Your Supply and demand treasury bonds images are available. Supply and demand treasury bonds are a topic that is being searched for and liked by netizens now. You can Get the Supply and demand treasury bonds files here. Get all free vectors.

If you’re looking for supply and demand treasury bonds images information linked to the supply and demand treasury bonds keyword, you have come to the ideal blog. Our site frequently provides you with hints for seeking the highest quality video and image content, please kindly surf and locate more enlightening video articles and graphics that fit your interests.

Supply And Demand Treasury Bonds. The Fed only two months ago was buying an extra 120 bln a month in bonds. Once again too many Treasuries. Explain this difference using the bond supply and demand analysis. That dynamic may help explain why we have seen such a powerful rise in US bond prices mirrored by a.

Will Yields Rise Due To Increased Issuance Of Treasury Bonds Let S Get The Elephant Out Of The Room The Real Economy Blog From realeconomy.rsmus.com

Will Yields Rise Due To Increased Issuance Of Treasury Bonds Let S Get The Elephant Out Of The Room The Real Economy Blog From realeconomy.rsmus.com

The Fed only two months ago was buying an extra 120 bln a month in bonds. The Mechanics of Treasury Bonds. When the Fed buys government bonds the money supply quizlet. On August 1 2018 the Treasury Department announced that it was introducing the 8-week T-bill. What the Spike in Treasury Bonds Supply Means for Interest Rates and Inflation. The Federal Reserves open market operations which involve the sale and repurchase of all Treasuries including T-bonds covers budget shortfalls and regulates money supply.

Given the Feds aggressive purchases of long-term Treasuries many.

The default risk for the corporate bond increased compared to the default-free Treasury bond. This includes one of twenty-three financial institutions authorized to conduct trades with the Fed. A purchase of bonds means the Fed buys a US. Treasury yield prices are based on supply and demand. When the Fed buys bonds banks have more reserves and then are able to lend more. That dynamic may help explain why we have seen such a powerful rise in US bond prices mirrored by a.

Source: pinterest.com

Source: pinterest.com

A Increased supply of duration risk raises term premia b increased supply of Treasuries reduces specialness of Treasuries c expectations channel a and b are essentially taking a supply and demand perspective on the Treasury market. As it does so the same questions of supply versus demand have predictably resurfaced. Graphs the yield spread between Aaa-rated corporate bonds and Treasury securities against the US government debt-to-GDP ratio ie the ratio of the market value of publicly held US government debt to US GDP. Treasury bonds are initially. The ratio of the market value of publicly held US government debt to US GDP.

Source: pinterest.com

Source: pinterest.com

Demand for bonds relative to supply is also expected to worsen this year as central banks pare back purchases. Demand for the bond would decline and the yield would rise until supply and demand reached a new equilibrium. Once again too many Treasuries. On August 1 2018 the Treasury Department announced that it was introducing the 8-week T-bill. The Mechanics of Treasury Bonds.

Source: realeconomy.rsmus.com

Source: realeconomy.rsmus.com

Demand for bonds relative to supply is also expected to worsen this year as central banks pare back purchases. Supply and demand is a guiding principle of setting market prices. The Effect of Monetary Policy on Bond Yields Interest rates are a key part of a. On Tuesday the US. This includes one of twenty-three financial institutions authorized to conduct trades with the Fed.

Source: realeconomy.rsmus.com

Source: realeconomy.rsmus.com

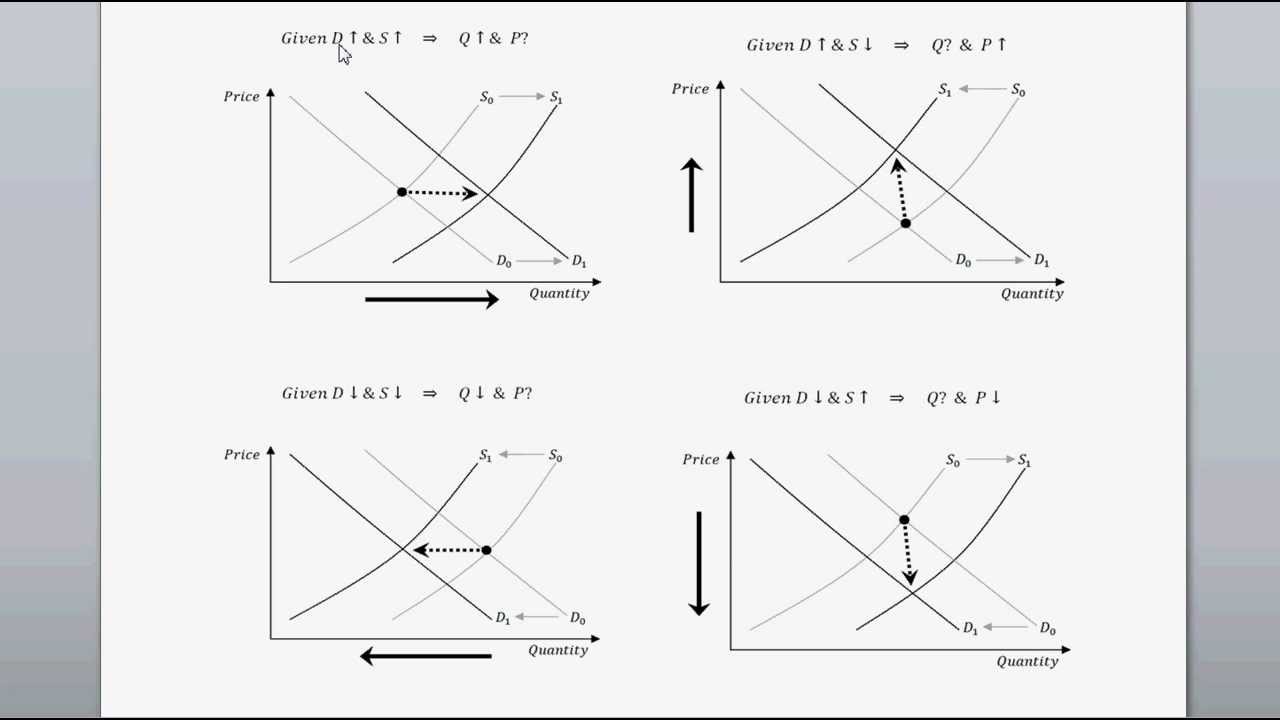

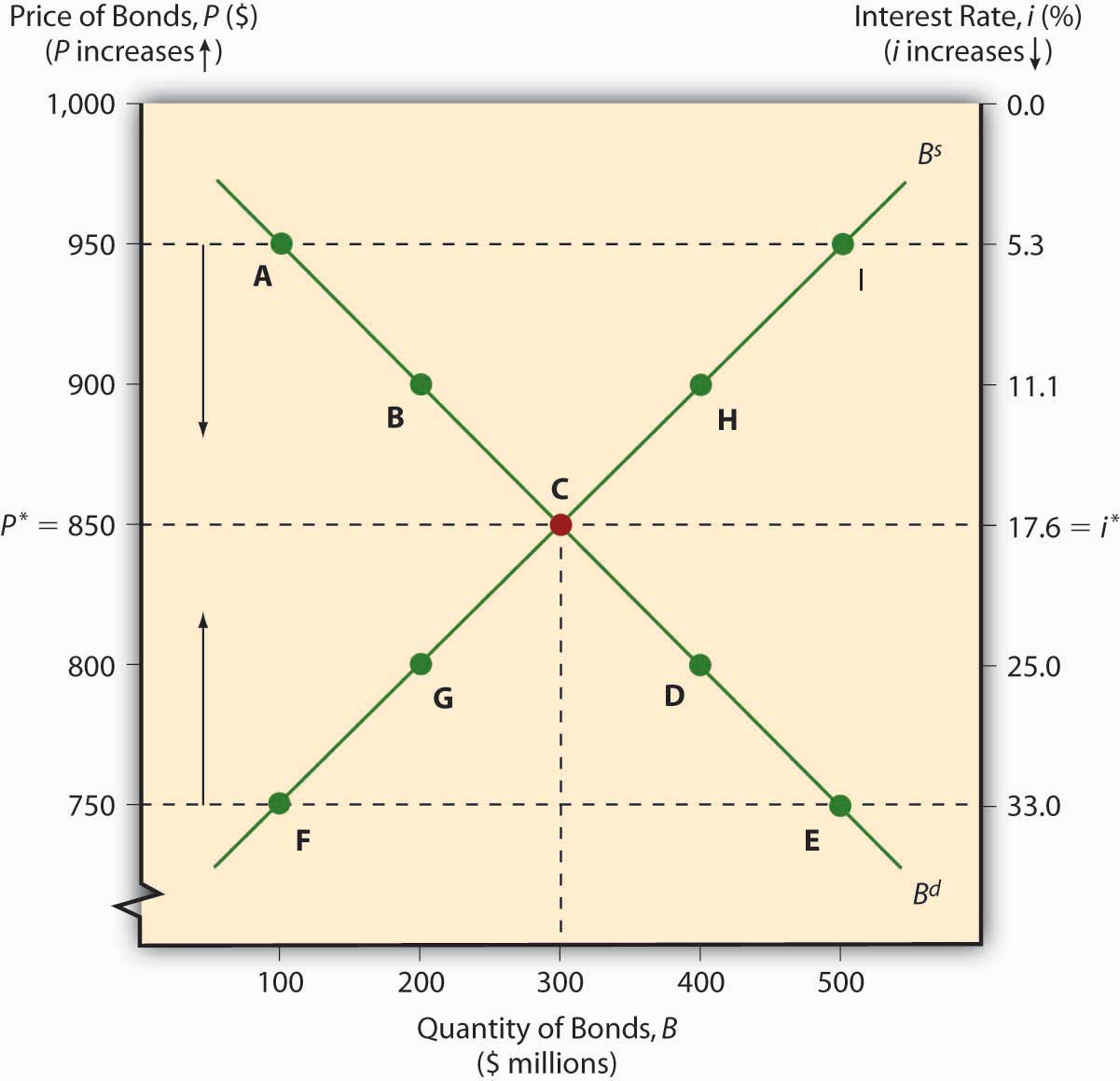

Supply and demand are the basic determinants of prices for bonds and other financial assets. On Tuesday the US. In the beginning the bonds are sold at auction by the Department of the Treasury. An expansion will cause the bond supply curve to shift right which alone will decrease bond prices increase the interest rate. Will the Feds tapering and ending of its quantitative easing QE program lead to a collapse in the Treasury bond market.

Source: researchgate.net

Source: researchgate.net

T-bills currently represent approximately 25 of total Treasury debt outstanding exceeding the historical average of 23 and are at the highest proportion since 2009. On Tuesday the US. Graphs the yield spread between Aaa-rated corporate bonds and Treasury securities against the US government debt-to-GDP ratio ie the ratio of the market value of publicly held US government debt to US GDP. What the Spike in Treasury Bonds Supply Means for Interest Rates and Inflation. T-bills currently represent approximately 25 of total Treasury debt outstanding exceeding the historical average of 23 and are at the highest proportion since 2009.

Source: pinterest.com

Source: pinterest.com

Demand for bonds relative to supply is also expected to worsen this year as central banks pare back purchases. The Fed only two months ago was buying an extra 120 bln a month in bonds. The Fed only two months ago was buying an extra 120 bln a month in bonds. Demand for bonds relative to supply is also expected to worsen this year as central banks pare back purchases. Learn About it Now.

Source: no.pinterest.com

Source: no.pinterest.com

Aaa rated corporate bonds and Treasury securities against the US government Debt-to-GDP ratio ie. That dynamic may help explain why we have seen such a powerful rise in US bond prices mirrored by a. Aaa rated corporate bonds and Treasury securities against the US government Debt-to-GDP ratio ie. This includes one of twenty-three financial institutions authorized to conduct trades with the Fed. Learn About it Now.

Source: 2012books.lardbucket.org

Source: 2012books.lardbucket.org

An expansion will cause the bond supply curve to shift right which alone will decrease bond prices increase the interest rate. Graphs the yield spread between Aaa-rated corporate bonds and Treasury securities against the US government debt-to-GDP ratio ie the ratio of the market value of publicly held US government debt to US GDP. The Federal Reserves open market operations which involve the sale and repurchase of all Treasuries including T-bonds covers budget shortfalls and regulates money supply. Demand for the bond would decline and the yield would rise until supply and demand reached a new equilibrium. Supply and demand are the basic determinants of prices for bonds and other financial assets.

Source: pinterest.com

Source: pinterest.com

Supply and demand are the basic determinants of prices for bonds and other financial assets. The Fed only two months ago was buying an extra 120 bln a month in bonds. The Federal Reserves open market operations which involve the sale and repurchase of all Treasuries including T-bonds covers budget shortfalls and regulates money supply. Treasury bonds are initially. A purchase of bonds means the Fed buys a US.

Source: realeconomy.rsmus.com

Source: realeconomy.rsmus.com

T-bills currently represent approximately 25 of total Treasury debt outstanding exceeding the historical average of 23 and are at the highest proportion since 2009. The figure reflects a Treasury demand function akin to a money demand function. Demand for bonds relative to supply is also expected to worsen this year as central banks pare back purchases. Treasury yield prices are based on supply and demand. Ad Search for Results.

Source: investopedia.com

Source: investopedia.com

Given the Feds aggressive purchases of long-term Treasuries many. Demand for high-quality short-term assets. On August 1 2018 the Treasury Department announced that it was introducing the 8-week T-bill. Supply and demand are the basic determinants of prices for bonds and other financial assets. Bond prices rise when demand outpaces supply and fall when there is insufficient demand.

Source: pinterest.com

Source: pinterest.com

Once again too many Treasuries. Treasury sold a staggering 179. Demand for bonds relative to supply is also expected to worsen this year as central banks pare back purchases. Government Treasury bond from one of its primary dealers. The Mechanics of Treasury Bonds.

Source:

Source:

The Fed only two months ago was buying an extra 120 bln a month in bonds. The huge 179 billion issuance this week is only the beginning. On August 1 2018 the Treasury Department announced that it was introducing the 8-week T-bill. Demand for high-quality short-term assets. Once again too many Treasuries.

Source: pinterest.com

Source: pinterest.com

Will the Feds tapering and ending of its quantitative easing QE program lead to a collapse in the Treasury bond market. A Increased supply of duration risk raises term premia b increased supply of Treasuries reduces specialness of Treasuries c expectations channel a and b are essentially taking a supply and demand perspective on the Treasury market. The Fed only two months ago was buying an extra 120 bln a month in bonds. Demand for bonds relative to supply is also expected to worsen this year as central banks pare back purchases. Supply and demand are the basic determinants of prices for bonds and other financial assets.

Source: realeconomy.rsmus.com

Source: realeconomy.rsmus.com

Demand for high-quality short-term assets. The ratio of the market value of publicly held US government debt to US GDP. The Fed only two months ago was buying an extra 120 bln a month in bonds. The demand for corporate bonds decreased while the demand for Treasury bonds increased resulting in a larger risk premium. A purchase of bonds means the Fed buys a US.

Source: pinterest.com

Source: pinterest.com

The Effect of Monetary Policy on Bond Yields Interest rates are a key part of a. The Fed only two months ago was buying an extra 120 bln a month in bonds. The figure reflects a Treasury demand function akin to a money de-mand function. This includes one of twenty-three financial institutions authorized to conduct trades with the Fed. Supply and demand are the basic determinants of prices for bonds and other financial assets.

Source: pinterest.com

Source: pinterest.com

Supply and demand is a guiding principle of setting market prices. When the supply of Treasuries is low the value that. The figure reflects a Treasury demand function akin to a money de-mand function. That dynamic may help explain why we have seen such a powerful rise in US bond prices mirrored by a. An expansion will cause the bond supply curve to shift right which alone will decrease bond prices increase the interest rate.

Source:

Source:

The ratio of the market value of publicly held US government debt to US GDP. Will the Feds tapering and ending of its quantitative easing QE program lead to a collapse in the Treasury bond market. Treasury yield prices are based on supply and demand. Aaa rated corporate bonds and Treasury securities against the US government Debt-to-GDP ratio ie. When the Fed buys government bonds the money supply quizlet.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title supply and demand treasury bonds by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.