Your Negative demand correlation images are ready in this website. Negative demand correlation are a topic that is being searched for and liked by netizens now. You can Download the Negative demand correlation files here. Find and Download all free photos.

If you’re searching for negative demand correlation images information connected with to the negative demand correlation interest, you have visit the ideal site. Our website always provides you with suggestions for seeing the maximum quality video and image content, please kindly hunt and find more informative video articles and images that match your interests.

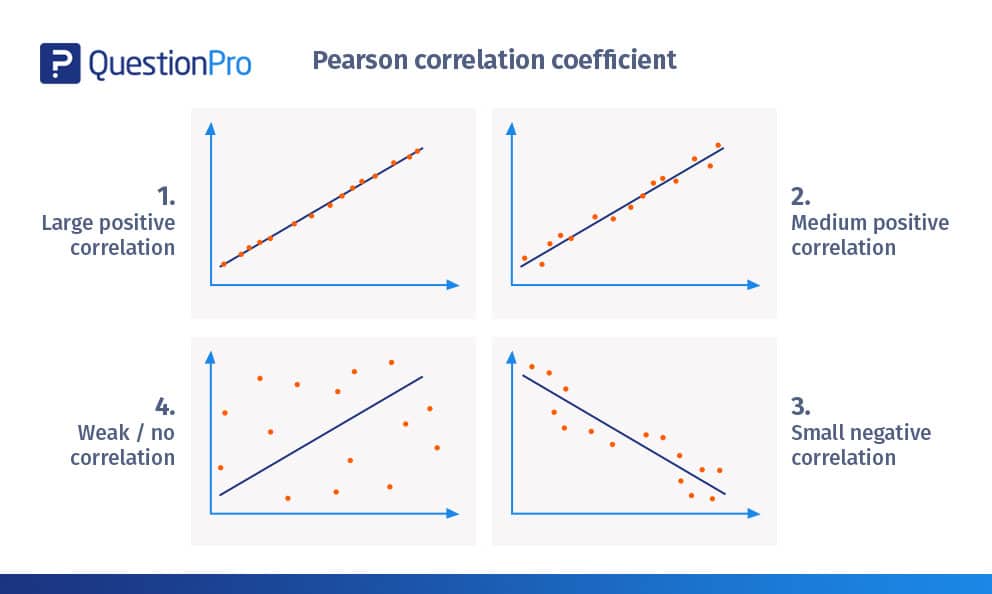

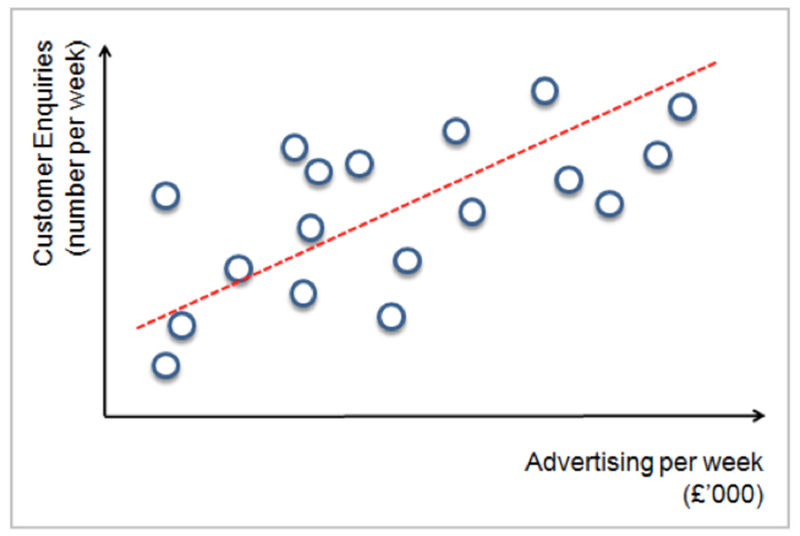

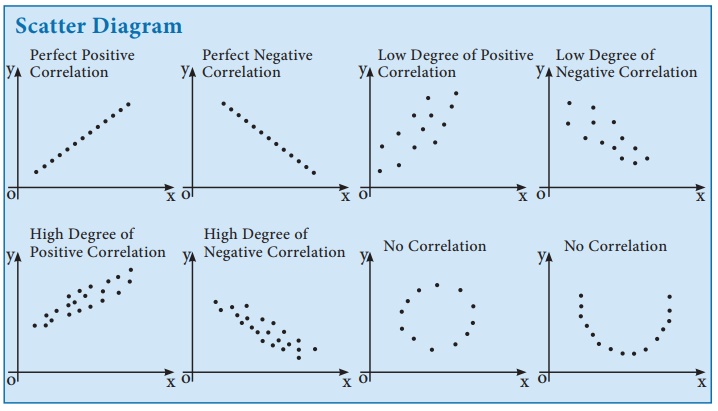

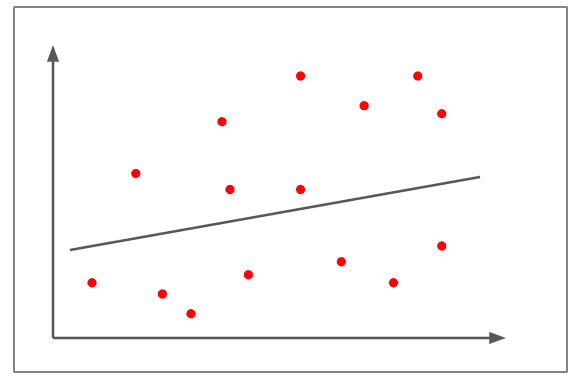

Negative Demand Correlation. Supply and demand Economists observe a negative correlation between the price of a product and the demand for it. The elasticity is determined by the fact that the products are essential or not essential to consumers. That correlation of demand between customer demands are inversely proportional to the distance between customer locations ie. High numerical figures on one set relates to high numerical figures of the other set.

Students of class 11 Economics should refer to MCQ Questions Class 11 Economics Correlation with answers provided here which is an important chapter in Class 11 Economics NCERT textbook. In some cases the correlation may be positive or it may be negative. The higher the number of absences the lower a students grades will be. This relationship between the movements can be helpful for matters relating to economic policies. Here if one variable increases the other decreases and vice versa. The middle range indicates two stocks have a moderate negative correlation.

It will take a value ranging from -1 to 1.

The correlation between median wages and demand shocks is 026 p-value 28 10 13 and between median wages and supply shocks is 041 p-value 15 10 30. This relationship between the movements can be helpful for matters relating to economic policies. This is the correct sequence to calculate Karl Pearsons correlation coefficient. Consider the following variable examples that would produce negative correlations. Although negative correlation is a common part of psychological and statistical analysis you can also. In some cases the correlation may be positive or it may be negative.

Source: questionpro.com

Source: questionpro.com

Many trends associated with economics involve negative correlation. A price and demand of a commodity. Although negative correlation is a common part of psychological and statistical analysis you can also. Two people or situations known as variables with a negative correlation have an inverse relationship which means one increases as the other decreases. It is common to regard these rank correlation coefficients as alternatives to Pearsons coefficient used either to reduce the amount of calculation or to make the coefficient less sensitive to non-normality in distributions.

Source: sciencedirect.com

Source: sciencedirect.com

Non-elastic markets are food or healthcare markets as people will still buy these products irrespective of the price. The correlation decreases as the distance between customer locations increases. A negative correlation is a relationship between two variables such that as the value of one variable increases the other decreases. A price and demand of a commodity. It will take a value ranging from -1 to 1.

Source: sciencedirect.com

Source: sciencedirect.com

Correlation in the opposite direction is called a negative correlation. In this type of demand a marketer thinks that there is a demand for the product in the market but in reality there is no demand for the product. Students of class 11 Economics should refer to MCQ Questions Class 11 Economics Correlation with answers provided here which is an important chapter in Class 11 Economics NCERT textbook. Several health-related occupations such as Nurses Medical Equipment Preparers and Healthcare Social Workers are employed in industries experiencing increased demand. For instance as the price of increases the quantity demanded declines as the good becomes more expensive relative to when the price had not increased.

Source: byjus.com

Source: byjus.com

Correlation in the opposite direction is called a negative correlation. Two people or situations known as variables with a negative correlation have an inverse relationship which means one increases as the other decreases. The middle range indicates two stocks have a moderate negative correlation. Non-elastic markets are food or healthcare markets as people will still buy these products irrespective of the price. Think of school absences for example.

Source: tutor2u.net

Source: tutor2u.net

Negative correlation A variable decreases as the other variable increases. The elasticity is determined by the fact that the products are essential or not essential to consumers. This relationship between the movements can be helpful for matters relating to economic policies. In the vast majority of cases correlation falls somewhere between -10 and 10. Examples of negative correlation are.

Source: studyfinance.com

Source: studyfinance.com

In many cases companies lose their market value by not analyzing this demand. These MCQ for Class 11 Economics with Answers have been prepared based on the latest CBSE and NCERT syllabus and examination guidelines for Class. Non-elastic markets are food or healthcare markets as people will still buy these products irrespective of the price. Positive values of correlation coefficient indicate positive relationship between the two variables while negative values are indicative of a negative relationship. In many cases companies lose their market value by not analyzing this demand.

Source: investopedia.com

Source: investopedia.com

Non-elastic markets are food or healthcare markets as people will still buy these products irrespective of the price. Students of class 11 Economics should refer to MCQ Questions Class 11 Economics Correlation with answers provided here which is an important chapter in Class 11 Economics NCERT textbook. High numerical figures on one set relates to high numerical figures of the other set. It is common to regard these rank correlation coefficients as alternatives to Pearsons coefficient used either to reduce the amount of calculation or to make the coefficient less sensitive to non-normality in distributions. That correlation of demand between customer demands are inversely proportional to the distance between customer locations ie.

Source: researchgate.net

Source: researchgate.net

The elasticity is determined by the fact that the products are essential or not essential to consumers. It will take a value ranging from -1 to 1. In other words while x gains value y decreases in value. In the vast majority of cases correlation falls somewhere between -10 and 10. Several health-related occupations such as Nurses Medical Equipment Preparers and Healthcare Social Workers are employed in industries experiencing increased demand.

Source: pmstudycircle.com

Source: pmstudycircle.com

In the vast majority of cases correlation falls somewhere between -10 and 10. High numerical figures on one set relates to high numerical figures of the other set. As for spending increases unemployment decreases generally. A negative correlation is written as -1. This means when one variable increases the other decreases and when one decreases the other increases.

Source: studyfinance.com

Source: studyfinance.com

Non-elastic markets are food or healthcare markets as people will still buy these products irrespective of the price. The middle range indicates two stocks have a moderate negative correlation. When all other things remain constant there is an inverse relationship or negative correlation between price and the demand for goods and services. If as the one variable increases the other decreases the rank correlation coefficients will be negative. Correlation is expressed on a range from 1 to -1 known as the correlation coefficent.

Source: investopedia.com

Source: investopedia.com

A perfect negative correlation has a coefficient of -1 indicating that an increase in one variable reliably. Non-elastic markets are food or healthcare markets as people will still buy these products irrespective of the price. The higher the number of absences the lower a students grades will be. Supply and demand Economists observe a negative correlation between the price of a product and the demand for it. When all other things remain constant there is an inverse relationship or negative correlation between price and the demand for goods and services.

A negative correlation is written as -1. In the vast majority of cases correlation falls somewhere between -10 and 10. In other words while x gains value y decreases in value. Non-elastic markets are food or healthcare markets as people will still buy these products irrespective of the price. Consider the following variable examples that would produce negative correlations.

Source: brainkart.com

Source: brainkart.com

For example the volume of gas will decrease as the pressure increases or the demand for a particular commodity increases as the price of such commodity decreases. The middle range indicates two stocks have a moderate negative correlation. Here if one variable increases the other decreases and vice versa. A negative correlation is written as -1. Supply and demand Economists observe a negative correlation between the price of a product and the demand for it.

Source: investopedia.com

Source: investopedia.com

Non-elastic markets are food or healthcare markets as people will still buy these products irrespective of the price. For example unemployment and consumer spending. The correlation decreases as the distance between customer locations increases. It is common to regard these rank correlation coefficients as alternatives to Pearsons coefficient used either to reduce the amount of calculation or to make the coefficient less sensitive to non-normality in distributions. A negative correlation between two variables means that one decreases in value while the other increases in value or vice versa.

Source: investopedia.com

Source: investopedia.com

A positive correlation means that as one variable increases the other variable increases eg. The PED coefficient is usually negative although economists often ignore the sign. Two people or situations known as variables with a negative correlation have an inverse relationship which means one increases as the other decreases. Correlation is expressed on a range from 1 to -1 known as the correlation coefficent. Positive values of correlation coefficient indicate positive relationship between the two variables while negative values are indicative of a negative relationship.

Source: emathzone.com

Source: emathzone.com

As a general rule a negative correlation between -10 and -070 is considered quite strong and anything between -030 and 0 is weak. For example unemployment and consumer spending. The middle range indicates two stocks have a moderate negative correlation. Demand for a good is relatively inelastic if the PED coefficient is less than one in absolute value. It is common to regard these rank correlation coefficients as alternatives to Pearsons coefficient used either to reduce the amount of calculation or to make the coefficient less sensitive to non-normality in distributions.

Source: study.com

Source: study.com

In other words while x gains value y decreases in value. This relationship between the movements can be helpful for matters relating to economic policies. Demand for a good is relatively elastic if the PED coefficient. In the vast majority of cases correlation falls somewhere between -10 and 10. This is the correct sequence to calculate Karl Pearsons correlation coefficient.

Source: questionpro.com

Source: questionpro.com

The correlation between median wages and demand shocks is 026 p-value 28 10 13 and between median wages and supply shocks is 041 p-value 15 10 30. For example the volume of gas will decrease as the pressure increases or the demand for a particular commodity increases as the price of such commodity decreases. Correlation is expressed on a range from 1 to -1 known as the correlation coefficent. The PED coefficient is usually negative although economists often ignore the sign. For example unemployment and consumer spending.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title negative demand correlation by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.