Your Supply and demand for bonds framework images are available. Supply and demand for bonds framework are a topic that is being searched for and liked by netizens today. You can Find and Download the Supply and demand for bonds framework files here. Find and Download all royalty-free photos.

If you’re looking for supply and demand for bonds framework images information linked to the supply and demand for bonds framework interest, you have visit the right blog. Our website always gives you hints for seeking the maximum quality video and image content, please kindly search and find more informative video content and images that fit your interests.

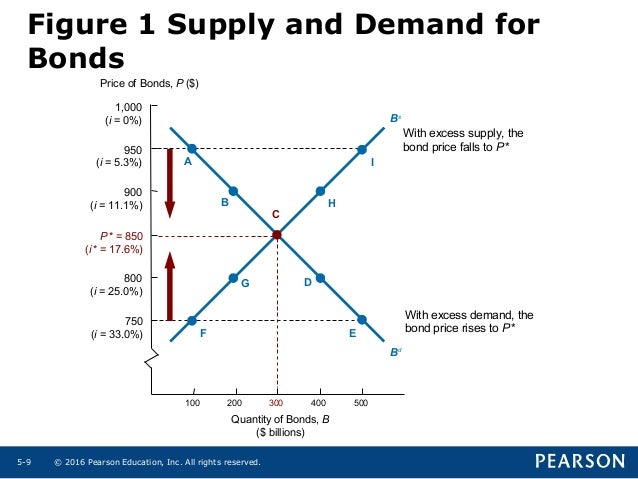

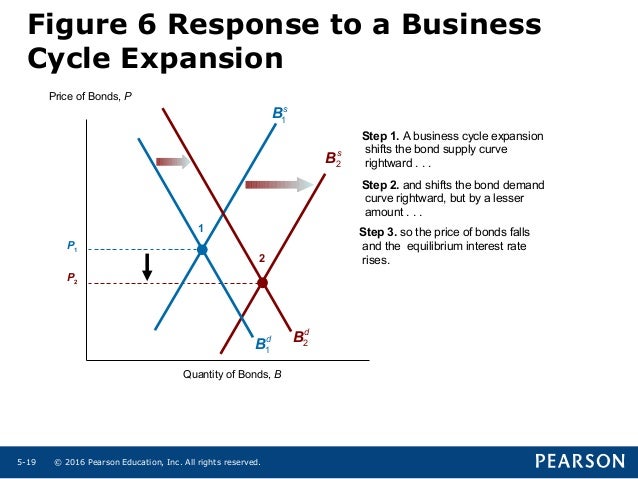

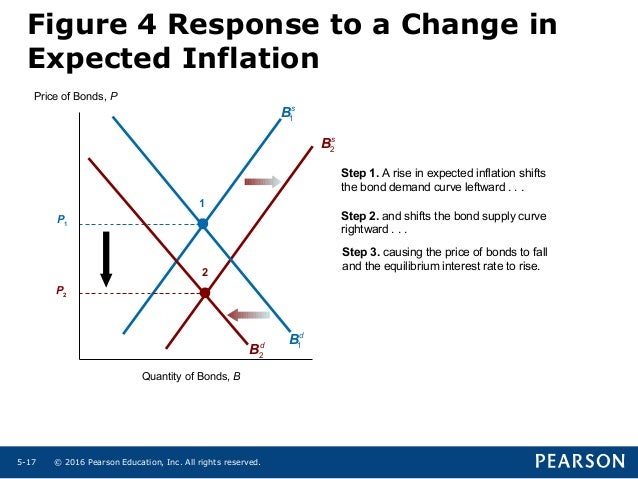

Supply And Demand For Bonds Framework. Everything else is exogenous. Using both the liquidity preference framework and the supply and demand for bonds framework show why interest rates are procyclical rising when the economy is expanding and falling during recessions. When the economy booms the demand for bonds increases. When the economy booms the demand for bonds increases.

Ch05 Mish11 Embfm From slideshare.net

Ch05 Mish11 Embfm From slideshare.net

The publics income and wealth rises while the supply of bonds also increases because rms have more at-tractive investment opportunities. The supply curve Bs shifts to the right and the equilibrium interest rate rises. When the economy booms the demand for bonds increases. Is expanding and falling during recessions. Demand for bonds will increase when wealth in the economy increases causing people to invest more money in bonds regardless of the price. Using both the liquidity preference framework and the supply and demand for bonds framework explain why interest rates are pro-cyclical rising when the economy is expanding and falling during recessions.

Using the supply-and-demand for bonds framework show why interest rates are procyclical rising when the economy is expanding and falling during recessions.

The supply curve Bs shifts to the right and the equilibrium interest rate rises. Is your answer consistent with what you would expect to find with the liquidity preference framework. An expansion will cause the bond supply curve to shift right which alone will decrease bond prices increase the interest rate. The supply curve Bs shifts to the right and the equilibrium interest rate rises. Figure 76 A Shift in the Supply Curve of an Individual Firm. Although several factors influence the supply and demand for bonds which in turn influences interest rates the Fed may also influence interest rates of bonds.

Source: courses.lumenlearning.com

Source: courses.lumenlearning.com

The bond supply and demand framework. Using the supply-and-demand for bonds framework show why interest rates are pro-cyclical rising when the economy is expanding and falling during recessions. When the economy booms the demand for bonds increases. Using a supply-and-demand analysis for bonds show what effect this action has on interest rates. Using both the liquidity preference framework and the supply and demand for bonds framework show why interest rates are procyclical rising when the economy is expanding and falling during recessions.

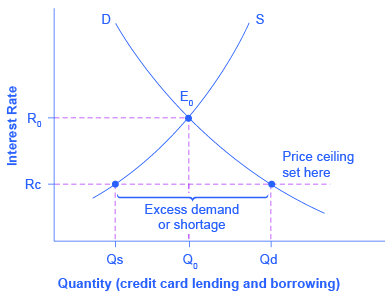

Using the supply-and-demand diagrams for bonds show what the effect is on interest rates when the riskiness of bonds rises. When the economy booms the demand for bonds increases. Thus the supply of bonds increases. The buyers of the bonds will decrease the demand for bonds since they k View the full answer Transcribed image text. Using the supply-and-demand for bonds framework show why interest rates are pro-cyclical rising when the economy is expanding and falling during recessions.

Source: courses.lumenlearning.com

Source: courses.lumenlearning.com

In a business cycle expansion the amounts of goods and services being produced in the economy increases so national income increases. When the economy booms the demand for bonds increases. Start of expansion long term rates will be higher than the short term rates leading to an upward sloping yield curve. The opposite is true at the time of recession. Using both the liquidity preference framework and the.

Source: pinterest.com

Source: pinterest.com

Using the supply-and-demand diagrams for bonds show what the effect is on interest rateswhen the riskiness of bonds rises3. But expansions also cause the demand for bonds to increase the bond demand curve to shift right which has the effect of increasing bond prices and hence lowering bond yields. Using the supply-and-demand for bonds framework show why interest rates are pro-cyclical rising when the economy is expanding and falling during recessions. Thus the supply of bonds increases. Everything else is exogenous.

Source: investopedia.com

Source: investopedia.com

The publics income and wealth rises while the supply of bonds also increases because firms have more attractive investment opportunities. The bond supply and demand framework. But expansions also cause the demand for bonds to increase the bond demand curve to shift right which has the effect of increasing bond prices and hence lowering bond yields. Supply and demand for bonds framework show why. Using the supply-and-demand diagrams for bonds framework show why interest rates are procyclical rising when the economy is expanding and falling during recessions.

Interest rates are procyclical rising when the economy. In a business cycle expansion the amounts of goods and services being produced in the economy increases so national income increases. When using the supply-and-demand framework price and quantity are endogenous variables. Using the supply-and-demand diagrams for bonds show what the effect is on interest rateswhen the riskiness of bonds rises3. Everything else is exogenous.

Source: slideshare.net

Source: slideshare.net

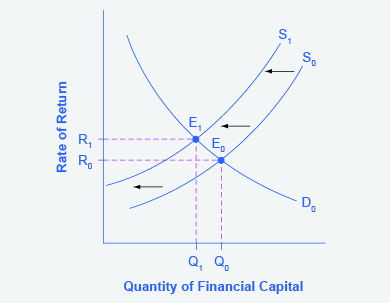

The publics income and wealth rises while the supply of bonds also increases because firms have more attractive investment opportunities. Predict what will happen to interest rates if prices in the bond market become more volatile. Using a supply and demand analysis for bonds show what effect this action has on interest rates. An important way in which the Federal Reserve decreases the money supply is by selling bonds to the public. An increase in marginal cost leads a firm to produce less output at any given price.

Source: courses.lumenlearning.com

Source: courses.lumenlearning.com

The supply curve Bs shifts to the right and the equilibrium interest rate rises. Withe the liquidity preference framework the decrease in the money supply shifts the money supply curve to the. The large federal deficits require the Treasury to issue more bonds. He Using both the liquidity preference framework and the supply and demand for bonds framework show why interest rates are procyclical rising when the economy is expanding and. Demand for bonds will increase when wealth in the economy increases causing people to invest more money in bonds regardless of the price.

Source: pinterest.com

Source: pinterest.com

The supply curve Bs shifts to the right and the equilibrium interest rate rises. When the economy booms the demand for bonds increases. Using the supply-and-demand diagrams for bonds show what the effect is on interest rateswhen the riskiness of bonds rises3. The supply curve Bs shifts to the right and the equilibrium interest rate rises. When the Fed buys bonds.

Are the results the same in the two frameworks. An increase in marginal cost leads a firm to produce less output at any given price. Demand for bonds will increase when wealth in the economy increases causing people to invest more money in bonds regardless of the price. Although several factors influence the supply and demand for bonds which in turn influences interest rates the Fed may also influence interest rates of bonds. Using the supply-and-demand for bonds framework show why interest rates are procyclical rising when the economy is expanding and falling during recessions.

Using the supply-and-demand diagrams for bonds framework show why interest rates areprocyclical rising when the economy is expanding and falling during recessions2. Although several factors influence the supply and demand for bonds which in turn influences interest rates the Fed may also influence interest rates of bonds. An expansion will cause the bond supply curve to shift right which alone will decrease bond prices increase the interest rate. Using the supply-and-demand diagrams for bonds show what the effect is on interest rateswhen the riskiness of bonds rises3. Using the supply-and-demand for bonds framework show why interest rates are pro-cyclical rising when the economy is expanding and falling during recessions.

Source: pinterest.com

Source: pinterest.com

The publics income and wealth rises while the supply of bonds also increases because firms have more attractive investment opportunities. An important way in which the Federal Reserve decreases the money supply is by selling bonds to the public. Using a supply-and-demand analysis for bonds show what effect this action has on interest rates. Withe the liquidity preference framework the decrease in the money supply shifts the money supply curve to the. Although several factors influence the supply and demand for bonds which in turn influences interest rates the Fed may also influence interest rates of bonds.

Source: pinterest.com

Source: pinterest.com

The bond supply and demand framework. But expansions also cause the demand for bonds to increase the bond demand curve to shift right which has the effect of increasing bond prices and hence lowering bond yields. Predict what will happen to interest rates if prices in the bond market become more volatile. When the economy booms the demand for bonds increases. The publics income and wealth rises while the supply of bonds also increases because rms have more at-tractive investment opportunities.

Source: pinterest.com

Source: pinterest.com

Some economists believe that when the Treasury issues more bonds the demand for bonds increases because the issue of bonds increases the publics wealth. When the economy booms the demand for bonds increases. The publics income and wealth rises while the supply of bonds also increases because firms have more attractive investment opportunities. The publics income and wealth rises while the supply of bonds also increases because firms have more attractive investment opportunities. The opposite is true at the time of recession.

Source: opentextbc.ca

Source: opentextbc.ca

Interest rates are procyclical rising when the economy. Everything else is exogenous. Figure 76 A Shift in the Supply Curve of an Individual Firm. Is expanding and falling during recessions. View the full answer.

Using the supply-and-demand diagrams for bonds framework show why interest rates areprocyclical rising when the economy is expanding and falling during recessions2. The opposite is true at the time of recession. Using the supply-and-demand diagrams for bonds show what the effect is on interest rateswhen the riskiness of bonds rises3. Using the supply-and-demand diagrams for bonds framework show why interest rates areprocyclical rising when the economy is expanding and falling during recessions2. Demand for bonds will increase when wealth in the economy increases causing people to invest more money in bonds regardless of the price.

Source: opentextbc.ca

Source: opentextbc.ca

Using the supply-and-demand diagrams for bonds framework show why interest rates areprocyclical rising when the economy is expanding and falling during recessions2. Using both the liquidity preference framework and the. Using the supply-and-demand for bonds framework show why interest rates are pro-cyclical rising when the economy is expanding and falling during recessions. Beer Prices in Britain. A Shift in Supply.

Source: slideshare.net

Source: slideshare.net

Thus the supply of bonds increases. The publics income and wealth rises while the supply of bonds also increases because firms have more attractive investment opportunities. Using a supply-and-demand analysis for bonds show what effect this action has on interest rates. An important way in which the Federal Reserve decreases the money supply is by selling bonds to the public. Interest rates are procyclical rising when the economy.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title supply and demand for bonds framework by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.