Your Tax on supply and demand graph images are ready in this website. Tax on supply and demand graph are a topic that is being searched for and liked by netizens today. You can Download the Tax on supply and demand graph files here. Find and Download all free photos and vectors.

If you’re searching for tax on supply and demand graph images information linked to the tax on supply and demand graph keyword, you have pay a visit to the right blog. Our site always provides you with suggestions for downloading the highest quality video and image content, please kindly surf and find more informative video articles and graphics that match your interests.

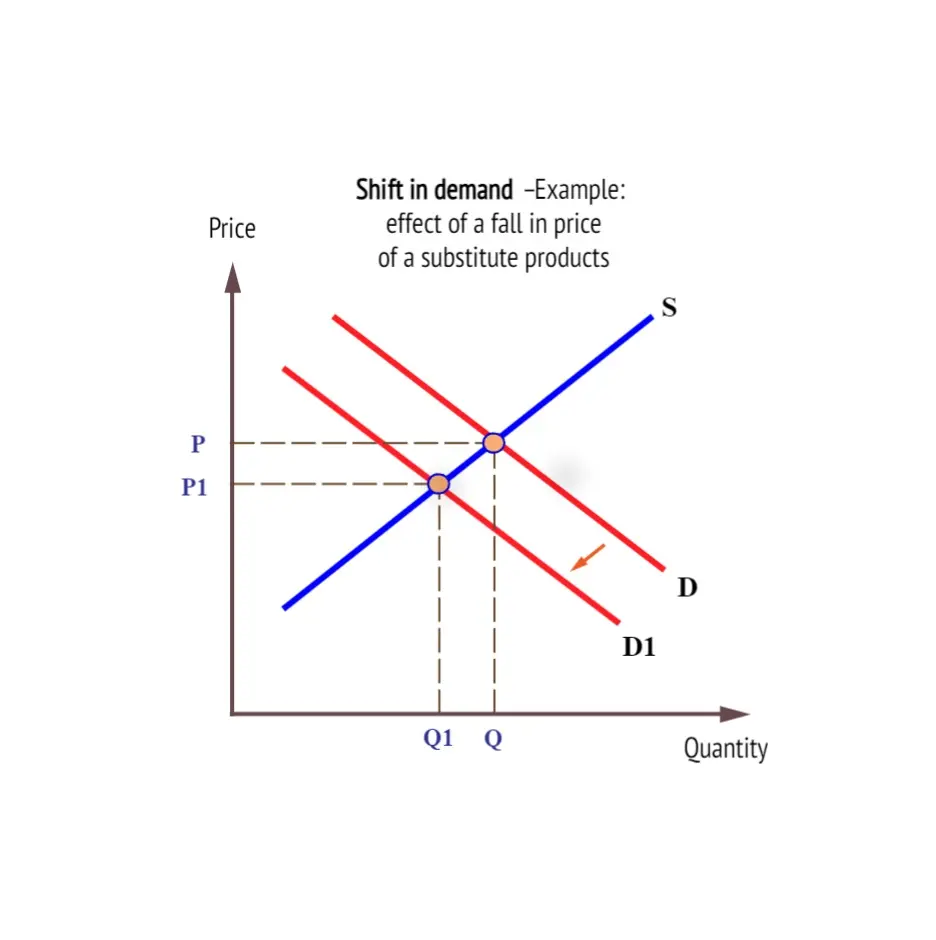

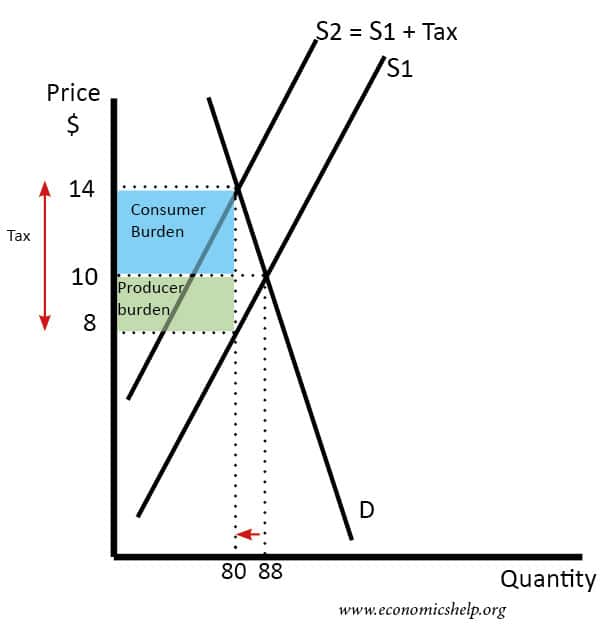

Tax On Supply And Demand Graph. The consumers will now pay price P while producers will receive P P - t. 430 b displays a perfectly inelastic demand curve. Thus the incidence of a sales tax falls entirely upon the sellers. Use the diagram to find out the new equilibrium price and quantity.

Excise Tax Overview And How It Affects The Price And Quantitiy Of Goods From corporatefinanceinstitute.com

Excise Tax Overview And How It Affects The Price And Quantitiy Of Goods From corporatefinanceinstitute.com

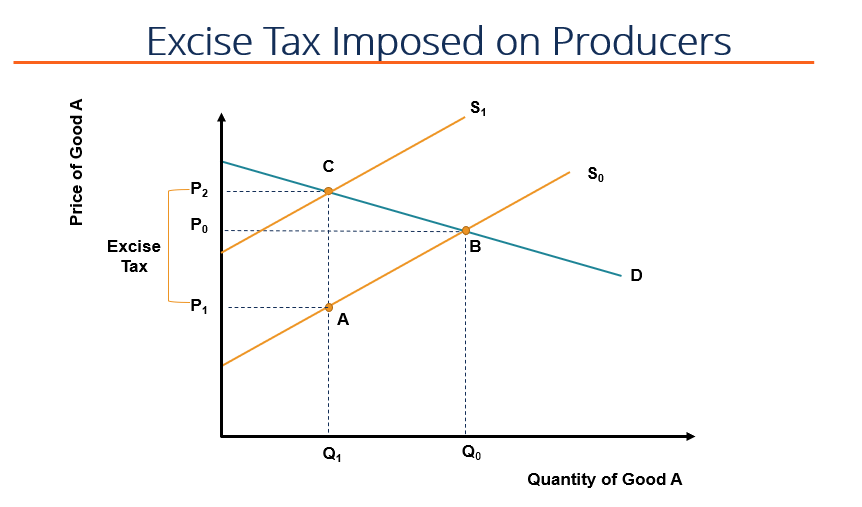

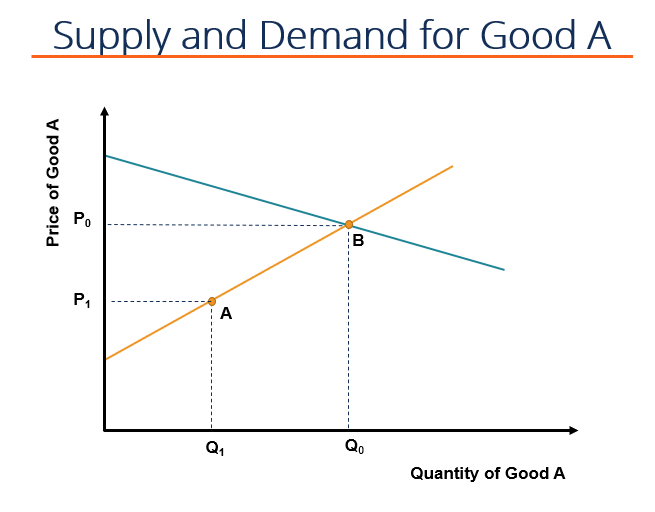

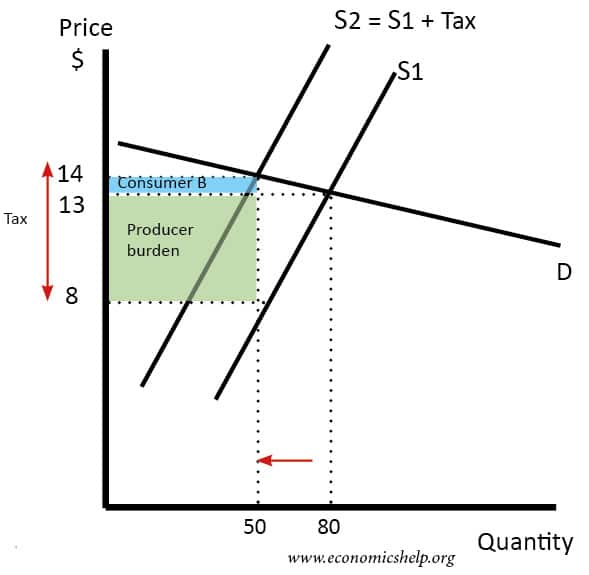

In other words pre-tax and post-tax price P P T are the same. If we draw a perpendicular from the point of equilibrium to both axis we can find the. The demand curve because of the tax t. In this case the tax burden is split evenly between the consumer and producer. When demand happens to be price inelastic and supply is price elastic the majority of the tax burden falls upon the consumer. So before the tax I have this supply curve right over here in blue.

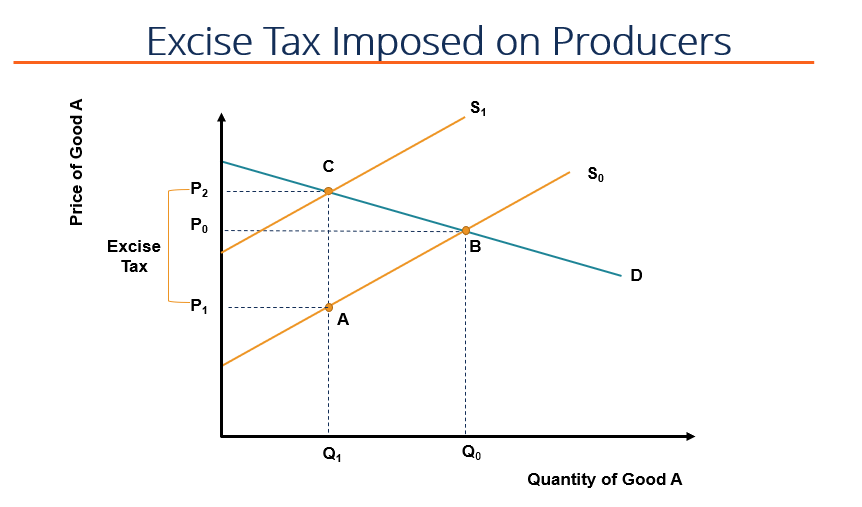

Therefore what remains is an upwards shift that will lead to increased equilibrium price-decreased equilibrium quantity.

How do you calculate tax on supply and demand curve. If the supply curve is relatively flat the supply is price elastic. And if we wanted to look at the consumer surplus it would be the area above this horizontal line. However demand being perfectly elastic price is not altered. If the government imposes a specific tax per unit of 3 plot the new supply curve on the original supply and demand diagram. How do you calculate tax on supply and demand curve.

Source: ec2014marielouiseschnetz.wordpress.com

Source: ec2014marielouiseschnetz.wordpress.com

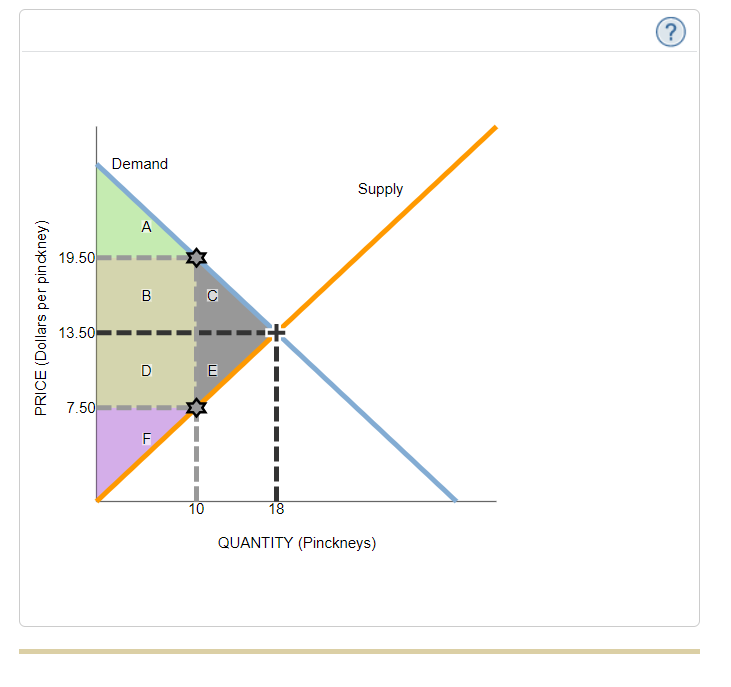

On the following graph use the green rectangle triangle symbols to shade the area that represents tax revenue for leather jackets. And below the demand curve. Use the diagram to find out the new equilibrium price and quantity. In this case the tax burden is split evenly between the consumer and producer. With 4 tax on producers the supply curve after tax is P Q3 4.

Source: researchgate.net

Source: researchgate.net

The consumers will now pay price P while producers will receive P P - t. The consumers will now pay price P while producers will receive P P - t. If the supply curve is relatively flat the supply is price elastic. Following from the Law of Supply and Demand as the price to consumers increases and the price received by suppliers decreases the quantity that each wishes to trade will decrease. Extensive study in economics has considered this issue and theories exist to explain the relationship between taxes and the demand curve.

Source: slideplayer.com

Source: slideplayer.com

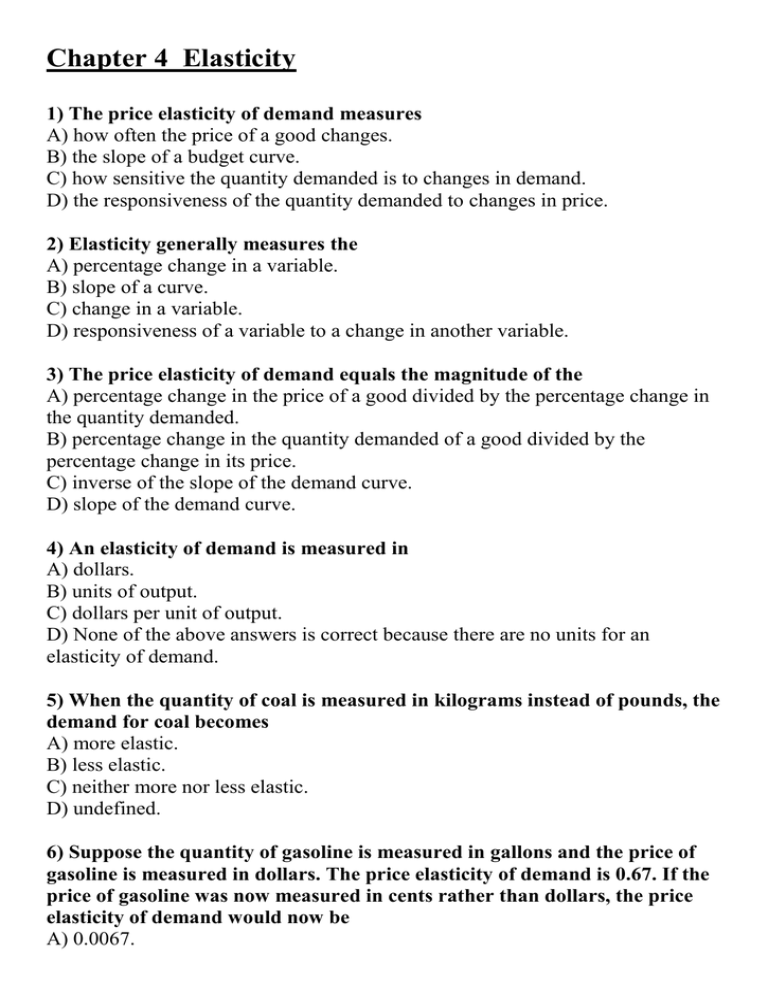

Shifts from D to D. And if we wanted to look at the consumer surplus it would be the area above this horizontal line. And I have this demand curve. 430 b displays a perfectly inelastic demand curve. The tax incidence depends upon the relative elasticity of demand and supply.

Source: economics.stackexchange.com

Source: economics.stackexchange.com

In other words pre-tax and post-tax price P P T are the same. The demand curve because of the tax t. Before the tax after the tax. Economists are often concerned with the effect of government policies like taxes or subsidies on the interaction of supply and demand. Shifts from D to D.

Source: instructables.com

Source: instructables.com

So before the tax I have this supply curve right over here in blue. The following graph shows the annual supply and demand for this good. With 4 tax on producers the supply curve after tax is P Q3 4. With 4 tax on producers the supply curve after tax is P Q3 4. Following from the Law of Supply and Demand as the price to consumers increases and the price received by suppliers decreases the quantity that each wishes to trade will decrease.

Source: economicshelp.org

Source: economicshelp.org

Economists are often concerned with the effect of government policies like taxes or subsidies on the interaction of supply and demand. If a government puts a 1 tax on each packet of cigarettes the legal incidence is on the cigarette smoker. It illustrates a concept based on select economic assumptions- it does not reflect a precise reality. So that is our original consumer surplus. Represents the demand curveThis curve is plotted horizontally to indicate perfectly elastic demand.

Before you begin understand that the economic graph of supply and demand is a model. That said regardless of the scale of your organization it is imperative to create supply and demand graph to get a clear picture of the market and come up with an effective. Before you begin understand that the economic graph of supply and demand is a model. Thus the incidence of a sales tax falls entirely upon the sellers. And I have this demand curve.

Source: slideplayer.com

Source: slideplayer.com

It also shows the supply curve S Tax shifted up by the amount of the proposed tax 100 per jacket. If the government imposes a specific tax per unit of 3 plot the new supply curve on the original supply and demand diagram. Graph of a tax wedge showing consumer and producer incidence. A supply and demand graph is pretty helpful as it clearly illustrates the then-current state of Market Equilibrium or Market Disequilibrium and enables you to take correct and timely decisions accordingly. The demand curve because of the tax t.

Source: chegg.com

Source: chegg.com

The new demandsupply curve is not drawn as which curve will be shifted depends on who is to be taxed and as we already know the effect of taxing either consumers or sellers will have an equivalent. Hence the new equilibrium quantity after tax can be found from equating P Q3 4 and P 20 Q so Q3 4 20 Q which gives QT 12. And our equilibrium quantity right over there. The tax incidence depends upon the relative elasticity of demand and supply. The algebra should lead one to.

Source: assignmentexpert.com

Source: assignmentexpert.com

When demand happens to be price inelastic and supply is price elastic the majority of the tax burden falls upon the consumer. Thus the incidence of a sales tax falls entirely upon the sellers. Demand curve and the MR curve are the same since a perfectly competitive seller earns the price each time another unit is sold. When demand is elastic the tax burden is mainly on the producer. That said regardless of the scale of your organization it is imperative to create supply and demand graph to get a clear picture of the market and come up with an effective.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Shifts from D to D. Price producers receive is from pre-tax supply equation Pnet. If we draw a perpendicular from the point of equilibrium to both axis we can find the. Rewrite the demand and supply equation as P 20 Q and P Q3. New supply curve when tax is imposedThe curve shifts upwards to the left because the same output quantity will be supplied at a higher price.

Source: wikiwand.com

Source: wikiwand.com

The difference between the two supply curves S and S T determines the volume of tax. With 4 tax on producers the supply curve after tax is P Q3 4. If the government imposes a specific tax per unit of 3 plot the new supply curve on the original supply and demand diagram. With 4 tax on producers the supply curve after tax is P Q3 4. Where they intersect gives us our equilibrium price.

Source: wikiwand.com

Source: wikiwand.com

While supply for the product has not changed all of the determinants of supply are the same producers incur higher cost which is why we will see a new equilibrium point further up the demand curve at a higher. Taxes on supply and demand The VAT on the suppliers will shift the supply curve to the left symbolizing a reduction in supply similar to firms facing higher input costs. Hence the new equilibrium quantity after tax can be found from equating P Q3 4 and P 20 Q so Q3 4 20 Q which gives QT 12. So before the tax I have this supply curve right over here in blue. Price producers receive is from pre-tax supply equation Pnet.

Source: instructables.com

Source: instructables.com

And I have this demand curve. It also shows the supply curve S Tax shifted up by the amount of the proposed tax 100 per jacket. That said regardless of the scale of your organization it is imperative to create supply and demand graph to get a clear picture of the market and come up with an effective. When the tax is imposed the price that the buyer pays must exceed. So that is our original consumer surplus.

Source: economicshelp.org

Source: economicshelp.org

Example of tax incidence. A tax of 6 causes the price to. So that is our original consumer surplus. The tax paid by the consumer is calculated as P 0 P 1. That said regardless of the scale of your organization it is imperative to create supply and demand graph to get a clear picture of the market and come up with an effective.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

This is illustrated in Figure 53 Effect of a tax on equilibrium. After a tax is introduced a new equilibrium is reached where consumers pay more suppliers receive less and the. And our equilibrium quantity right over there. Where they intersect gives us our equilibrium price. Understanding the basics of the effect of tax on the demand curve is important both for.

If the supply curve is relatively flat the supply is price elastic. How do you calculate tax on supply and demand curve. The demand curve because of the tax t. When demand is elastic the tax burden is mainly on the producer. Supply and Demand With A Tax - YouTube.

Source: slidetodoc.com

Source: slidetodoc.com

In the graph above the total tax paid by the producer and the consumer is equal to P 0 P 2. That said regardless of the scale of your organization it is imperative to create supply and demand graph to get a clear picture of the market and come up with an effective. When the tax is imposed the price that the buyer pays must exceed. The following graph shows the annual supply and demand for this good. Shifts from D to D.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title tax on supply and demand graph by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.