Your What increases demand for money images are ready in this website. What increases demand for money are a topic that is being searched for and liked by netizens today. You can Download the What increases demand for money files here. Find and Download all free images.

If you’re searching for what increases demand for money pictures information related to the what increases demand for money interest, you have come to the ideal blog. Our site always provides you with suggestions for refferencing the maximum quality video and picture content, please kindly surf and find more informative video content and graphics that fit your interests.

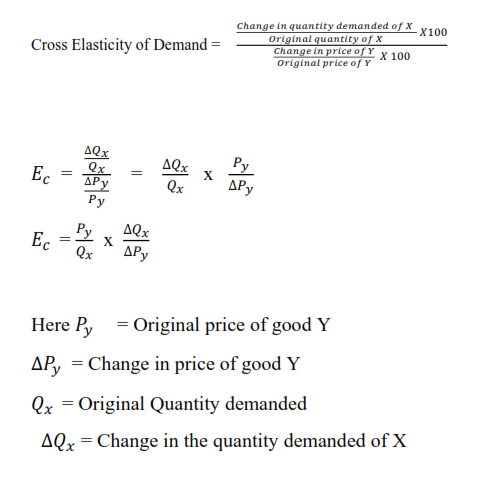

What Increases Demand For Money. These two items are substitutes as money is used to purchase bonds. An Increase in Money Demand. The equation for the demand for money is. By setting short-term interest rates it is argued that the central bank can influence the entire interest rate structure by creating expectations about the future course of its interest rate policy.

John Crestani Review Internet Jetset 6 Figure Side Income Online Entrepreneur Quotes Entreprene Print On Demand Money Habits Personal Development Tools From pinterest.com

John Crestani Review Internet Jetset 6 Figure Side Income Online Entrepreneur Quotes Entreprene Print On Demand Money Habits Personal Development Tools From pinterest.com

This increased inflation rate lowers the real interest rate stimulating economic activity. The Demand for Money. The equation for the demand for money is. The demand for money increases when national income increases because A spending on goods and services increases B interest rates increase C the budget deficit increases D the money supply increases E the public becomes more optimistic about the future. The increased demand for money will increase interest rates. As a general rule we can say that there is.

A fall in the price level will reduce the demand for money raise the interest rate and increase investment spending.

Most importantly households businesses and so on use the money to purchase goods and services. A rise in the price level increases the demand for money raises the interest rate and reduces investment spending. Note the real interest rate falls. C an increase in the quantity of money demanded. The equation for the demand for money is. Since BOND PRICES MOVE IN THE OPPOSITE DIRECTION FROM INTEREST RATES when interest rates increase as they do when the real GDP is growing bond prices will decrease.

Source: pinterest.com

Source: pinterest.com

Hence as income or GDP rises the transactions demand for money also rises. In economics the demand for money is generally equated with cash or bank demand deposits. The increase came into effect on January 1 as inflation continues to reach record highs across the country amid the supply chain crisis. Note the real interest rate falls. Once it rises to equal the new money supply there will be no further difference between the amount of money people hold and the amount they wish to hold and the story will end.

Source: pinterest.com

Source: pinterest.com

As a general rule we can say that there is. Money demand shifts rightward or money supply shifts leftward. This rise in the price level is associated with a fall in the value of money. Two of the more important stores of wealth are bonds and money. In addition the decrease in the money supply will lead to a decrease in consumer spending.

Source: pinterest.com

Source: pinterest.com

An increase in real GDP the price level or transfer costs for example will increase the quantity of money demanded at any interest rate r increasing the demand for money from D1 to D2. As a general rule we can say that there is. The effect of this is to raise domestic interest rates from R 1 to R 2 and to cause an appreciation of the domestic currency from E 1 to E 2. R 5 - 4 1. By setting short-term interest rates it is argued that the central bank can influence the entire interest rate structure by creating expectations about the future course of its interest rate policy.

Source: pinterest.com

Source: pinterest.com

Generally the nominal demand for money increases with the level of nominal output and decreases with the nominal interest rate. People often demand money as a precaution against an uncertain future. This decrease will shift the aggregate demand curve to the left. Most importantly households businesses and so on use the money to purchase goods and services. What Is the Demand For Money.

Source: pinterest.com

Source: pinterest.com

Since i r p e we can decompose the effects on an increase in i into real interest rate increases holding expected inflation fixed and expected inflation increases holding the. By setting short-term interest rates it is argued that the central bank can influence the entire interest rate structure by creating expectations about the future course of its interest rate policy. This increased inflation rate lowers the real interest rate stimulating economic activity. The effect of this is to raise domestic interest rates from R 1 to R 2 and to cause an appreciation of the domestic currency from E 1 to E 2. Note the real interest rate falls.

Source: sk.pinterest.com

Source: sk.pinterest.com

This rise in the price level is associated with a fall in the value of money. Now suppose the inflation rate rises to 4. The money demand curve will shift to the right and. The demand for money increases when national income increases because A spending on goods and services increases B interest rates increase C the budget deficit increases D the money supply increases E the public becomes more optimistic about the future. D an increase in the demand for money that might be the result of a decrease in the price level.

Source: pinterest.com

Source: pinterest.com

What Is the Demand For Money. The total number of transactions made in an economy tends to increase over time as income rises. This rise in the price level is associated with a rise in the value of money. These two items are substitutes as money is used to purchase bonds. Most importantly households businesses and so on use the money to purchase goods and services.

Source: pinterest.com

Source: pinterest.com

The effect of this is to raise domestic interest rates from R 1 to R 2 and to cause an appreciation of the domestic currency from E 1 to E 2. Interest Rates and the Demand for Money. The demand for money increases when national income increases because A spending on goods and services increases B interest rates increase C the budget deficit increases D the money supply increases E the public becomes more optimistic about the future. This rise in the price level is associated with a fall in the value of money. The effect of this is to raise domestic interest rates from R 1 to R 2 and to cause an appreciation of the domestic currency from E 1 to E 2.

Source: pinterest.com

Source: pinterest.com

The money demand curve will shift to the right and. The increase came into effect on January 1 as inflation continues to reach record highs across the country amid the supply chain crisis. Since i r p e we can decompose the effects on an increase in i into real interest rate increases holding expected inflation fixed and expected inflation increases holding the. This question ties together with Q1 in the multiple choice section. The total number of transactions made in an economy tends to increase over time as income rises.

Source: pinterest.com

Source: pinterest.com

As a general rule we can say that there is. Change in the General. As a general rule we can say that there is. The increase came into effect on January 1 as inflation continues to reach record highs across the country amid the supply chain crisis. The demand for money increases when national income increases because A spending on goods and services increases B interest rates increase C the budget deficit increases D the money supply increases E the public becomes more optimistic about the future.

Source: pinterest.com

Source: pinterest.com

The price level rises if either. Most importantly households businesses and so on use the money to purchase goods and services. As the interest rate falls money demand will rise. C an increase in the quantity of money demanded. An increase in real GDP the price level or transfer costs for example will increase the quantity of money demanded at any interest rate r increasing the demand for money from D1 to D2.

Source: in.pinterest.com

Source: in.pinterest.com

An increase in the demand for a currency creates a rightward shift of the demand curve ultimately causing a rise in the exchange rate and increasing the value of. A fall in the price level will reduce the demand for money raise the interest rate and increase investment spending. Generally the nominal demand for money increases with the level of nominal output and decreases with the nominal interest rate. Money demand shifts rightward or money supply shifts leftward. The effect of this is to raise domestic interest rates from R 1 to R 2 and to cause an appreciation of the domestic currency from E 1 to E 2.

Source: pinterest.com

Source: pinterest.com

This increased inflation rate lowers the real interest rate stimulating economic activity. This is why and how an increase in the money supply lowers the interest rate. The effect of this is to raise domestic interest rates from R 1 to R 2 and to cause an appreciation of the domestic currency from E 1 to E 2. According to mainstream thinking the central bank is the key factor in interest rates. Hence as income or GDP rises the transactions demand for money also rises.

Source: pinterest.com

Source: pinterest.com

C an increase in the quantity of money demanded. In economics the demand for money is generally equated with cash or bank demand deposits. The increased demand for money will increase interest rates. By setting short-term interest rates it is argued that the central bank can influence the entire interest rate structure by creating expectations about the future course of its interest rate policy. A rise in the price level increases the demand for money raises the interest rate and reduces investment spending.

Source: pinterest.com

Source: pinterest.com

The increased demand for money will increase interest rates. Since i r p e we can decompose the effects on an increase in i into real interest rate increases holding expected inflation fixed and expected inflation increases holding the. An increase in the demand for a currency creates a rightward shift of the demand curve ultimately causing a rise in the exchange rate and increasing the value of. This rise in the price level is associated with a fall in the value of money. As the interest rate falls money demand will rise.

Source: nl.pinterest.com

Source: nl.pinterest.com

The equation for the demand for money is. This rise in the price level is associated with a rise in the value of money. Hence as income or GDP rises the transactions demand for money also rises. According to mainstream thinking the central bank is the key factor in interest rates. Generally the nominal demand for money increases with the level of nominal output and decreases with the nominal interest rate.

Source: pinterest.com

Source: pinterest.com

Once it rises to equal the new money supply there will be no further difference between the amount of money people hold and the amount they wish to hold and the story will end. A rise in the price level increases the demand for money raises the interest rate and reduces investment spending. This question ties together with Q1 in the multiple choice section. The demand for money tends to increase when the potential returns in other asset classes decline or when the perceived risk of such investments increases. As the nominal interest rate on non-money assets bonds i increases the opportunity cost of holding money increases and so the demand for nominal money balances decreases.

Source: pinterest.com

Source: pinterest.com

Change in the General. By setting short-term interest rates it is argued that the central bank can influence the entire interest rate structure by creating expectations about the future course of its interest rate policy. As a general rule we can say that there is. Interest Rates and the Demand for Money. Two of the more important stores of wealth are bonds and money.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what increases demand for money by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.