Your What is outward supply images are ready. What is outward supply are a topic that is being searched for and liked by netizens now. You can Get the What is outward supply files here. Find and Download all royalty-free photos.

If you’re looking for what is outward supply pictures information connected with to the what is outward supply interest, you have pay a visit to the right blog. Our website frequently gives you suggestions for downloading the highest quality video and image content, please kindly search and locate more informative video articles and graphics that fit your interests.

What Is Outward Supply. In this you have to show the invoice in your GSTR1 with the applicable tax rate and all other details similar to. There are certain notified goods and services for which the recipient needs to pay the tax instead of supplier. Outward Taxable Supplies INTRA AND INTER STATES 2. They can be found outdoors in all regions but are not found in dungeons or cities.

Inward Supply Vs Outward Supply Income Tax Tax Finance From in.pinterest.com

Inward Supply Vs Outward Supply Income Tax Tax Finance From in.pinterest.com

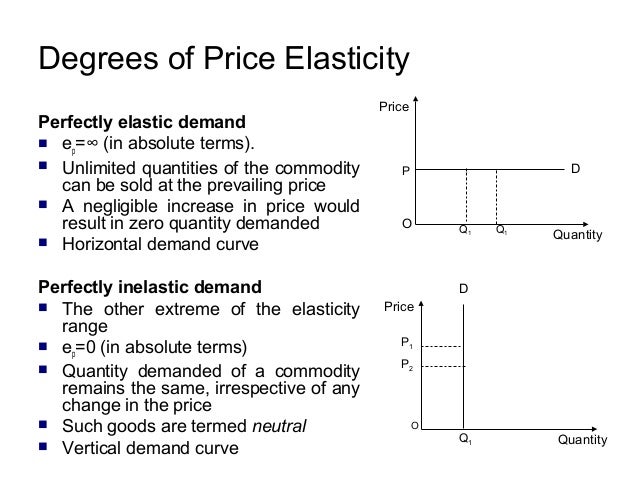

4 Taxable outward supplies made to registered persons including UIN-holders other than supplies covered by Table 6. 6 Zero rated supplies and Deemed Exports. An increase in supply. Factors that will cause an outward shift of a market supply curve ie. 4Inward Supplies liable to be paid on reverse charge basis. Outward Supply in relation to a person shall mean supply of goods andor services whether by sale transfer barter exchange license rental lease or disposal made or agreed to make by such person in the course or furtherance of business.

FORM GSTR-1 is a statement of the details of outward supplies ie.

Outward Supply in relation to a person shall mean supply of goods andor services whether by sale transfer barter exchange license rental lease or disposal made or agreed to make by such person in the course or furtherance of business. Outward Taxable Supplies Zero Rated 3. Outward supplies under GST is one of the most common terms in GST Rule. GST return for outward supplies in form GSTR-1 for a particular month is to be filed on or before the 10th day of the immediately succeeding month. Where to show outward RCM supply in 3B and R1. Exempt Supply under GST.

Source: in.pinterest.com

Source: in.pinterest.com

FORM GSTR-1 is a statement of the details of outward supplies ie. FAQs on E-way bill related to Inward Outward Supply are compiled. 31 a Outward taxable supplies other than zero rated nil rated and exempted State and Central Sales in which you charge GST and its Tax amount. An increase in supply. Q What are pre-requisites to generate the e-way bill.

Source: in.pinterest.com

Source: in.pinterest.com

If the supply curve moves inwards there is a decrease in supply meaning that less will be supplied at each price. Outward Taxable Supplies INTRA AND INTER STATES 2. Q What are pre-requisites to generate the e-way bill. 20x Chersonese 20x Hallowed Marsh 20x Enmerkar Forest 20x Abrassar 20x Antique Plateau 21x Caldera Unlike most other loot containers the potential contents of. 31 b Outward taxable supplies zero rated Supplies with Zero GST rate ie exports or supplies made to SEZ.

Source: pinterest.com

Source: pinterest.com

Outward supplies means any supply made by your business Sales and any other services provided. If the supply curve moves inwards there is a decrease in supply meaning that less will be supplied at each price. Non GST Outward Supply. Exempt Supply under GST. Section 2 73 Outward Supply.

Source: pinterest.com

Source: pinterest.com

Q What are pre-requisites to generate the e-way bill. There are certain notified goods and services for which the recipient needs to pay the tax instead of supplier. In other words for the month of january form GSTR-1 can be filed any time between 1st and 10th day of february month. 4 Taxable outward supplies made to registered persons including UIN-holders other than supplies covered by Table 6. Make sure that you understand the key factors that can bring about a shift in the supply curve for a product in a market.

Source: in.pinterest.com

Source: in.pinterest.com

5 Taxable outward inter-State supplies to un-registered persons where the invoice value is more than Rs 25 lakh. Outward Supplies towards Nil Rated and Exempted. Where to show outward RCM supply in 3B and R1. FORM GSTR-1 is a statement of the details of outward supplies ie. There are certain notified goods and services for which the recipient needs to pay the tax instead of supplier.

Source: in.pinterest.com

Source: in.pinterest.com

Outward supply. Outward Taxable Supplies Zero Rated 3. 20x Chersonese 20x Hallowed Marsh 20x Enmerkar Forest 20x Abrassar 20x Antique Plateau 21x Caldera Unlike most other loot containers the potential contents of. There are certain notified goods and services for which the recipient needs to pay the tax instead of supplier. Inward supplies means any supply received by your business purchases and expenses.

Source: pinterest.com

Source: pinterest.com

Outward supplies under GST is one of the most common terms in GST Rule. Supply Cache is a type of loot container in Outward. Factors that will cause an outward shift of a market supply curve ie. Where to show outward RCM supply in 3B and R1. Shall pay GST on outward supply of goods at the time of supply specified in clause a of sub-section 2 of Section 12.

Source: in.pinterest.com

Source: in.pinterest.com

Outward supplies means any supply made by your business Sales and any other services provided. 31 a Outward taxable supplies other than zero rated nil rated and exempted State and Central Sales in which you charge GST and its Tax amount. Make sure that you understand the key factors that can bring about a shift in the supply curve for a product in a market. Outward provides are items offered provided or companies supplied inside India each inter-state and intra-state Inward provides liable to reverse cost. Outward supply.

Source: in.pinterest.com

Source: in.pinterest.com

Statement of Outward Supplies GSTR-1 in GST Introduction. Where to show outward RCM supply in 3B and R1. 6 Zero rated supplies and Deemed Exports. The details of outward supplies shall include details of invoices debit notes credit notes advances received. Statement of Outward Supplies GSTR-1 in GST Introduction.

Source: in.pinterest.com

Source: in.pinterest.com

31 a Outward taxable supplies other than zero rated nil rated and exempted State and Central Sales in which you charge GST and its Tax amount. The details filed in table of this statement are to be communicated to the respective recipients of the said supplies. What is FORM GSTR 1. Thus in respect of supply of goods by normal registered persons other than composition dealers the time of supply will be the issue of invoice or the last date by which invoice has to be. 31 a Outward taxable supplies other than zero rated nil rated and exempted State and Central Sales in which you charge GST and its Tax amount.

Source: in.pinterest.com

Source: in.pinterest.com

In other words for the month of january form GSTR-1 can be filed any time between 1st and 10th day of february month. 31 b Outward taxable supplies zero rated Supplies with Zero GST rate ie exports or supplies made to SEZ. Particulars of Outward Provides and in addition present Tax quantity in third Level of ITC avilable of 4 ie. 7 Taxable supplies Net of debit notes and. Make sure that you understand the key factors that can bring about a shift in the supply curve for a product in a market.

Source: pinterest.com

Source: pinterest.com

Outward supplies means any supply made by your business Sales and any other services provided. If the supply curve moves inwards there is a decrease in supply meaning that less will be supplied at each price. The details filed in table of this statement are to be communicated to the respective recipients of the said supplies. 20x Chersonese 20x Hallowed Marsh 20x Enmerkar Forest 20x Abrassar 20x Antique Plateau 21x Caldera Unlike most other loot containers the potential contents of. Make sure that you understand the key factors that can bring about a shift in the supply curve for a product in a market.

Source: pinterest.com

Source: pinterest.com

Outward supplies means any supply made by your business Sales and any other services provided. What is FORM GSTR 1. Outward supplies under GST is one of the most common terms in GST Rule. Supply Cache is a type of loot container in Outward. 4 Taxable outward supplies made to registered persons including UIN-holders other than supplies covered by Table 6.

Source: ar.pinterest.com

Source: ar.pinterest.com

Inward supplies means any supply received by your business purchases and expenses. Outward Taxable Supplies Zero Rated 3. Outward supply in relation to a person shall mean supply of goods andor services whether by sale transfer barter exchange licence rental lease or disposal made or agreed to be made by such person in the course or furtherance of business except in case of such supplies where the tax is payable on reverse charge basis. Outward supplies under GST is one of the most common terms in GST Rule. Outward Supplies towards Nil Rated and Exempted.

Source: in.pinterest.com

Source: in.pinterest.com

Shall pay GST on outward supply of goods at the time of supply specified in clause a of sub-section 2 of Section 12. In other words for the month of january form GSTR-1 can be filed any time between 1st and 10th day of february month. Outward provides are items offered provided or companies supplied inside India each inter-state and intra-state Inward provides liable to reverse cost. They can be found outdoors in all regions but are not found in dungeons or cities. Exempt Supply under GST.

Source: pinterest.com

Source: pinterest.com

Non GST Outward Supply. If the supply curve moves inwards there is a decrease in supply meaning that less will be supplied at each price. Particulars of Outward Provides and in addition present Tax quantity in third Level of ITC avilable of 4 ie. Exempt Supply under GST. 31 b Outward taxable supplies zero rated Supplies with Zero GST rate ie exports or supplies made to SEZ.

Source: pinterest.com

Source: pinterest.com

31 b Outward taxable supplies zero rated Supplies with Zero GST rate ie exports or supplies made to SEZ. For Suppliers the goods or services that he sells are the outward supply the same is the inward supply for the receiver of. Outward supplies are goods sold supplied or services provided within India both inter-state and intra-state Inward supplies liable to reverse charge. For the month of January GSTR-1 has to be filed on or before 10th February. 6 Zero rated supplies and Deemed Exports.

Source: pinterest.com

Source: pinterest.com

Particulars of Outward Provides and in addition present Tax quantity in third Level of ITC avilable of 4 ie. Inward supplies means any supply received by your business purchases and expenses. Outward supplies means any supply made by your business Sales and any other services provided. Sales of goods or provision of services of goods or services or both. Outward Supply It means a supply of goods or services or both whether by sale transfer barter exchange license rental lease or disposal or any other mode made or agreed to be made by such person in the course or furtherance of business.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is outward supply by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.