Your Supply demand curve tax increase images are available. Supply demand curve tax increase are a topic that is being searched for and liked by netizens now. You can Find and Download the Supply demand curve tax increase files here. Get all free photos.

If you’re searching for supply demand curve tax increase pictures information related to the supply demand curve tax increase interest, you have pay a visit to the ideal site. Our site frequently provides you with hints for refferencing the highest quality video and image content, please kindly hunt and find more informative video content and graphics that match your interests.

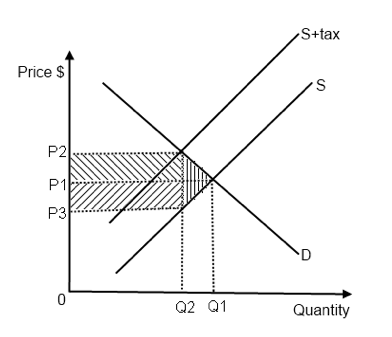

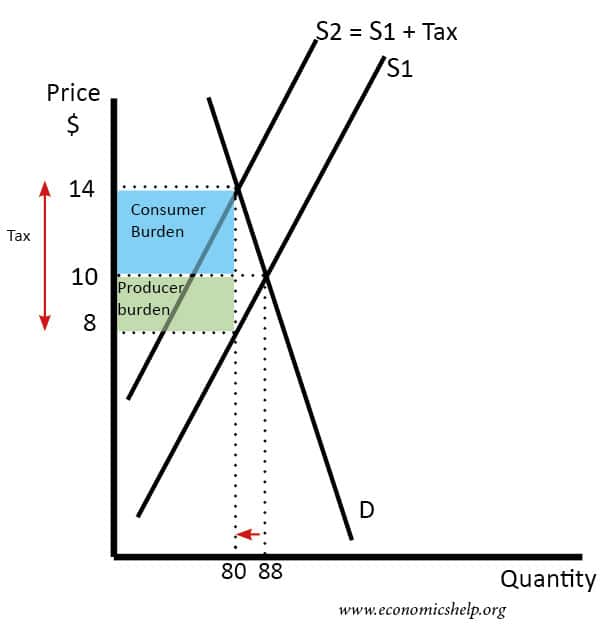

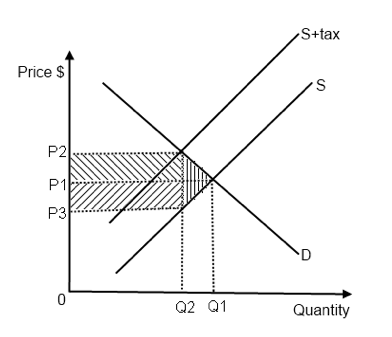

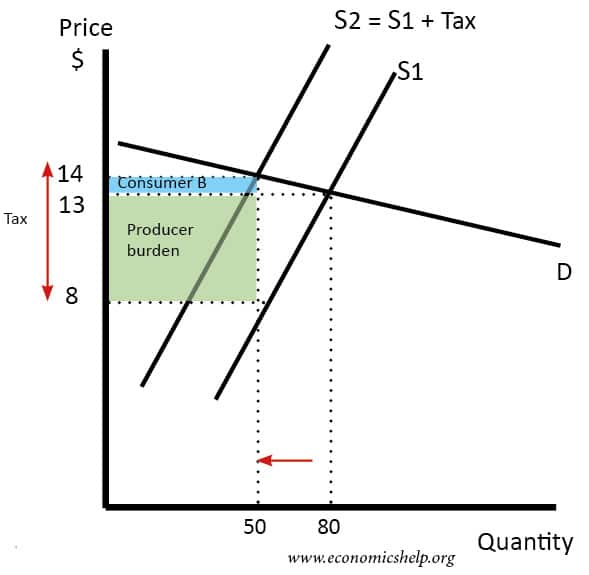

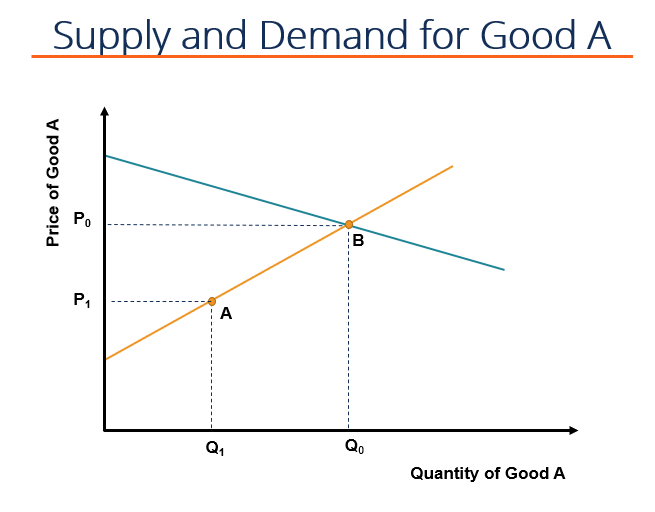

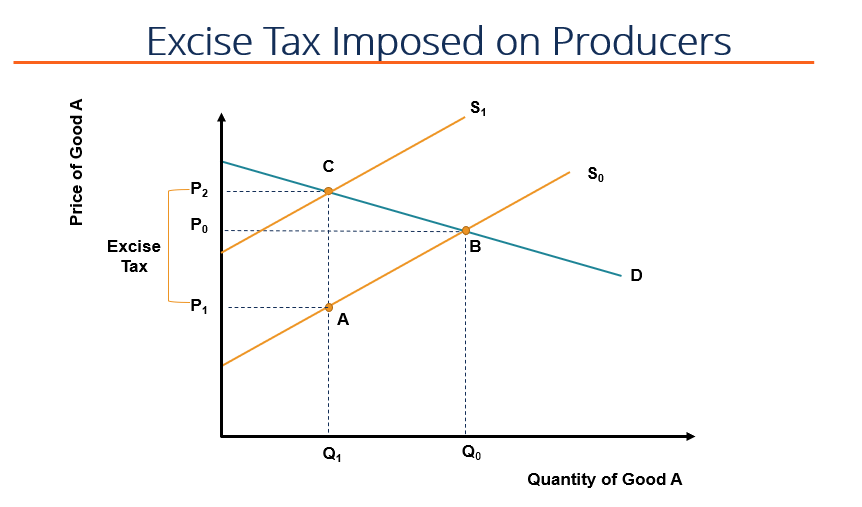

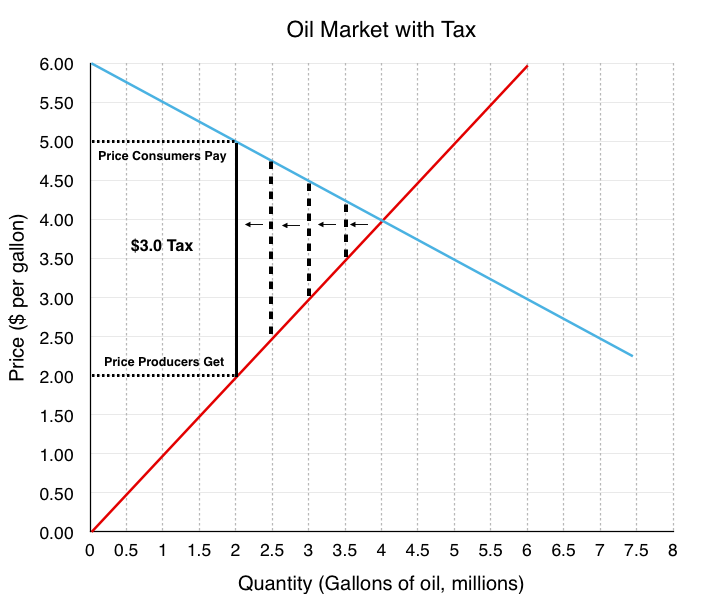

Supply Demand Curve Tax Increase. With 4 tax on producers the supply curve after tax is P Q3 4. If a new tax is enacted the demand curve may be expected to shift depending on the tax. If the government increases the tax on a good that shifts the supply curve to the left the consumer price increases and sellers price decreases. None of the above.

Ib Economics Notes 3 1 Indirect Taxes From ibguides.com

Ib Economics Notes 3 1 Indirect Taxes From ibguides.com

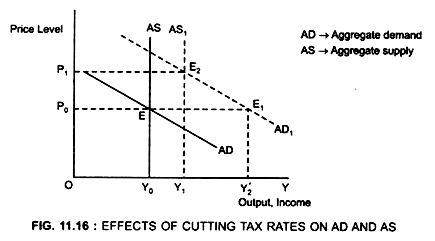

B increases aggregate demand and the AD curve shifts rightward. The effect of the tax on the supply-demand equilibrium is to shift the quantity toward a point where the before-tax demand minus the before-tax supply is the amount of the tax. It is important to under-stand precisely what these curves represent. First let us calculate the equilibrium price and equilibrium quantity that were before the imposed tax. But because the money went from consumers to the government and then is loaned out to businesses the increase in investment will slowly shift aggregate demand back to where it was originally. If the aggregate supply increases equals.

B increases aggregate demand and the AD curve shifts rightward.

However the equilibrium quantity rises. Given that the supply of money is xed the interest rate must decrease to push up the demand for money and maintain the equilibrium. The supply-demand model combines two important concepts. The equilibrium price rises to 7 per pound. If the aggregate supply increases equals. A tax increases the price a buyer pays by less than the tax.

Source: economicshelp.org

Source: economicshelp.org

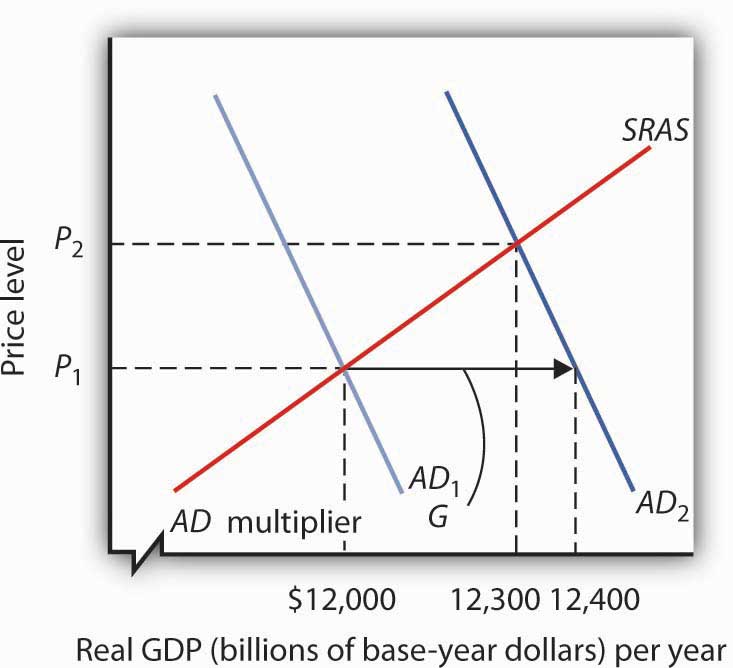

Consequently the equilibrium price remains the same. Introduction to Macroeconomics TOPIC 4. Typically if we have a tax increase aggregate demand will shift left immediately because of the reduction in consumption going on in the economy. Does not shift or lead to a movement along the aggregate demand curve. In the model of aggregate demand and aggregate supply a tax rate increase will shift the aggregate demand curve to the left by an amount equal to the initial change in aggregate expenditures induced by the tax rate boost times the new value of the multiplier.

Source: economicshelp.org

Source: economicshelp.org

Taxes are among the market and regulatory conditions that define the demand curve. Q_D Q_S QD. The supply-demand model combines two important concepts. It helps us understand why and how prices change and what happens when the government intervenes in a market. Suppliers produce two goods cheese and butter.

Source: ibguides.com

Source: ibguides.com

A tax increases the price a buyer pays by less than the tax. Q_D Q_S QD. First let us calculate the equilibrium price and equilibrium quantity that were before the imposed tax. Consumption goes down leading to a decrease in outputincome. It helps us understand why and how prices change and what happens when the government intervenes in a market.

Source: medium.com

Source: medium.com

If the aggregate supply increases equals. Aggregate demand is affected by some concepts like personal income taxes. A tax increases the price a buyer pays by less than the tax. The equilibrium price rises to 7 per pound. The basic model of supply and demand is the workhorse of microeconomics.

Source: wikiwand.com

Source: wikiwand.com

With the use of aggregate demand curve one can see that if there is a change in personal income tax rates there will be a shift in the aggregate demand curve or the aggregate demand will increase or decrease. 125 125 from each sold kilogram of potatoes. If a new tax is enacted the demand curve may be expected to shift depending on the tax. C the aggregate quantity demanded is equal to the aggregate quantity supplied. The effect of the tax on the supply-demand equilibrium is to shift the quantity toward a point where the before-tax demand minus the before-tax supply is the amount of the tax.

Consumption goes down leading to a decrease in outputincome. A tax increases the price a buyer pays by less than the tax. It is important to under-stand precisely what these curves represent. The supply curve for cars will shift to the right. First let us calculate the equilibrium price and equilibrium quantity that were before the imposed tax.

Source: courses.lumenlearning.com

Source: courses.lumenlearning.com

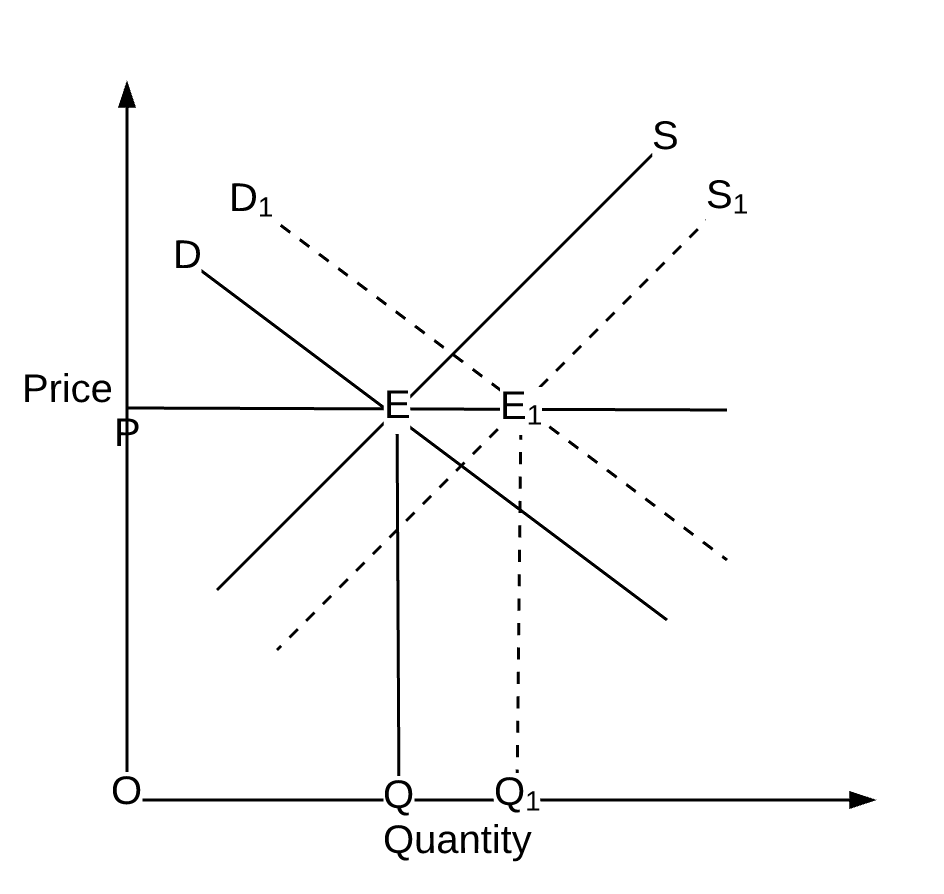

First let us calculate the equilibrium price and equilibrium quantity that were before the imposed tax. The effect of the tax on the supply-demand equilibrium is to shift the quantity toward a point where the before-tax demand minus the before-tax supply is the amount of the tax. However the equilibrium quantity rises. An increase in demand for coffee shifts the demand curve to the right as shown in Panel a of Figure 317 Changes in Demand and Supply. Given that the supply of money is xed the interest rate must decrease to push up the demand for money and maintain the equilibrium.

Source: economicshelp.org

Source: economicshelp.org

First let us calculate the equilibrium price and equilibrium quantity that were before the imposed tax. It helps us understand why and how prices change and what happens when the government intervenes in a market. The equilibrium quantity of cars will decrease. The effect of the tax on the supply-demand equilibrium is to shift the quantity toward a point where the before-tax demand minus the before-tax supply is the amount of the tax. The equilibrium price rises to 7 per pound.

Source: researchgate.net

Source: researchgate.net

The increase in demand increase in supply. With the use of aggregate demand curve one can see that if there is a change in personal income tax rates there will be a shift in the aggregate demand curve or the aggregate demand will increase or decrease. With 4 tax on producers the supply curve after tax is P Q3 4. The equilibrium price rises to 7 per pound. A tax increases the price a buyer pays by less than the tax.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Taxes are among the market and regulatory conditions that define the demand curve. But because the money went from consumers to the government and then is loaned out to businesses the increase in investment will slowly shift aggregate demand back to where it was originally. None of the above. Investment also affects the long-run aggregate supply curve since a change in the capital stock changes the potential level of real GDP. The equilibrium price rises to 7 per pound.

Source: instructables.com

Source: instructables.com

The supply curve for cars will shift to the right. The tax size predicts the new level of quantity supplied which is reduced in comparison to the initial level. With the use of aggregate demand curve one can see that if there is a change in personal income tax rates there will be a shift in the aggregate demand curve or the aggregate demand will increase or decrease. If the increase in both demand and supply is exactly equal there occurs a proportionate shift in the demand and supply curve. Q D Q S.

Source: researchgate.net

Source: researchgate.net

Rewrite the demand and supply equation as P 20 Q and P Q3. A tax increases the price a buyer pays by less than the tax. Hence the new equilibrium quantity after tax can be found from equating P Q3 4 and P 20 Q so Q3 4 20 Q which gives QT 12. Taxes are among the market and regulatory conditions that define the demand curve. Given that the supply of money is xed the interest rate must decrease to push up the demand for money and maintain the equilibrium.

Source: economicsdiscussion.net

Source: economicsdiscussion.net

A tax increase does not affect the demand curve nor does it make supply or demand more or less elastic. A tax on buyers is thought to shift the demand curve to the leftreduce consumer demandbecause the price of goods relative to their value to consumers has gone up. 125 125 from each sold kilogram of potatoes. The demand curve and shifted supply curve create a new equilibrium which is burdened by the tax. Taxes on supply and demand The VAT on the suppliers will shift the supply curve to the left symbolizing a reduction in supply similar to firms facing higher input costs.

A tax on buyers is thought to shift the demand curve to the leftreduce consumer demandbecause the price of goods relative to their value to consumers has gone up. The increase in demand increase in supply. It is important to under-stand precisely what these curves represent. B increases aggregate demand and the AD curve shifts rightward. Tax increases If the government increases the tax on a good that shifts the supply curve to the left consumer prices rise and sellers prices fall.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

The supply-demand model combines two important concepts. With 4 tax on producers the supply curve after tax is P Q3 4. If the aggregate supply increases equals. The equilibrium price rises to 7 per pound. The supply curve for cars will shift to the right.

Source: economics.stackexchange.com

Source: economics.stackexchange.com

The supply-demand model combines two important concepts. The equilibrium price rises to 7 per pound. Consequently the equilibrium price remains the same. If the government increases the tax on a good that shifts the supply curve to the left the consumer price increases and sellers price decreases. The equilibrium price rises to 7 per pound.

Source: assignmentexpert.com

Source: assignmentexpert.com

A tax increase A decreases aggregate demand and the AD curve shifts leftward. The equilibrium price rises to 7 per pound. If the increase in both demand and supply is exactly equal there occurs a proportionate shift in the demand and supply curve. Q D Q S. Rewrite the demand and supply equation as P 20 Q and P Q3.

Source: ecampusontario.pressbooks.pub

Source: ecampusontario.pressbooks.pub

125 125 from each sold kilogram of potatoes. It is obvious that. B increases aggregate demand and the AD curve shifts rightward. Taxes are among the market and regulatory conditions that define the demand curve. In the model of aggregate demand and aggregate supply a tax rate increase will shift the aggregate demand curve to the left by an amount equal to the initial change in aggregate expenditures induced by the tax rate boost times the new value of the multiplier.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title supply demand curve tax increase by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.