Your What changes the supply of loanable funds images are available in this site. What changes the supply of loanable funds are a topic that is being searched for and liked by netizens now. You can Get the What changes the supply of loanable funds files here. Download all royalty-free photos.

If you’re searching for what changes the supply of loanable funds pictures information connected with to the what changes the supply of loanable funds interest, you have come to the right site. Our site frequently gives you hints for downloading the maximum quality video and image content, please kindly hunt and find more enlightening video content and graphics that fit your interests.

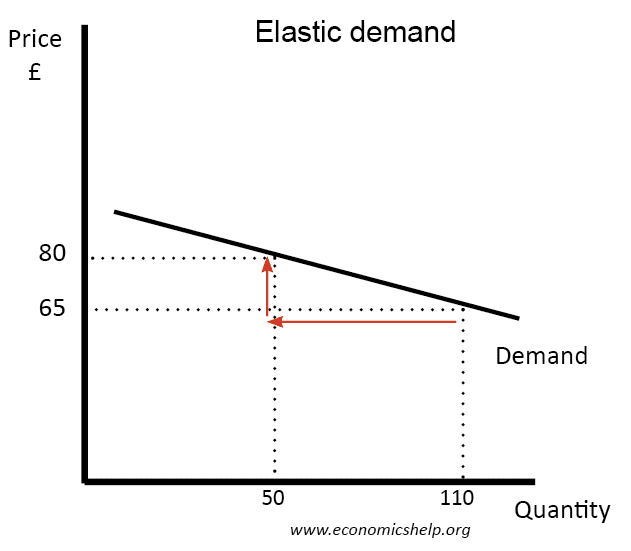

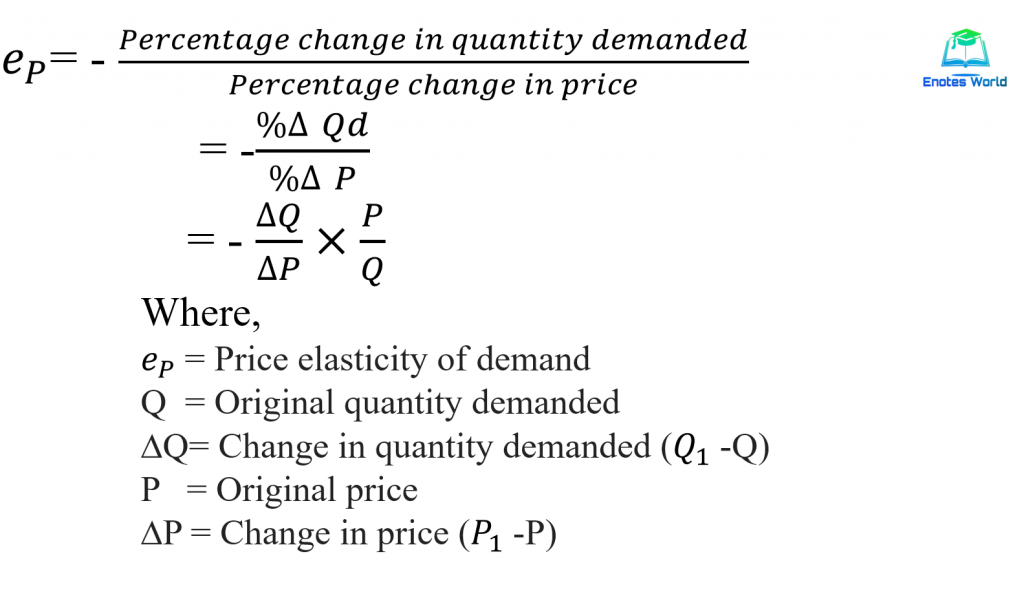

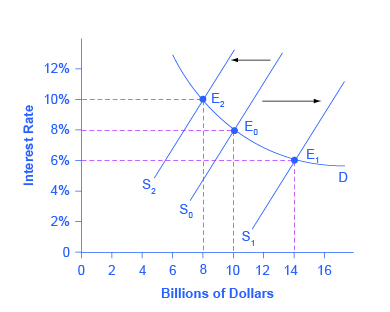

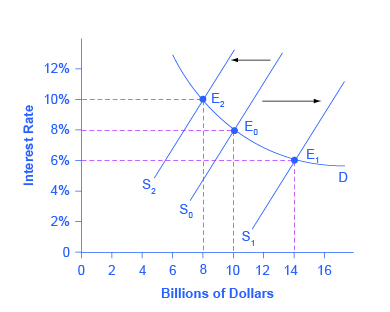

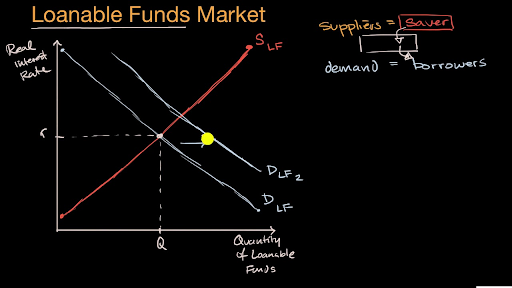

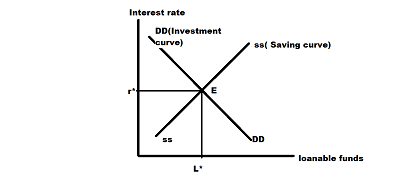

What Changes The Supply Of Loanable Funds. A change that begins in the loanable funds market can affect the quantity of capital firms demand. If interest rates go up you get a higher return. Does not influence the supply of or the demand for loanable funds. The supply of loanable funds increases with the increase in interest rates.

The Loanable Funds Market Principles Of Economics Scarcity And Social Provisioning 2nd Ed From openoregon.pressbooks.pub

The Loanable Funds Market Principles Of Economics Scarcity And Social Provisioning 2nd Ed From openoregon.pressbooks.pub

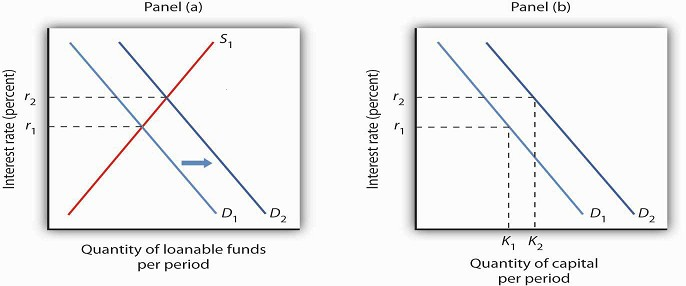

Here a decrease in consumer saving causes a shift in the supply of. A change in disposable income expected future income wealth or default risk changes the supply of loanable funds. If interest rates go up you get a higher return. A Change in the Loanable Funds Market and the Quantity of Capital Demanded. Private saving and so shift the supply of loanable funds left. This is bad for the growth of capital stock and slows down the rate of long run economic growth.

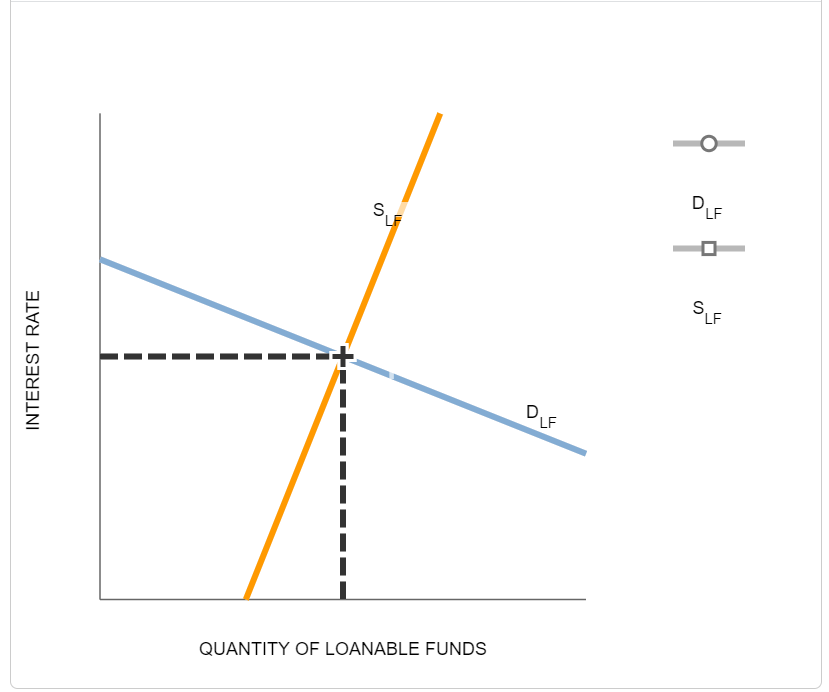

The lower the level of interest the less they are willing to supply.

The supply of loanable funds increases with increasing interest rate because there is a competition between using the money now for personal consumption and delaying consumption by lending the money out so that the lender will have more later on. As I said earlier the interest rate represents the return you get when you lend money. Changes both the supply of and demand for loanable funds. In reality a change in the interest rate changes only the composition of interest-bearing and non interest-bearing asset holdings which keeps the quantity of saving and by extension the quantity of loanable funds supplied constant at s y in Figure. The higher interest rate that a saver can earn the more likely they are to save money. A change that begins in the loanable funds market can affect the quantity of capital firms demand.

Source: openoregon.pressbooks.pub

Source: openoregon.pressbooks.pub

A Change in the Loanable Funds Market and the Quantity of Capital Demanded. The Loanable Funds Market The loanable funds market is made up of borrowers who demand funds D lf and lenders who supply funds S lf. The lower the level of interest the less they are willing to supply. When demand for investment decreases quantity quantity of loanable funds decreases and real interest rate decreases. The supply curve is upward sloping because as the interest rate increases people will want to save more.

When a change in the supply of money leads to a change in the interest rate the resulting change in real GDP causes the supply of loanable funds to change as well. This is bad for the growth of capital stock and slows down the rate of long run economic growth. When a change in the supply of money leads to a change in the interest rate the resulting change in real GDP causes the supply of loanable funds to change as well. Supply The supply of loanable funds represents the behavior of all of the savers in an economy. Individuals supply loanable funds through savings.

Source: slidetodoc.com

Source: slidetodoc.com

The supply of loanable funds increases with increasing interest rate because there is a competition between using the money now for personal consumption and delaying consumption by lending the money out so that the lender will have more later on. When investors shift funds out of stocks they move it into money market securities causing an increase in the supply of loanable funds and lower interest rates. Does not influence the supply of or the demand for loanable funds. The supply curve is upward sloping because as the interest rate increases people will want to save more. When the real interest rate increases investment spending decreases.

Source: courses.lumenlearning.com

Source: courses.lumenlearning.com

Does not influence the supply of or the demand for loanable funds. A change in disposable income expected future income wealth or default risk changes the supply of loanable funds. Individuals supply loanable funds through savings. The supply of loanable funds increases with increasing interest rate because there is a competition between using the money now for personal consumption and delaying consumption by lending the money out so that the lender will have more later on. A Change in the Loanable Funds Market and the Quantity of Capital Demanded.

Source: courses.lumenlearning.com

Source: courses.lumenlearning.com

The lower real interest rate increases the quantity of loanable funds demanded and increases investment. Other policies such as budget deficits might increase the demand for loanable funds. The interest rate is determined in the market for loanable funds. The supply of loanable funds increases with increasing interest rate because there is a competition between using the money now for personal consumption and delaying consumption by lending the money out so that the lender will have more later on. These same entities demand loanable funds demanding more when the level of interest rates is low and less when interest rates are higher.

Source: pinterest.com

Source: pinterest.com

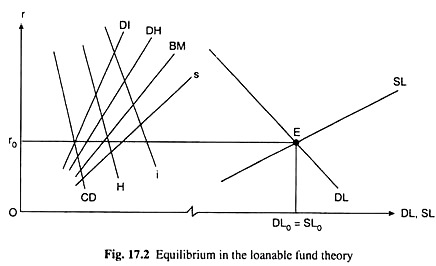

The demand for loanable funds D LF curve slopes downward because the higher the real interest rate the higher the price someone has to pay for a loan. Some government policies such as investment tax credits basically lower the cost of borrowing money at every real interest rate. Individuals supply loanable funds through savings. This is bad for the growth of capital stock and slows down the rate of long run economic growth. Professor Alvin H Hansen argues that the schedule of loanable funds is compounded of savings plus net additions to loanable funds from new money and dishoarding idle balances.

A change in disposable income expected future income wealth or default risk changes the supply of loanable funds. The demand for loanable funds D LF curve slopes downward because the higher the real interest rate the higher the price someone has to pay for a loan. The lower the level of interest the less they are willing to supply. If interest rates go up you get a higher return. Such policies would increase the demand for loanable funds.

Source: opentextbooks.org.hk

Source: opentextbooks.org.hk

As such the supply of loanable funds shows that the quantity of savings available will increase as. The lower the level of interest the less they are willing to supply. Public saving and so shift the supply of. Neither curve shifts but the quantity of loanable funds supplied increases and the quantity demanded decreases as the interest rate rises to equilibrium. Supply The supply of loanable funds represents the behavior of all of the savers in an economy.

Source: slideplayer.com

Source: slideplayer.com

The supply of loanable funds increases with increasing interest rate because there is a competition between using the money now for personal consumption and delaying consumption by lending the money out so that the lender will have more later on. Represents a change in the quantity of loanable funds demanded in response to a change in interest rates. Investment and so shift the demand for loanable funds left. As such the supply of loanable funds shows that the quantity of savings available will increase as. Here a decrease in consumer saving causes a shift in the supply of.

Represents a change in the quantity of loanable funds demanded in response to a change in interest rates. The supply for loanable funds shifts left and the demand shifts right. If the government has a budget surplus it increases the supply of loanable funds the real interest rate falls which decreases household saving and decreases the quantity of private funds supplied. If there is a decrease in savings by the private sector the supply of loanable funds decreases shifts left causing the real interest rate to rise. The higher interest rate that a saver can earn the more likely they are to save money.

Source: slidetodoc.com

Source: slidetodoc.com

Professor Alvin H Hansen argues that the schedule of loanable funds is compounded of savings plus net additions to loanable funds from new money and dishoarding idle balances. A Supply and demand for loanable funds determines the real interest rate B Savers and lenders supply money to the loanable funds market C Government firms and individuals make up the demand in the loanable funds market D The supply of loanable funds is vertical and is set by the Federal Reserve government lowers corporate taxes to. When a change in the supply of money leads to a change in the interest rate the resulting change in real GDP. Private saving and so shift the supply of loanable funds left. In reality a change in the interest rate changes only the composition of interest-bearing and non interest-bearing asset holdings which keeps the quantity of saving and by extension the quantity of loanable funds supplied constant at s y in Figure.

Source: in.pinterest.com

Source: in.pinterest.com

Some government policies such as investment tax credits basically lower the cost of borrowing money at every real interest rate. Private saving and so shift the supply of loanable funds left. When a change in the supply of money leads to a change in the interest rate the resulting change in real GDP. Such policies would increase the demand for loanable funds. In reality a change in the interest rate changes only the composition of interest-bearing and non interest-bearing asset holdings which keeps the quantity of saving and by extension the quantity of loanable funds supplied constant at s y in Figure.

Source: pinterest.com

Source: pinterest.com

When a change in the supply of money leads to a change in the interest rate the resulting change in real GDP causes the supply of loanable funds to change as well. As such the supply of loanable funds shows that the quantity of savings available will increase as. The interest rate is determined in the market for loanable funds. Such policies would increase the demand for loanable funds. When a change in the supply of money leads to a change in the interest rate the resulting change in real GDP.

Source: pinterest.com

Source: pinterest.com

In reality a change in the interest rate changes only the composition of interest-bearing and non interest-bearing asset holdings which keeps the quantity of saving and by extension the quantity of loanable funds supplied constant at s y in Figure. Some government policies such as investment tax credits basically lower the cost of borrowing money at every real interest rate. The supply for loanable funds shifts left and the demand shifts right. Public saving and so shift the supply of. Why is the supply of loanable funds upward sloping.

Source: economicsdiscussion.net

Source: economicsdiscussion.net

A change that begins in the loanable funds market can affect the quantity of capital firms. Some government policies such as investment tax credits basically lower the cost of borrowing money at every real interest rate. The supply for loanable funds shifts left and the demand shifts right. These same entities demand loanable funds demanding more when the level of interest rates is low and less when interest rates are higher. A change that begins in the loanable funds market can affect the quantity of capital firms.

Source: in.pinterest.com

Source: in.pinterest.com

Here a decrease in consumer saving causes a shift in the supply of. The higher interest rate that a saver can earn the more likely they are to save money. The demand for loanable funds D LF curve slopes downward because the higher the real interest rate the higher the price someone has to pay for a loan. As such the supply of loanable funds shows that the quantity of savings available will increase as. The supply for loanable funds S LF curve slopes upward because the higher the real interest rate the higher the return someone gets from loaning his or her money.

Source: in.pinterest.com

Source: in.pinterest.com

Public saving and so shift the supply of. There is no crowding out occurs when the government has a budget surplus. The supply of loanable funds increases with the increase in interest rates. A change that begins in the loanable funds market can affect the quantity of capital firms. Why is the supply of loanable funds upward sloping.

Source: study.com

Source: study.com

The demand for loanable funds D LF curve slopes downward because the higher the real interest rate the higher the price someone has to pay for a loan. The lower the level of interest the less they are willing to supply. In reality a change in the interest rate changes only the composition of interest-bearing and non interest-bearing asset holdings which keeps the quantity of saving and by extension the quantity of loanable funds supplied constant at s y in Figure. Here a decrease in consumer saving causes a shift in the supply of. The higher the level of interest rates the more such entities are willing to supply loan funds.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what changes the supply of loanable funds by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.