Your Supply and demand graph per unit tax images are available in this site. Supply and demand graph per unit tax are a topic that is being searched for and liked by netizens now. You can Download the Supply and demand graph per unit tax files here. Find and Download all royalty-free images.

If you’re searching for supply and demand graph per unit tax images information linked to the supply and demand graph per unit tax interest, you have come to the ideal blog. Our website always provides you with hints for downloading the maximum quality video and image content, please kindly search and locate more enlightening video articles and images that match your interests.

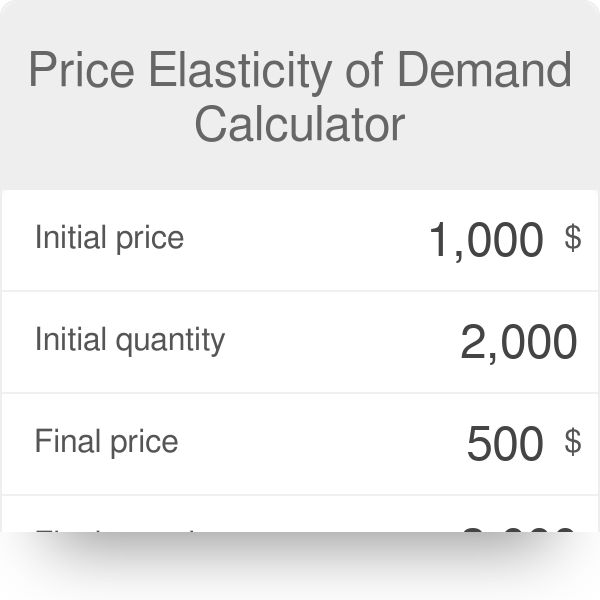

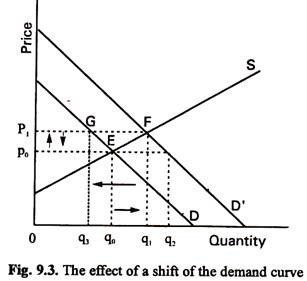

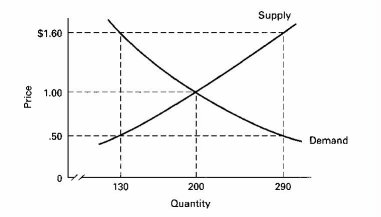

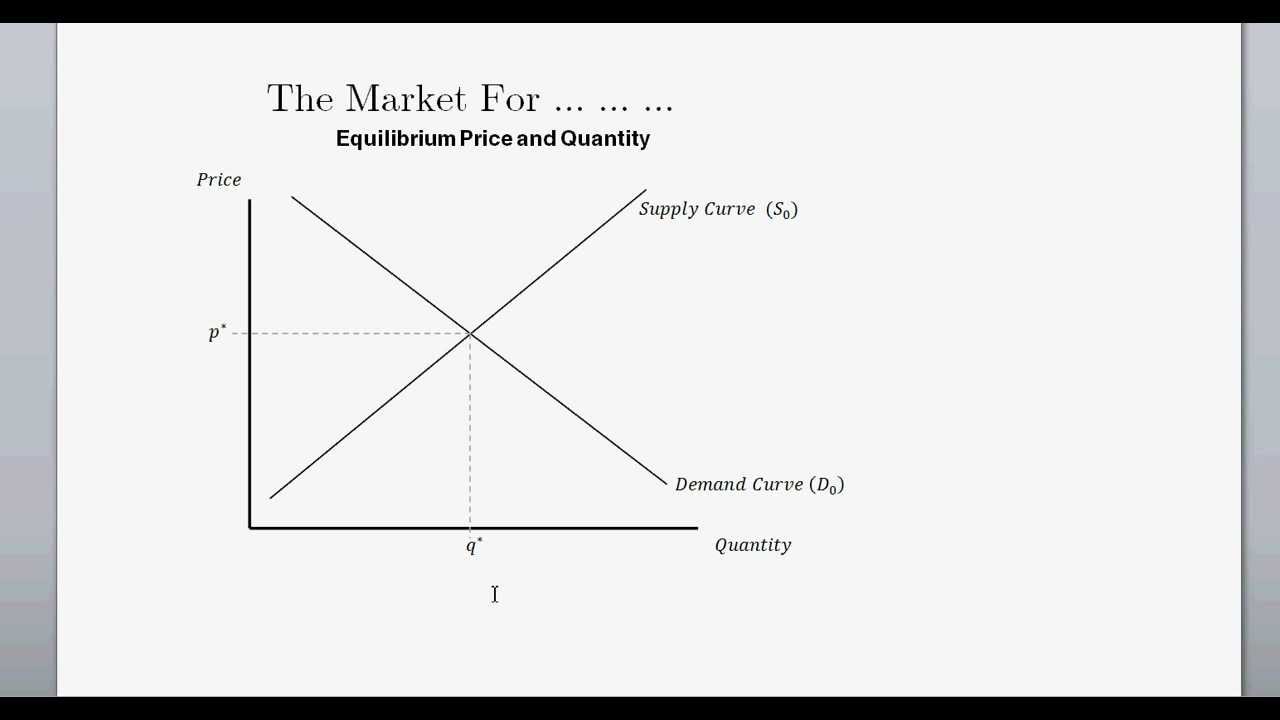

Supply And Demand Graph Per Unit Tax. It also shows the supply curve STax shifted up by the amount of the proposed tax 100 per jacket. When the tax is imposed the price that the buyer pays must exceed. The following graph shows the annual supply and demand for this good. A demand curve shows the relationship between price and quantity demanded on a graph like the graph below with quantity on the horizontal axis and the price per gallon on the vertical axis.

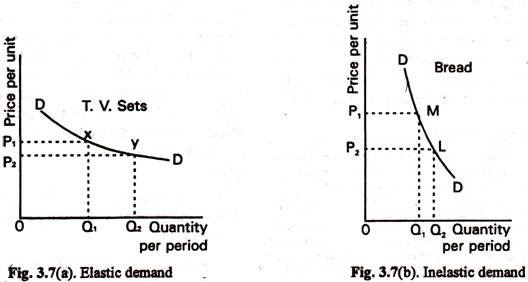

Shifts In Demand And Supply With Diagram From economicsdiscussion.net

Shifts In Demand And Supply With Diagram From economicsdiscussion.net

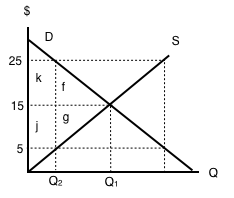

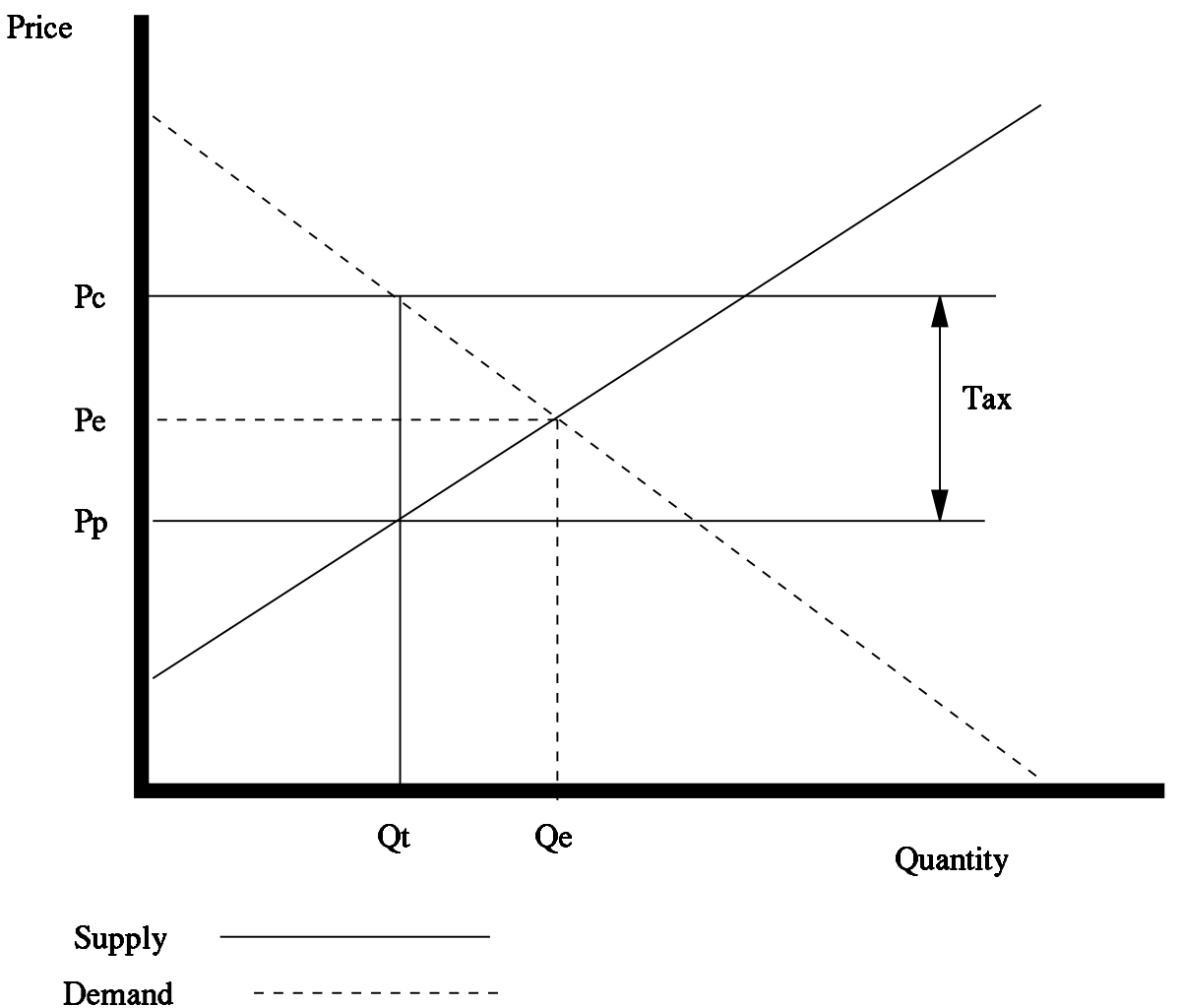

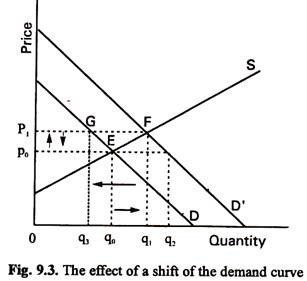

Taxes on supply and demand The VAT on the suppliers will shift the supply curve to the left symbolizing a reduction in supply similar to firms facing higher input costs. Calculate the revenue received by the firms. That is why in Fig. And I must find the equilibrium quantity of the curves after the 2 tax has been taken into account for. 2044Q 4Q16 Q4 units transacted one less than before. 119c a D 1 D 1 curve is drawn which gives at any q the demand price minus the sales tax of a certain percentage here 20 per cent of the supply price.

It is obvious that.

A Perfectly elastic With perfectly elastic demand a 5 excise tax shifts the supply curve up by 5. The difference between P 2 and P 1 is the amount of excise tax that is imposed. The demand for leather jackets is shown by DL on the first graph and the demand for smartphones is shown by Ds on the second graph. A per unit tax is a fixed tax on a product independent of the products price It can be represented as a wedge between the supply and demand curves indicates the price buyers pay and indicates the price sellers receive net of the tax The orange rectangle represents the tax revenue the per unit tax times the quantity sold The consumer surplus is shaded in blue the producer surplus in. Since as q and the supply price increase the amount of the tax also increases and the vertical gap between the DD and D 1 D 1 curves will increase. The following graph shows the annual supply and demand for this good.

Source: ecampusontario.pressbooks.pub

Source: ecampusontario.pressbooks.pub

It is obvious that. The difference between P 2 and P 1 is the amount of excise tax that is imposed. Buyers pay only P B 20. Q D Q S. When the tax is imposed the price that the buyer pays must exceed.

Source: acqnotes.com

Source: acqnotes.com

Quantity shifts from Q 0 to Q 1 after the excise tax has been imposed on consumers of each unit of Good A. Q_D Q_S QD. And ii in the absence of government regulation the market supply curve is the one labeled S1. I there are no externalities. The following graph shows the annual supply and demand for this good.

Source: courses.lumenlearning.com

Source: courses.lumenlearning.com

A Perfectly elastic With perfectly elastic demand a 5 excise tax shifts the supply curve up by 5. With 4 tax on producers the supply curve after tax is P Q3 4. A demand curve shows the relationship between price and quantity demanded on a graph like the graph below with quantity on the horizontal axis and the price per gallon on the vertical axis. Q_D Q_S QD. It also shows the supply curve S Tax shifted up by the amount of the proposed tax 100 per jacket.

Source: pinterest.com

Source: pinterest.com

The quantity traded before a tax was imposed was q B. It is obvious that. The following graph shows the annual supply and demand for this good. The government decides to levy a tax of 2 per unit on the good to be paid by the seller. Sellers receive what the buyers pay minus the tax P S P BT20416.

Source: pinterest.com

Source: pinterest.com

The following graph shows the annual supply and demand for this good. When the tax is imposed the price that the buyer pays must exceed. 119c a D 1 D 1 curve is drawn which gives at any q the demand price minus the sales tax of a certain percentage here 20 per cent of the supply price. Rewrite the demand and supply equation as P 20 Q and P Q3. It also shows the supply curve STax shifted up by the amount of the proposed tax 100 per jacket.

Source: mlpp.pressbooks.pub

Source: mlpp.pressbooks.pub

That is why in Fig. With 4 tax on producers the supply curve after tax is P Q3 4. In both cases the effect of the tax on the supply-demand equilibrium is to shift the quantity toward a point where the before-tax demand minus the before-tax supply is the amount of the tax. Calculate the tax revenue received by the government indicate it on your diagram. Since as q and the supply price increase the amount of the tax also increases and the vertical gap between the DD and D 1 D 1 curves will increase.

Source: pressbooks.bccampus.ca

Source: pressbooks.bccampus.ca

Buyers pay only P B 20. Hence the new equilibrium quantity after tax can be found from equating P Q3 4 and P 20 Q so Q3 4 20 Q which gives QT 12. If excise tax is imposed on consumers the consumers demand for Good A will decrease. A demand curve shows the relationship between price and quantity demanded on a graph like the graph below with quantity on the horizontal axis and the price per gallon on the vertical axis. Then use the black triangle plus symbols to shade.

Source: www2.harpercollege.edu

Source: www2.harpercollege.edu

Since as q and the supply price increase the amount of the tax also increases and the vertical gap between the DD and D 1 D 1 curves will increase. And ii in the absence of government regulation the market supply curve is the one labeled S1. AP is owned by the College Board which does not endorse this site or the above reviewStudy Questions1 Show supply demand with an equilibrium price and. Sellers receive what the buyers pay minus the tax P S P BT20416. Calculate the tax revenue received by the government indicate it on your diagram.

The supply curve for each of these two goods is identical as you can see on each of the following graphs. Q_D Q_S QD. On the following graph use the green rectangle triangle symbols to shade the area that represents tax revenue for leather jackets. If a 5 per unit tax is introduced in this market which area represents the deadweight loss. The supply curve for each of these two goods is identical as you can see on each of the following graphs.

Source: investopedia.com

Source: investopedia.com

And ii in the absence of government regulation the market supply curve is the one labeled S1. Q D Q S. Sellers suffer the full tax burden due to demand being perfectly elastic. Buyers pay only P B 20. When the tax is imposed the price that the buyer pays must exceed.

Source: en.wikipedia.org

Source: en.wikipedia.org

If a 5 per unit tax is introduced in this market which area represents the deadweight loss. Consider the supply and demand diagram below. A demand curve shows the relationship between price and quantity demanded on a graph like the graph below with quantity on the horizontal axis and the price per gallon on the vertical axis. If excise tax is imposed on consumers the consumers demand for Good A will decrease. It also shows the supply curve S Tax shifted up by the amount of the proposed tax 100 per jacket.

Source: economicsonline.co.uk

Source: economicsonline.co.uk

The quantity traded before a tax was imposed was q B. Calculate the revenue received by the firms. And I must find the equilibrium quantity of the curves after the 2 tax has been taken into account for. Hence the new equilibrium quantity after tax can be found from equating P Q3 4 and P 20 Q so Q3 4 20 Q which gives QT 12. The difference between P 2 and P 1 is the amount of excise tax that is imposed.

Source: slidetodoc.com

Source: slidetodoc.com

It also shows the supply curve S Tax shifted up by the amount of the proposed tax 100 per jacket. It is obvious that. And the demand for a good is given by Q D 960 120 P D. The supply curve for each of these two goods is identical as you can see on each of the following graphs. Taxes on supply and demand The VAT on the suppliers will shift the supply curve to the left symbolizing a reduction in supply similar to firms facing higher input costs.

Source: financetrain.com

Source: financetrain.com

How do you calculate tax on supply and demand curve. Suppose the government taxes leather jackets. I there are no externalities. AP is owned by the College Board which does not endorse this site or the above reviewStudy Questions1 Show supply demand with an equilibrium price and. The government is about to impose an excise tax of 5 per unit.

Source: sanandres.esc.edu.ar

Source: sanandres.esc.edu.ar

A per unit tax is a fixed tax on a product independent of the products price It can be represented as a wedge between the supply and demand curves indicates the price buyers pay and indicates the price sellers receive net of the tax The orange rectangle represents the tax revenue the per unit tax times the quantity sold The consumer surplus is shaded in blue the producer surplus in. Use the diagram to find out the new equilibrium price and quantity. Sellers suffer the full tax burden due to demand being perfectly elastic. Rewrite the demand and supply equation as P 20 Q and P Q3. Then use the black triangle plus symbols to shade.

Source: youtube.com

Source: youtube.com

Rewrite the demand and supply equation as P 20 Q and P Q3. View Q12 MEpng from ECO 162 at Malaysia University of Science Technology. With the tax the supply curve shifts up by T4 to P44Q. How do you calculate tax on supply and demand curve. The demand for leather jackets is shown by DL on the first graph and the demand for smartphones is shown by Ds on the second graph.

Source: economicsdiscussion.net

Source: economicsdiscussion.net

In the new equilibrium with the tax what price will producers receive and consumers pay if the demand curve is. Rewrite the demand and supply equation as P 20 Q and P Q3. With the tax the supply curve shifts up by T4 to P44Q. In both cases the effect of the tax on the supply-demand equilibrium is to shift the quantity toward a point where the before-tax demand minus the before-tax supply is the amount of the tax. Q D Q S.

AP is owned by the College Board which does not endorse this site or the above reviewStudy Questions1 Show supply demand with an equilibrium price and. Note that this is an exception to the normal rule in mathematics that the independent variable x goes on the horizontal axis and the dependent variable. The diagram below shows demand and supply curves for good X. That is why in Fig. And I must find the equilibrium quantity of the curves after the 2 tax has been taken into account for.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title supply and demand graph per unit tax by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.