Your Tax revenue supply demand graph images are ready. Tax revenue supply demand graph are a topic that is being searched for and liked by netizens today. You can Download the Tax revenue supply demand graph files here. Get all free vectors.

If you’re searching for tax revenue supply demand graph pictures information related to the tax revenue supply demand graph topic, you have pay a visit to the right blog. Our website always gives you suggestions for viewing the maximum quality video and picture content, please kindly surf and find more informative video articles and images that fit your interests.

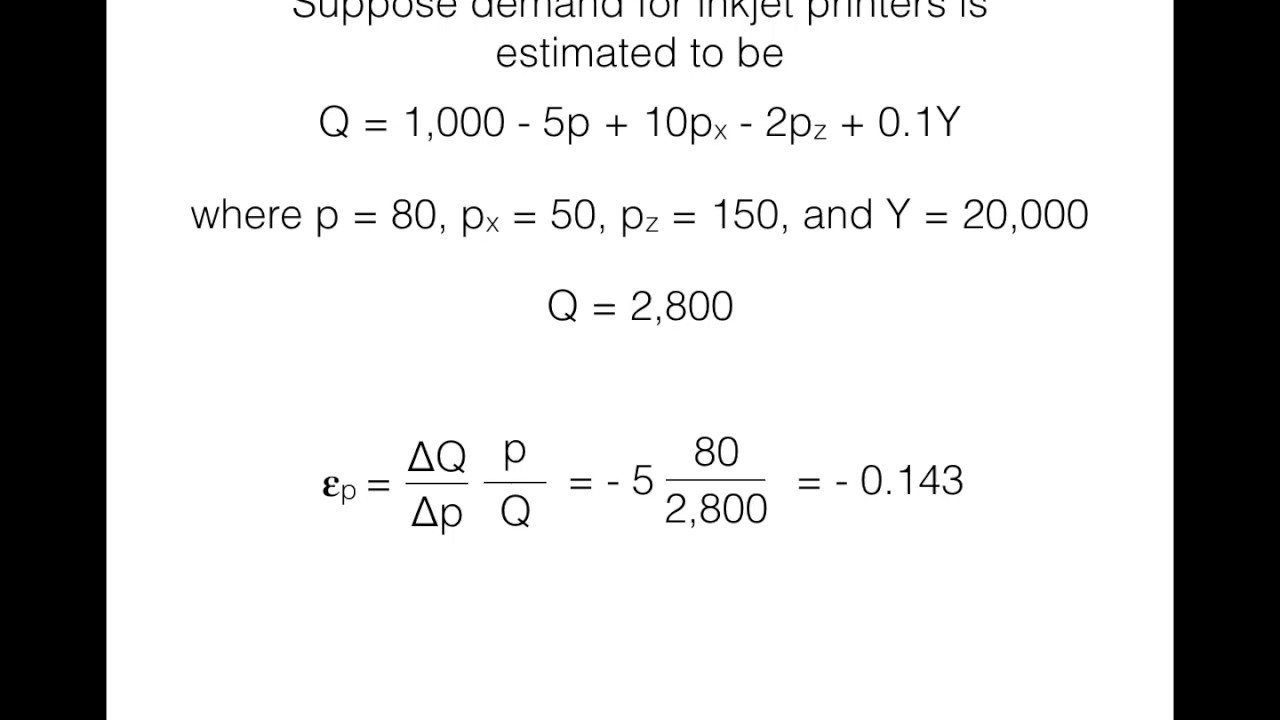

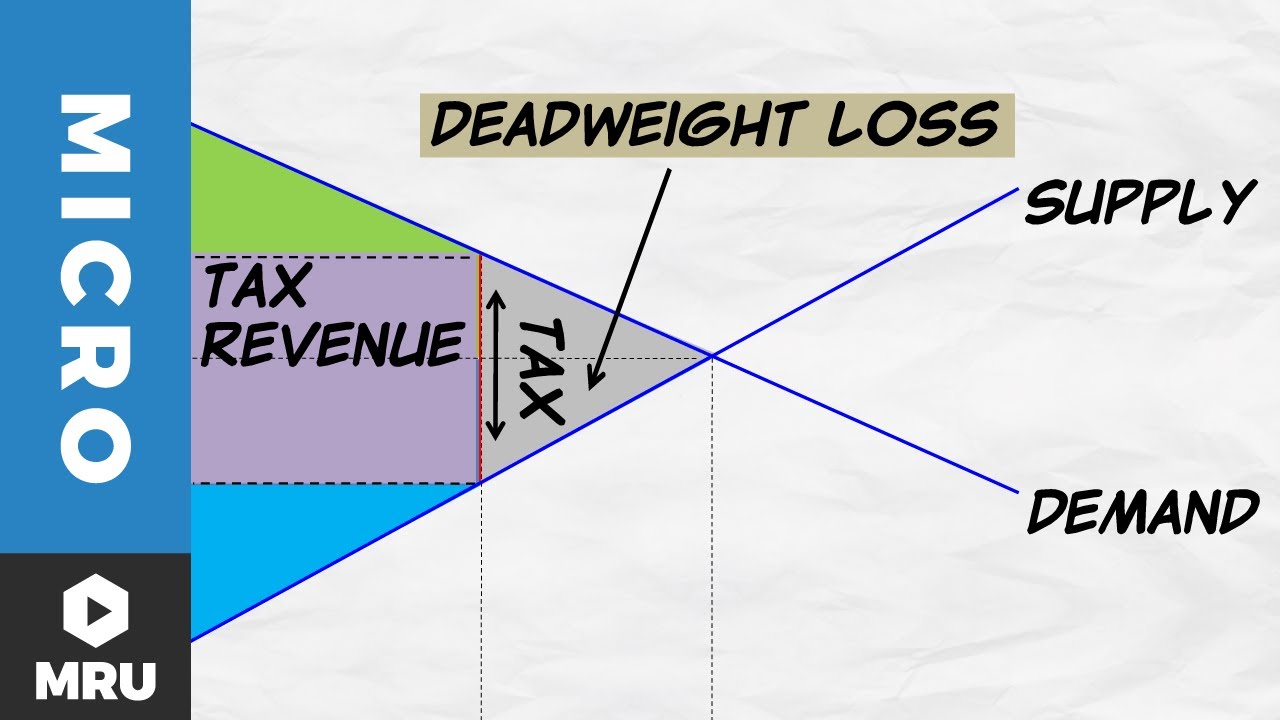

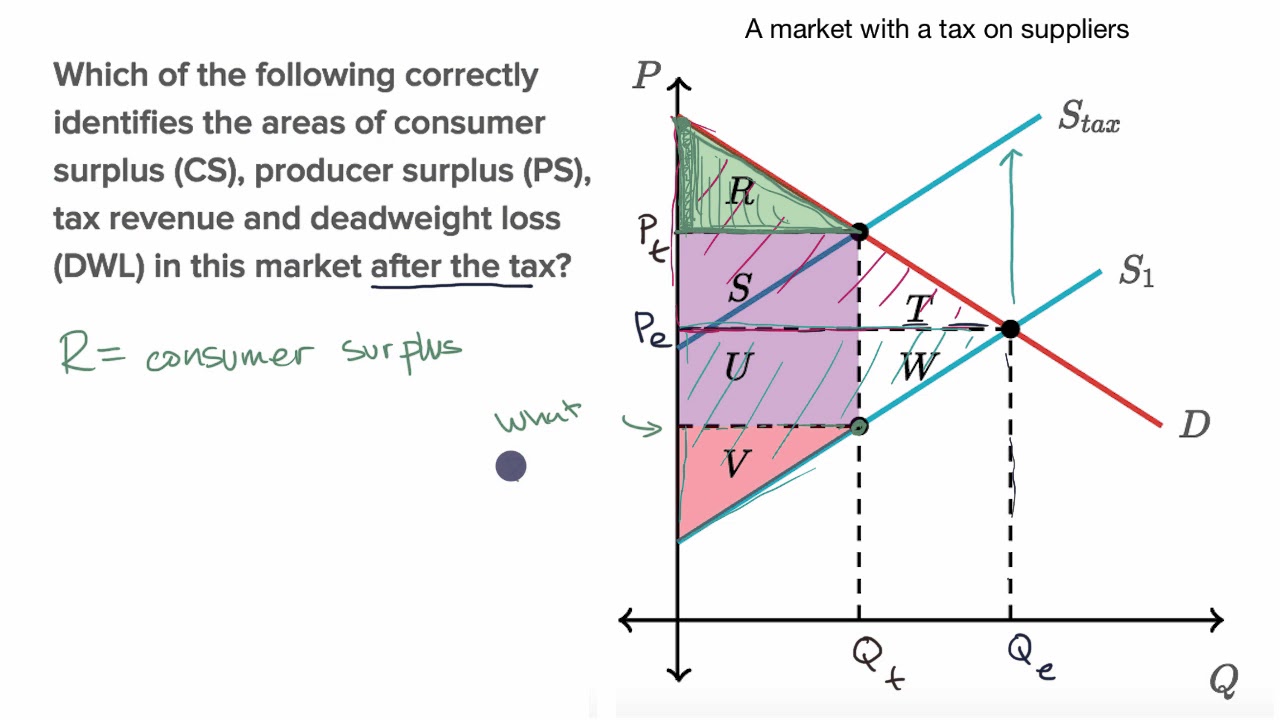

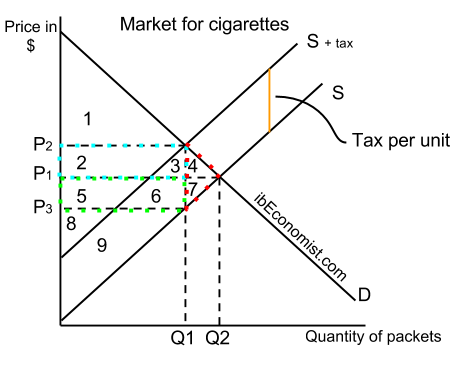

Tax Revenue Supply Demand Graph. The following graph shows the annual supply and demand for this good. On the following graph use the green rectangle triangle symbols to shade the area that represents tax revenue for leather jackets. Example breaking down tax incidence. This calculation is relatively easy if you already have the.

Here are a number of highest rated Tax On Supply And Demand Graph pictures upon internet. And plot the demand and supply curves if the government has imposed an indirect tax at a rate of. It also shows the supply curve STax shifted up by the amount of the proposed tax 100 per jacket. T P b P s 250 3 Q 2. The following graph shows the demand and supply curves for Airbnb rentals in 2018. We identified it from honorable source.

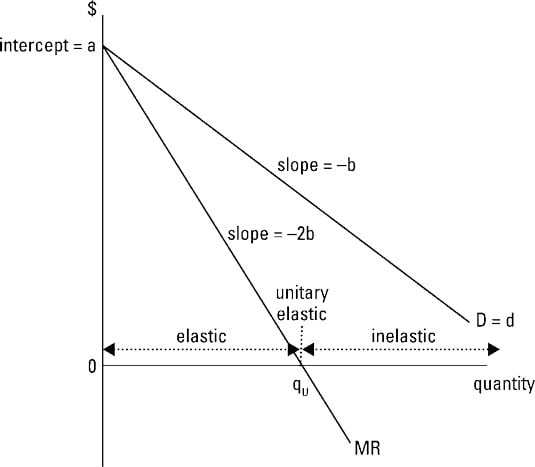

A firms revenue is where its supply and demand curve intersect producing an equilibrium level of price and quantity.

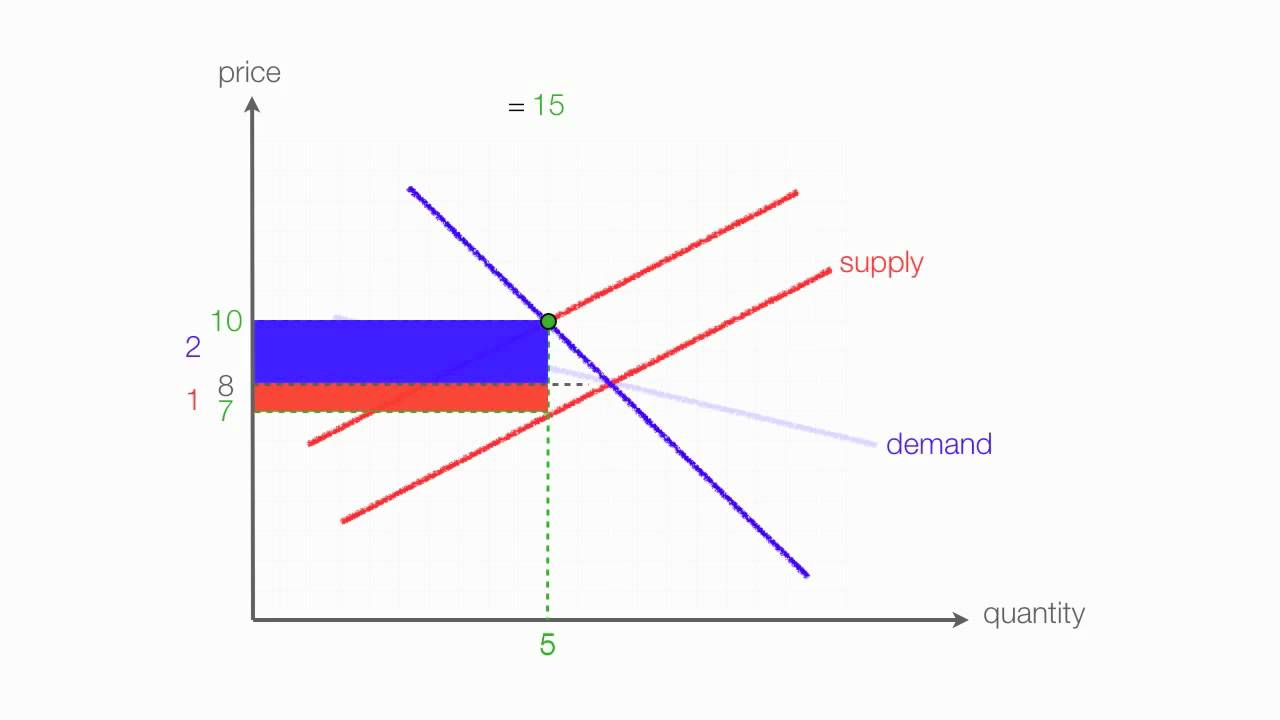

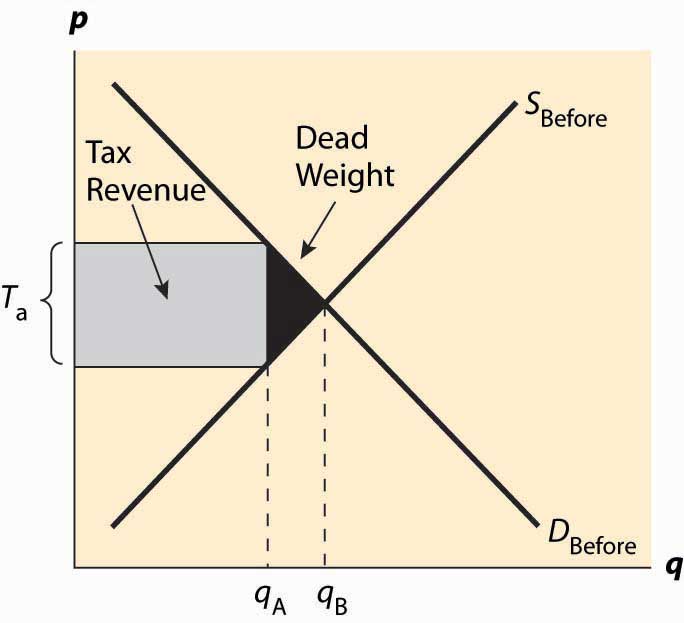

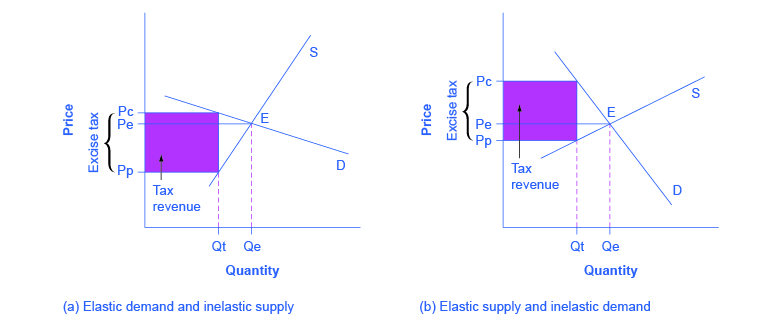

This is a very quick video about how to calculate revenue using the supply and demand curves. Then use the black point cross symbol to shade the area representing the deadweight loss generated by this tax. The tax incidence depends on the relative price elasticity of supply and demand. If the government imposes a specific tax per unit of 3 plot the new supply curve on the original supply and demand diagram. The tax incidence on the consumers is given by the difference between the price paid Pc and the initial equilibrium price Pe. On the following graph use the green rectangle triangle symbols to shade the area that represents tax revenue for leather jackets.

Source: economicshelp.org

Source: economicshelp.org

The more elastic the supply curve the easier it is for sellers to reduce the quantity sold instead of taking lower prices. More hosts have now entered the Airbnb market and awareness of this hotel alternative has increased demand. Use the diagram to find out the new equilibrium price and quantity. A firms revenue is where its supply and demand curve intersect producing an equilibrium level of price and quantity. Then use the black point cross symbol to shade the area representing the deadweight loss generated by this tax.

Source: economics.stackexchange.com

Source: economics.stackexchange.com

This is the currently selected item. This is illustrated in Figure 53 Effect of a tax on equilibrium. A per unit tax is a fixed tax on a product independent of the products price It can be represented as a wedge between the supply and demand curves indicates the price buyers pay and indicates the price sellers receive net of the tax The orange rectangle represents the tax revenue the per unit tax times the quantity sold The consumer surplus is shaded in blue the producer surplus in. First let us calculate the equilibrium price and equilibrium quantity that were before the imposed tax. We undertake this kind of Tax On Supply And Demand Graph graphic could possibly be the most trending subject later we ration it in google.

Source: instructables.com

Source: instructables.com

It is obvious that. P b 200 Q. The more elastic the supply curve the easier it is for sellers to reduce the quantity sold instead of taking lower prices. Calculate the revenue received by the firms. How do you calculate tax on supply and demand curve.

Source: microeconomics2012.blogspot.com

Source: microeconomics2012.blogspot.com

P b 200 Q. An excise tax a tariff and to see calculations eg. When supply is more elastic than demand buyers bear most of the tax burden. What are the types of tax revenue. However the outcome is the same regardless of who pays the tax.

Source: tutorsonnet.com

Source: tutorsonnet.com

It also shows the supply curve STax shifted up by the amount of the proposed tax 100 per jacket. Its submitted by processing in the best field. While supply for the product has not changed all of the determinants of supply are the same producers incur higher cost which is why we will see a new equilibrium point further up the demand curve at a higher. T P b P s 250 3 Q 2. This calculation is relatively easy if you already have the.

Source: youtube.com

Source: youtube.com

T P b P s 250 3 Q 2. T P b P s 250 3 Q 2. We identified it from honorable source. Hence the new equilibrium quantity after tax can be found from equating P Q3 4 and P 20 Q so Q3 4 20 Q which gives QT 12. In this case you can solve for your P in both of your equations.

Source: atlas101.ca

Source: atlas101.ca

In this case you can solve for your P in both of your equations. This calculation is relatively easy if you already have the. We identified it from honorable source. An excise tax a tariff and to see calculations eg. The tax revenue is given by the shaded area which we obtain by multiplying the tax per unit by the total quantity sold Qt.

Source: khanacademy.org

Source: khanacademy.org

The more elastic the supply curve the easier it is for sellers to reduce the quantity sold instead of taking lower prices. The more elastic supply and demand are in a market the more taxes in that market distort behavior and the more likely it is that a tax cut will raise tax revenue. With 4 tax on producers the supply curve after tax is P Q3 4. Total Revenue price x quantity TR P Q output P TR Q output TR maximum when MR goes negative In perfect competition MR price demand. Our lessons are m.

Source: youtube.com

Source: youtube.com

This is a very quick video about how to calculate revenue using the supply and demand curves. In both cases the effect of the tax on the supply-demand equilibrium is to shift the quantity toward a point where the before-tax demand minus the before-tax supply is the amount of the tax. Consumer surplus tax revenue. Use the green rectangle triangle symbols to illustrate the area representing the revenue raised by a 20-per-room tax. The following graph shows the annual supply and demand for this good.

This calculation is relatively easy if you already have the. Consumer surplus tax revenue. When the tax is imposed the price that the buyer pays must exceed. Then use the black triangle plus symbols to shade. Total Revenue price x quantity TR P Q output P TR Q output TR maximum when MR goes negative In perfect competition MR price demand.

Source: instructables.com

Source: instructables.com

Q_D Q_S QD. If this video is a little fast we apologize. With 4 tax on producers the supply curve after tax is P Q3 4. Excise taxes tend to be thought to hurt mainly the specific industries they target. The tax incidence on the consumers is given by the difference between the price paid Pc and the initial equilibrium price Pe.

Source: instructables.com

Source: instructables.com

More hosts have now entered the Airbnb market and awareness of this hotel alternative has increased demand. Calculate the revenue received by the firms. It is obvious that. When demand is more elastic than supply producers bear most of the cost of the tax. Our lessons are m.

Source: ibeconomist.com

Source: ibeconomist.com

When the tax is imposed the price that the buyer pays must exceed. On the following graph use the green rectangle triangle symbols to shade the area that represents tax revenue for leather jackets. The tax amount could be expressed as the vertical difference between your buyer price Pb and your seller price Ps. P s Q 2 50. It also shows the supply curve STax shifted up by the amount of the proposed tax 100 per jacket.

Source: ictsd.org

Source: ictsd.org

Calculate the tax revenue received by the government indicate it on your diagram. Tax On Supply And Demand Graph. If the government imposes a specific tax per unit of 3 plot the new supply curve on the original supply and demand diagram. The quantity traded before a tax was imposed was q B. This web-based personal project allows the user to graph supply and demand for the products of an industry.

Source: socialsci.libretexts.org

Source: socialsci.libretexts.org

On the following graph use the green rectangle triangle symbols to shade the area that represents tax revenue for leather jackets. In both cases the effect of the tax on the supply-demand equilibrium is to shift the quantity toward a point where the before-tax demand minus the before-tax supply is the amount of the tax. This calculation is relatively easy if you already have the. Tax On Supply And Demand Graph. The more elastic supply and demand are in a market the more taxes in that market distort behavior and the more likely it is that a tax cut will raise tax revenue.

T P b P s 250 3 Q 2. A tax paid by buyers shifts the demand curve while a tax paid by sellers shifts the supply curve. If the government imposes a specific tax per unit of 3 plot the new supply curve on the original supply and demand diagram. The following graph shows the demand and supply curves for Airbnb rentals in 2018. A firms revenue is where its supply and demand curve intersect producing an equilibrium level of price and quantity.

Source: khanacademy.org

Source: khanacademy.org

This is the currently selected item. Example breaking down tax incidence. We identified it from honorable source. A per unit tax is a fixed tax on a product independent of the products price It can be represented as a wedge between the supply and demand curves indicates the price buyers pay and indicates the price sellers receive net of the tax The orange rectangle represents the tax revenue the per unit tax times the quantity sold The consumer surplus is shaded in blue the producer surplus in. This is illustrated in Figure 53 Effect of a tax on equilibrium.

This calculation is relatively easy if you already have the. The following graph shows the annual supply and demand for this good. Excise taxes tend to be thought to hurt mainly the specific industries they target. The quantity traded before a tax was imposed was q B. However the outcome is the same regardless of who pays the tax.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title tax revenue supply demand graph by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.