Your Money market graph increase in money supply images are available. Money market graph increase in money supply are a topic that is being searched for and liked by netizens now. You can Download the Money market graph increase in money supply files here. Download all royalty-free vectors.

If you’re searching for money market graph increase in money supply pictures information linked to the money market graph increase in money supply topic, you have come to the right site. Our website frequently gives you suggestions for downloading the highest quality video and picture content, please kindly hunt and find more enlightening video content and images that fit your interests.

Money Market Graph Increase In Money Supply. The money market is no exception. Its known as you guessed it M2. Another measure of the money supply adds these savings deposits and checkable money funds to M1. An increase in the money supply means that more money is available for borrowing in the economy.

Pin On گراف خرد From pinterest.com

Pin On گراف خرد From pinterest.com

445 42 Views. As in the United States this economy has a central. Join us and start trading popular stock CFDs. Refers to any policy initiative by a countrys central bank to raise or expand its money supply. Stocks with real time quotes. Its known as you guessed it M2.

Stocks with real time quotes.

Money Supply M2 in the United States increased to 2143670 USD Billion in November from 2118710 USD Billion in October of 2021. Consider the money market in the accompanying graph. 32 Votes The supply of money is a vertical line suggesting the quantity of money is fixed at a level largely determined by the Fed. Specifically nominal interest rates which. Refers to any policy initiative by a countrys central bank to raise or expand its money supply. This Demonstration shows the implications for the economy if the money supply is increased.

Source: pinterest.com

Source: pinterest.com

Suppose the central bank reduces the money supply. 32 Votes The supply of money is a vertical line suggesting the quantity of money is fixed at a level largely determined by the Fed. Money Supply M2 in the United States increased to 2143670 USD Billion in November from 2118710 USD Billion in October of 2021. Figure 2512 An Increase in the Money Supply. Join us and start trading popular stock CFDs.

Source: pinterest.com

Source: pinterest.com

The money market is an economic model describing the supply and demand for money in a nation. Another measure of the money supply adds these savings deposits and checkable money funds to M1. From the graph we see that the growth. It uses the four key graphs taught in AP Macroeconomics. As in the United States this economy has a central.

Source: pinterest.com

Source: pinterest.com

Money Supply M2 in the United States increased to 2143670 USD Billion in November from 2118710 USD Billion in October of 2021. There are three tools that the FED uses to influence the money supply. The vertical curve indicates the money. The Fed increases the money supply by buying bonds increasing the demand for bonds in Panel a from D 1 to D 2 and the price of bonds to. Ad 72 of retail CFD accounts lose money.

Source: pinterest.com

Source: pinterest.com

Figure 2512 An Increase in the Money Supply. Suppose the central bank reduces the money supply. Figure 2512 An Increase in the Money Supply. Figure 2510 An Increase in the Money Supply. Ad 72 of retail CFD accounts lose money.

Source: pinterest.com

Source: pinterest.com

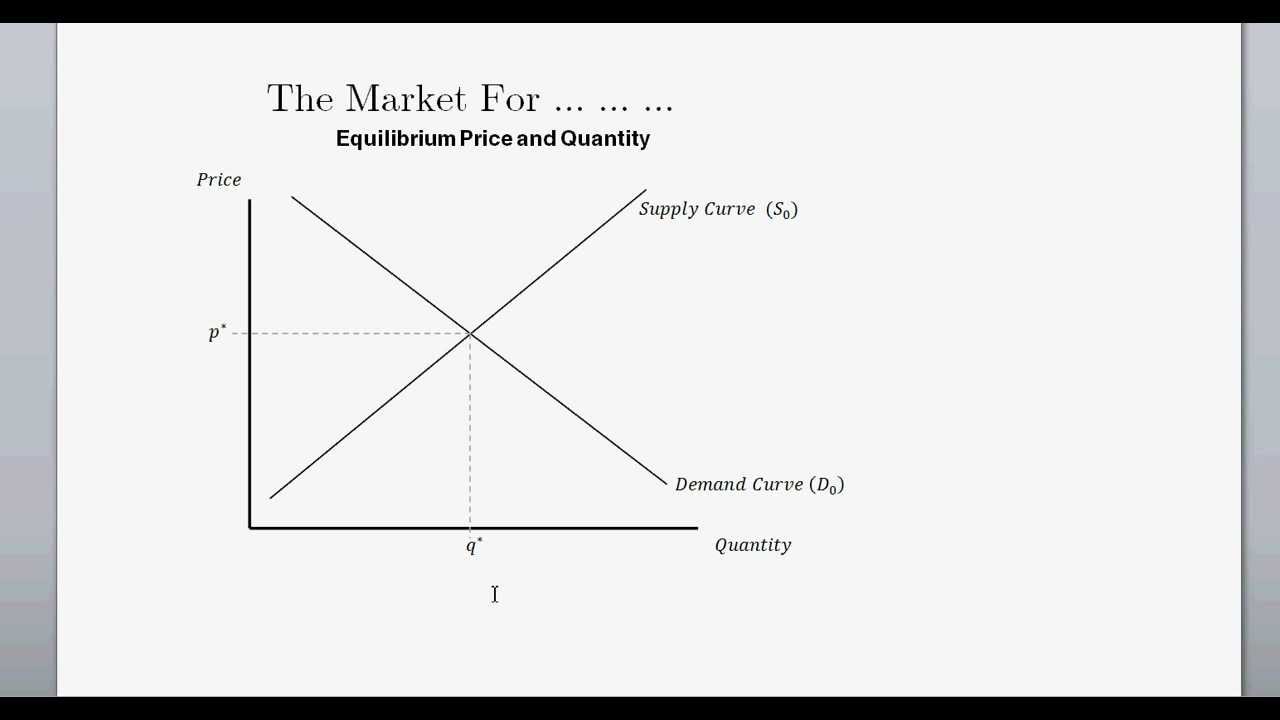

The money market is an economic model describing the supply and demand for money in a nation. Ad 72 of retail CFD accounts lose money. An increase in the money supply means that more money is available for borrowing in the economy. Initially the equilibrium interest rate and quantity are represented by the point E1. Stocks with real time quotes.

Source: pinterest.com

Source: pinterest.com

In any market an equilibrium occurs when the quantity supplied is equal to the quantity demanded. Refers to any policy initiative by a countrys central bank to raise or expand its money supply. 445 42 Views. Join us and start trading popular stock CFDs. This Demonstration shows the implications for the economy if the money supply is increased.

Source: pinterest.com

Source: pinterest.com

From the graph we see that the growth. The money market is no exception. Suppose the Fed increases the nominal. 445 42 Views. Specifically nominal interest rates which.

Source: pinterest.com

Source: pinterest.com

Expansionary monetary policy An increase in the money supply in a country. Another measure of the money supply adds these savings deposits and checkable money funds to M1. A graph representing the downward slope of the demand curve. Increase in the nominal money supply M Consider the money market initially in equilibrium at r 6 as illustrated in the above graph. 32 Votes The supply of money is a vertical line suggesting the quantity of money is fixed at a level largely determined by the Fed.

Source: id.pinterest.com

Source: id.pinterest.com

It uses the four key graphs taught in AP Macroeconomics. Module 29 explained that in the long run. Ad 72 of retail CFD accounts lose money. Specifically nominal interest rates which. Join us and start trading popular stock CFDs.

Source: pinterest.com

Source: pinterest.com

An increase in the money supply means that more money is available for borrowing in the economy. There are three tools that the FED uses to influence the money supply. Money Supply M2 in the United States averaged. From the graph we see that the growth. The Fed increases the money supply by buying bonds increasing the demand for bonds in Panel a from D 1 to D 2 and the price of bonds to.

Source: pinterest.com

Source: pinterest.com

Refers to any policy initiative by a countrys central bank to raise or expand its money supply. Money Supply M2 in the United States increased to 2143670 USD Billion in November from 2118710 USD Billion in October of 2021. These include the reserve requirement the discount rate open market operations the buying and. As in the United States this economy has a central. Prices adjust until the market is in equilibrium.

Source: pinterest.com

Source: pinterest.com

C A correctly labeled money market graph is shown in the rubrics section. The next chart is the Long-Term M1 Money Supply chart since 1980. Prices adjust until the market is in equilibrium. Suppose the central bank reduces the money supply. 445 42 Views.

Source: pinterest.com

Source: pinterest.com

Suppose the central bank reduces the money supply. The vertical curve indicates the money. Money Supply M2 in the United States increased to 2143670 USD Billion in November from 2118710 USD Billion in October of 2021. This Demonstration shows the implications for the economy if the money supply is increased. This increase in supplyin accordance with the law of demandtends to lower.

Source: pinterest.com

Source: pinterest.com

These include the reserve requirement the discount rate open market operations the buying and. These include the reserve requirement the discount rate open market operations the buying and. Ad 72 of retail CFD accounts lose money. Expansionary monetary policy An increase in the money supply in a country. In any market an equilibrium occurs when the quantity supplied is equal to the quantity demanded.

Source: pinterest.com

Source: pinterest.com

From the graph we see that the growth. The next chart is the Long-Term M1 Money Supply chart since 1980. This Demonstration shows the implications for the economy if the money supply is increased. Prices adjust until the market is in equilibrium. In any market an equilibrium occurs when the quantity supplied is equal to the quantity demanded.

Source: pinterest.com

Source: pinterest.com

Suppose the central bank reduces the money supply. The increase in the US money supply in the past two weeks is absolutely shocking. C A correctly labeled money market graph is shown in the rubrics section. Specifically nominal interest rates which. Prices adjust until the market is in equilibrium.

Source: pinterest.com

Source: pinterest.com

It uses the four key graphs taught in AP Macroeconomics. There are three tools that the FED uses to influence the money supply. Like many economic variables in a reasonably free-market economy interest rates are determined by the forces of supply and demand. 445 42 Views. Ad 72 of retail CFD accounts lose money.

Source: pinterest.com

Source: pinterest.com

In the short run an increase in the money supply leads to a fall in the interest rate and a decrease in the money supply leads to a rise in the interest rate. The money market is no exception. An increase in the money supply means that more money is available for borrowing in the economy. Join us and start trading popular stock CFDs. Changes in the money supply The following graph represents the money market in a hypothetical economy.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title money market graph increase in money supply by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.