Your Supply and demand analysis for bonds images are ready in this website. Supply and demand analysis for bonds are a topic that is being searched for and liked by netizens today. You can Get the Supply and demand analysis for bonds files here. Download all free images.

If you’re searching for supply and demand analysis for bonds pictures information linked to the supply and demand analysis for bonds keyword, you have pay a visit to the ideal blog. Our website frequently provides you with hints for downloading the maximum quality video and image content, please kindly surf and locate more enlightening video articles and images that fit your interests.

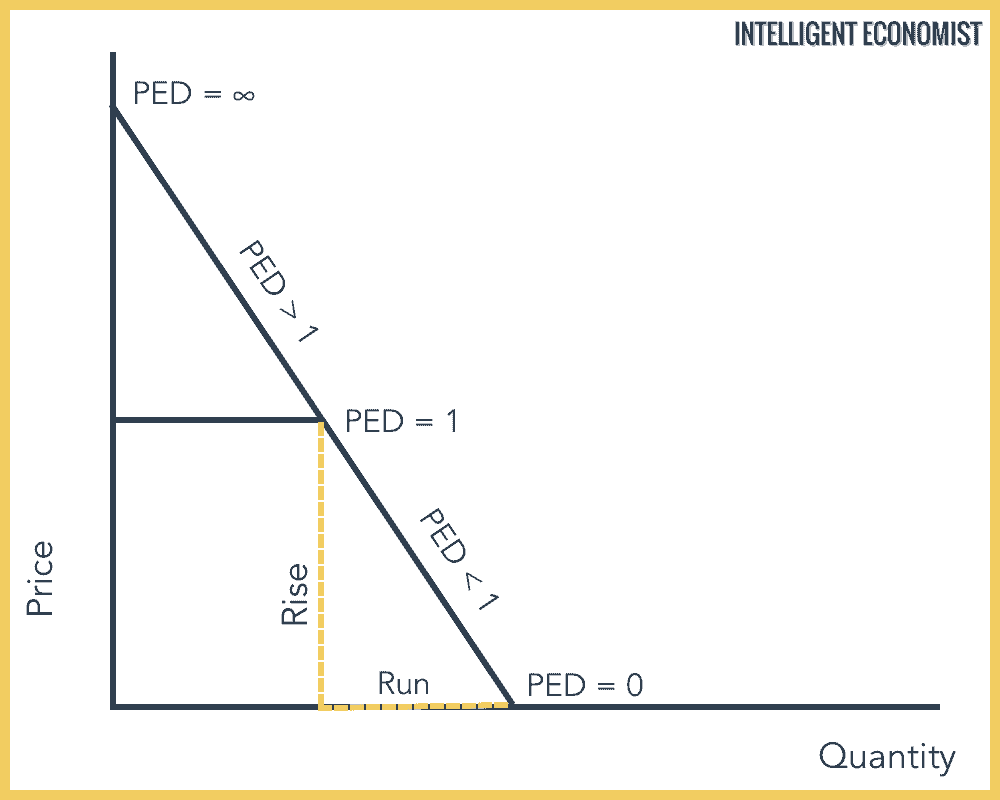

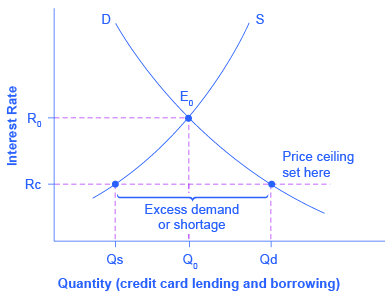

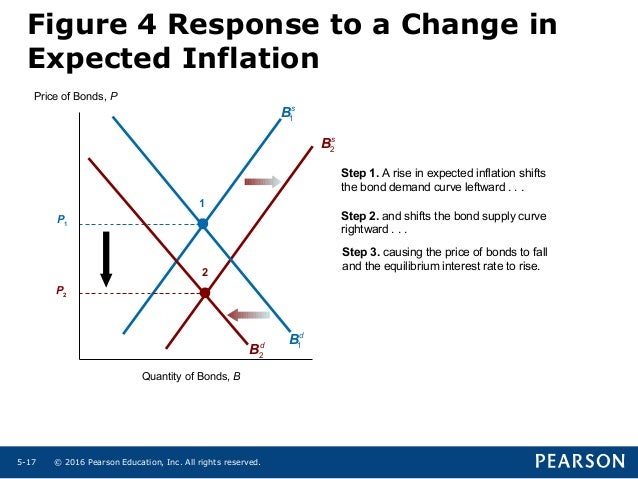

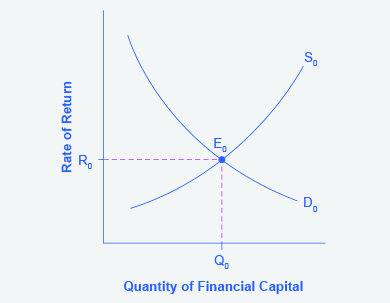

Supply And Demand Analysis For Bonds. The demand curve Bd shifts to the left and the equilibrium interest rate rises. Its an upward-sloping line because issuers will supply more bonds when they fetch a higher price. In the bond supply and demand analysis the increased riskiness of bonds lowers the demand for bonds. 1 For each of the following cases use the supply and demand analysis for bonds to the show the effect on interest rates.

Pin On Economy From pinterest.com

Pin On Economy From pinterest.com

During the Great Depression many businesses failed. Using the supply-and-demand for bonds framework show why interest rates are pro-cyclical rising when the economy is expanding and falling during recessions. Once again too many Treasuries. Its an upward-sloping line because issuers will supply more bonds when they fetch a higher price. 2 Reading 13 Demand and Supply Analysis. We identified it from trustworthy source.

Using a supply-and-demand analysis for bonds show what effect this action has on interest rates.

Is your answer consistent with what you would. The motives driving the demand for money are now represented by the supply of bonds. Must draw diagrams and give explanation to support your answers a. Once again too many Treasuries. Its submitted by executive in the best. The publics income and wealth rises while the supply of bonds also increases because rms have more at-tractive investment opportunities.

Source: opentextbc.ca

Source: opentextbc.ca

Price 08 Quantity 1160. The publics income and wealth rises while the supply of bonds also increases because firms have more attractive investment. Demand for bonds will increase when wealth in the economy increases causing people to invest more money in bonds regardless of the price. During the Great Depression many businesses failed. As we learned when the Fed buys bonds the supply of money increases.

Source: pinterest.com

Source: pinterest.com

The large federal deficits require the Treasury to issue more bonds. Its an upward-sloping line because issuers will supply more bonds when they fetch a higher price. The demand curve and supply curve for one-year discount bonds with a face value of 1 050 are represented by the following equations. Using a supply-and-demand analysis for bonds show what effect this action has on interest rates. The Feds purchase of bonds shifts the demand curve for bonds to the right raising bond prices to P b 2.

Source: ro.pinterest.com

Source: ro.pinterest.com

Once again too many Treasuries. Decision of the Federal Reserve on interest. The publics income and wealth rises while the supply of bonds also increases because firms have more attractive investment. Introduction INTRODUCTION In a general sense economics is the study of production distribution and con- sumption and can be divided into. In the bond supply and demand analysis the increased riskiness of bonds lowers the demand for bonds.

Source: pinterest.com

Source: pinterest.com

We identified it from trustworthy source. Using a supply and demand analysis for bonds show what effect this action has on interest rates. Thus the supply of bonds increases. Hence real estate property investment is defined as the key. Explain this difference using the bond supply and demand analysis.

Price 08 Quantity 1160. Explain this difference using the bond supply and demand analysis. The demand curve and supply curve for one-year discount bonds with a face value of 1 050 are represented by the following equations. As it does so the same questions of supply versus demand have predictably resurfaced. Decision of the Federal Reserve on interest.

Source: courses.lumenlearning.com

Source: courses.lumenlearning.com

Introduction INTRODUCTION In a general sense economics is the study of production distribution and con- sumption and can be divided into. During the Great Depression many businesses failed. The Feds purchase of bonds shifts the demand curve for bonds to the right raising bond prices to P b 2. Using a supply-and-demand analysis for bonds show what effect this action has on interest rates. Just like any other market which actually happened in the capital market is a bidding process between buyers and sellers while the goods securities are traded in the form of stocks bonds.

Source: pinterest.com

Source: pinterest.com

As we learned when the Fed buys bonds the supply of money increases. As we learned when the Fed buys bonds the supply of money increases. The demand curve Bd shifts to the left and the equilibrium interest rate rises. The Feds purchase of bonds shifts the demand curve for bonds to the right raising bond prices to P b 2. Using the supply-and-demand for bonds framework show why interest rates are pro-cyclical rising when the economy is expanding and falling during recessions.

Source: pinterest.com

Source: pinterest.com

2 Reading 13 Demand and Supply Analysis. We identified it from trustworthy source. Tells us how the quantity of a good supplied by the sum of all producers in the market depends on various factors. Must draw diagrams and give explanation to support your answers a. Demand for bonds will increase when wealth in the economy increases causing people to invest more money in bonds regardless of the price.

Source: slideshare.net

Source: slideshare.net

Just like any other market which actually happened in the capital market is a bidding process between buyers and sellers while the goods securities are traded in the form of stocks bonds. Is your answer consistent with what you would. When the economy booms the demand for bonds increases. Once again too many Treasuries. 1 For each of the following cases use the supply and demand analysis for bonds to the show the effect on interest rates.

Source: foxbusiness.com

Source: foxbusiness.com

Is your answer consistent with what you would. Tells us how the quantity of a good supplied by the sum of all producers in the market depends on various factors. Just like any other market which actually happened in the capital market is a bidding process between buyers and sellers while the goods securities are traded in the form of stocks bonds. The publics income and wealth rises while the supply of bonds also increases because firms have more attractive investment. Supply is by selling bonds to the public.

Supply is by selling bonds to the public. During the Great Depression many businesses failed. The demand for bonds increases. The demand curve and supply curve for one-year discount bonds with a face value of 1 050 are represented by the following equations. Just like any other market which actually happened in the capital market is a bidding process between buyers and sellers while the goods securities are traded in the form of stocks bonds.

Source: pinterest.com

Source: pinterest.com

In the bond supply and demand analysis the increased riskiness of bonds lowers the demand for bonds. When the Fed sells bonds to the public it increases the supply of bonds thus shifting. The publics income and wealth rises while the supply of bonds also increases because firms have more attractive investment. 1 For each of the following cases use the supply and demand analysis for bonds to the show the effect on interest rates. Its an upward-sloping line because issuers will supply more bonds when they fetch a higher price.

Source: pinterest.com

Source: pinterest.com

The demand curve and supply curve for one-year discount bonds with a face value of 1 050 are represented by the following equations. During the Great Depression many businesses failed. Using a supply and demand analysis for bonds show what effect this action has on interest rates. Explain this difference using the bond supply and demand analysis. Hence real estate property investment is defined as the key.

Source: opentextbc.ca

Source: opentextbc.ca

The publics income and wealth rises while the supply of bonds also increases because firms have more attractive investment. In the bond supply and demand analysis the increased riskiness of bonds lowers the demand for bonds. The Feds purchase of bonds shifts the demand curve for bonds to the right raising bond prices to P b 2. The motives driving the demand for money are now represented by the supply of bonds. Once again too many Treasuries.

Source: pinterest.com

Source: pinterest.com

Price 08 Quantity 1160. Using a supply-and-demand analysis for bonds show what effect this action has on interest rates. The motives driving the demand for money are now represented by the supply of bonds. Is your answer consistent with what you would. Its an upward-sloping line because issuers will supply more bonds when they fetch a higher price.

Source: pinterest.com

Source: pinterest.com

The large federal deficits require the Treasury to issue more bonds. We identified it from trustworthy source. 2 Reading 13 Demand and Supply Analysis. Using a supply and demand analysis for bonds show what effect this action has on interest rates. As we learned when the Fed buys bonds the supply of money increases.

Source: pinterest.com

Source: pinterest.com

QsQp p o w r P o price of other goods w. Using a supply-and-demand analysis for bonds show what effect this action has on interest rates. The publics income and wealth rises while the supply of bonds also increases because rms have more at-tractive investment opportunities. Using the supply-and-demand for bonds framework show why interest rates are pro-cyclical rising when the economy is expanding and falling during recessions. Once again too many Treasuries.

Source: pinterest.com

Source: pinterest.com

Using the supply-and-demand for bonds framework show why interest rates are pro-cyclical rising when the economy is expanding and falling during recessions. Here are a number of highest rated Supply And Demand Graph Template pictures upon internet. Is your answer consistent with what you would. Just like any other market which actually happened in the capital market is a bidding process between buyers and sellers while the goods securities are traded in the form of stocks bonds. The Feds purchase of bonds shifts the demand curve for bonds to the right raising bond prices to P b 2.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title supply and demand analysis for bonds by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.