Your Shifters of loanable funds market images are available in this site. Shifters of loanable funds market are a topic that is being searched for and liked by netizens now. You can Find and Download the Shifters of loanable funds market files here. Get all free images.

If you’re looking for shifters of loanable funds market pictures information linked to the shifters of loanable funds market topic, you have come to the right blog. Our website always gives you suggestions for refferencing the maximum quality video and image content, please kindly search and locate more informative video articles and images that fit your interests.

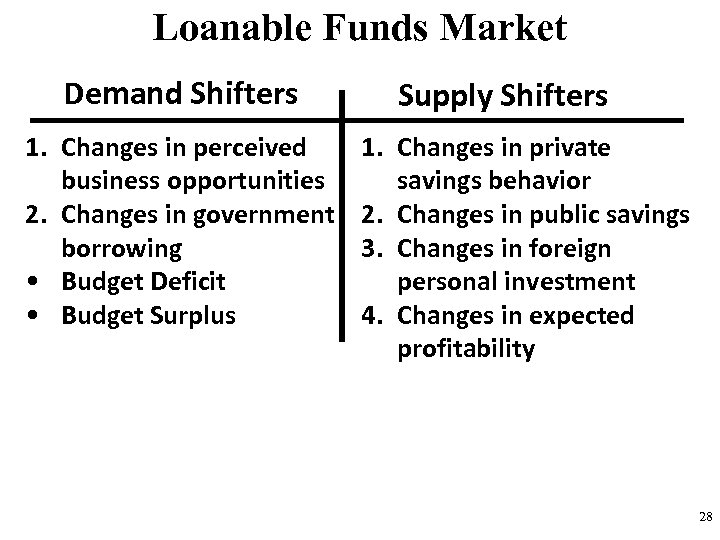

Shifters Of Loanable Funds Market. Ad Bekijk ons uitgebreide aanbod Shifters. A change that begins in the loanable funds market can. A few factors can change the supply of funds in the loanable funds market. Ad Discover online stock brokers and find the trading platform or app that best fits you.

Unit 4 Money And Monetary Policy Ppt Download From slideplayer.com

Unit 4 Money And Monetary Policy Ppt Download From slideplayer.com

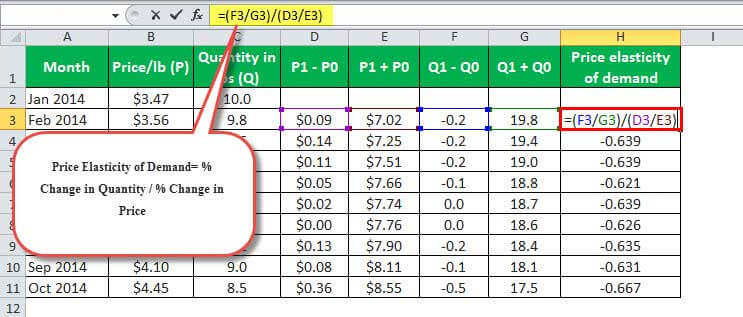

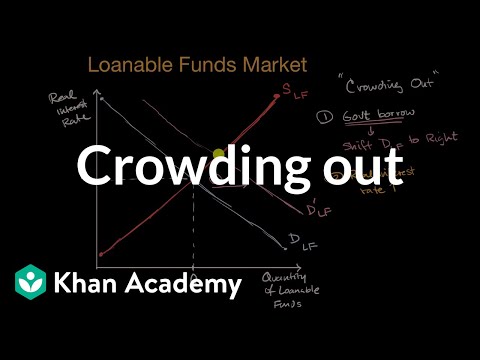

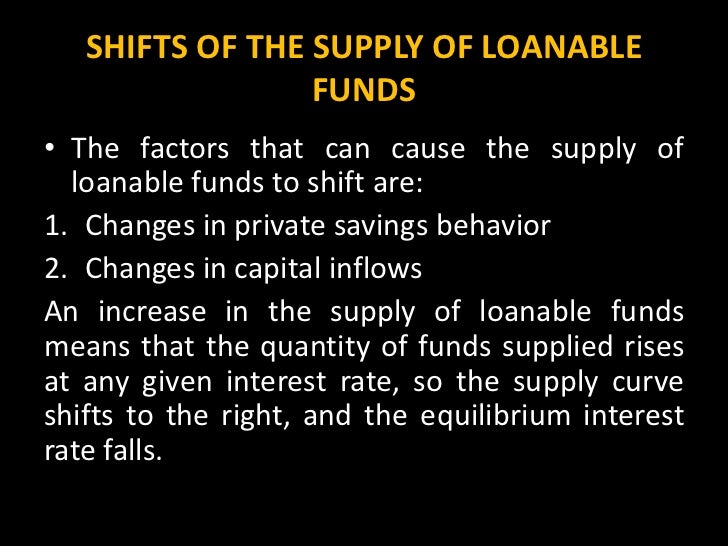

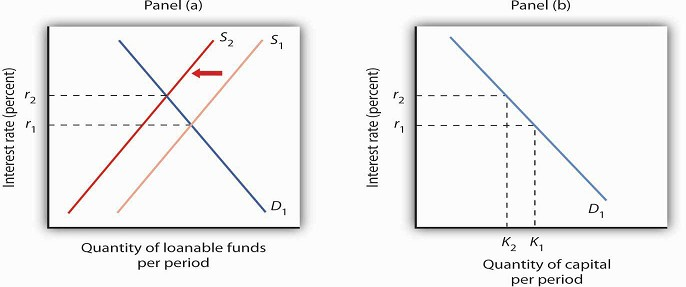

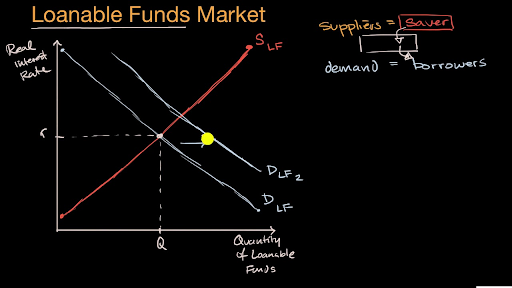

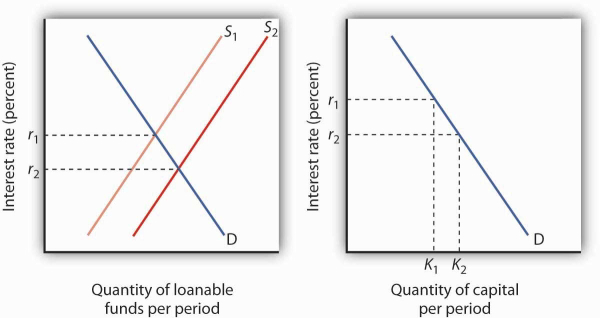

Rightward shift in SLF curve Real interest rates decrease Quantity of investment increases. The demand of loanable funds comes from investment. A Change in the Loanable Funds Market and the Quantity of Capital Demanded. Factors that shift the supply of loanable funds Recall that the supply of loanable funds comes from savings. The loanable funds market with two alternative shifts in the supply of loanable funds. Decrease in supply Leftward shift of SLF Curve Real interest rates Changes in Demand for.

S 2 indicates a decrease shift to the left of the supply curve.

Ad Discover online stock brokers and find the trading platform or app that best fits you. The loanable funds market with two alternative shifts in the supply of loanable funds. Shifters Policies that influence the loanable. In the standard loanable funds market graph a decrease in business optimism about future economic performance would. Ad Bekijk ons uitgebreide aanbod Shifters. Ad Discover online stock brokers and find the trading platform or app that best fits you.

Source: khanacademy.org

Source: khanacademy.org

The loanable funds market illustrates the interaction of borrowers and savers in the economy. It is a variation of a market model but what is being bought and sold is money that has been. The easy and safe way to start investing in stock market from your home. The loanable funds market describes the behavior of savers and borrowers. The loanable funds market with two alternative shifts in the supply of loanable funds.

Source: slideplayer.com

Source: slideplayer.com

All Borrowing Loans Credit direct Applying for funds 3. A few factors can change the supply of funds in the loanable funds market. The market for loanable funds is a way of representing all of the potential savers and all of the potential. S 2 indicates a decrease shift to the left of the supply curve. A change that begins in the loanable funds market can.

Source: courses.lumenlearning.com

Source: courses.lumenlearning.com

The loanable funds market illustrates the interaction of borrowers and savers in the economy. Once again I have updated this post with a few minor changes. Equilibrium is at the real interest rate where dollars saved equals dollars invested. Ad Discover online stock brokers and find the trading platform or app that best fits you. The demand curve for loanable funds has a negative slope.

Source: slidetodoc.com

Source: slidetodoc.com

Snel thuisbezorgd en gratis retour. Ad Bekijk ons uitgebreide aanbod Shifters. A Change in the Loanable Funds Market and the Quantity of Capital Demanded. Equilibrium is at the real interest rate where dollars saved equals dollars invested. Shifters Policies that influence the loanable.

Source: slideshare.net

Source: slideshare.net

Meanwhile two factors that cause the demand for loanable funds to shift are. Changes in government spending. A change that begins in the loanable funds market can. A change that begins in the loanable funds market can affect the quantity of capital firms demand. In the standard loanable funds market graph a decrease in business optimism about future economic performance would.

Source: slideplayer.com

Source: slideplayer.com

The interest rate is determined in the market for loanable funds. The loanable funds market with two alternative shifts in the supply of loanable funds. S 2 indicates a decrease shift to the left of the supply curve. The loanable funds market describes the behavior of savers and borrowers. Equilibrium is at the real interest rate where dollars saved equals dollars invested.

Source: pinterest.com

Source: pinterest.com

Change in opportunities perceived by businesses. All Borrowing Loans Credit direct Applying for funds 3. S 1 indicates an increase shift to the. Rightward shift in SLF curve Real interest rates decrease Quantity of investment increases. In the standard loanable funds market graph a decrease in business optimism about future economic performance would.

Source: present5.com

Source: present5.com

A change that begins in the loanable funds market can affect the quantity of capital firms demand. The demand curve for loanable funds has a negative slope. Equilibrium is at the real interest rate where dollars saved equals dollars invested. The demand of loanable funds comes from investment. A Change in the Loanable Funds Market and the Quantity of Capital Demanded.

Source: opentextbooks.org.hk

Source: opentextbooks.org.hk

Snel thuisbezorgd en gratis retour. Change in opportunities perceived by businesses. A few factors can change the supply of funds in the loanable funds market. The market for loanable funds is a way of representing all of the potential savers and all of the potential. Equilibrium is at the real interest rate where dollars saved equals dollars invested.

A shift the demand for loanable funds to the right. A change that begins in the loanable funds market can. S 1 indicates an increase shift to the. Equilibrium is at the real interest rate where dollars saved equals dollars invested. Government Budget Deficits direct Borrowing in order to spend 2.

Source: courses.lumenlearning.com

Source: courses.lumenlearning.com

Demand for Loanable Funds. Snel thuisbezorgd en gratis retour. The demand of loanable funds comes from investment. Decrease in supply Leftward shift of SLF Curve Real interest rates Changes in Demand for. The market for loanable funds is a way of representing all of the potential savers and all of the potential.

Source: slidetodoc.com

Source: slidetodoc.com

The easy and safe way to start investing in stock market from your home. Meanwhile two factors that cause the demand for loanable funds to shift are. A change that begins in the loanable funds market can. S 2 indicates a decrease shift to the left of the supply curve. Snel thuisbezorgd en gratis verzending vanaf 20.

Source: pinterest.com

Source: pinterest.com

Snel thuisbezorgd en gratis verzending vanaf 20. Shifters Policies that influence the loanable. Government Budget Deficits direct Borrowing in order to spend 2. Meanwhile two factors that cause the demand for loanable funds to shift are. Change in opportunities perceived by businesses.

Source: opentextbooks.org.hk

Source: opentextbooks.org.hk

A shift the demand for loanable funds to the right. S 2 indicates a decrease shift to the left of the supply curve. In the standard loanable funds market graph a decrease in business optimism about future economic performance would. The demand curve for loanable funds has a negative slope. The interest rate is determined in the market for loanable funds.

Source: slideplayer.com

Source: slideplayer.com

S 2 indicates a decrease shift to the left of the supply curve. It is a variation of a market model but what is being bought and sold is money that has been. Decrease in supply Leftward shift of SLF Curve Real interest rates Changes in Demand for. A change that begins in the loanable funds market can affect the quantity of capital firms demand. In the standard loanable funds market graph a decrease in business optimism about future economic performance would.

Source: slideplayer.com

Source: slideplayer.com

Ad Bekijk ons uitgebreide aanbod Shifters. S 2 indicates a decrease shift to the left of the supply curve. Once again I have updated this post with a few minor changes. Demand for Loanable Funds. When the demand for loanable funds increases then the real interest rate will increaseWhen the demand for loanable funds decreases then the real interest rate will.

Source: courses.lumenlearning.com

Source: courses.lumenlearning.com

Once again I have updated this post with a few minor changes. Snel thuisbezorgd en gratis retour. The loanable funds market with two alternative shifts in the supply of loanable funds. All Borrowing Loans Credit direct Applying for funds 3. Demand for Loanable Funds.

Source: slideplayer.com

Source: slideplayer.com

The easy and safe way to start investing in stock market from your home. S 2 indicates a decrease shift to the left of the supply curve. In the standard loanable funds market graph a decrease in business optimism about future economic performance would. A shift the demand for loanable funds to the right. Change in opportunities perceived by businesses.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title shifters of loanable funds market by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.