Your U200bif money supply and money demand both increase images are ready. U200bif money supply and money demand both increase are a topic that is being searched for and liked by netizens today. You can Get the U200bif money supply and money demand both increase files here. Download all free photos and vectors.

If you’re looking for u200bif money supply and money demand both increase pictures information connected with to the u200bif money supply and money demand both increase topic, you have come to the right site. Our website always provides you with hints for seeing the highest quality video and image content, please kindly hunt and find more enlightening video articles and graphics that match your interests.

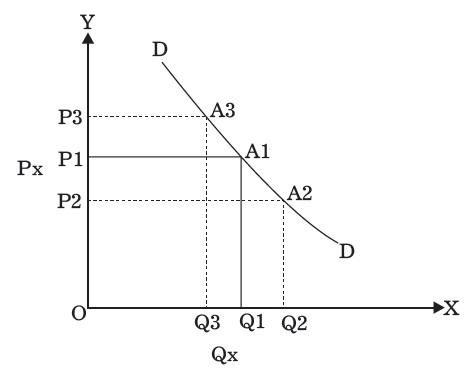

U200bif Money Supply And Money Demand Both Increase. Further Figure 2 reveals the. This corresponds to an increase in the money supply to M in Panel b. The Fed increases the money supply by buying bonds increasing the demand for bonds in Panel a from D 1 to D 2 and the price of bonds to P b 2. Real money demand and the real money supply as functions of the real interest rate are illustrated in the above graph.

Econowaugh Ap Demand Supply Cheat Sheet Economics Notes Managerial Economics Economics Lessons From pinterest.com

Econowaugh Ap Demand Supply Cheat Sheet Economics Notes Managerial Economics Economics Lessons From pinterest.com

An inflow of funds from abroad. This corresponds to an increase in the money supply to M in Panel b. When the currency-deposit ratio k of the public decreases. Normally characterized by slow steady growth the US. If the demand for money decreases but the Fed keeps the money supply the same then. On the other hand if the supply of money increases in tandem with the demand for money the Fed can help to stabilize nominal interest rates and related quantities including inflation.

With the increase in the supply of high-powered money to Hs the supply of money also increases to OM 1 at the new equilibrium point E 1.

The demand for money will fall if transfer costs decline. As the interest rate increases the opportunity cost of holding money increases and people hold less money. This corresponds to an increase in the money supply to M in Panel b. It uses the four key graphs taught in AP Macroeconomics. The negatively sloped demand curve for money represents the quantity of money. In many circumstances an increase in the money supply could lead to a depreciation in the exchange rate.

Source: pinterest.com

Source: pinterest.com

Further Figure 2 reveals the. Both nominal interest rates and aggregate supply will increase. In both of the. This is for two main reasons. A money supply increase may also increase national output.

Source: pinterest.com

Source: pinterest.com

A decrease in a countrys. This Demonstration shows the implications for the economy if the money supply is increased. At E the demand and supply of high-powered money is in equilibrium and money supply is OM. The demand for an asset depends on both its rate of return and its opportunity cost. Growth in real output ie real GDP will increase the demand for money and will increase the nominal interest rate if the money supply is held constant.

Source: pinterest.com

Source: pinterest.com

Money supply has grown 20 from 1533 trillion at the end of 2019 to 183 trillion at the end of July. Inflation can happen if the money supply grows faster than the economic output under otherwise normal economic circumstances. If the demand for money decreases but the Fed keeps the money supply the same then. This means banks will be willing to lend a larger proportion of their funds. On the other hand if the supply of money increases in tandem with the demand for money the Fed can help to stabilize nominal interest rates and related quantities including inflation.

Source: pinterest.com

Source: pinterest.com

To obtain superior broader measures one must go. At E the demand and supply of high-powered money is in equilibrium and money supply is OM. In many circumstances an increase in the money supply could lead to a depreciation in the exchange rate. Inflation can happen if the money supply grows faster than the economic output under otherwise normal economic circumstances. Decrease both investment spending and aggregate demand.

Source: pinterest.com

Source: pinterest.com

When the cash or currency reserves-deposit ratio of the banks r falls. Both nominal interest rates and aggregate demand will increase. Therefore spending goes up demand goes up resultingin excess demand. In recent years transfer costs have fallen leading to a decrease in money demand. The opportunity cost of holding money is the interest rate that can be earned by lending or investing ones money holdings.

Source: pinterest.com

Source: pinterest.com

An increase in the supply of high- powered money by DH shifts the Hs curve upward to Hs. The interest rate must fall to r 2 to achieve equilibrium. An increase in the supply of high- powered money by DH shifts the Hs curve upward to Hs. Consumers and businesses have a demand for money including cash and checking and savings accounts. Money supply has grown 20 from 1533 trillion at the end of 2019 to 183 trillion at the end of July.

Source: pinterest.com

Source: pinterest.com

In both of the. When the currency-deposit ratio k of the public decreases. Topics include the quantity theory of money the velocity of money and how increases in the money supply may lead to inflation. A money supply increase will tend to raise the price level in the long run. The negatively sloped demand curve for money represents the quantity of money.

Source: pinterest.com

Source: pinterest.com

The interest rate must fall to r 2 to achieve equilibrium. The interest rate must fall to r 2 to achieve equilibrium. Real money demand and the real money supply as functions of the real interest rate are illustrated in the above graph. In general the demand for money will increase as it becomes more expensive to transfer between money and nonmoney accounts. This corresponds to an increase in the money supply to M in Panel b.

Source: pinterest.com

Source: pinterest.com

In general the demand for money will increase as it becomes more expensive to transfer between money and nonmoney accounts. This Demonstration shows the implications for the economy if the money supply is increased. In many circumstances an increase in the money supply could lead to a depreciation in the exchange rate. Increase both investment spending and aggregate demand. The real money supply is equal to the nominal amount of M1 denoted M 0 divided by the fixed aggregate price level P 0.

Source: pinterest.com

Source: pinterest.com

The Fed increases the money supply by buying bonds increasing the demand for bonds in Panel a from D 1 to D 2 and the price of bonds to P b 2. In general the demand for money will increase as it becomes more expensive to transfer between money and nonmoney accounts. This is for two main reasons. A money supply increase may also increase national output. When the cash or currency reserves-deposit ratio of the banks r falls.

Source: pinterest.com

Source: pinterest.com

Increase investment spending and decrease aggregate demand If money supply and. Through quantitative easing creating money electronically. When the cash or currency reserves-deposit ratio of the banks r falls. Both nominal interest rates and aggregate supply will increase. In many circumstances an increase in the money supply could lead to a depreciation in the exchange rate.

Source: pinterest.com

Source: pinterest.com

A money supply increase will tend to raise the price level in the long run. Decrease both investment spending and aggregate demand. Central Banks print more money. This Demonstration shows the implications for the economy if the money supply is increased. Normally characterized by slow steady growth the US.

Source: pinterest.com

Source: pinterest.com

Central Banks print more money. When the cash or currency reserves-deposit ratio of the banks r falls. POL3A LO POL3A1 EK POL3A2 EK POL3A3 EK In this lesson summary review and remind yourself of the key terms and calculations related to money growth and inflation. To obtain superior broader measures one must go. It uses the four key graphs taught in AP Macroeconomics.

Source: pinterest.com

Source: pinterest.com

This means banks will be willing to lend a larger proportion of their funds. Both nominal interest rates and aggregate demand will decrease. Consumers and businesses have a demand for money including cash and checking and savings accounts. They will therefore increase the quantity of money they demand. POL3A LO POL3A1 EK POL3A2 EK POL3A3 EK In this lesson summary review and remind yourself of the key terms and calculations related to money growth and inflation.

Source: pinterest.com

Source: pinterest.com

Decrease investment spending and increase aggregate demand. If the demand for money decreases but the Fed keeps the money supply the same then. The money market is an economic model describing the supply and demand for money in a nation. Interest rate will decline but we cannot predict the change in the equilibrium quantity of money. The Fed increases the money supply by buying bonds increasing the demand for bonds in Panel a from D 1 to D 2 and the price of bonds to P b 2.

Source: pinterest.com

Source: pinterest.com

In general the demand for money will increase as it becomes more expensive to transfer between money and nonmoney accounts. This corresponds to an increase in the money supply to M in Panel b. Through quantitative easing creating money electronically. They will therefore increase the quantity of money they demand. Normally characterized by slow steady growth the US.

Source: pinterest.com

Source: pinterest.com

When the currency-deposit ratio k of the public decreases. This Demonstration shows the implications for the economy if the money supply is increased. They will therefore increase the quantity of money they demand. Lower interest rates to make it cheaper to borrow and encourage both consumption and investment. Increase both investment spending and aggregate demand.

Source: pinterest.com

Source: pinterest.com

Decrease both consumption spending and aggregate demand. Economist and former Treasury. The Fed can increase the money supply by lowering the reserve. Figure 2512 An Increase in the Money Supply. The demand for an asset depends on both its rate of return and its opportunity cost.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title u200bif money supply and money demand both increase by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.