Your Tax on luxury goods economics images are available. Tax on luxury goods economics are a topic that is being searched for and liked by netizens today. You can Download the Tax on luxury goods economics files here. Download all royalty-free photos.

If you’re searching for tax on luxury goods economics images information linked to the tax on luxury goods economics keyword, you have pay a visit to the right site. Our website frequently gives you hints for downloading the maximum quality video and image content, please kindly surf and locate more informative video articles and images that match your interests.

Tax On Luxury Goods Economics. Economists generally have condemned such taxes as imposing an excess. Luxury goods are often the highest quality Beierlein 2014. Also it is alleged that any desired income redistribution could be. We set up a three-production-sector neoclassical growth model with inelastic labor supply and analyze the tax incidence.

Glowing Star Taxation Pvt Ltd Accounting Services Bookkeeping Services Accounting From in.pinterest.com

Glowing Star Taxation Pvt Ltd Accounting Services Bookkeeping Services Accounting From in.pinterest.com

By Patrick Imam. We find that the two consumption taxes are neutral to economic growth and that the welfare maximization optimal tax mix involves levying the same rate on those two goods. Luxury goods In economics a luxury good is one in which demand grows more and faster than an increase of the income of a potential buyers. Why should govt discourage purchase of luxury goods by increasing taxes. Demand for luxury goods tends to be more elastic than demand for necessities So luxury goods should be taxed less. If the consumption of luxury goods decline and it results in hoard I think that an income tax would be always better than a goods tax.

Luxury goods is often used synonymously with.

If quantity demanded is so responsive to an income increase that the percentage increase in quantity demanded exceeds the percentage. 7 marks Why do you think Adam Smith preferred to impose a tax on luxury goods. A luxury good or service is one whose income elasticity exceeds unity. As part of Budget 2021 the Government of Canada announced its intention to introduce a new Tax on Select Luxury Goods the Luxury Tax effective as of January 1 2022 aimed at helping to ensure that those Canadians who can afford to buy luxury goods are contributing a little more. These elasticities can be understood with the help of Equation 41 part a. Indonesias luxury tax and import tariff on passenger cars of more than 3000 cc engines amount to 50 and 80 respectively.

But that hoarding could be reinvested in economic activity creating more jobs as well. Luxury services and goods. However in reality luxury goods. This makes sense that luxury good are enjoyed by rich so imposing higher taxes is a sound and prudent measure to take for welfare of poor but here is my thought - Lets say if we dont impose high tax on luxury goods then it would drive more consumption which in turn will cause firms to hire. If the consumption of luxury goods decline and it results in hoard I think that an income tax would be always better than a goods tax.

Source: economicshelp.org

Source: economicshelp.org

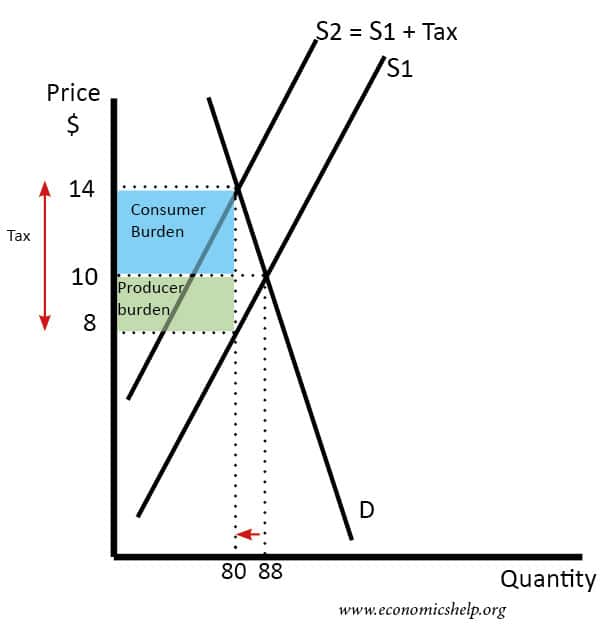

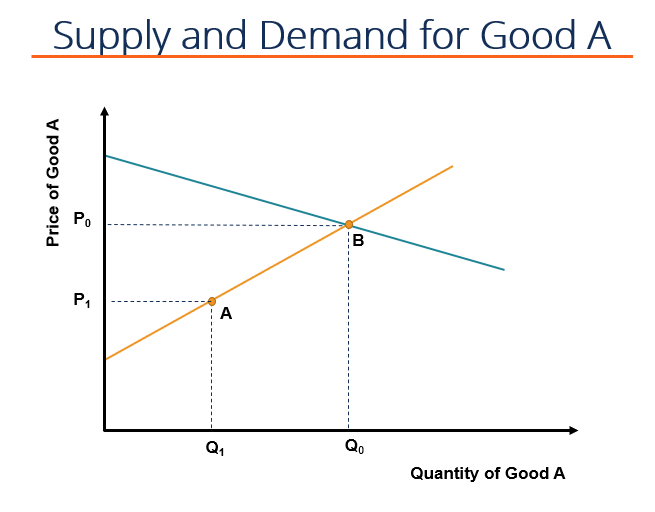

In the tobacco example above the tax burden falls on the most inelastic. The tax system should tax commodities with inelastic demand relatively more than those with elastic demand so as to minimize DWL. Economists generally have condemned such taxes as imposing an excess. Also it is alleged that any desired income redistribution could be. Illustrate with the use of appropriate figures.

Source: slideplayer.com

Source: slideplayer.com

2 In the recent past for example Thailand levies luxury taxes on the entertainment industry that could be as much as 25. But if we want to predict which group will bear most of the burden all we need to do is examine the elasticity of demand and supply. Economists also classify all products with low demand elasticity which include such luxuries as cigarettes and food as necessities to escape moralistic consequences. 7 marks Why do you think Adam Smith preferred to impose a tax on luxury goods. Economists generally have condemned such taxes as imposing an excess.

Source: in.pinterest.com

Source: in.pinterest.com

Why do you think Adam Smith preferred a tax on objects of almost universal consumption. Luxury tax is predicated on the concept of positional goods which are scarce goods whose value arises as status symbols largely from their ranking against other positional goods. Cant see meaningful logic behind higher GST on luxury goods. Economists also classify all products with low demand elasticity which include such luxuries as cigarettes and food as necessities to escape moralistic consequences. In the tobacco example above the tax burden falls on the most inelastic.

Source: pinterest.com

Source: pinterest.com

It stands in opposition to necessity goods for which demand grows much slower than income. Note that Smiths proposal to tax sugar was not aimed at improving health. 7 marks Why do you think Adam Smith preferred to impose a tax on luxury goods. The re-elected Liberal party promised that it will move ahead with implementing this new tax which is slated to come into force on Jan. Economists also classify all products with low demand elasticity which include such luxuries as cigarettes and food as necessities to escape moralistic consequences.

Source: pl.pinterest.com

Source: pl.pinterest.com

Canadas new luxury goods tax. Why should govt discourage purchase of luxury goods by increasing taxes. One of the tool mentioned in that was - Higher taxes on luxury goods. As part of Budget 2021 the Government of Canada announced its intention to introduce a new Tax on Select Luxury Goods the Luxury Tax effective as of January 1 2022 aimed at helping to ensure that those Canadians who can afford to buy luxury goods are contributing a little more. It stands in opposition to necessity goods for which demand grows much slower than income.

By Patrick Imam. Such goods include expensive cars private jets yachts jewellery etc. Luxury taxes generally fall into two categories. In economics a luxury good or upmarket good is a good for which demand increases more than what is proportional as income rises so that expenditures on the good become a greater proportion of overall spending. A necessity is one whose income elasticity is less than unity.

Source: economicshelp.org

Source: economicshelp.org

2 Why do you think Adam Smith preferred to impose a tax on luxury goods. Why do you think Adam Smith preferred a tax on objects of almost universal consumption. Such goods include expensive cars private jets yachts jewellery etc. They increase tax to discourage consumption of tobacco alcohol etc sin items but why luxury goods. Bitrus Baba Introduction Whether it seems timely or a little too late Nigeria seems to be keen on measures to make the rich pay more and therefore address redistribution of wealth through taxation of luxury items.

Source: pinterest.com

Source: pinterest.com

The re-elected Liberal party promised that it will move ahead with implementing this new tax which is slated to come into force on Jan. Algeria imposes a 150 tax on caviar. Goods and services that are not. Demand for luxury goods tends to be more elastic than demand for necessities So luxury goods should be taxed less. This makes sense that luxury good are enjoyed by rich so imposing higher taxes is a sound and prudent measure to take for welfare of poor but here is my thought - Lets say if we dont impose high tax on luxury goods then it would drive more consumption which in turn will cause firms to hire.

Source: in.pinterest.com

Source: in.pinterest.com

Luxury tax is a tax placed on goods considered expensive unnecessary and non-essential. Canadas new luxury goods tax. Illustrate with the use of appropriate figures. It stands in opposition to necessity goods for which demand grows much slower than income. However in reality luxury goods.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

2 In the recent past for example Thailand levies luxury taxes on the entertainment industry that could be as much as 25. Generally luxury tax is a tax on luxury goods and services ie. We set up a three-production-sector neoclassical growth model with inelastic labor supply and analyze the tax incidence. As part of Budget 2021 the Government of Canada announced its intention to introduce a new Tax on Select Luxury Goods the Luxury Tax effective as of January 1 2022 aimed at helping to ensure that those Canadians who can afford to buy luxury goods are contributing a little more. Burden in comparison with more broadly based general sales or income.

Source: in.pinterest.com

Source: in.pinterest.com

We set up a three-production-sector neoclassical growth model with inelastic labor supply and analyze the tax incidence. Why should govt discourage purchase of luxury goods by increasing taxes. 3 The article does not mention the costs involved with the imposition of a sugary tax. The author argues that one avenue is to tax luxury goods more heavily which could simultaneously tackle inequality and spur development with minimal distortionary effect as was practiced by many successful East Asian countries in the. Taxes on items that can be purchased only by the wealthiest consumers who presumably can afford to.

Source: researchgate.net

Source: researchgate.net

Illustrate with the use of appropriate figures. Economists generally have condemned such taxes as imposing an excess. 7 marks Why do you think Adam Smith preferred to impose a tax on luxury goods. Why should govt discourage purchase of luxury goods by increasing taxes. They increase tax to discourage consumption of tobacco alcohol etc sin items but why luxury goods.

Source: in.pinterest.com

Source: in.pinterest.com

Luxury tax is a tax placed on goods considered expensive unnecessary and non-essential. Taxes on items that can be purchased only by the wealthiest consumers who presumably can afford to. 3 The article does not mention the costs involved with the imposition of a sugary tax. Luxury goods are in contrast to necessity goods where demand increases proportionally less than income. Why should govt discourage purchase of luxury goods by increasing taxes.

Source: pinterest.com

Source: pinterest.com

In reality the tax rate levied on the luxury good is usually higher so that the. Economists also classify all products with low demand elasticity which include such luxuries as cigarettes and food as necessities to escape moralistic consequences. EXCISE TAXES ON LUXURY GOODS are a traditional form of taxation. 3 The article does not mention the costs involved with the imposition of a sugary tax. A luxury good or service is one whose income elasticity exceeds unity.

Source: in.pinterest.com

Source: in.pinterest.com

Luxury tax is a tax placed on goods considered expensive unnecessary and non-essential. We find that the two consumption taxes are neutral to economic growth and that the welfare maximization optimal tax mix involves levying the same rate on those two goods. Such goods include expensive cars private jets yachts jewellery etc. A necessity is one whose income elasticity is less than unity. Elasticity and tax incidence.

Source: elibrary.imf.org

Source: elibrary.imf.org

Luxury services and goods. Luxury goods In economics a luxury good is one in which demand grows more and faster than an increase of the income of a potential buyers. The author argues that one avenue is to tax luxury goods more heavily which could simultaneously tackle inequality and spur development with minimal distortionary effect as was practiced by many successful East Asian countries in the. Luxury goods are in contrast to necessity goods where demand increases proportionally less than income. So the idea of expanding the tax base on luxury goods and adopting comprehensive tax governance has re-emerged for example Li Daming Wang Meng 40 2009 believed that the consumption tax on luxury goods can achieve the indirect adjustment of the income of the high-income and affluent groups and thus with the direct adjustment of personal income tax the.

Source: msrblog.com

Source: msrblog.com

Luxury tax is an indirect tax that increases the price of a good or service and is only incurred. Elasticity and tax incidence. This makes sense that luxury good are enjoyed by rich so imposing higher taxes is a sound and prudent measure to take for welfare of poor but here is my thought - Lets say if we dont impose high tax on luxury goods then it would drive more consumption which in turn will cause firms to hire. Demand for luxury goods tends to be more elastic than demand for necessities So luxury goods should be taxed less. Also it is alleged that any desired income redistribution could be.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title tax on luxury goods economics by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.