Your Theory of industry supply and demand for bonds images are available in this site. Theory of industry supply and demand for bonds are a topic that is being searched for and liked by netizens today. You can Get the Theory of industry supply and demand for bonds files here. Find and Download all free images.

If you’re searching for theory of industry supply and demand for bonds images information related to the theory of industry supply and demand for bonds interest, you have come to the right site. Our website frequently gives you hints for downloading the maximum quality video and picture content, please kindly surf and locate more enlightening video articles and graphics that fit your interests.

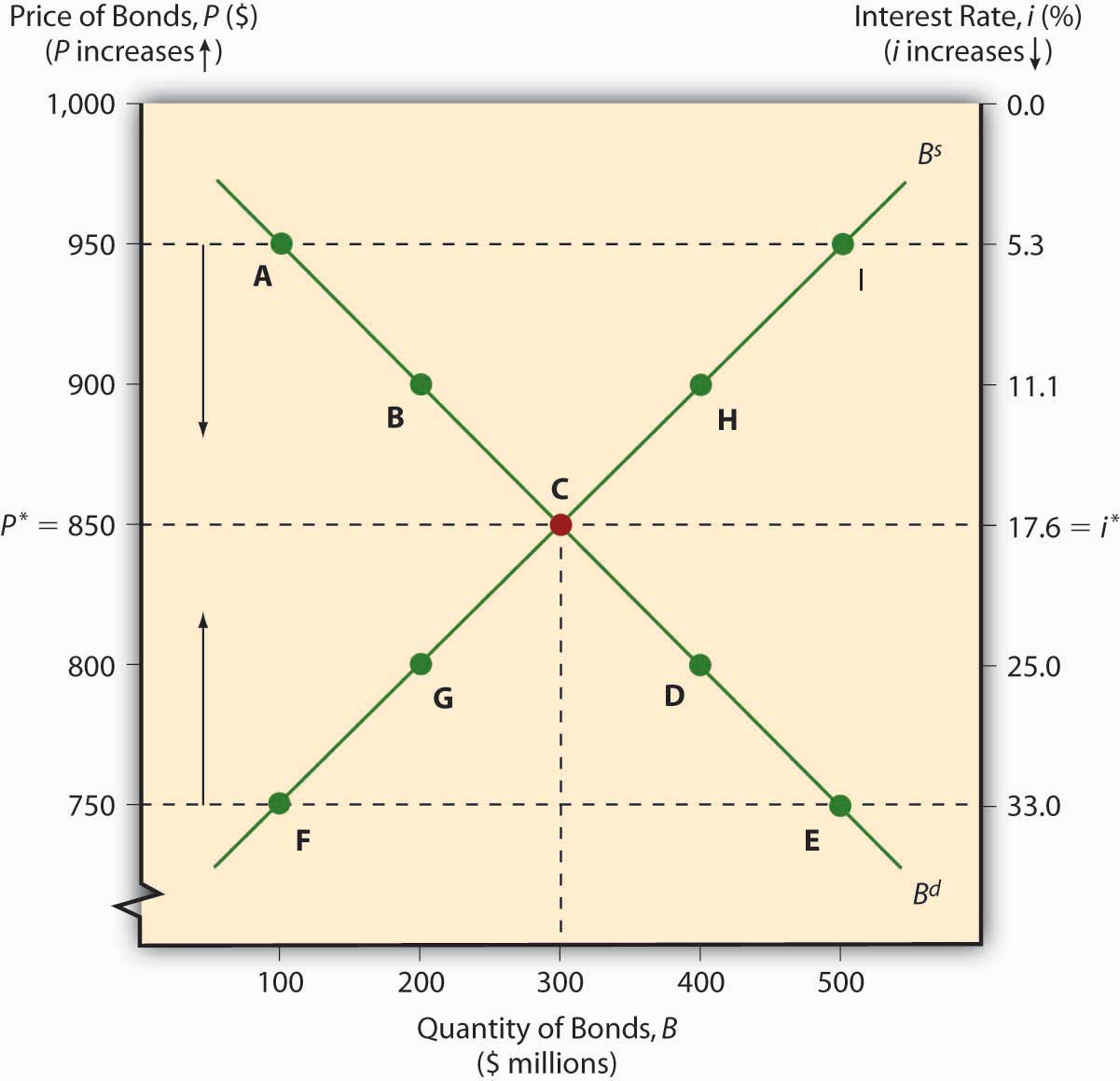

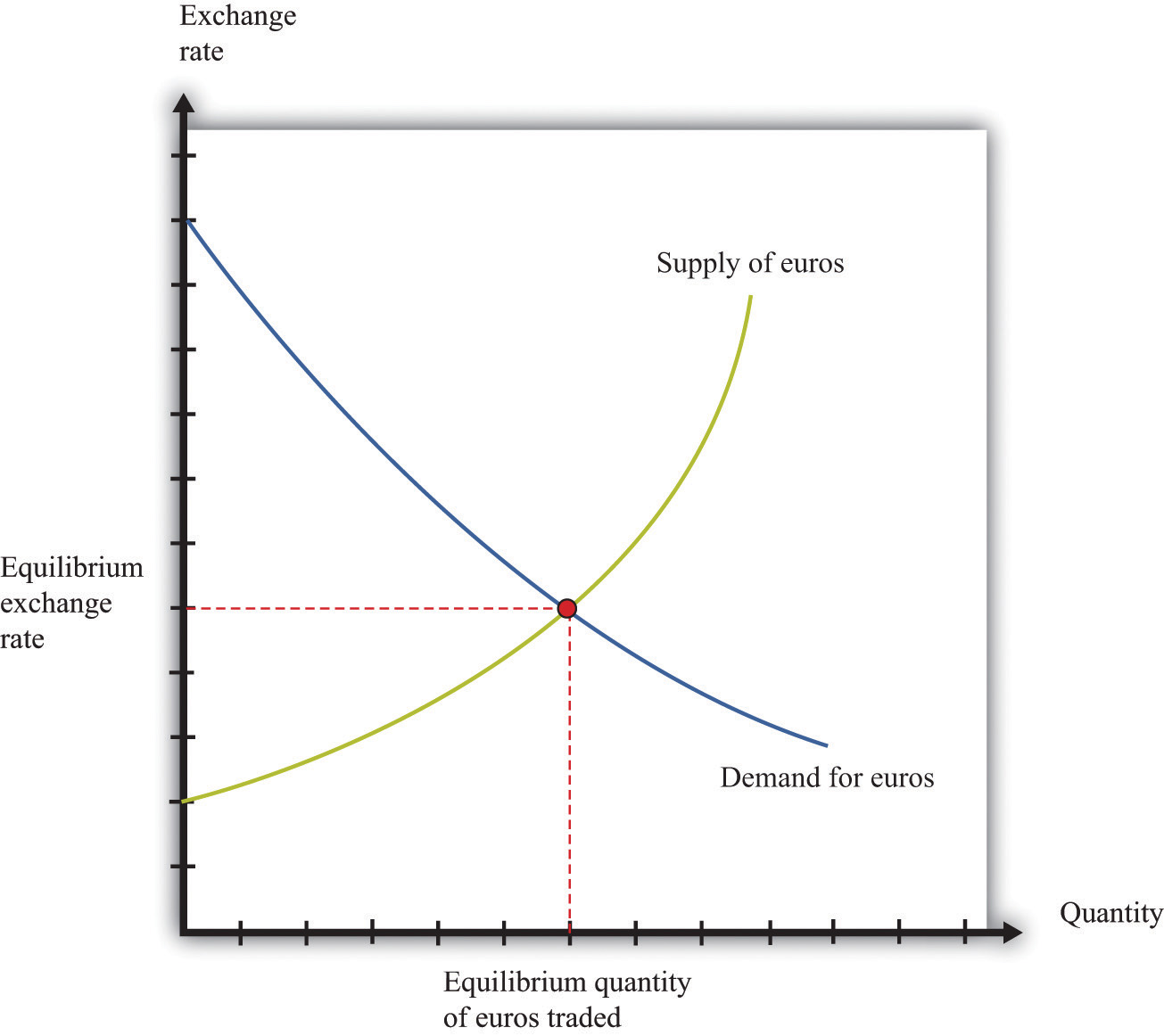

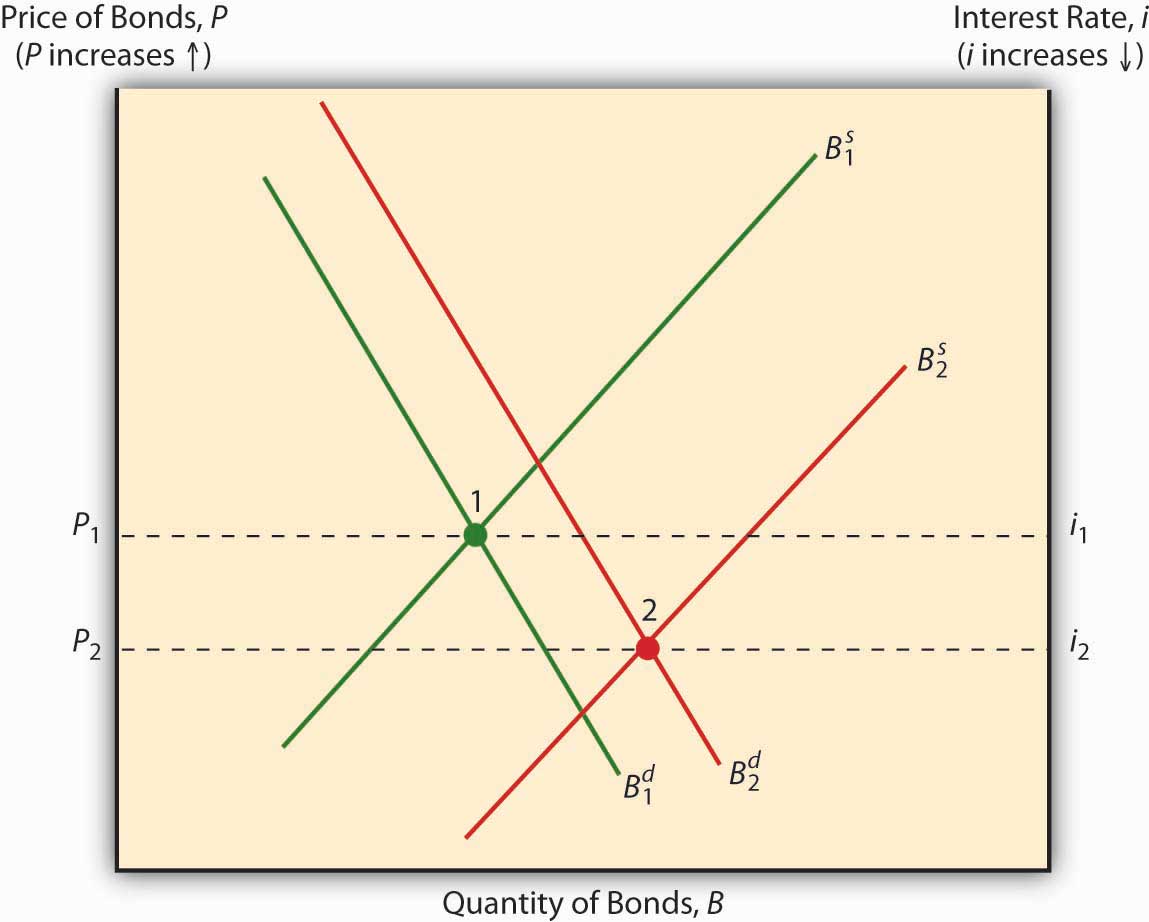

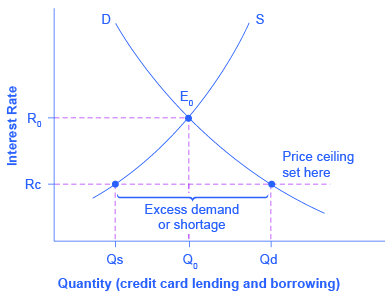

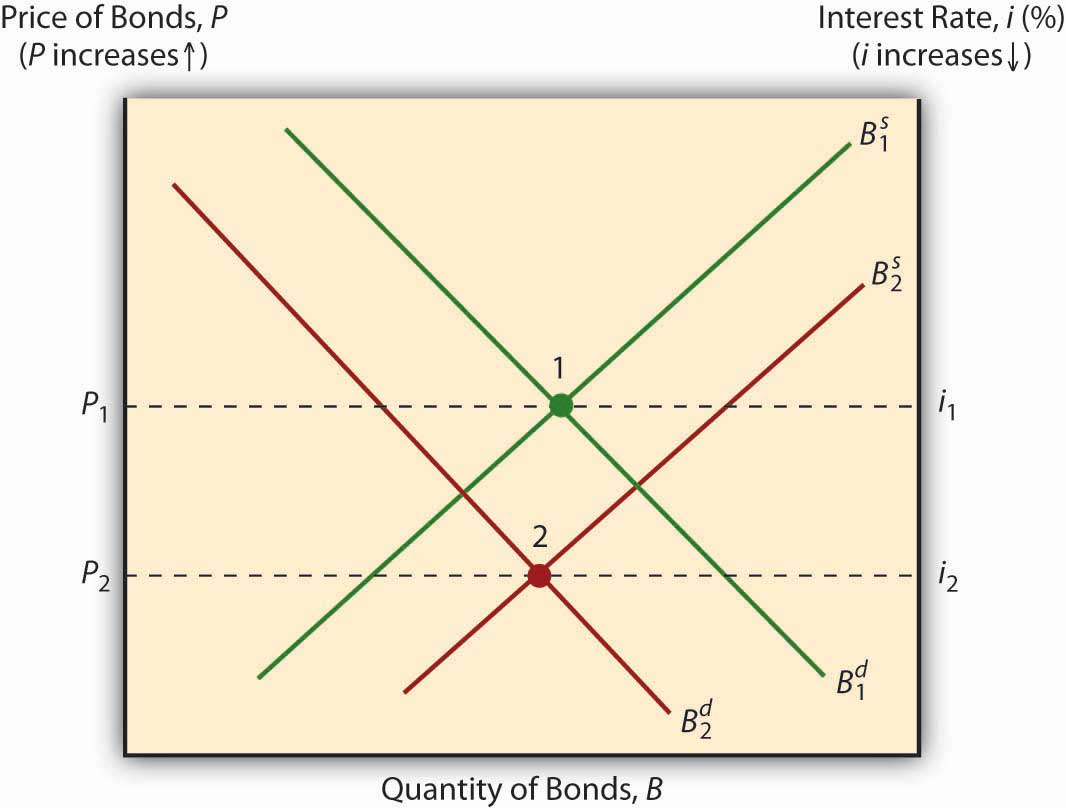

Theory Of Industry Supply And Demand For Bonds. Short run and supposes that the price level adjusts to bring money supply and money demand into balance. It predicts that interest rates will change when there is a change in demand because of changes in income or wealth expected returns risk or liquidity or when there is a change in supply because of changes in the attractiveness of investment opportunities the real cost of. That interest rates on long-term bonds respond to supply and demand conditions for those bonds. The demand and supply model predicts that at the lower price ceiling interest rate the quantity demanded of credit card debt will increase from its original level of Q 0 to Qd.

If a firm has fixed costs of 30000 a price of 400 and a breakeven point. Some analysts believe that the term structure of interest rates is determined by the behaviour of various types of financial institutions. At the price ceiling Rc quantity demanded will exceed quantity supplied. When quantity demanded or supplied changes as a result of a change in the price. In a capitalistic society prices are not determined by a central. That an average of expected short-term rates is an important component of interest rates on long-term bonds.

Investors have a preference for short-term bonds as they have lower interest-rate risk.

Buyers behavior is captured in the demand function and its graphical equivalent the demand curve. If a firm has fixed costs of 30000 a price of 400 and a breakeven point. YIt decides to raise interest rates to discourage borrowing and the purchase of goods. Demand for bonds will increase when wealth in the economy increases causing people to invest more money in bonds regardless of the price. This might seem like a violation of the law of demand which tells us that when price decreases the quantity demanded increases. If the price of solar power falls and the price of oil and coal stay the same the demand for solar power will rise.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Microeconomic theory teaches us. We can understand the difference by using the supply-and-demand framework. Decision of the Federal Reserve on interest rates. If a firm has fixed costs of 30000 a price of 400 and a breakeven point. We substitute solar power for coal power.

Source: investopedia.com

Source: investopedia.com

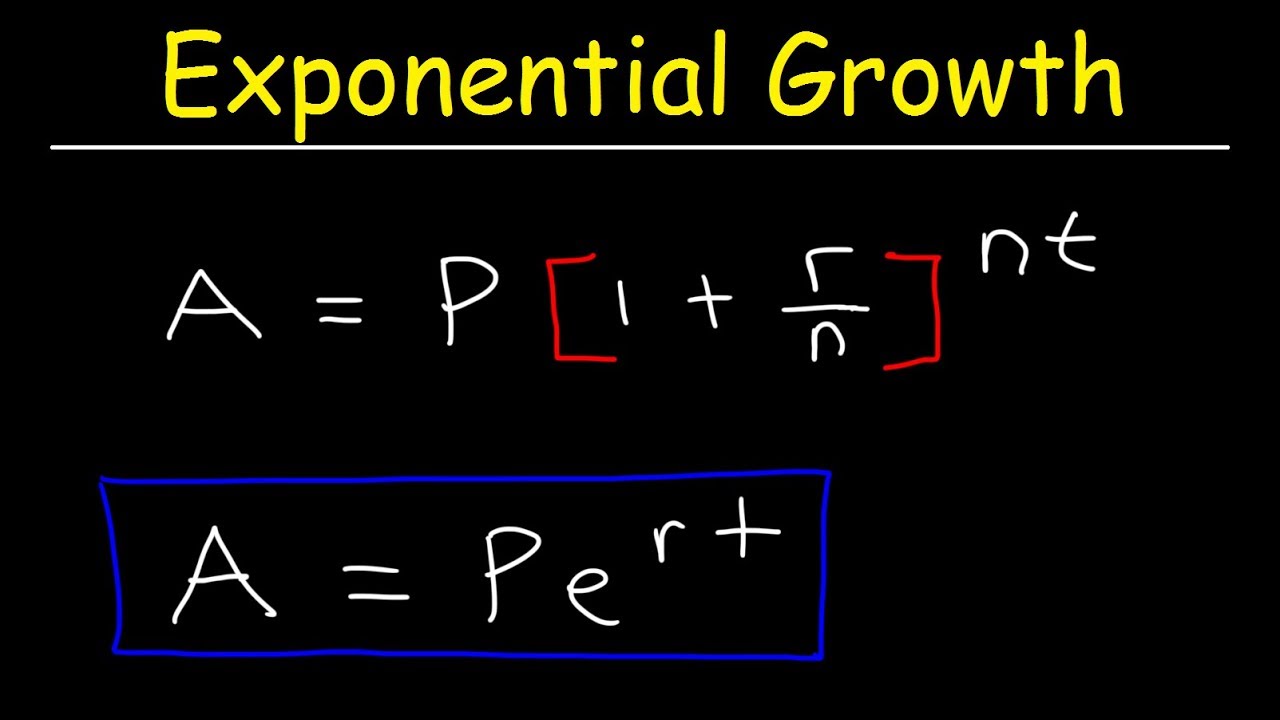

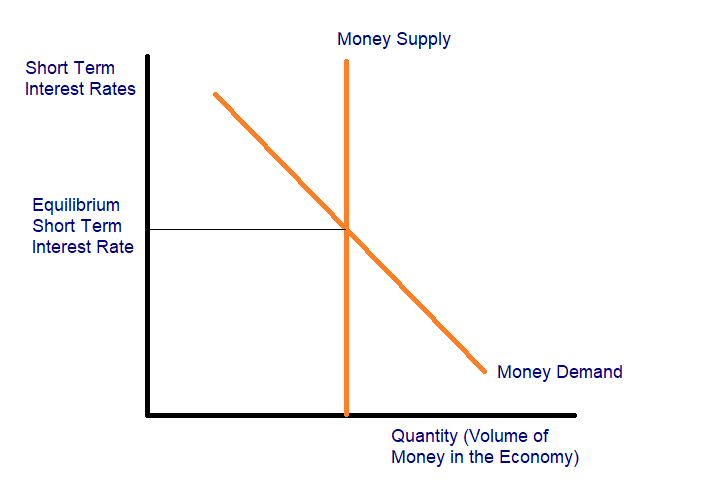

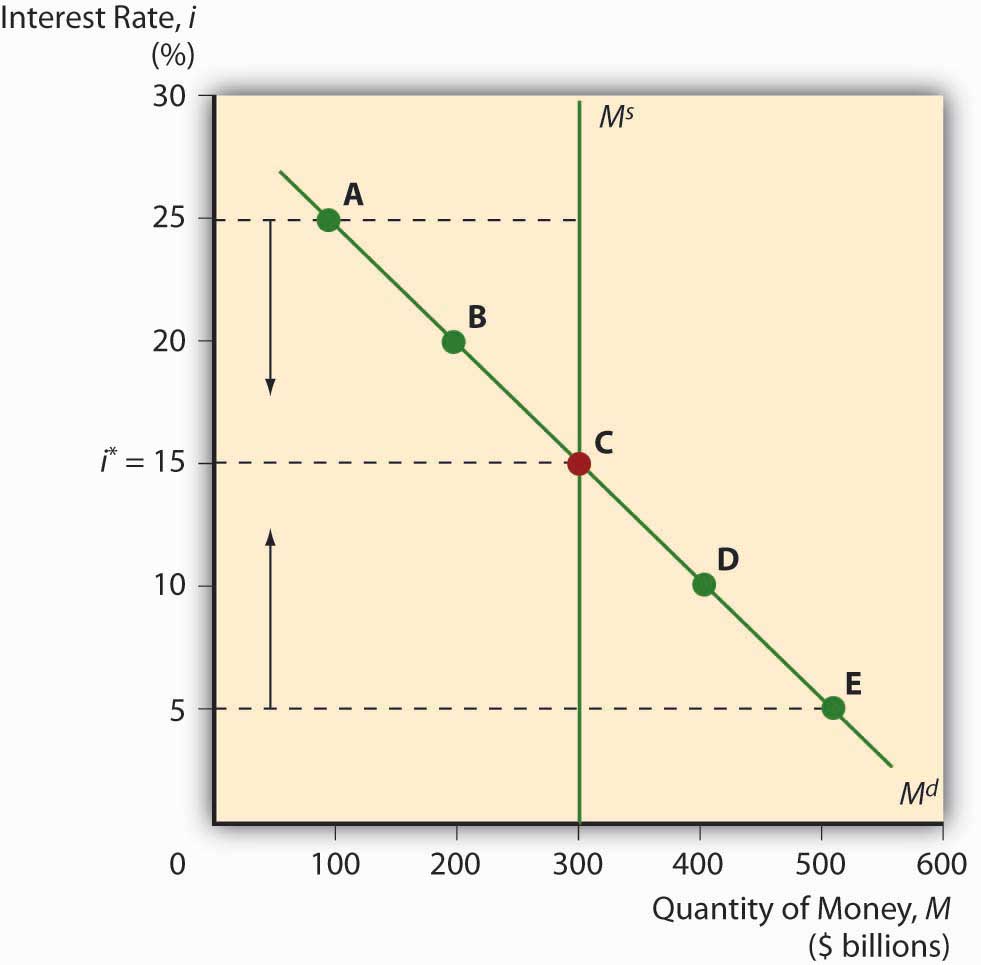

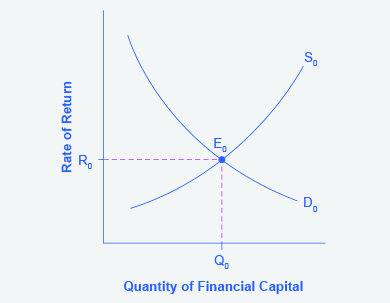

The demand for money is represented by a downward-sloping line on a supply-and-demand graph. Although several factors influence the supply and demand for bonds which in turn influences interest rates the Fed may also influence interest rates of bonds. That interest rates on long-term bonds respond to supply and demand conditions for those bonds. All of the above are correct. Decision of the Federal Reserve on interest rates.

Source: 2012books.lardbucket.org

Source: 2012books.lardbucket.org

When quantity demanded or supplied changes as a result of a change in the price. Short run and supposes that the price level adjusts to bring money supply and money demand into balance. Multiple Choice expectations hypothesis. Market segmentation theory also referred to as the segmented markets theory says that bonds of different maturities effectively trade in different markets each with its own supply-and-demand. If a firm has fixed costs of 30000 a price of 400 and a breakeven point.

Source: rba.gov.au

Source: rba.gov.au

However the quantity supplied of credit card debt will decrease from the original Q 0 to Qs. Some analysts believe that the term structure of interest rates is determined by the behaviour of various types of financial institutions. In the Detroit Tigers example there is a decrease in the price of shirts and in the quantity sold. This theory is called the. Determination of interest rate in the money market Changing the Interest Rate ySuppose the Fed begins to fear inflation.

In a capitalistic society prices are not determined by a central. Forming the basis for introductory concepts of economics the supply and demand model refers to the combination of buyers preferences comprising the demand and the sellers preferences comprising the supply which together determine the market prices and product quantities in any given market. Buyers behavior is captured in the demand function and its graphical equivalent the demand curve. Theory of industry supply and demand for bonds. A micro example demand curves working for an individual market.

Source: 2012books.lardbucket.org

Source: 2012books.lardbucket.org

Liquidity Theory supplydemand for money report bondsmoney bonds demand price profit fear lendinginvestment riskreliability transactions attention to the future speculative purposes Public agents government and private individuals banks. Liquidity preference theory is most relevant to the a. We substitute solar power for coal power. When supply exceeds demand prices are going lower. People buy bonds and interest rate falls Excess demand for money.

Source: 2012books.lardbucket.org

Source: 2012books.lardbucket.org

When the price of an individual good falls demand rises the law of demand. Demand for bonds will increase when wealth in the economy increases causing people to invest more money in bonds regardless of the price. Liquidity preference theory is most relevant to the a. Short run and supposes that the price level adjusts to bring money supply and money demand into balance. A micro example demand curves working for an individual market.

Source: rba.gov.au

Source: rba.gov.au

Liquidity preference theory is most relevant to the a. Determination of interest rate in the money market Changing the Interest Rate ySuppose the Fed begins to fear inflation. Although several factors influence the supply and demand for bonds which in turn influences interest rates the Fed may also influence interest rates of bonds. However the quantity supplied of credit card debt will decrease from the original Q 0 to Qs. When the Fed buys bonds.

Source: saylordotorg.github.io

Source: saylordotorg.github.io

On the theory of the firm will yield the supply curve. The concept of demand demonstrates that _____. A micro example demand curves working for an individual market. To avoid confusion it is important to make the distinction between movements along a demand or supply curve and shifts in a demand or supply curve. Investors have a preference for short-term bonds as they have lower interest-rate risk.

When demand exceeds supply prices are going higher. However the quantity supplied of credit card debt will decrease from the original Q 0 to Qs. Although several factors influence the supply and demand for bonds which in turn influences interest rates the Fed may also influence interest rates of bonds. We can understand the difference by using the supply-and-demand framework. In a capitalistic society prices are not determined by a central.

If a firm has fixed costs of 30000 a price of 400 and a breakeven point. In economics demand refers to_____ a Quantity demanded at a particular time b Quantity demanded backed by ability to pay c Quantity demanded of all goods d Quantity demanded at a particular price in a given period of time 2. The demand and supply model predicts that at the lower price ceiling interest rate the quantity demanded of credit card debt will increase from its original level of Q 0 to Qd. We will now use the supply and demand framework for bonds to analyze why inter-est rates change. People buy bonds and interest rate falls Excess demand for money.

Source: courses.lumenlearning.com

Source: courses.lumenlearning.com

It predicts that interest rates will change when there is a change in demand because of changes in income or wealth expected returns risk or liquidity or when there is a change in supply because of changes in the attractiveness of investment opportunities the real cost of. When supply and demand are balanced in the financial markets the markets balance and are ranging. A micro example demand curves working for an individual market. When supply exceeds demand prices are going lower. Forming the basis for introductory concepts of economics the supply and demand model refers to the combination of buyers preferences comprising the demand and the sellers preferences comprising the supply which together determine the market prices and product quantities in any given market.

Source: opentextbc.ca

Source: opentextbc.ca

Market segmentation theory also referred to as the segmented markets theory says that bonds of different maturities effectively trade in different markets each with its own supply-and-demand. The demand and supply model is useful in explaining how price and quantity traded are determined and how external influences affect the values of those variables. It predicts that interest rates will change when there is a change in demand because of changes in income or wealth expected returns risk or liquidity or when there is a change in supply because of changes in the attractiveness of investment opportunities the real cost of. By the behavior of various types of financial institutions. All of the above are correct.

At the price ceiling Rc quantity demanded will exceed quantity supplied. When demand exceeds supply prices are going higher. Liquidity preference theory is most relevant to the a. That interest rates on long-term bonds respond to supply and demand conditions for those bonds. When the price of an individual good falls demand rises the law of demand.

Source: 2012books.lardbucket.org

Source: 2012books.lardbucket.org

If a firm has fixed costs of 30000 a price of 400 and a breakeven point. Buyers behavior is captured in the demand function and its graphical equivalent the demand curve. A micro example demand curves working for an individual market. Decision of the Federal Reserve on interest rates. Microeconomic theory teaches us.

Source: rba.gov.au

Source: rba.gov.au

When supply and demand are balanced in the financial markets the markets balance and are ranging. When demand exceeds supply prices are going higher. YIt decides to raise interest rates to discourage borrowing and the purchase of goods. The demand and supply model is useful in explaining how price and quantity traded are determined and how external influences affect the values of those variables. The demand for money is represented by a downward-sloping line on a supply-and-demand graph.

Source: opentextbc.ca

Source: opentextbc.ca

This theory is called the. People buy bonds and interest rate falls Excess demand for money. When demand exceeds supply prices are going higher. When the Fed buys bonds. This theory is called the.

Source: 2012books.lardbucket.org

Source: 2012books.lardbucket.org

In a capitalistic society prices are not determined by a central. Forming the basis for introductory concepts of economics the supply and demand model refers to the combination of buyers preferences comprising the demand and the sellers preferences comprising the supply which together determine the market prices and product quantities in any given market. When the Fed buys bonds. People sell bonds and interest rate rises 0 27 2. Investors have a preference for short-term bonds as they have lower interest-rate risk.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title theory of industry supply and demand for bonds by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.