Your What is an inverted demand curve images are ready. What is an inverted demand curve are a topic that is being searched for and liked by netizens today. You can Download the What is an inverted demand curve files here. Find and Download all free photos and vectors.

If you’re looking for what is an inverted demand curve images information related to the what is an inverted demand curve topic, you have come to the right blog. Our website always gives you suggestions for seeing the highest quality video and image content, please kindly hunt and locate more informative video articles and graphics that fit your interests.

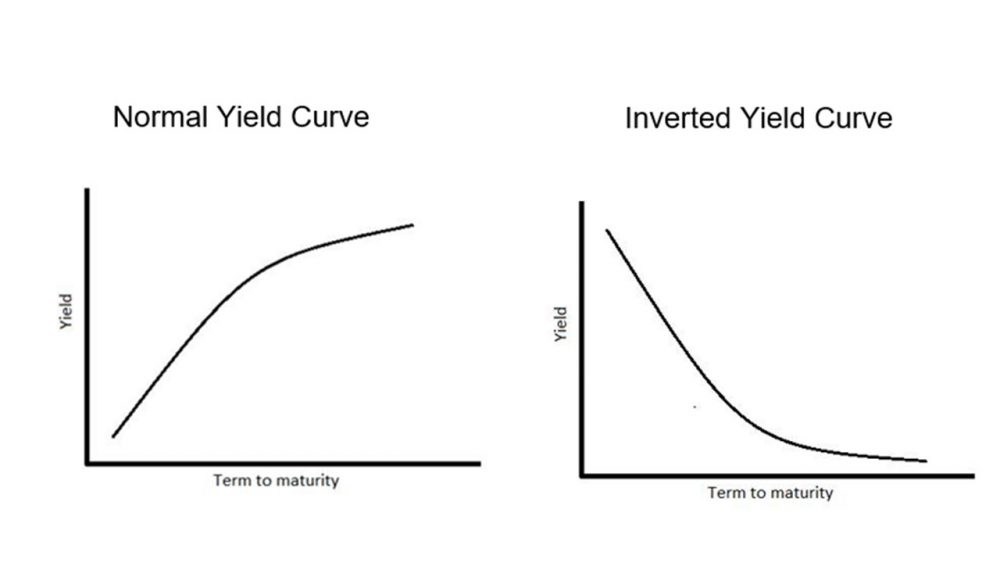

What Is An Inverted Demand Curve. This means that changes in the quantity demanded lead to changes in price levels which is the inverse of a demand curve. If theyre not something is going on in the economy that might not necessarily be bad. Demand curve can be a straight line downward sloping according to percentage change in price. Most significantly properly focus on what to do when the yield curve inverts.

This Chart Could Be A Bad Omen For Markets Yield Curve Curve Inversions From pinterest.com

This Chart Could Be A Bad Omen For Markets Yield Curve Curve Inversions From pinterest.com

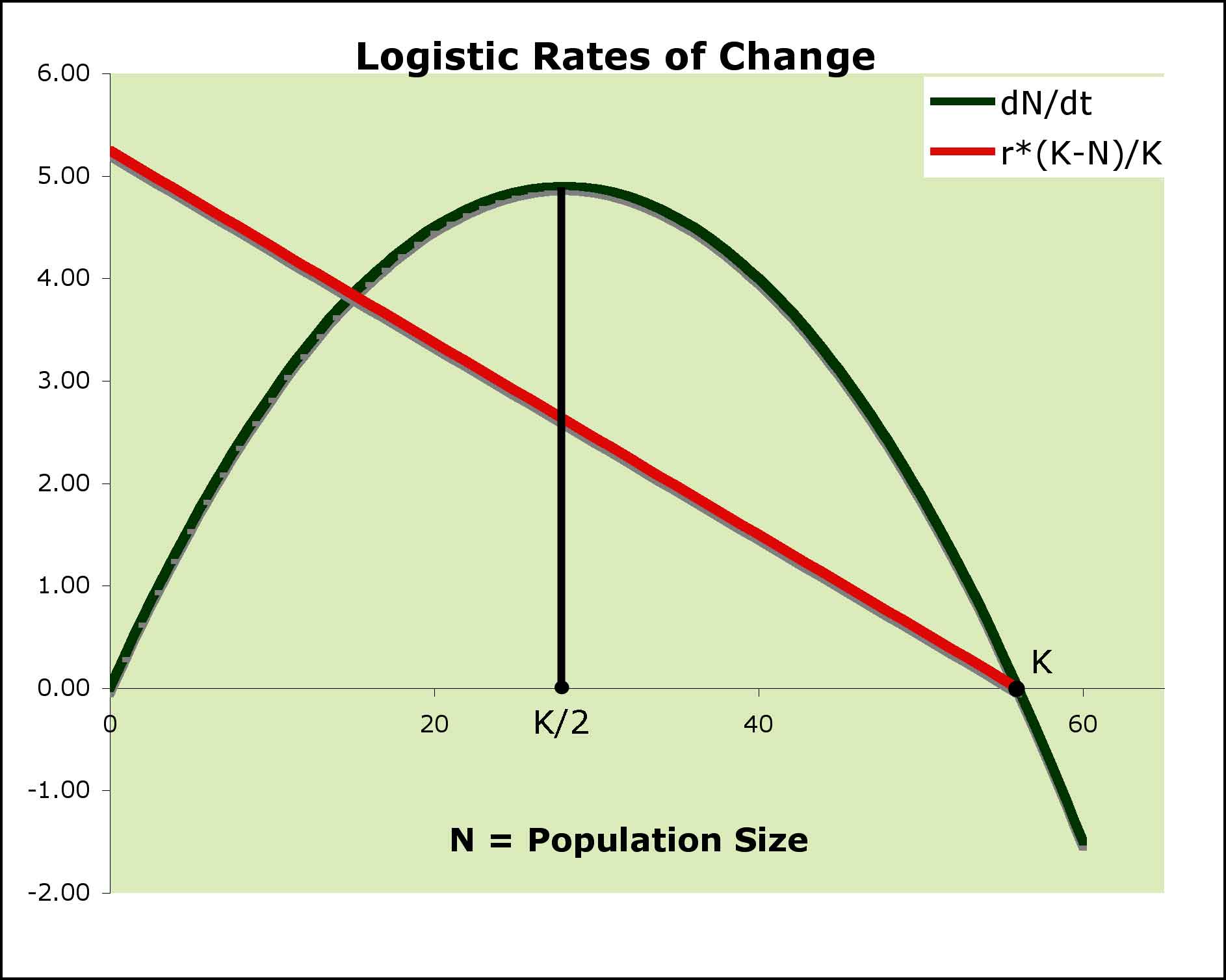

At each quantity of x the inverse demand function measures how much money the consumer is willing go give up for a little more of x 1 or alternatively stated how much money the consumer was willing to sacrifice for the last unit purchased of x 1. The same price quantity relationship can be expressed as p 1 αmx 1. If theyre not something is going on in the economy that might not necessarily be bad. It forms a curve where the greatest quantity sold comes at a medium price and the quantities fall as the price increases or decreases. 716 we present an inverse demand curve which graphically represents such a function. In this video I show how to invert a demand curve to solve for an inverse demand curve.

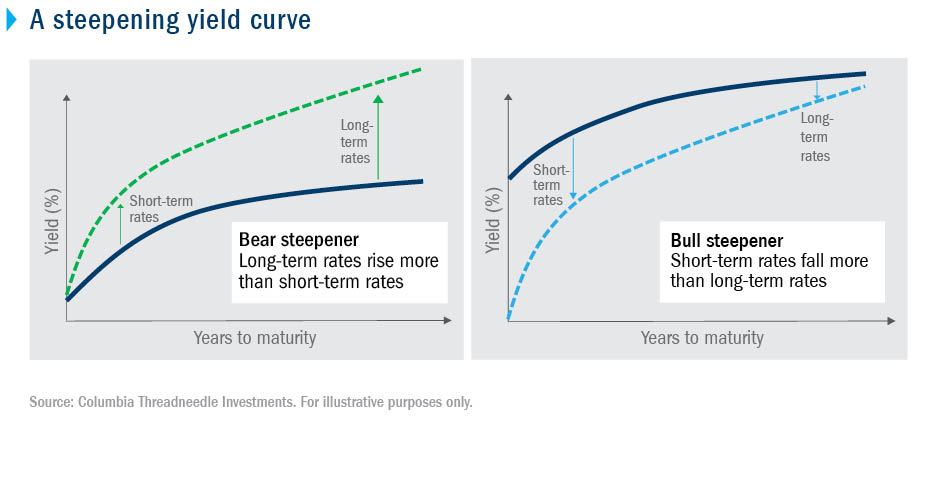

An inverted curve eliminates the risk premium for long-term investments allowing investors to get better returns with short-term investments.

At each quantity of x the inverse demand function measures how much money the consumer is willing go give up for a little more of x 1 or alternatively stated how much money the consumer was willing to sacrifice for the last unit purchased of x 1. Not all inverted yield curves are alike Notice that the yield curve isnt inverted across all maturities only in the 2-5 year range. An inverted curve eliminates the risk premium for long-term investments allowing investors to get better returns with short-term investments. Pin On Numerology December 2019 Which means that modifications within the amount demanded result in modifications in value ranges which is the inverse of a requirement. Demand curve can be a straight line downward sloping according to percentage change in price. What is the difference between a demand curve and an inverse demand curve.

Source: pinterest.com

Source: pinterest.com

The rest of the yield curve is still normal upward sloping meaning investors are for now still only willing to buy 10-year and 30-year bonds at yields that are greater than shorter maturity treasuries. In other words if you buy a three-year bond and a 10-year bond on the same day their respective yields should be roughly equal. Types of Credit Curves. With an inverse demand curve price becomes a function of quantity demanded. An inverted yield curve is a term used by economists to describe when the yields on bonds with different maturities have inverted.

With an inverse demand curve price becomes a function of quantity demanded. For a very small amount of x 1 the two come down to the same thing. Types of Credit Curves. Most significantly properly focus on what to do when the yield curve inverts. An inverted yield curve is a term used by economists to describe when the yields on bonds with different maturities have inverted.

Source: researchgate.net

Source: researchgate.net

Types of Credit Curves. An inverted curve eliminates the risk premium for long-term investments allowing investors to get better returns with short-term investments. In the early stages of economic growth the environment is under increased pressure due to the release of pollutants and the extensive and intensive use of resources. I show each bit of algebra step by step. 716 we present an inverse demand curve which graphically represents such a function.

Source: investopedia.com

Source: investopedia.com

Dec 11 2021 0912 AM. An inverted yield curve is a term used by economists to describe when the yields on bonds with different maturities have inverted. In the early stages of economic growth the environment is under increased pressure due to the release of pollutants and the extensive and intensive use of resources. Demand curve can be a straight line downward sloping according to percentage change in price. An inverted yield curve is a term used by economists to describe when the yields on bonds with different maturities have inverted.

Source: mdpi.com

Source: mdpi.com

Most significantly properly focus on what to do when the yield curve inverts. The inverse demand function views price as a function of quantity. This means that changes in the quantity demanded lead to changes in price levels which is the inverse of a demand curve. In this video I show how to invert a demand curve to solve for an inverse demand curve. An inverted yield curve is.

Source: pinterest.com

Source: pinterest.com

What is the difference between a demand curve and an inverse demand curve. What is the difference between a demand curve and an inverse demand curve. In other words if you buy a three-year bond and a 10-year bond on the same day their respective yields should be roughly equal. As a result item will certainly not be created. The Cobb-Douglas demand for x 1 is expressed as αmp 1.

Source: columbiathreadneedleus.com

Source: columbiathreadneedleus.com

Types of Credit Curves. Whats an inverted demand. In other words if you buy a three-year bond and a 10-year bond on the same day their respective yields should be roughly equal. An inverted yield curve is a term used by economists to describe when the yields on bonds with different maturities have inverted. What is the difference between a demand curve and an inverse demand curve.

Source: economicsonline.co.uk

Source: economicsonline.co.uk

This means that changes in the quantity demanded lead to changes in price levels which is the inverse of a demand curve. An inverted curve eliminates the risk premium for long-term investments allowing investors to get better returns with short-term investments. In the early stages of economic growth the environment is under increased pressure due to the release of pollutants and the extensive and intensive use of resources. An inverted yield curve is a term used by economists to describe when the yields on bonds with different maturities have inverted. The credit curve reflects the immediate short-term and long-term rates of securities and gives the investor an indication of where the economy is headed.

Source: sciencedirect.com

Source: sciencedirect.com

Inverse demand curve is in the form of curve. For a very small amount of x 1 the two come down to the same thing. A downward sloping or inverted curve shows that the company is likely to default in the near future but far less likely to default in the long term. In other words if you buy a three-year bond and a 10-year bond on the same day their respective yields should be roughly equal. With an inverse demand curve price becomes a function of quantity demanded.

Source: mdpi.com

Source: mdpi.com

What is the difference between a demand curve and an inverse demand curve. Its an irregular scenario that always alerts an impending recession. The credit curve reflects the immediate short-term and long-term rates of securities and gives the investor an indication of where the economy is headed. In the early stages of economic growth the environment is under increased pressure due to the release of pollutants and the extensive and intensive use of resources. 716 we present an inverse demand curve which graphically represents such a function.

Source: pinterest.com

Source: pinterest.com

As a result item will certainly not be created. What is the difference between a demand curve and an inverse demand curve. In economics an Inverse Demand Function is the inverse function of a demand function. In this video I show how to invert a demand curve to solve for an inverse demand curve. In other words if you buy a three-year bond and a 10-year bond on the same day their respective yields should be roughly equal.

Source: penpoin.com

Source: penpoin.com

In this video I show how to invert a demand curve to solve for an inverse demand curve. With an inverse demand curve price becomes a function of quantity demanded. I show each bit of algebra step by step. The graph of an inverse demand curve is derived from the formula used to determine the demand curve for a product. What is the difference between a demand curve and an inverse demand curve.

In economics an Inverse Demand Function is the inverse function of a demand function. The credit curve reflects the immediate short-term and long-term rates of securities and gives the investor an indication of where the economy is headed. In other words if you buy a three-year bond and a 10-year bond on the same day their respective yields should be roughly equal. In other words if you buy a three-year bond and a 10-year bond on the same day their respective yields should be roughly equal. I show each bit of algebra step by step.

Source: washingtonpost.com

Source: washingtonpost.com

As a result item will certainly not be created. The graph of an inverse demand curve is derived from the formula used to determine the demand curve for a product. Pin On Numerology December 2019 Which means that modifications within the amount demanded result in modifications in value ranges which is the inverse of a requirement. In economics an Inverse Demand Function is the inverse function of a demand function. An inverted curve eliminates the risk premium for long-term investments allowing investors to get better returns with short-term investments.

Source: pinterest.com

Source: pinterest.com

I show each bit of algebra step by step. Whats an inverted demand. Demand curve existing listed below supply curve suggests that there is no demand for the item of distributors due to the fact that the cost is expensive for the customers. An inverted yield curve is a term used by economists to describe when the yields on bonds with different maturities have inverted. Most significantly properly focus on what to do when the yield curve inverts.

Source: actuaries.blog.gov.uk

Source: actuaries.blog.gov.uk

In economics an Inverse Demand Function is the inverse function of a demand function. When investors are extremely worried about the financial future it can lead to what is called an inverted yield curve. Dec 11 2021 0912 AM. The credit curve reflects the immediate short-term and long-term rates of securities and gives the investor an indication of where the economy is headed. A downward sloping or inverted curve shows that the company is likely to default in the near future but far less likely to default in the long term.

The same price quantity relationship can be expressed as p 1 αmx 1. A downward sloping or inverted curve shows that the company is likely to default in the near future but far less likely to default in the long term. With an inverse demand curve price becomes a function of quantity demanded. In economics an Inverse Demand Function is the inverse function of a demand function. E It slopes from left to right at a very mild slope.

Source: researchgate.net

Source: researchgate.net

An inverted yield curve is a term used by economists to describe when the yields on bonds with different maturities have inverted. In other words if you buy a three-year bond and a 10-year bond on the same day their respective yields should be roughly equal. In economics an Inverse Demand Function is the inverse function of a demand function. This means that changes in the quantity demanded lead to changes in price levels which is the inverse of a demand curve. Demand curve can be a straight line downward sloping according to percentage change in price.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is an inverted demand curve by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.