Your What shifts loanable funds images are available. What shifts loanable funds are a topic that is being searched for and liked by netizens now. You can Get the What shifts loanable funds files here. Get all free photos and vectors.

If you’re searching for what shifts loanable funds pictures information related to the what shifts loanable funds interest, you have visit the ideal blog. Our site always provides you with suggestions for seeking the highest quality video and image content, please kindly search and locate more informative video content and images that match your interests.

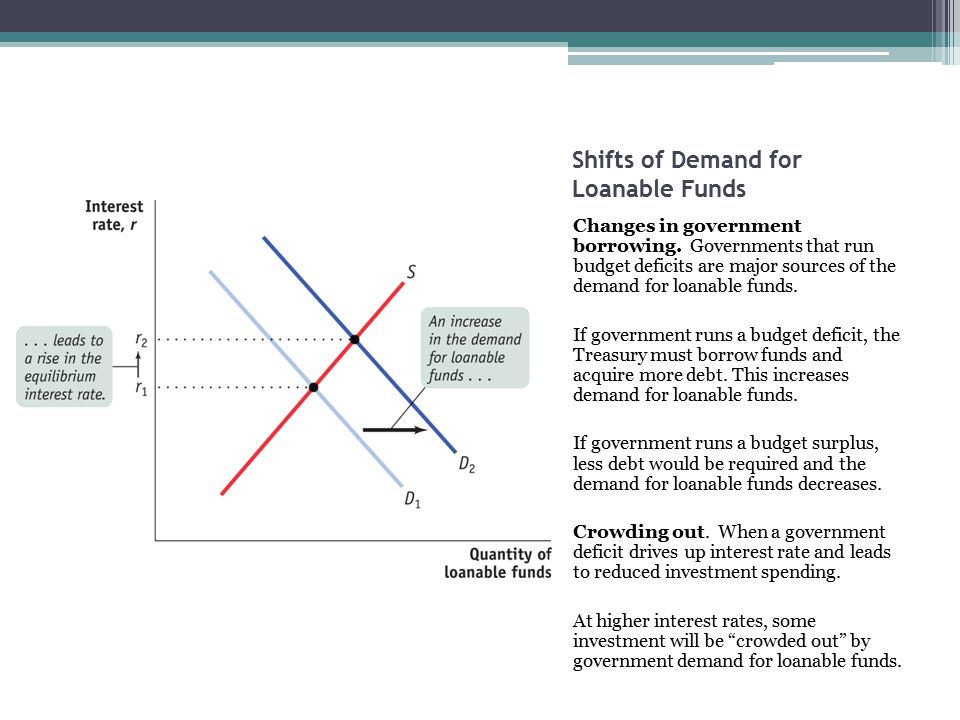

What Shifts Loanable Funds. If people trust the government and trust that the borrowed money will be used productively the D LF curve moves rightward and interest rates are. As real interest rates fall banks are less willing or less able to supply the same quantity of loanable funds and therefore make. The relationship between real interest rates and the quantity of loanable funds supplied is direct or positive. Loanable Funds Theory Business Demand for Loanable Funds There is an inverse relationship between interest rates and the quantity of loanable funds demanded The curve can shift in response to events that affect business borrowing preferences Example.

Loanable Funds Able Funds Demand Shifters Changes In From slidetodoc.com

Loanable Funds Able Funds Demand Shifters Changes In From slidetodoc.com

This will affect both the market for loanable funds and the market for foreign currency exchange. First it will increase the demand for loanable funds in order to increase the purchase of assets overseas shifting the demand curve D LF to the right increasing the real interest rate. What shifts supply and demand of loanable funds. The supply of loanable funds is the quantity of credit provided at every real interest rates by banks and other lenders in an economy. A change that begins in the loanable funds market can. Expectations For Future Economy direct Anticipation of economic performance.

If people trust the government and trust that the borrowed money will be used productively the D LF curve moves rightward and interest rates are.

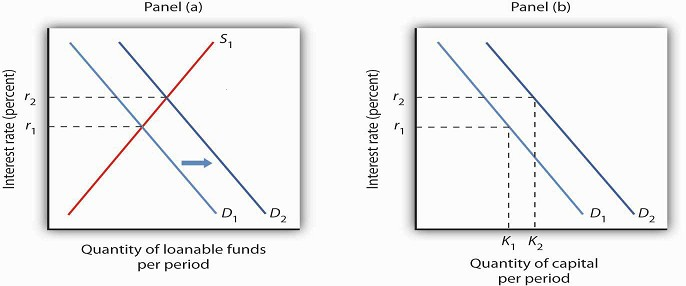

The increase in deficit prompted the government to increase the demand for loanable funds on the financial market. A change that begins in the loanable funds market can affect the quantity of capital firms demand. As real interest rates fall banks are less willing or less able to supply the same quantity of loanable funds and therefore make. A change that begins in the loanable funds market can. Changes in income and wealth shift the supply of loanable funds. What curve does this change in.

Source: courses.lumenlearning.com

Source: courses.lumenlearning.com

What factors shift the demand for loanable funds. What happens in the loanable funds market if the government borrows money is context-dependent. The supply of loanable funds is the quantity of credit provided at every real interest rates by banks and other lenders in an economy. Federal Reserve Lending direct Lending via discount window 3. The supply for loanable funds shifts left and the demand shifts right.

Source: khanacademy.org

Source: khanacademy.org

This is all there is. It is a variation of a market model but what is being bought and sold is money that has been saved. Federal Reserve Lending direct Lending via discount window 3. Neither curve shifts but the quantity of loanable funds supplied increases and the quantity demanded decreases as the. Capital productivity is the main determinant of the demand for loanable funds.

Source: econ101help.com

Source: econ101help.com

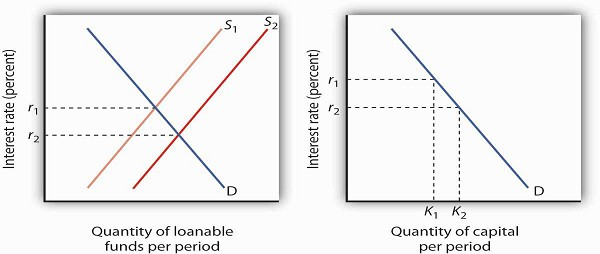

The increase in deficit prompted the government to increase the demand for loanable funds on the financial market. What curve does this change in. Loanable Funds Theory Business Demand for Loanable Funds There is an inverse relationship between interest rates and the quantity of loanable funds demanded The curve can shift in response to events that affect business borrowing preferences Example. The increase in the supply of loanable funds shifts the supply curve for loanable funds depicted in Figure down and to the right. Federal Reserve Lending direct Lending via discount window 3.

Source: slidetodoc.com

Source: slidetodoc.com

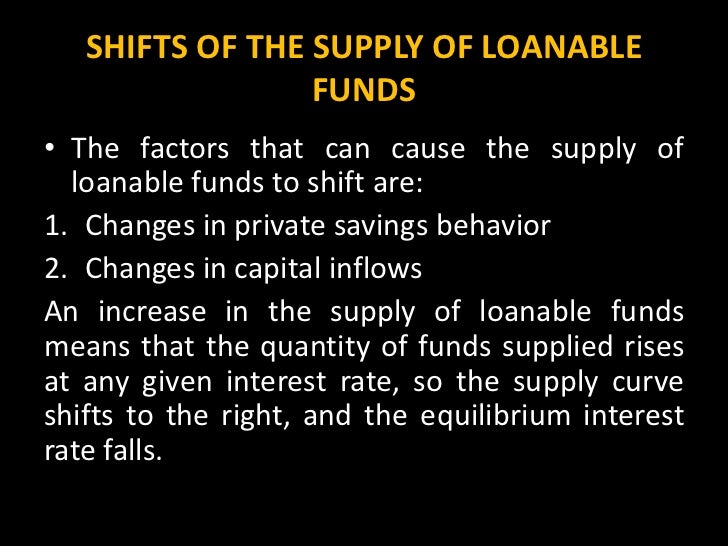

If people want to save less MPS goes down then the supply of loanable funds shifts to the left. Consumption smoothing is another factor that shifts the loanable funds supply. Shifts in The Supply or Demand Curves Anything that affects the demand for loanable funds except a change in the interest rate will cause a shift in the demand curve. Here a decrease in consumer saving causes a shift in the supply of. What curve does this change in.

Source: slideplayer.com

Source: slideplayer.com

S 1 indicates an increase shift to the right. Determinants of Loanable Funds Demand. Among the forces that can shift the demand curve for capital are changes in expectations changes in technology changes in the demands for goods and services changes in relative factor prices and changes in tax policy. If people want to save more they will save more at every possible interest rate which is a shift to the right of the supply curve. A change that begins in the loanable funds market can.

Source: opentextbooks.org.hk

Source: opentextbooks.org.hk

Foreign Purchases of Domestic Assets direct International investments 4. If people want to save more they will save more at every possible interest rate which is a shift to the right of the supply curve. Federal Reserve Lending direct Lending via discount window 3. Hence the problem of saving is solved. Shifts in The Supply or Demand Curves Anything that affects the demand for loanable funds except a change in the interest rate will cause a shift in the demand curve.

Source: opentextbooks.org.hk

Source: opentextbooks.org.hk

Anything which increases national savings other than a decrease in the real interest rate will shift the supply curve of loanable funds to the right. Supply of Loanable Funds. The supply of loanable funds is the quantity of credit provided at every real interest rates by banks and other lenders in an economy. A Change in the Loanable Funds Market and the Quantity of Capital Demanded. The relationship between real interest rates and the quantity of loanable funds supplied is direct or positive.

Source: freeeconhelp.com

Source: freeeconhelp.com

Loanable funds constitute the savings available in an economy that can be used to provide loans for investment. What shifts the supply of loanable funds. The supply of loanable funds is the quantity of credit provided at every real interest rates by banks and other lenders in an economy. If households become more thriftythat is if households decide to save morethe supply of loanable funds increases. The increase in the supply of loanable funds shifts the supply curve for loanable funds depicted in Figure down and to the right.

Here a decrease in consumer saving causes a shift in the supply of. Changes in time preferences also affect the supply of loanable funds. The relationship between real interest rates and the quantity of loanable funds supplied is direct or positive. Anything which increases national savings other than a decrease in the real interest rate will shift the supply curve of loanable funds to the right. Determinants of Loanable Funds Demand.

This will affect both the market for loanable funds and the market for foreign currency exchange. The loanable funds theory is also called neoclassical theory. Supply of Loanable Funds. For example an increase in borrowing resulting from an improvement in consumer or business confidence would cause the demand curve for loanable funds to shift to the right. Loanable Funds Theory Business Demand for Loanable Funds There is an inverse relationship between interest rates and the quantity of loanable funds demanded The curve can shift in response to events that affect business borrowing preferences Example.

Source: courses.lumenlearning.com

Source: courses.lumenlearning.com

A change that begins in the loanable funds market can affect the quantity of capital firms demand. S 1 indicates an increase shift to the right. Economic conditions become more favorable Expected cash flows will increase more positive NPV projects. Borrowers demand loanable funds and savers supply loanable funds. A Change in the Loanable Funds Market and the Quantity of Capital Demanded.

Economic conditions become more favorable Expected cash flows will increase more positive NPV projects. What might cause the supply curve for loanable funds to shift from S1 to S2. Anything which decreases national savings other than an increase in the real interest rate will shift the supply curve of loanable funds to the left. What shifts the demand curve for loanable funds. The theory of loanable funds is a market theory.

Source: courses.lumenlearning.com

Source: courses.lumenlearning.com

Changes in the expected rate of return on investment. The increase in the supply of loanable funds shifts the supply curve for loanable funds depicted in Figure down and to the right. Loanable funds constitute the savings available in an economy that can be used to provide loans for investment. For example an increase in borrowing resulting from an improvement in consumer or business confidence would cause the demand curve for loanable funds to shift to the right. The supply of loanable funds reflects the thriftiness of households and other lenders.

Source: youtube.com

Source: youtube.com

Changes in time preferences also affect the supply of loanable funds. This will affect both the market for loanable funds and the market for foreign currency exchange. What happens in the loanable funds market if the government borrows money is context-dependent. What shifts the supply of loanable funds. The market is in equilibrium when the real interest rate has adjusted so that the amount of borrowing is equal to the amount of saving.

Source: econ101help.com

Source: econ101help.com

A change that begins in the loanable funds market can affect the quantity of capital firms demand. What happens in the loanable funds market if the government borrows money is context-dependent. What shifts the supply of loanable funds. If people trust the government and trust that the borrowed money will be used productively the D LF curve moves rightward and interest rates are. Federal Reserve Lending direct Lending via discount window 3.

Source: slideshare.net

Source: slideshare.net

Among the forces that can shift the demand curve for capital are changes in expectations changes in technology changes in the demands for goods and services changes in relative factor prices and changes in tax policy. S 2 indicates a decrease shift to the left of the supply curve. Federal Reserve Lending direct Lending via discount window 3. What might cause the supply curve for loanable funds to shift from S1 to S2. Capital productivity is the main determinant of the demand for loanable funds.

Source: slideplayer.com

Source: slideplayer.com

What happens in the loanable funds market if the government borrows money is context-dependent. This is all there is. A Change in the Loanable Funds Market and the Quantity of Capital Demanded. A change that begins in the loanable funds market can. Foreign Purchases of Domestic Assets direct International investments 4.

Source: slidetodoc.com

Source: slidetodoc.com

Change in opportunities perceived by businesses. Meanwhile two factors that cause the demand for loanable funds to shift are. Consumption smoothing is another factor that shifts the loanable funds supply. Loanable funds constitute the savings available in an economy that can be used to provide loans for investment. Change in opportunities perceived by businesses.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what shifts loanable funds by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.