Your Tax curve supply and demand images are ready. Tax curve supply and demand are a topic that is being searched for and liked by netizens today. You can Get the Tax curve supply and demand files here. Get all free photos.

If you’re looking for tax curve supply and demand images information connected with to the tax curve supply and demand keyword, you have pay a visit to the ideal blog. Our website always provides you with hints for viewing the maximum quality video and picture content, please kindly hunt and find more informative video content and graphics that match your interests.

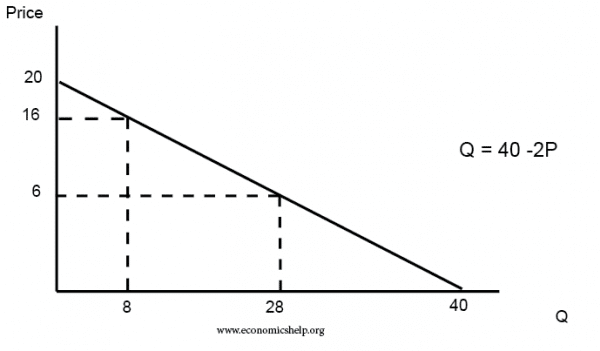

Tax Curve Supply And Demand. You should also verify that these demand and supply curves imply a market price of 1 and quantity of 100 bgyr. The variation of the surplus of each agents is quite telling. Q_D 20 P QD. In the model of aggregate demand and aggregate supply a tax rate increase will shift the aggregate demand curve to the left by an amount equal to the initial change in aggregate expenditures induced by the tax rate boost.

Supply Demand Curve For Excise Tax That S Being Passed 100 On To Consumers Economics Stack Exchange From economics.stackexchange.com

Supply Demand Curve For Excise Tax That S Being Passed 100 On To Consumers Economics Stack Exchange From economics.stackexchange.com

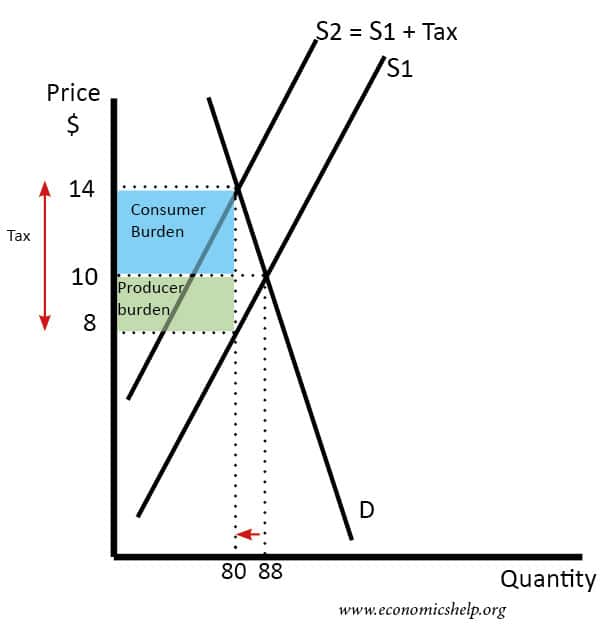

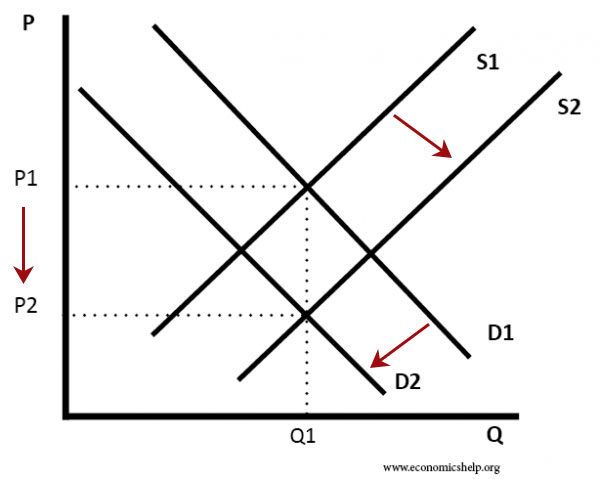

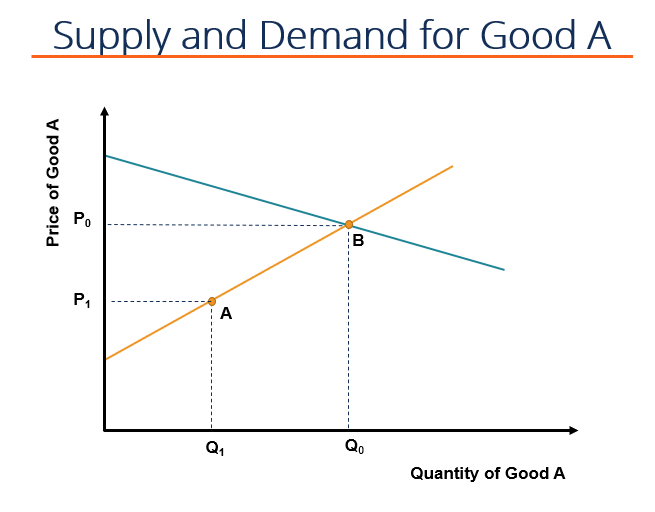

Therefore when the supply is elastic and demand is inelastic the majority of the burden of tax is on the part of consumers or buyers. The extent of change is the price or the extent to which tax can be passed on to buyers depends on the degree of supply elasticity. Taxes on supply and demand The VAT on the suppliers will shift the supply curve to the left symbolizing a reduction in supply similar to firms facing higher input costs. The consumers will now pay price P while producers will receive P P - t. If the tax is instead imposed on consumers the demand curve shifts down by the amount of the tax 50 cents to D 2. 430 demonstrates the sharing of the burden of a sales tax between buyers and sellers.

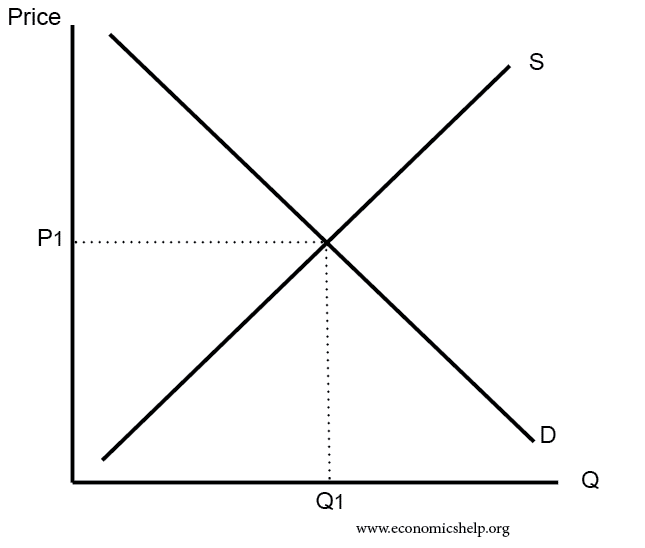

Intersection of these two curves define equilibrium price and equilibrium quantities prior to the imposition of sales tax.

Elastic Demand and Inelastic Supply. Understanding the basics of the effect of tax on the demand curve is important. Assuming constant demand elasticity the greater the supply elasticity the greater is the burden on buyers. If the tax is instead imposed on consumers the demand curve shifts down by the amount of the tax 50 cents to D 2. Elastic Demand and Inelastic Supply. Note that the demand curve in that figure labeled.

Source: slidetodoc.com

Source: slidetodoc.com

Lets consider how the increase in taxes affects the demand and supply curves. First we write the four conditions that must hold as given by equations 91a-d. We can use these linear demand and supply curves to calculate the effect of a 50 cents per gallon tax. The effect of the tax cut on the short-run aggregate supply SRAS curve depends on which model you use. Therefore when the supply is elastic and demand is inelastic the majority of the burden of tax is on the part of consumers or buyers.

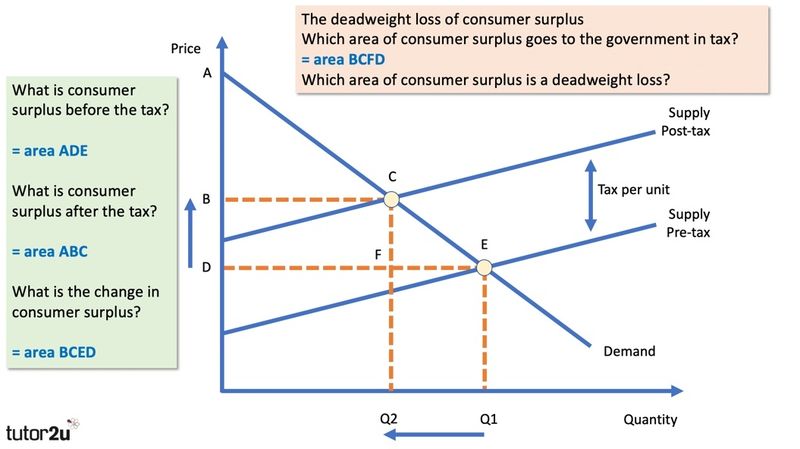

Q_D 20 P QD. QD 150 - 50Pb Demand QS 60 40Ps. When the tax is introduced the consumer surplus orange and producer surplus blue shrink while deadweight loss purple the inefficiency caused by the tax increases. 20P and the function of the supply of potatoes is given by. Since the demand curve represents the consumers willingness to pay the demand curve will shift down as a result of the tax.

Source: assignmentexpert.com

Source: assignmentexpert.com

You should also verify that these demand and supply curves imply a market price of 1 and quantity of 100 bgyr. Lets suppose that the function of demand of potatoes is given by. In the model of aggregate demand and aggregate supply a tax rate increase will shift the aggregate demand curve to the left by an amount equal to the initial change in aggregate expenditures induced by the tax rate boost. When the tax is introduced the consumer surplus orange and producer surplus blue shrink while deadweight loss purple the inefficiency caused by the tax increases. First we write the four conditions that must hold as given by equations 91a-d.

Additionally the Demonstration shows and calculates the revenue for the government raised by the tax. Therefore when the supply is elastic and demand is inelastic the majority of the burden of tax is on the part of consumers or buyers. Understanding the basics of the effect of tax on the demand curve is important. AP is owned by the College Board which does not endorse this site or the above reviewStudy Questions1 Show supply demand with an equilibrium price and. Shows how much of a good consumers are willing to buy as the price per unit changes.

Source: hifreqecon.com

Source: hifreqecon.com

First we write the four conditions that must hold as given by equations 91a-d. Does taxes increase aggregate demand. The variation of the surplus of each agents is quite telling. How do you calculate tax on supply and demand curve. The above figure has clearly shown the given case.

Source: economicshelp.org

Source: economicshelp.org

430 demonstrates the sharing of the burden of a sales tax between buyers and sellers. You should also verify that these demand and supply curves imply a market price of 1 and quantity of 100 bgyr. Economists are often concerned with the effect of government policies like taxes or subsidies on the interaction of supply and demand. Shows how much of a good consumers are willing to buy as the price per unit changes. Hence the new equilibrium quantity after tax can be found from equating P Q3 4 and P 20 Q so Q3 4 20 Q which gives QT 12.

Source: economics.stackexchange.com

Source: economics.stackexchange.com

Therefore when the supply is elastic and demand is inelastic the majority of the burden of tax is on the part of consumers or buyers. Assuming constant demand elasticity the greater the supply elasticity the greater is the burden on buyers. Taxes on supply and demand The VAT on the suppliers will shift the supply curve to the left symbolizing a reduction in supply similar to firms facing higher input costs. Understanding the basics of the effect of tax on the demand curve is important. 20P and the function of the supply of potatoes is given by.

Source: slideplayer.com

Source: slideplayer.com

The variation of the surplus of each agents is quite telling. Shows how much of a good consumers are willing to buy as the price per unit changes. Tax increases If the government increases the tax on a good that shifts the supply curve to the left consumer prices rise and sellers prices fall. The extent of change is the price or the extent to which tax can be passed on to buyers depends on the degree of supply elasticity. Hence the new equilibrium quantity after tax can be found from equating P Q3 4 and P 20 Q so Q3 4 20 Q which gives QT 12.

Source: economics.stackexchange.com

Source: economics.stackexchange.com

Q_D 20 P QD. Understanding the basics of the effect of tax on the demand curve is important. The example of cigarette taxes introduced previously demonstrated that because demand is inelastic taxes are not effective at reducing the equilibrium quantity of smoking and they mainly pass along to consumers in the form of higher prices. As the price of the apples increases producers are. The extent of change is the price or the extent to which tax can be passed on to buyers depends on the degree of supply elasticity.

Source: economicshelp.org

Source: economicshelp.org

With 4 tax on producers the supply curve after tax is P Q3 4. Rewrite the demand and supply equation as P 20 Q and P Q3. AP is owned by the College Board which does not endorse this site or the above reviewStudy Questions1 Show supply demand with an equilibrium price and. Does taxes increase aggregate demand. The consumers will now pay price P while producers will receive P P - t.

Source: economicshelp.org

Source: economicshelp.org

Q S 4 P 5. The consumers will now pay price P while producers will receive P P - t. Intersection of these two curves define equilibrium price and equilibrium quantities prior to the imposition of sales tax. In the model of aggregate demand and aggregate supply a tax rate increase will shift the aggregate demand curve to the left by an amount equal to the initial change in aggregate expenditures induced by the tax rate boost. Does taxes increase aggregate demand.

Lets suppose that the function of demand of potatoes is given by. Elastic Demand and Inelastic Supply. In the model of aggregate demand and aggregate supply a tax rate increase will shift the aggregate demand curve to the left by an amount equal to the initial change in aggregate expenditures induced by the tax rate boost. AP is owned by the College Board which does not endorse this site or the above reviewStudy Questions1 Show supply demand with an equilibrium price and. The example of cigarette taxes introduced previously demonstrated that because demand is inelastic taxes are not effective at reducing the equilibrium quantity of smoking and they mainly pass along to consumers in the form of higher prices.

Source: economicshelp.org

Source: economicshelp.org

Economists are often concerned with the effect of government policies like taxes or subsidies on the interaction of supply and demand. D P or we can draw it graphically as in Figure 22. When the tax is introduced the consumer surplus orange and producer surplus blue shrink while deadweight loss purple the inefficiency caused by the tax increases. Additionally the Demonstration shows and calculates the revenue for the government raised by the tax. Elastic Demand and Inelastic Supply.

Source: sanandres.esc.edu.ar

Source: sanandres.esc.edu.ar

Tax increases If the government increases the tax on a good that shifts the supply curve to the left consumer prices rise and sellers prices fall. Similarly the price the seller obtains falls but by less than the tax. A tax paid by buyers shifts the demand curve while a tax paid by sellers shifts the supply curve. The example of cigarette taxes introduced previously demonstrated that because demand is inelastic taxes are not effective at reducing the equilibrium quantity of smoking and they mainly pass along to consumers in the form of higher prices. Tax increases If the government increases the tax on a good that shifts the supply curve to the left consumer prices rise and sellers prices fall.

The consumers will now pay price P while producers will receive P P - t. Intersection of these two curves define equilibrium price and equilibrium quantities prior to the imposition of sales tax. You should also verify that these demand and supply curves imply a market price of 1 and quantity of 100 bgyr. Additionally the Demonstration shows and calculates the revenue for the government raised by the tax. Lets suppose that the function of demand of potatoes is given by.

Source: tutor2u.net

Source: tutor2u.net

If the tax is instead imposed on consumers the demand curve shifts down by the amount of the tax 50 cents to D 2. Taxes on supply and demand The VAT on the suppliers will shift the supply curve to the left symbolizing a reduction in supply similar to firms facing higher input costs. Q_D 20 P QD. In the model of aggregate demand and aggregate supply a tax rate increase will shift the aggregate demand curve to the left by an amount equal to the initial change in aggregate expenditures induced by the tax rate boost. The demand curve because of the tax t.

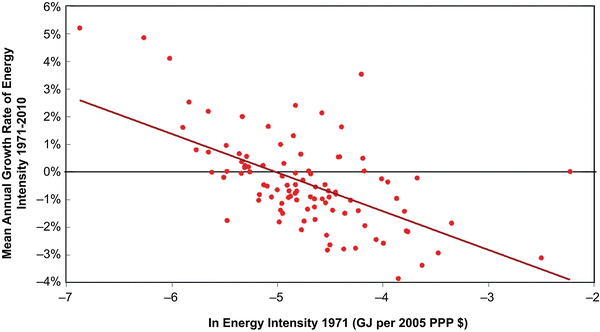

Source: researchgate.net

Source: researchgate.net

Similarly the price the seller obtains falls but by less than the tax. Similar to the demand curve a movement along the supply curve from point A to point B is called a change in the quantity supplied. Note that the demand curve in that figure labeled. When a tax is imposed on consumers the demand curve will. Shifts from D to D.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Therefore when the supply is elastic and demand is inelastic the majority of the burden of tax is on the part of consumers or buyers. Similarly the price the seller obtains falls but by less than the tax. As the price of the apples increases producers are. A tax increases the price a buyer pays by less than the tax. The consumers will now pay price P while producers will receive P P - t.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title tax curve supply and demand by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.