Your Supply and demand diagram with tax images are ready. Supply and demand diagram with tax are a topic that is being searched for and liked by netizens now. You can Get the Supply and demand diagram with tax files here. Find and Download all royalty-free photos.

If you’re searching for supply and demand diagram with tax images information connected with to the supply and demand diagram with tax topic, you have come to the ideal blog. Our website frequently provides you with hints for refferencing the highest quality video and image content, please kindly hunt and locate more enlightening video articles and graphics that match your interests.

Supply And Demand Diagram With Tax. Tax supply and demandsvg. Use the diagram to find out the new equilibrium price and quantity. Supply and Demand Calculator. Show the price paid by consumers the price received by producers and the quantity.

Economics Of The Sugar Tax Economics Lessons Managerial Economics Teaching Economics From pinterest.com

Economics Of The Sugar Tax Economics Lessons Managerial Economics Teaching Economics From pinterest.com

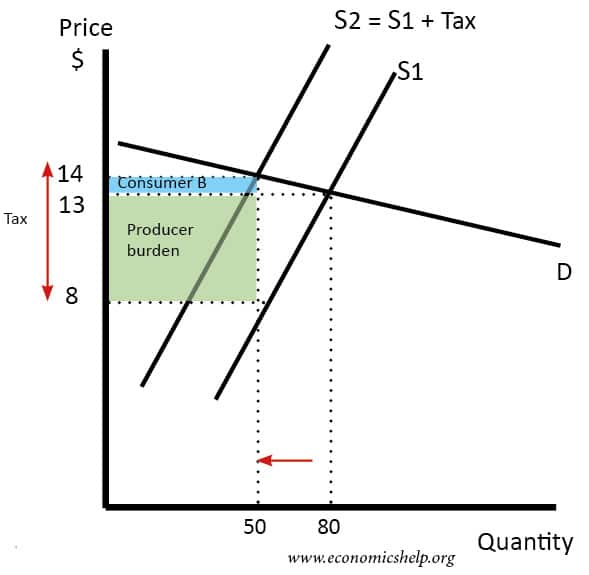

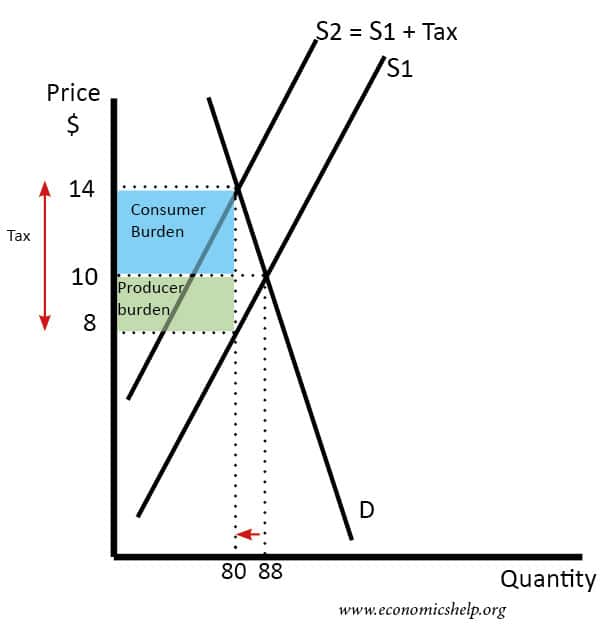

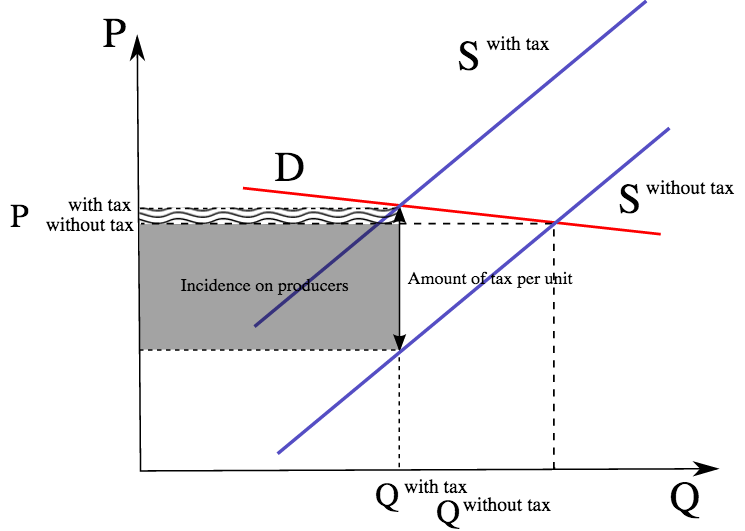

Now if an ad valorem tax is imposed on the good and the buyers are to pay the tax then the price that the buyers would pay would include the tax and the sellers will receive the price net of tax. The effect of the tax on the supply-demand equilibrium is to shift the quantity toward a point where the before-tax demand minus the before-tax supply is the amount of the tax. If the government imposes a specific tax per unit of 3 plot the new supply curve on the original supply and demand diagram. The result is shown in Fig. The imposition of the tax has caused the supply curve to shift to the left from SS to ST. While supply for the product has not changed all of the determinants of supply are the same producers incur higher cost which is why we will see a new equilibrium point further up the demand curve at a higher.

The behavior of individual firms.

In this diagram supply and demand have shifted to the right. Taxes have the ability to impact a consumers ability to afford a good but the type of tax impacts the change in demand. In fact both the federal and state governments impose beer taxes of some sort a. Now if an ad valorem tax is imposed on the good and the buyers are to pay the tax then the price that the buyers would pay would include the tax and the sellers will receive the price net of tax. Created by jrincayc for the purpose of illustrating the effect of taxes and subsidies on price. The demand curve DD shows the price that the buyers would pay at each quantity purchased and the curve D t D t shows the price net of tax that the sellers would receive at each quantity sold.

Source: economicshelp.org

Source: economicshelp.org

The Calculator helps calculating the market equilibrium given Supply and Demand curves. In both of your diagrams show the change in the price paid by car. A tax increases the price a buyer pays by less than the tax. Taxes have the ability to impact a consumers ability to afford a good but the type of tax impacts the change in demand. The specific tax increases production costs for the firm and therefore supply decreases from S1 to S1tax.

Source: pinterest.com

Source: pinterest.com

In fact both the federal and state governments impose beer taxes of some sort a. 1 Take a highlighter or colored pencil and make a border around the rectangular region encompassing Cost to Consumers and Cost to Producers. In fact both the federal and state governments impose beer taxes of some sort a. Taxes have the ability to impact a consumers ability to afford a good but the type of tax impacts the change in demand. Show the price paid by consumers the price received by producers and the quantity.

Source: economicshelp.org

Source: economicshelp.org

Who benefits from a binding price ceiling. Your instructor asks you to determine P_E and Q_E and plot the demand and supply curves if the government has imposed an indirect tax at a rate of 125 from each sold kilogram of potatoes. Since it doesnt matter whether a tax shifts the demand curve or the supply curve we can more easily draw a tax as. 1 Take a highlighter or colored pencil and make a border around the rectangular region encompassing Cost to Consumers and Cost to Producers. Now if an ad valorem tax is imposed on the good and the buyers are to pay the tax then the price that the buyers would pay would include the tax and the sellers will receive the price net of tax.

Source: pinterest.com

Source: pinterest.com

It postulates that in a competitive market the unit price for a particular good or other traded item such as labor or liquid. The economy as a whole d. Now if an ad valorem tax is imposed on the good and the buyers are to pay the tax then the price that the buyers would pay would include the tax and the sellers will receive the price net of tax. Created by jrincayc for the purpose of illustrating the effect of taxes and subsidies on price. 2 Calculate the Total Tax Revenue in this economy by finding the area of the rectangle border.

Source: pinterest.com

Source: pinterest.com

The tax aims to correct an undesirable or unsustainable market result by setting the external marginal cost of negative externalities at the same amount. Tax supply and demandsvg. A 33-29 900-0. Taxes have the ability to impact a consumers ability to afford a good but the type of tax impacts the change in demand. The specific tax increases production costs for the firm and therefore supply decreases from S1 to S1tax.

Source: pinterest.com

Source: pinterest.com

A tax increases the price a buyer pays by less than the tax. - a wedge driven between the demand curve. 1 Take a highlighter or colored pencil and make a border around the rectangular region encompassing Cost to Consumers and Cost to Producers. A diagram showing the effect of a per unit tax on the standard supply and demand diagram. The diagrams representing a general demand and supply graph pre-tax and post tax equilibrium are posted in the explanation section.

Source: pinterest.com

Source: pinterest.com

This diagram shows a specific tax. Suppose the federal government requires beer drinkers to pay a 2 tax on each case of beer purchased. In fact both the federal and state governments impose beer taxes of some sort a. A diagram showing the effect of a per unit tax on the standard supply and demand diagram. In this diagram the supply curve shifts to the left.

Source: slideplayer.com

Source: slideplayer.com

- a wedge driven between the demand curve. The economy as a whole d. If the government imposes a specific tax per unit of 3 plot the new supply curve on the original supply and demand diagram. Similarly the price the seller obtains falls but by less than the tax. It leads to a higher price and fall in quantity demand.

Source: pinterest.com

Source: pinterest.com

A tax increases the price a buyer pays by less than the tax. Indicate the consumer and producer surplus before the tax using colour may help - I would just outline the relevant areas rather than shading them. In fact both the federal and state governments impose beer taxes of some sort a. Pigouvian Tax is a tax on any business operation that produces negative externalities. As a result quantity decreases from Q1 to Q2 thus helping to reduce consumption as well as production of the goodservice.

Source: pinterest.com

Source: pinterest.com

In a supply-and-demand diagram show how a tax on car buyers of 1000 per car affects the quantity of cars sold and the price of cars. It is obvious that Q_D Q_S and we get. The interaction of producers and consumers for a particular good or service. The economy as a whole d. The specific tax increases production costs for the firm and therefore supply decreases from S1 to S1tax.

Source: tr.pinterest.com

Source: tr.pinterest.com

Draw a supply-and-demand diagram of the market for beer without the tax. Draw a supply-and-demand diagram of the market for beer without the tax. If the government imposes a specific tax per unit of 3 plot the new supply curve on the original supply and demand diagram. In this diagram supply and demand have shifted to the right. The demand curve DD shows the price that the buyers would pay at each quantity purchased and the curve D t D t shows the price net of tax that the sellers would receive at each quantity sold.

Source: study.com

Source: study.com

The Calculator helps calculating the market equilibrium given Supply and Demand curves. The diagrams should look like panels a and b of Figure 6-1 in the text. In fact both the federal and state governments impose beer taxes of some sort a. Show the price paid by consumers the price received by producers and the quantity. The imposition of the tax has caused the supply curve to shift to the left from SS to ST.

Source: economicshelp.org

Source: economicshelp.org

Now if an ad valorem tax is imposed on the good and the buyers are to pay the tax then the price that the buyers would pay would include the tax and the sellers will receive the price net of tax. Show the price paid by consumers the price received by producers and the quantity. While supply for the product has not changed all of the determinants of supply are the same producers incur higher cost which is why we will see a new equilibrium point further up the demand curve at a higher. 1 Take a highlighter or colored pencil and make a border around the rectangular region encompassing Cost to Consumers and Cost to Producers. Draw a supply-and-demand diagram of the market for beer without the tax.

Source: pinterest.com

Source: pinterest.com

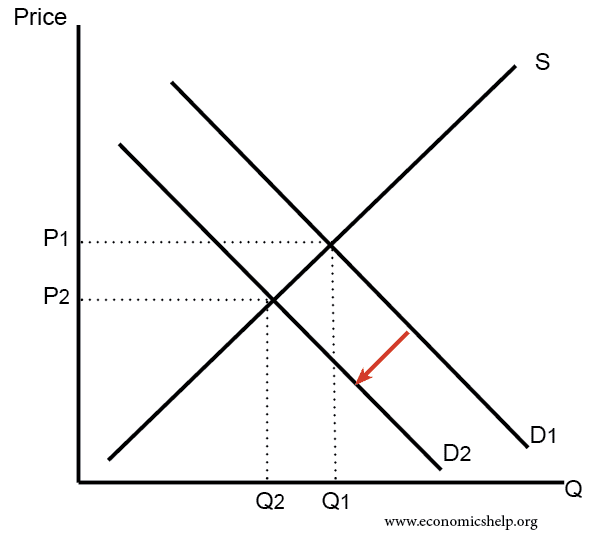

The supply curve may shift to the left because of. Supply Demand and Government Policies Review Questions Using supply-demand diagrams show the difference between a non-binding price ceiling and a binding price ceiling in the wheat market. It is obvious that Q_D Q_S and we get. Show the price paid by consumers the price received by producers and the quantity. This causes price to increase from P1 to P1.

Source: pinterest.com

Source: pinterest.com

Taxes on supply and demand The VAT on the suppliers will shift the supply curve to the left symbolizing a reduction in supply similar to firms facing higher input costs. The supply curve may shift to the left because of. If the government imposes a specific tax per unit of 3 plot the new supply curve on the original supply and demand diagram. The behavior of individual firms. - a line connecting the lowest point on the demand curve with the highest point on the supply curve.

Source: pinterest.com

Source: pinterest.com

Indicate the consumer and producer surplus before the tax using colour may help - I would just outline the relevant areas rather than shading them. A diagram showing the effect of a per unit tax on the standard supply and demand diagram. In microeconomics supply and demand is an economic model of price determination in a market. It postulates that in a competitive market the unit price for a particular good or other traded item such as labor or liquid. The interaction of producers and consumers for a particular good or service.

Source: pinterest.com

Source: pinterest.com

The tax aims to correct an undesirable or unsustainable market result by setting the external marginal cost of negative externalities at the same amount. First let us calculate the equilibrium price and equilibrium quantity that were before the imposed tax. In fact both the federal and state governments impose beer taxes of some sort a. Taxes have the ability to impact a consumers ability to afford a good but the type of tax impacts the change in demand. Taxes on supply and demand The VAT on the suppliers will shift the supply curve to the left symbolizing a reduction in supply similar to firms facing higher input costs.

The behavior of individual firms. The economy as a whole d. Higher costs of production. Who benefits from a binding price ceiling. In fact both the federal and state governments impose beer taxes of some sort a.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title supply and demand diagram with tax by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.