Your Money supply money demand diagram images are available in this site. Money supply money demand diagram are a topic that is being searched for and liked by netizens now. You can Download the Money supply money demand diagram files here. Find and Download all royalty-free photos and vectors.

If you’re searching for money supply money demand diagram pictures information linked to the money supply money demand diagram keyword, you have pay a visit to the right site. Our site always gives you hints for seeing the highest quality video and picture content, please kindly search and find more informative video articles and graphics that match your interests.

Money Supply Money Demand Diagram. Based on the diagram the nominal interest rate equals _____ and the money supply equals . Beginning at the initial equilibrium suppose the Bank of. So the interest rate falls rises and LM curves shifts up down by the amount of_ But the fall in interest rate in turn has ramifications for the goods market. If so then targeting the interest rate stabilizes income better than targeting the money supply.

How Money Supply And Demand Determine Nominal Interest Rates Interest Rates Rate Money From pinterest.com

How Money Supply And Demand Determine Nominal Interest Rates Interest Rates Rate Money From pinterest.com

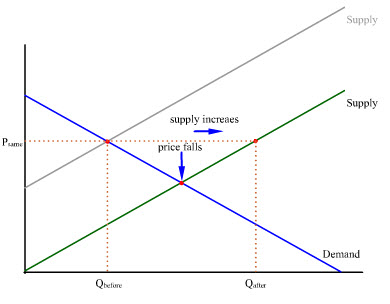

If you shift the money supply curve in to the left on the money supplymoney demand diagram then you will get a higher i in equilibrium at all levels of income thats the equivalent to shifting the LM curve up. But since money supply and bond supply are xed equilibrium in nancial markets requires an increase in the interest rate to increase bond demand and reduce money demand back to their initial equilibrium levels. This corresponds to an increase in the money supply to M in Panel b. These variable are MP and p e. Figure 2512 An Increase in the Money Supply. The mean mobile money t ransaction value between 20 11 and 2018 is 2164725 million shillings while that of the M 1 money supply is 98178770 million shillings.

The LM curve will shift whenever the variables we hold fixed other than Y in the money-supplymoney-demand diagram change.

In the US the central bank is the Federal Reserve System. Figure 2510 An Increase in the Money Supply. At the original interest rate real money supply has risen to level 2 along the horizontal axis while real money demand remains at level 1. If so then targeting the interest rate stabilizes income better than targeting the money supply. The demand curve for money illustrates the quantity of money demanded at a given interest rate. Which component of that curve accounts for the shift.

Source: pinterest.com

Source: pinterest.com

In this scenario money might be neutral in the long run and it might not. In practice this means that interest rates increase when the dollar value of aggregate output and expenditure increases. In th e United Kingdom money is endogeno us - the Bank supplies base money on demand at its prevailing interest rate and broad money is created b y the banking system. In the diagram this is shown as a rightward shift from M S P to M S P. They would want to do tis to pull back on a growing economy.

Source: pinterest.com

Source: pinterest.com

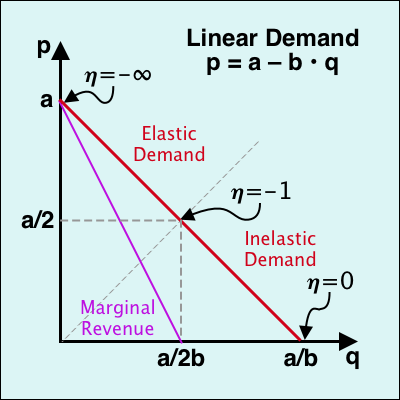

The demand curve for money illustrates the quantity of money demanded at a given interest rate. This figure shows the total demand for money combining the equation L 3 kY which includes precautionary demand L p also and the equation L e Ir we now have an equation for the total demand for money. If you shift the money supply curve in to the left on the money supplymoney demand diagram then you will get a higher i in equilibrium at all levels of income thats the equivalent to shifting the LM curve up. Demand for money - Outline yMeaning of demand for money yFactors affecting the demand for money yTransaction demand for money yPrecautionary demand for money yAsset demand for money yMoney demand as a function of nominal interest rate and income 3 1. Figure 2510 An Increase in the Money Supply.

Source: pinterest.com

Source: pinterest.com

The interest rate is i and desired investment is lo- Interest Rate Interest Rate Quantity of Money Desired Investment a. CHAPTER 11 Aggregate Demand II 21 2 The Fed might believe that LM shocks are more prevalent than IS shocks. The interest rate must fall to r2 to achieve equilibrium. M 1c c r 1t H. In the diagram this is shown as a rightward shift from M S P to M S P.

Source: pinterest.com

Source: pinterest.com

At the original interest rate real money supply has risen to level 2 along the horizontal axis while real money demand remains at level 1. The money market is an economic model describing the supply and demand for money in a nation. If you shift the money supply curve in to the left on the money supplymoney demand diagram then you will get a higher i in equilibrium at all levels of income thats the equivalent to shifting the LM curve up. Bond demand decreases for a given interest rate. Suppose the money supply rises by.

Source: pinterest.com

Source: pinterest.com

Central banks determine the money supply. If output remains unchanged then on the money market the money demand curve_____ and money supply curve _____. CHAPTER 11 Aggregate Demand II 21 2 The Fed might believe that LM shocks are more prevalent than IS shocks. The Fed increases the money supply by buying bonds increasing the demand for bonds in Panel a from D1 to D2 and the price of bonds to Pb2. If you shift the money supply curve in to the left on the money supplymoney demand diagram then you will get a higher i in equilibrium at all levels of income thats the equivalent to shifting the LM curve up.

Source: pinterest.com

Source: pinterest.com

Beginning at the initial equilibrium suppose the Bank of. The Federal Reserve directly regulates the amount of currency in circulation as well as banking system reserves. Bond demand decreases for a given interest rate. 1511 The above ultimately is the key equation of the H theory of money supply. The interest rate must fall to r2 to achieve equilibrium.

Source: pinterest.com

Source: pinterest.com

Demand for money yHolding money To use money one must hold money. The mean mobile money t ransaction value between 20 11 and 2018 is 2164725 million shillings while that of the M 1 money supply is 98178770 million shillings. The LM curve will shift whenever the variables we hold fixed other than Y in the money-supplymoney-demand diagram change. The Fed increases the money supply by buying bonds increasing the demand for bonds in Panel a from D1 to D2 and the price of bonds to Pb2. In particular if MP increases holding expected inflation fixed then r falls in the.

Source: pinterest.com

Source: pinterest.com

Remember that prices also affect the position of the money supply curve because we are thinking about real money balances MP. If so then targeting the interest rate stabilizes income better than targeting the money supply. The LM curve will shift whenever the variables we hold fixed other than Y in the money-supplymoney-demand diagram change. This figure shows the total demand for money combining the equation L 3 kY which includes precautionary demand L p also and the equation L e Ir we now have an equation for the total demand for money. Money Supply Who controls the quantity of money that circulates in an economy the money supply.

Source: pinterest.com

Source: pinterest.com

We shall denote it by m. See end-of-chapter Problem 7 on p337 IS-LMand aggregate demand. The Fed increases the money supply by buying bonds increasing the demand for bonds in Panel a from D1 to D2 and the price of bonds to Pb2. These variable are MP and p e. At the original interest rate real money supply has risen to level 2 along the horizontal axis while real money demand remains at level 1.

Source: pinterest.com

Source: pinterest.com

In th e United Kingdom money is endogeno us - the Bank supplies base money on demand at its prevailing interest rate and broad money is created b y the banking system. Figure 2512 An Increase in the Money Supply. The LM curve will shift whenever the variables we hold fixed other than Y in the money-supplymoney-demand diagram change. In the money supplymoney demand diagram the decrease in nominal money shifts the money supply curve to the left so you get a new higher equilibrium interest rate. At the original interest rate real money supply has risen to level 2 along the horizontal axis while real money demand remains at level 1.

Source: in.pinterest.com

Source: in.pinterest.com

In the money supplymoney demand diagram the decrease in nominal money shifts the money supply curve to the left so you get a new higher equilibrium interest rate. Which component of that curve accounts for the shift. If output remains unchanged then on the money market the money demand curve_____ and money supply curve _____. CHAPTER 11 Aggregate Demand II 21 2 The Fed might believe that LM shocks are more prevalent than IS shocks. Similarly if expected inflation increases real money demand falls.

Source: pinterest.com

Source: pinterest.com

YIf people desire to hold money there. The Expression 1 c c r 1t gives the value of what is known as the money multiplier. The interest rate must fall to r2 to achieve equilibrium. Similarly if expected inflation increases real money demand falls. Figure 2510 An Increase in the Money Supply.

Source: pinterest.com

Source: pinterest.com

These variable are MP and e. If the interest rate rises to i 1 with the money supply fixed at M i 0 the level of income must rise to Y 1 to maintain money market equilibrium. CHAPTER 11 Aggregate Demand II 21 2 The Fed might believe that LM shocks are more prevalent than IS shocks. In the money supplymoney demand diagram the decrease in nominal money shifts the money supply curve to the left so you get a new higher equilibrium interest rate. See end-of-chapter Problem 7 on p337 IS-LMand aggregate demand.

Source: in.pinterest.com

Source: in.pinterest.com

In particular if MP increases holding expected inflation fixed then r falls in the. What happens to price and output. This corresponds to an increase in the money supply to M in Panel b. Please show work and Label this new point as point B on your diagram above. This means that the money market comes into equilibrium at a higher interest rate for all levels of output so it is reflected in an upward shift of the LM curve.

Source: pinterest.com

Source: pinterest.com

Demand for money - Outline yMeaning of demand for money yFactors affecting the demand for money yTransaction demand for money yPrecautionary demand for money yAsset demand for money yMoney demand as a function of nominal interest rate and income 3 1. The Expression 1 c c r 1t gives the value of what is known as the money multiplier. So the interest rate falls rises and LM curves shifts up down by the amount of_____ But the fall in interest rate in turn has ramifications for the goods market. This corresponds to an increase in the money supply to M in Panel b. The interest rate is i and desired investment is lo- Interest Rate Interest Rate Quantity of Money Desired Investment a.

Source: pinterest.com

Source: pinterest.com

This corresponds to an increase in the money supply to M in Panel b. See end-of-chapter Problem 7 on p337 IS-LMand aggregate demand. The LM curve will shift whenever the variables we hold fixed other than Y in the money-supplymoney-demand diagram change. This is shown in LM diagram of Fig. Figure 2510 An Increase in the Money Supply.

Source: pinterest.com

Source: pinterest.com

The Federal Reserve expands the money supply by 5. M 1c c r 1t H. The Federal Reserve directly regulates the amount of currency in circulation as well as banking system reserves. Above below the IS there is excess supply demand in the goods market. As shown in the left-hand panel of this diagram an increase in the demand for money initially creates a shortage of money and ultimately increases the nominal interest rate.

Source: pinterest.com

Source: pinterest.com

It makes the supply of money a function of H and the three behavioural ratios ct and r. It makes the supply of money a function of H and the three behavioural ratios ct and r. The Federal Reserve expands the money supply by 5. As shown in the left-hand panel of this diagram an increase in the demand for money initially creates a shortage of money and ultimately increases the nominal interest rate. See end-of-chapter Problem 7 on p337 IS-LMand aggregate demand.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title money supply money demand diagram by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.