what shifts supply of loanable funds by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.