Your Supply and demand curve for bonds images are ready in this website. Supply and demand curve for bonds are a topic that is being searched for and liked by netizens now. You can Download the Supply and demand curve for bonds files here. Find and Download all free photos.

If you’re looking for supply and demand curve for bonds images information linked to the supply and demand curve for bonds keyword, you have come to the right site. Our site always gives you suggestions for downloading the maximum quality video and picture content, please kindly hunt and find more informative video content and images that match your interests.

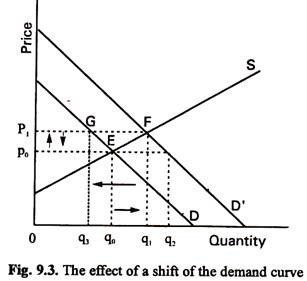

Supply And Demand Curve For Bonds. Shifting supply and demand curves around can be fun but figuring out why the curves shift is the interesting part. Both the supply and demand curves Bdand Bs shifttotherightbutasisindicatedinthetextthede-mand curve probably shifts less than the. Show and explain what the effect of contractionary monetary policy using open market operations will have on this equilibrium. The demand curve for bonds shifts due to changes in wealth expected relative returns risk and liquidity.

Mbs Morning Two Ways To View The Current Trend Corporate Bonds Mbs Corporate From pinterest.com

Mbs Morning Two Ways To View The Current Trend Corporate Bonds Mbs Corporate From pinterest.com

For example if companies start issuing more bonds and borrowing less from banks theres no. Now suppose the bond purchases by the Fed. Answer 1 of 4. Higher inflation expectations decrease demand for bonds and increase their supply. The demand for bonds will also be low when bonds tend to be riskier than other investments and when bonds are difficult to sell. Show and explain what the effect of contractionary monetary policy using open market operations will have on this equilibrium.

If the Fed increases the supply of bonds in the market by 100 at any given price the bond supply equation will become Price Quantity 600 increase to 1027 For every 1000 of annual income households maintain average cash balances their demand for money of 200.

Wealth sets the general level of demand. Use a demand and supply graph for bonds to illustrate the following situation. Draw a supply and demand curve for US government bonds. If at the current level of interest rates there is an excess. The bond demand curve and loanable funds supply curve will shift to the right. When the economy booms the demand for bonds increases.

Source: pinterest.com

Source: pinterest.com

Total supply of bonds is equal to P 23B remember you add up supply and demand curves horizontally not vertically. As we learned when the Fed buys bonds the supply of money increases. Supply decreases bond prices rise and interest rates decrease. When the price of a bond is high its interest rate is low. Both factors result in.

Source: pinterest.com

Source: pinterest.com

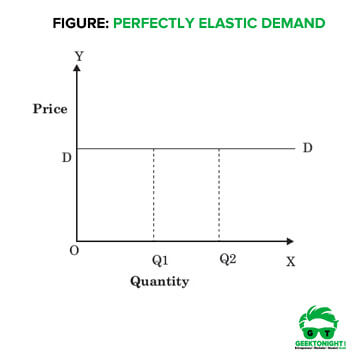

The bond supply and demand framework. Interest rates usually fall early in a recession then later rise as the economy recovers. Setting this supply curve equal to the demand curve gives a total amount of bonds sold as 900 and the equilibrium price of bonds as 600. Determining the shape and slope of the curves is interesting too but these details will not detain us here Movements along the curve or why the supply curve slopes upward and the demand curve downward were easy enough to grasp. When prices are low interest rates are high which means that less is borrowed and therefore fewer bonds are supplied.

Source: pinterest.com

Source: pinterest.com

Determining the shape and slope of the curves is interesting too but these details will not detain us here Movements along the curve or why the supply curve slopes upward and the demand curve downward were easy enough to grasp. Wealth sets the general level of demand. Draw a supply and demand curve for US government bonds. It also increases the supply of bonds. As we learned when the Fed buys bonds the supply of money increases.

Source: pinterest.com

Source: pinterest.com

We Fools may not all. Both the supply and demand curves Bdand Bs shifttotherightbutasisindicatedinthetextthede-mand curve probably shifts less than the. The demand curve for bonds shifts due to changes in wealth expected relative returns risk and liquidity. By the interaction of supply and demand. When one of these factors changes causing a shift in the demand or supply curve there will be a new equilibrium value for the.

Source: pinterest.com

Source: pinterest.com

Setting this supply curve equal to the demand curve gives a total amount of bonds sold as 900 and the equilibrium price of bonds as 600. Risk is inversely related to demand. The bond supply and demand framework. When the economy booms the demand for bonds increases. Interest rates usually fall early in a recession then later rise as the economy recovers.

Source: pinterest.com

Source: pinterest.com

The Feds purchase of bonds shifts the demand curve for bonds to the right raising bond prices to P b 2. Demand for bonds will increase when wealth in the economy increases causing people to invest more money in bonds regardless of the price. Answer 1 of 4. The bond supply and demand framework. The Feds purchase of bonds shifts the demand curve for bonds to the right raising bond prices to P b 2.

Source: pinterest.com

Source: pinterest.com

The Feds purchase of bonds shifts the demand curve for bonds to the right raising bond prices to P b 2. Use a demand and supply graph for bonds to illustrate the following situation. The publics income and wealth rises while the supply of bonds also increases because firmshavemoreat- tractive investment opportunities. The result is that bond prices are higher and the nominal interest rate is lower in the new equilibrium. Demand for bonds will increase when wealth in the economy increases causing people to invest more money in bonds regardless of the price.

Source: pinterest.com

Source: pinterest.com

Panel b of Figure 2512 An Increase in the Money Supply shows an economy with a money supply of M which is in equilibrium at an interest rate of r 1. It also increases the supply of bonds. Do interest rates go up in a recession. Use a demand and supply graph for bonds to illustrate the following situation. The demand curve for bonds shifts due to changes in wealth expected relative returns risk and liquidity.

Source: pinterest.com

Source: pinterest.com

When the price of a bond is high its interest rate is low. As we learned when the Fed buys bonds the supply of money increases. We Fools may not all. The United States credit rating is AA. Wealth returns and liquidity are positively related to demand.

Source: pinterest.com

Source: pinterest.com

As we learned when the Fed buys bonds the supply of money increases. If at the current level of interest rates there is an excess. The demand for bonds will also be low when bonds tend to be riskier than other investments and when bonds are difficult to sell. When prices are high interest rates are low which means that more is borrowed. Interest rates usually fall early in a recession then later rise as the economy recovers.

Source: pinterest.com

Source: pinterest.com

Use a demand and supply graph for bonds to illustrate the following situation. In general lower expected inflation shifts the demand for fixed-income bonds out and the supply of bonds in. Now suppose the bond purchases by the Fed. Of these 900 600 are government bonds and 300 are corporate bonds. Draw a supply and demand curve for US government bonds.

Source: sk.pinterest.com

Source: sk.pinterest.com

Both factors result in. The demand curve for bonds shifts due to changes in wealth expected relative returns risk and liquidity. Higher inflation expectations decrease demand for bonds and increase their supply. Using the line drawing tool draw the either a new bond supply curve or a new bond demand curve or both. The Feds purchase of bonds shifts the demand curve for bonds to the right raising bond prices to P b 2.

Source: pinterest.com

Source: pinterest.com

Interest rates usually fall early in a recession then later rise as the economy recovers. Investors then trade off. Using the line drawing tool draw the either a new bond supply curve or a new bond demand curve or both. Do interest rates go up in a recession. Both the supply and demand curves Bdand Bs shifttotherightbutasisindicatedinthetextthede-mand curve probably shifts less than the.

Source: pinterest.com

Source: pinterest.com

Shifting supply and demand curves around can be fun but figuring out why the curves shift is the interesting part. If at the current level of interest rates there is an excess. The bond demand curve and loanable funds supply curve will shift to the right. Show and explain what the effect expansionary monetary policy using open market operations will have on this equilibrium. Panel b of Figure 2510 An Increase in the Money Supply shows an economy with a money supply of M which is in equilibrium at an interest rate of r 1.

Source: id.pinterest.com

Source: id.pinterest.com

Now suppose the bond purchases by the Fed. When one of these factors changes causing a shift in the demand or supply curve there will be a new equilibrium value for the. The demand for bonds will also be low when bonds tend to be riskier than other investments and when bonds are difficult to sell. Show and explain what the effect of contractionary monetary policy using open market operations will have on this equilibrium. Of these 900 600 are government bonds and 300 are corporate bonds.

Source: in.pinterest.com

Source: in.pinterest.com

Use a demand and supply graph for bonds to illustrate the following situation. In general lower expected inflation shifts the demand for fixed-income bonds out and the supply of bonds in. Solution for Draw the demandand supply curves forthe bond market andidentify the equilibrium interest rate. Answer 1 of 4. Also higher interest rates will lead to a higher exchange rate and depress net exports.

Source: pinterest.com

Source: pinterest.com

Interest rates usually fall early in a recession then later rise as the economy recovers. Also higher interest rates will lead to a higher exchange rate and depress net exports. By the interaction of supply and demand. Shifting supply and demand curves around can be fun but figuring out why the curves shift is the interesting part. When the economy booms the demand for bonds increases.

Source: pinterest.com

Source: pinterest.com

The demand for bonds will also be low when bonds tend to be riskier than other investments and when bonds are difficult to sell. When one of these factors changes causing a shift in the demand or supply curve there will be a new equilibrium value for the. Both factors result in. When prices are low interest rates are high which means that less is borrowed and therefore fewer bonds are supplied. The United States credit rating is AA.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title supply and demand curve for bonds by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.