Your Tax demand supply curve images are available. Tax demand supply curve are a topic that is being searched for and liked by netizens now. You can Get the Tax demand supply curve files here. Find and Download all royalty-free photos and vectors.

If you’re searching for tax demand supply curve images information related to the tax demand supply curve keyword, you have visit the right blog. Our site frequently provides you with hints for downloading the highest quality video and image content, please kindly hunt and locate more informative video articles and graphics that fit your interests.

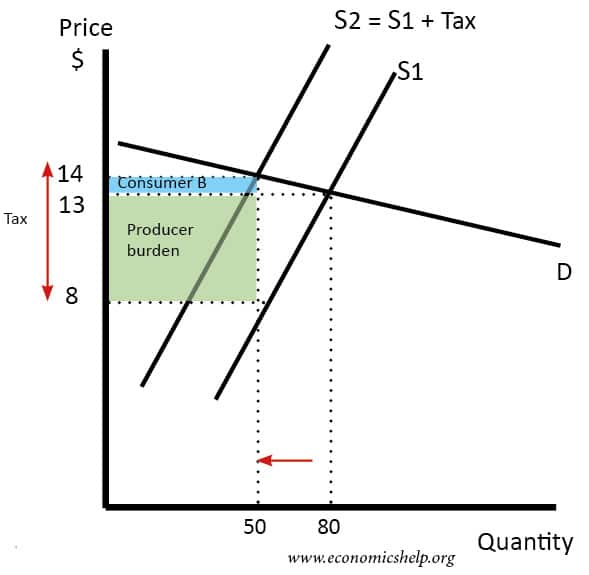

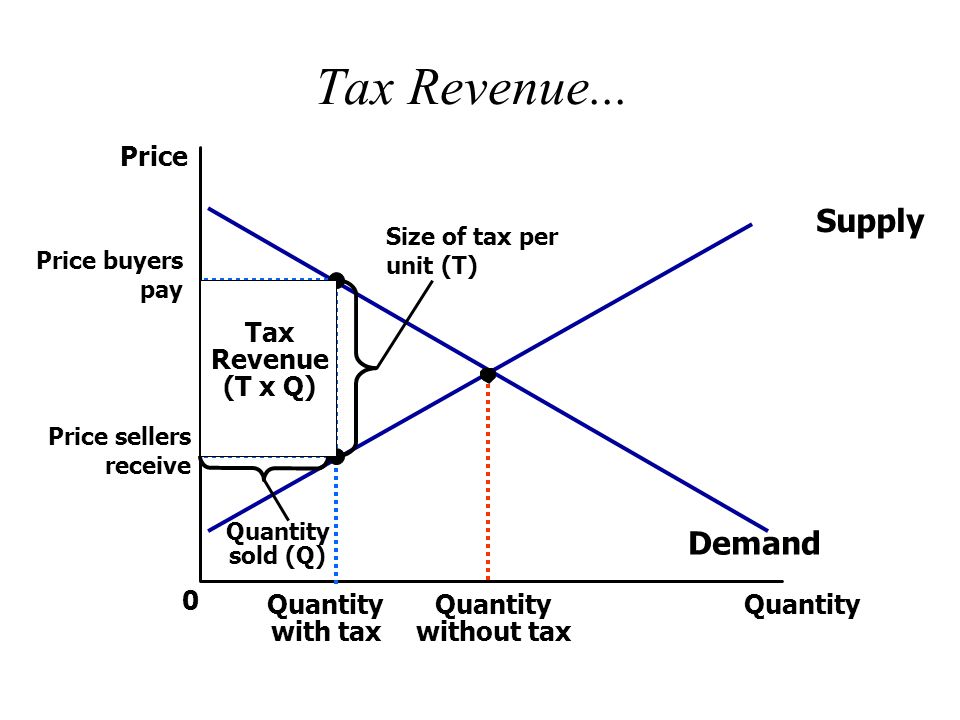

Tax Demand Supply Curve. Shifts from D to D. By introducing a tax the government essentially creates a wedge. Sellers suffer the full tax burden due to demand being perfectly elastic. What ends up getting passed is a tax of 10 per vial.

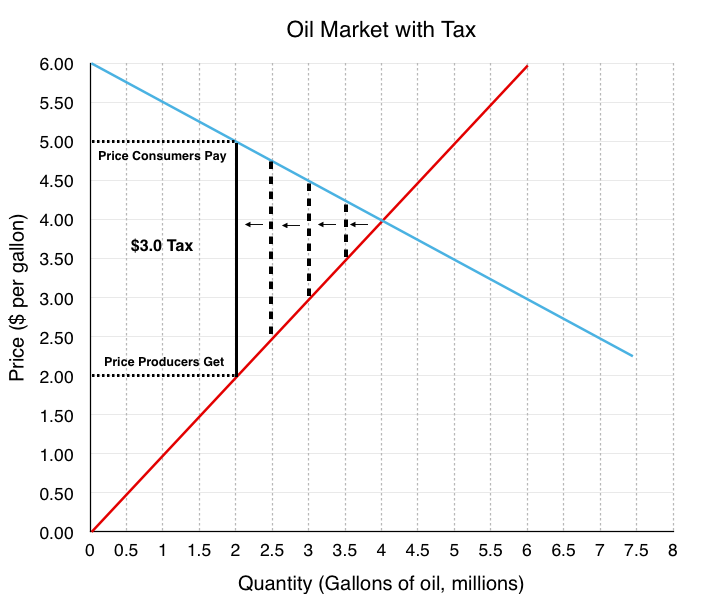

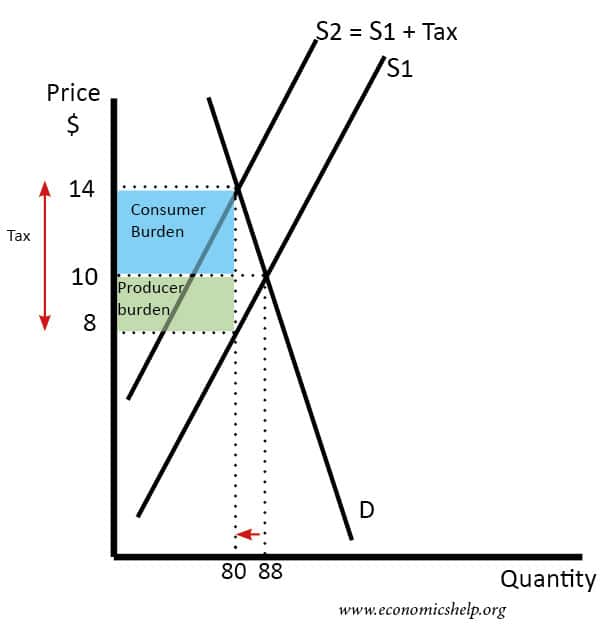

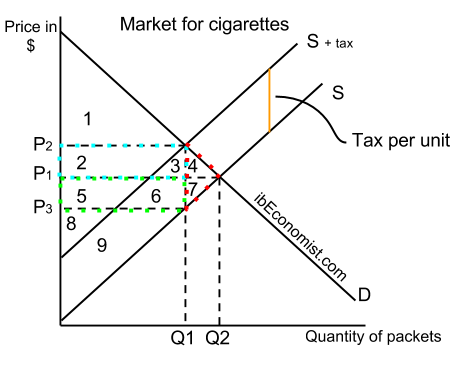

Elastic Demand and Inelastic Supply. Therefore when the supply is elastic and demand is inelastic the majority of the burden of tax is on the part of consumers or buyers. Post-tax price increases by TE1 or PP1. Taxes impact both the supply and demand curves. In Figure 1a the supply is inelastic and the demand is elastic such as in the example of beachfront hotels. While consumers may have other vacation choices sellers cant easily move their businesses.

While supply for the product has not changed all of the determinants of supply are the same producers incur higher cost which is why we will see a new equilibrium point further up the demand curve at a higher.

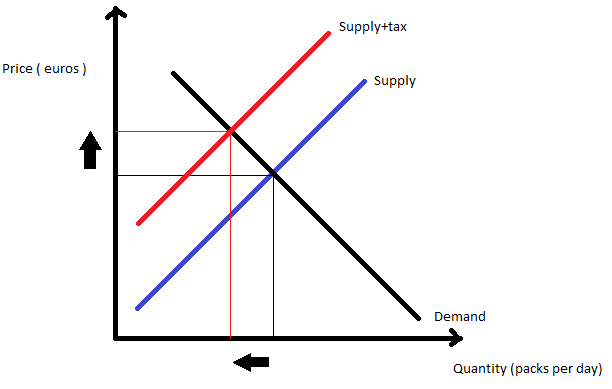

A tax increases the price a buyer pays by less than the tax. Well think it through with our supply and our perfectly inelastic demand curve. From the consideration of the graph we can see that after imposition of the tax the supply curve shifts up and to the left initial curve marked as S0 and the final one as S1. As the tax affects supply the supply curve tends to shift upward thus establishing the new equilibrium with the same demand curve. Taxes on supply and demand The VAT on the suppliers will shift the supply curve to the left symbolizing a reduction in supply similar to firms facing higher input costs. Therefore when the supply is elastic and demand is inelastic the majority of the burden of tax is on the part of consumers or buyers.

Source: sanandres.esc.edu.ar

Source: sanandres.esc.edu.ar

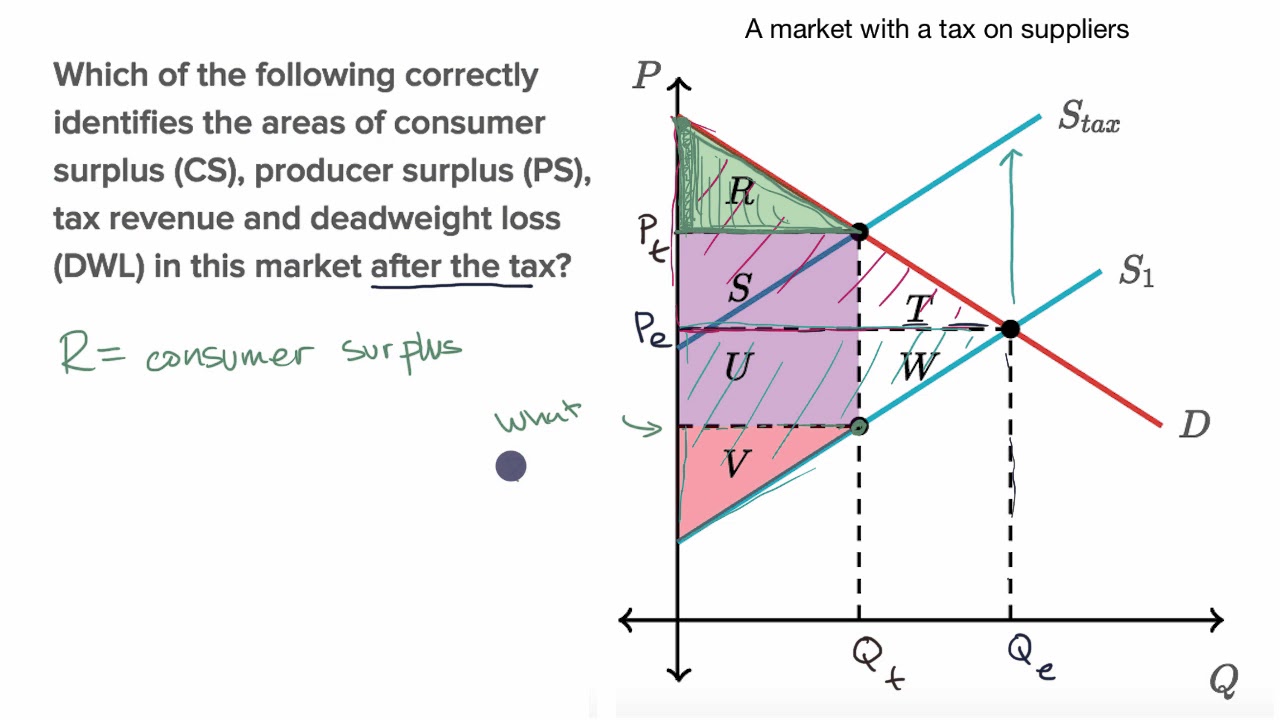

While supply for the product has not changed all of the determinants of supply are the same producers incur higher cost which is why we will see a new equilibrium point further up the demand curve at a higher. Hence the whole tax burden is shifted on the consumers. It is illustrated as the supply curve shifts from S 0 to S 1. The loss of value for both buyers and sellers is called the deadweight loss of taxation. Taxes cause a buyer to pay more for something and suppliers to receive less.

Source: researchgate.net

Source: researchgate.net

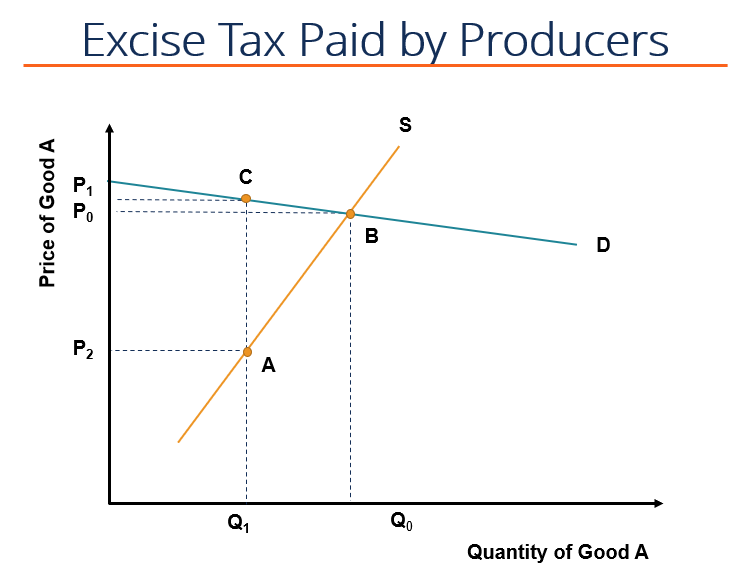

Quantity shifts from Q 0 to Q 1 after the excise tax is imposed on the production of Good A. The loss of value for both buyers and sellers is called the deadweight loss of taxation. Since a tax can be viewed as raising the costs of production this could also be represented by a leftward shift of the supply curve where the new supply curve would intercept the demand at the new quantity Qt. Buyers pay only P B 20. After VAT will be P 02Q 12 Effect of Subsidy on the supply curve.

Source: khanacademy.org

Source: khanacademy.org

The above figure has clearly shown the given case. Hence the whole tax burden is shifted on the consumers. Therefore the new price has to be established for the new supply curve equation and the new supply equation is equalized to demand equation to determine new equilibrium price. Similarly the price the seller obtains falls but by less than the tax. The loss of value for both buyers and sellers is called the deadweight loss of taxation.

Source: researchgate.net

Source: researchgate.net

Tax burden to consumers. Tax increases do not affect the demand curve nor do they increase supply or. Quantity shifts from Q 0 to Q 1 after the excise tax is imposed on the production of Good A. Tax burden to consumers. In Figure 1a the supply is inelastic and the demand is elastic such as in the example of beachfront hotels.

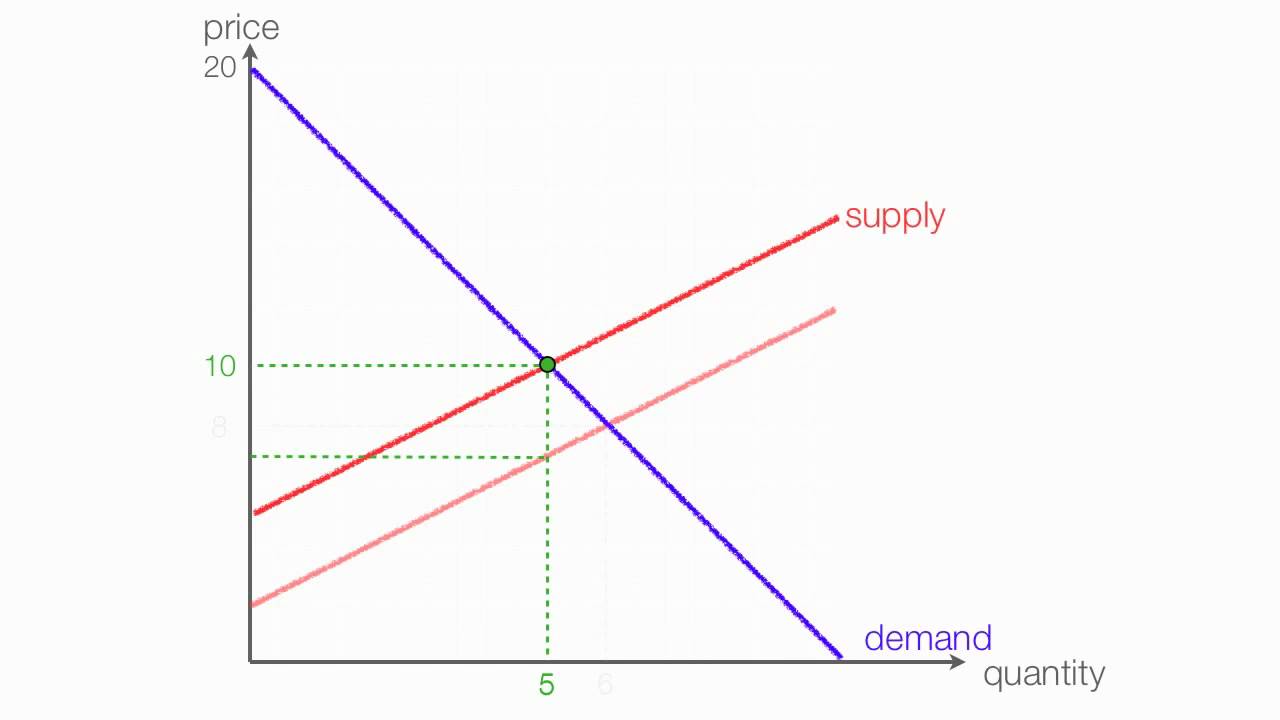

The new equilibrium price and the equilibrium quantity is P_E1 6 Q_E1 14kg. Elastic Demand and Inelastic Supply. Implementing dismalscience comment suggestion the unit tax burdens the suppliers. Suppose we have a supply curve. Tax burden to consumers.

Source: ecampusontario.pressbooks.pub

Source: ecampusontario.pressbooks.pub

Im just making it instead of a percentage Im just doing it as a fixed amount so that we get kind of a fixed shift in terms of the perceived supply price. The demand curve because of the tax t. 2044Q 4Q16 Q4 units transacted one less than before. Taxes impact both the supply and demand curves. After a subsidy of 10.

Source: economicshelp.org

Source: economicshelp.org

While consumers may have other vacation choices sellers cant easily move their businesses. Elastic Demand and Inelastic Supply. After the levy of tax the supply curve shifts upward from S to S1 by the tax amount TE1. Since a tax can be viewed as raising the costs of production this could also be represented by a leftward shift of the supply curve where the new supply curve would intercept the demand at the new quantity Qt. Im just making it instead of a percentage Im just doing it as a fixed amount so that we get kind of a fixed shift in terms of the perceived supply price.

Source: assignmentexpert.com

Source: assignmentexpert.com

Implementing dismalscience comment suggestion the unit tax burdens the suppliers. The loss of value for both buyers and sellers is called the deadweight loss of taxation. After the levy of tax the supply curve shifts upward from S to S1 by the tax amount TE1. Taxes on supply and demand The VAT on the suppliers will shift the supply curve to the left symbolizing a reduction in supply similar to firms facing higher input costs. By introducing a tax the government essentially creates a wedge.

Source: researchgate.net

Source: researchgate.net

Rewrite the demand and supply equation as P 20 Q and P Q3. The new equilibrium price and the equilibrium quantity is P_E1 6 Q_E1 14kg. The variation of the surplus of each agents is quite telling. Quantity shifts from Q 0 to Q 1 after the excise tax is imposed on the production of Good A. With 4 tax on producers the supply curve after tax is P Q3 4.

Tax increases If the government increases the tax on a good that shifts the supply curve to the left consumer prices rise and sellers prices fall. If a new tax is enacted the demand curve may be expected to shift depending on the tax. Tax increases If the government increases the tax on a good that shifts the supply curve to the left consumer prices rise and sellers prices fall. While consumers may have other vacation choices sellers cant easily move their businesses. If excise tax is imposed on the producer the supplier will provide less quantity of Good A.

Source: ppt-online.org

Source: ppt-online.org

In this case the supply curve is relatively inelastic and the demand curve is highly elastic. Quantity shifts from Q 0 to Q 1 after the excise tax is imposed on the production of Good A. Therefore when the supply is elastic and demand is inelastic the majority of the burden of tax is on the part of consumers or buyers. For simplicity Figure 510 omits the shift in the supply curve. Therefore the new price has to be established for the new supply curve equation and the new supply equation is equalized to demand equation to determine new equilibrium price.

Source: economicshelp.org

Source: economicshelp.org

Quantity shifts from Q 0 to Q 1 after the excise tax is imposed on the production of Good A. It is illustrated as the supply curve shifts from S 0 to S 1. What that means is that with the introduction of more taxes potential business owners have less incentive to go through the. What ends up getting passed is a tax of 10 per vial. After the levy of tax the supply curve shifts upward from S to S1 by the tax amount TE1.

Source: economics.stackexchange.com

Source: economics.stackexchange.com

Therefore when the supply is elastic and demand is inelastic the majority of the burden of tax is on the part of consumers or buyers. Elastic Demand and Inelastic Supply. Hence the new equilibrium quantity after tax can be found from equating P Q3 4 and P 20 Q so Q3 4 20 Q which gives QT 12. Tax burden to consumers. The effect of the tax on the supply-demand equilibrium is to shift the quantity toward a point where the before-tax demand minus the before-tax supply is the amount of the tax.

Source: wikiwand.com

Source: wikiwand.com

Tax burden to consumers. If a new tax is enacted the demand curve may be expected to shift depending on the tax. In Figure 1a the supply is inelastic and the demand is elastic such as in the example of beachfront hotels. 2044Q 4Q16 Q4 units transacted one less than before. The supply curve is a horizontal line.

Source: microeconomics2012.blogspot.com

Source: microeconomics2012.blogspot.com

Therefore the new price has to be established for the new supply curve equation and the new supply equation is equalized to demand equation to determine new equilibrium price. With 4 tax on producers the supply curve after tax is P Q3 4. Since the tax is fixed per unit sold and not a percentage charge then the slope of the supply curve should not change. Hence the whole tax burden is shifted on the consumers. Quantity shifts from Q 0 to Q 1 after the excise tax is imposed on the production of Good A.

Source: ibeconomist.com

Source: ibeconomist.com

Hence the whole tax burden is shifted on the consumers. Elastic Demand and Inelastic Supply. With the tax the supply curve shifts up by T4 to P44Q. Hence the new equilibrium quantity after tax can be found from equating P Q3 4 and P 20 Q so Q3 4 20 Q which gives QT 12. Shifts from D to D.

Source: youtube.com

Source: youtube.com

Since a tax can be viewed as raising the costs of production this could also be represented by a leftward shift of the supply curve where the new supply curve would intercept the demand at the new quantity Qt. As the tax affects supply the supply curve tends to shift upward thus establishing the new equilibrium with the same demand curve. The variation of the surplus of each agents is quite telling. Does A Tax On Sellers Affect The Demand Curve. What that means is that with the introduction of more taxes potential business owners have less incentive to go through the.

Source: slideplayer.com

Source: slideplayer.com

Well think it through with our supply and our perfectly inelastic demand curve. In this case the supply curve is relatively inelastic and the demand curve is highly elastic. While supply for the product has not changed all of the determinants of supply are the same producers incur higher cost which is why we will see a new equilibrium point further up the demand curve at a higher. A tax on buyers is thought to shift the demand curve to the leftreduce consumer demandbecause the price of goods relative to their value to consumers has gone up. What that means is that with the introduction of more taxes potential business owners have less incentive to go through the.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title tax demand supply curve by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.