Your What causes shifts in supply of loanable funds images are available. What causes shifts in supply of loanable funds are a topic that is being searched for and liked by netizens today. You can Download the What causes shifts in supply of loanable funds files here. Download all free vectors.

If you’re looking for what causes shifts in supply of loanable funds pictures information linked to the what causes shifts in supply of loanable funds topic, you have pay a visit to the right blog. Our website frequently gives you suggestions for refferencing the maximum quality video and image content, please kindly surf and locate more enlightening video content and graphics that match your interests.

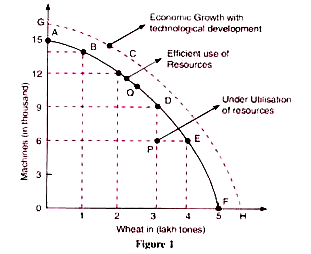

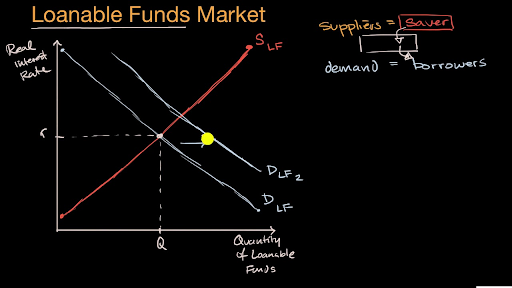

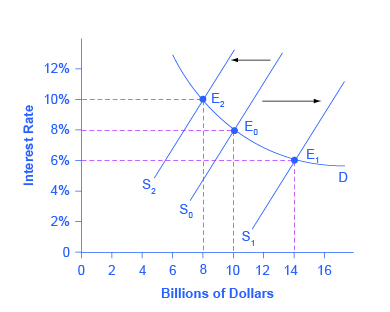

What Causes Shifts In Supply Of Loanable Funds. Government budget deficit shifts the a. An increase in the US. In the market for loanable funds people are interested in the real interest rate not the nominal interest rate. Explain and illustrate on another graph how that will affect.

Module 29 The Market For Loanable Funds Module From slidetodoc.com

Module 29 The Market For Loanable Funds Module From slidetodoc.com

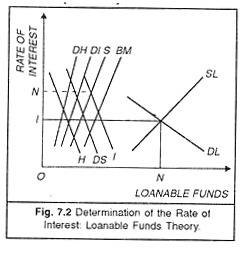

If the government begins to borrow a larger portion of this pool of savings it. 22 The Loanable Funds Market. Supply of loanable funds left and decreases investment spending. None of the above is correct. 3 EXCHANGE RATE 31 The FloatingFlexible Exchange Rate System. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines.

Government budget deficit shifts the a.

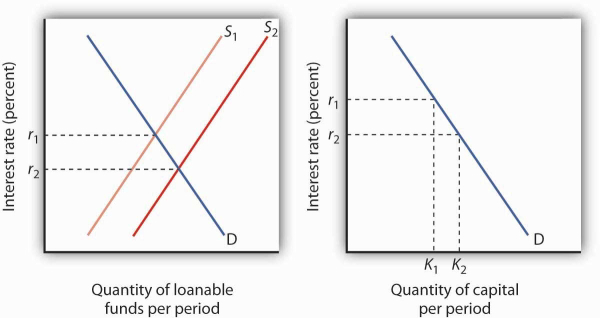

Fall because the demand for loanable funds shifts right. Equilibrium values of savings and investment according to the loanable. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. An increase in the US. Supply of loanable funds right and increases investment spending. If the government begins to borrow a larger portion of this pool of savings it.

Source: opentextbooks.org.hk

Source: opentextbooks.org.hk

22 The Loanable Funds Market. Rise because the demand for loanable funds shifts right. Rise because the supply of loanable funds shifts left. In the market for loanable funds people are interested in the real interest rate not the nominal interest rate. This lets us find the.

Source: courses.lumenlearning.com

Source: courses.lumenlearning.com

Fall because the demand for loanable funds shifts right. Rise because the demand for loanable funds shifts right. Equilibrium values of savings and investment according to the loanable. Supply of loanable funds right and increases investment spending. 32 Movements along versus Shifts in the Supply Curve 33 Non-price Determinants of Supply.

Source: courses.lumenlearning.com

Source: courses.lumenlearning.com

Dynamic stochastic general equilibrium modeling abbreviated as DSGE or DGE or sometimes SDGE is a macroeconomic method which is often employed by monetary and fiscal authorities for policy analysis explaining historical time-series data as well as future forecasting purposes. 72 Causes of Income Inequity in Singapore 73 Measures to Address the Problem of Income Inequity. If the government begins to borrow a larger portion of this pool of savings it. At any given time there is a limited supply of loanable funds available for the government and private parties to borrow froma global pool of savings. Take a new situation.

32 Movements along versus Shifts in the Supply Curve 33 Non-price Determinants of Supply. This lets us find the. 3 EXCHANGE RATE 31 The FloatingFlexible Exchange Rate System. Supply of loanable funds left and decreases investment spending. Fall because the demand for loanable funds shifts right.

Source: economicsdiscussion.net

Source: economicsdiscussion.net

Take a new situation. 3 EXCHANGE RATE 31 The FloatingFlexible Exchange Rate System. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. Take a new situation. Rise because the supply of loanable funds shifts left.

Source: welkerswikinomics.com

Source: welkerswikinomics.com

If the government begins to borrow a larger portion of this pool of savings it. An increase in the US. Supply of loanable funds right and increases investment spending. Rise because the supply of loanable funds shifts left. In the market for loanable funds people are interested in the real interest rate not the nominal interest rate.

In the market for loanable funds people are interested in the real interest rate not the nominal interest rate. At any given time there is a limited supply of loanable funds available for the government and private parties to borrow froma global pool of savings. 32 Movements along versus Shifts in the Supply Curve 33 Non-price Determinants of Supply. 22 The Loanable Funds Market. In the market for loanable funds people are interested in the real interest rate not the nominal interest rate.

Source: slidetodoc.com

Source: slidetodoc.com

How many hours that a person desires to work will also be determined by the real wage. Consider now a simple Keynesian model. Rise because the demand for loanable funds shifts right. Equilibrium in the market for loanable funds. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines.

The size of capital stock would be determined by the levels of savings which is market for loanable funds. Suppose that the government decreases its deficit which it finances by. This lets us find the. At any given time there is a limited supply of loanable funds available for the government and private parties to borrow froma global pool of savings. Equilibrium in the market for loanable funds.

72 Causes of Income Inequity in Singapore 73 Measures to Address the Problem of Income Inequity. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. The size of capital stock would be determined by the levels of savings which is market for loanable funds. Rise because the demand for loanable funds shifts right. Dynamic stochastic general equilibrium modeling abbreviated as DSGE or DGE or sometimes SDGE is a macroeconomic method which is often employed by monetary and fiscal authorities for policy analysis explaining historical time-series data as well as future forecasting purposes.

Source: chegg.com

Source: chegg.com

Explain and illustrate on another graph how that will affect. Rise because the demand for loanable funds shifts right. At any given time there is a limited supply of loanable funds available for the government and private parties to borrow froma global pool of savings. 72 Causes of Income Inequity in Singapore 73 Measures to Address the Problem of Income Inequity. Demand for loanable funds right and decreases investment spending.

Dynamic stochastic general equilibrium modeling abbreviated as DSGE or DGE or sometimes SDGE is a macroeconomic method which is often employed by monetary and fiscal authorities for policy analysis explaining historical time-series data as well as future forecasting purposes. At any given time there is a limited supply of loanable funds available for the government and private parties to borrow froma global pool of savings. In the market for loanable funds people are interested in the real interest rate not the nominal interest rate. Suppose that the government decreases its deficit which it finances by. Fall because the demand for loanable funds shifts right.

Source: youtube.com

Source: youtube.com

DSGE econometric modeling applies general equilibrium theory and microeconomic principles. An increase in the US. Rise because the supply of loanable funds shifts left. Equilibrium values of savings and investment according to the loanable. Supply of loanable funds left and decreases investment spending.

Rise because the supply of loanable funds shifts left. Dynamic stochastic general equilibrium modeling abbreviated as DSGE or DGE or sometimes SDGE is a macroeconomic method which is often employed by monetary and fiscal authorities for policy analysis explaining historical time-series data as well as future forecasting purposes. How many hours that a person desires to work will also be determined by the real wage. Fall because the demand for loanable funds shifts right. Rise because the demand for loanable funds shifts right.

Source: courses.lumenlearning.com

Source: courses.lumenlearning.com

The size of capital stock would be determined by the levels of savings which is market for loanable funds. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. Government budget deficit shifts the a. 72 Causes of Income Inequity in Singapore 73 Measures to Address the Problem of Income Inequity. At any given time there is a limited supply of loanable funds available for the government and private parties to borrow froma global pool of savings.

Source: slideplayer.com

Source: slideplayer.com

This lets us find the. At any given time there is a limited supply of loanable funds available for the government and private parties to borrow froma global pool of savings. Rise because the demand for loanable funds shifts right. The size of capital stock would be determined by the levels of savings which is market for loanable funds. DSGE econometric modeling applies general equilibrium theory and microeconomic principles.

If the government begins to borrow a larger portion of this pool of savings it. This lets us find the. 3 EXCHANGE RATE 31 The FloatingFlexible Exchange Rate System. If the government begins to borrow a larger portion of this pool of savings it. Consider now a simple Keynesian model.

Source: openoregon.pressbooks.pub

Source: openoregon.pressbooks.pub

Equilibrium values of savings and investment according to the loanable. 32 Movements along versus Shifts in the Supply Curve 33 Non-price Determinants of Supply. Supply of loanable funds left and decreases investment spending. If the government begins to borrow a larger portion of this pool of savings it. Equilibrium in the market for loanable funds.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what causes shifts in supply of loanable funds by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.