Your Loanable funds market graph shifts images are ready in this website. Loanable funds market graph shifts are a topic that is being searched for and liked by netizens now. You can Find and Download the Loanable funds market graph shifts files here. Find and Download all free vectors.

If you’re searching for loanable funds market graph shifts pictures information linked to the loanable funds market graph shifts keyword, you have visit the right blog. Our site always gives you suggestions for refferencing the maximum quality video and image content, please kindly search and find more enlightening video content and graphics that fit your interests.

Loanable Funds Market Graph Shifts. The loanable funds market illustrates the interaction of borrowers and savers in the economy. Raises personal income taxes and cuts spending. Unemployment rate is 6 and CPI is inc. Be sure your graph is fully labeled.

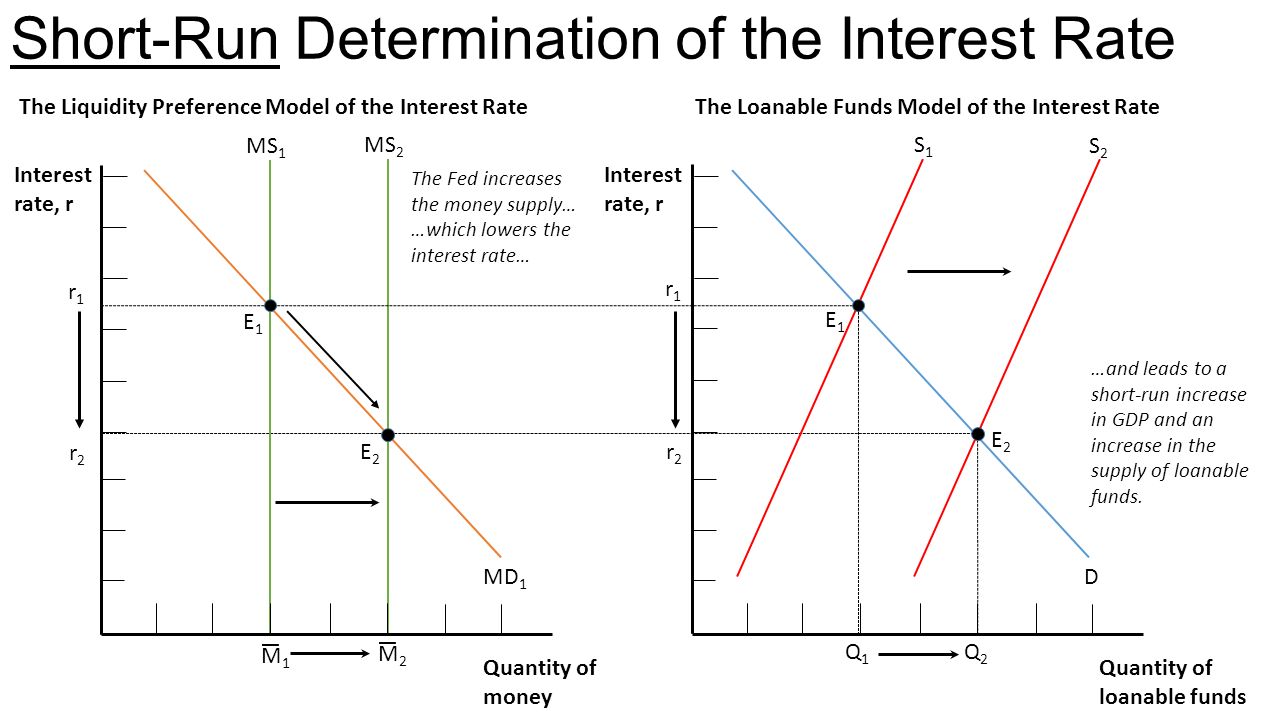

Economics In Plain English Loanable Funds Vs Money Market What S The Difference From welkerswikinomics.com

Economics In Plain English Loanable Funds Vs Money Market What S The Difference From welkerswikinomics.com

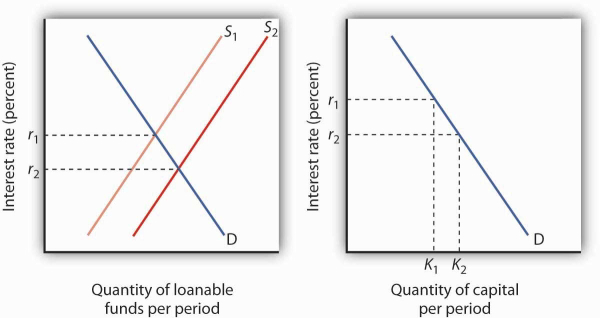

Stocks with real time quotes. An increase in the thriftinessthat is the desire to saveamong households will shift the supply of loanable funds to the right from the. Graphing the Loanable Funds Market Assignment Show the changes for each scenario on a properly drawn and labeled loanable funds market graph. Borrowers demand loanable funds and savers supply loanable funds. If we plot it on a graph the demand curve for loanable funds has a downward slope negative. Indicate whether the policy increases decreases or does not affect the.

Stocks with real time quotes.

The market for loanable funds shows the interaction between borrowers and lenders that helps determine the market interest rate and the quantity of loanable funds exchanged. The market for loanable funds is a way of representing all of the potential savers and all of the potential. Interested in Investing in Stocks. Also provide a brief explanation for each step. The loanable funds market illustrates the interaction of borrowers and savers in the economy. Shift the appropriate curve on the graph to reflect this change.

Source: opentextbooks.org.hk

Source: opentextbooks.org.hk

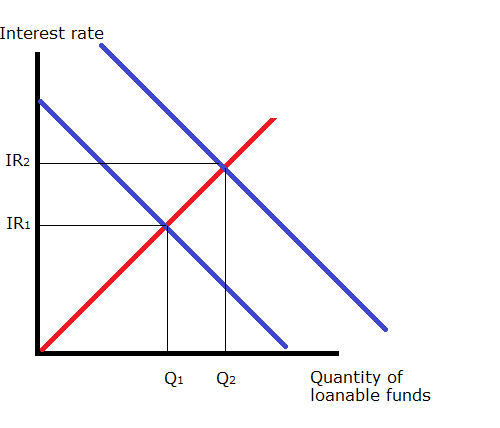

Demand for Loanable Funds. The demand will shift to the left. Indicate whether the policy increases decreases or does not affect the. At r2 the quantity of. Borrowers demand loanable funds and savers supply loanable funds.

Source: courses.lumenlearning.com

Source: courses.lumenlearning.com

Graphing the Loanable Funds Market Assignment Show the changes for each scenario on a properly drawn and labeled loanable funds market graph. Graphing the Loanable Funds Market Assignment Show the changes for each scenario on a properly drawn and labeled loanable funds market graph. The loanable funds market is a representation of decisions made by households and companies in relation to their lending and borrowing. Practice exam economics 2012 mpenb50v1 faculty economics and management exam coversheet year of study term course osiris modulename osiris modulecode lecturer. Also provide a brief explanation for each step.

At r2 the quantity of. In most emerging countries people save little as they. The market for loanable funds shows the interaction between borrowers and lenders that helps determine the market interest rate and the quantity of loanable funds exchanged. Then describe what happened to. At r2 the quantity of.

If money demand decreases how are the rest of the graphs affected. We use your LinkedIn profile and activity data to personalize ads and to show you more relevant ads. The loanable funds market is like any other market with a supply curve and demand curve along with an equilibrium price and quantity. Ad 72 of retail CFD accounts lose money. Borrowers demand loanable funds and savers supply loanable funds.

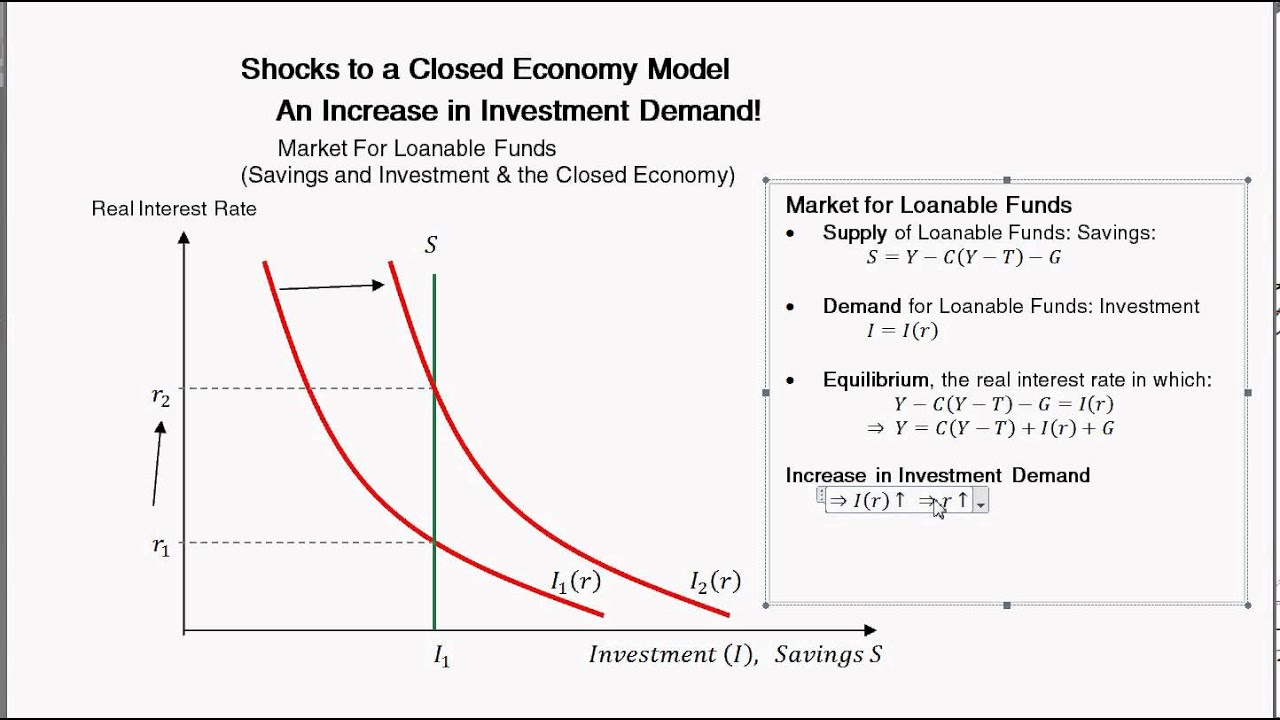

The market for loanable funds shows the interaction between borrowers and lenders that helps determine the market interest rate and the quantity of loanable funds exchanged. Unemployment rate is 6 and CPI is inc. Ad 72 of retail CFD accounts lose money. What happens to the real. A cut in T will increase C and reduce Y C G The consequent fall in the supply of loanable funds raises r and equilibrates the market for loanable funds.

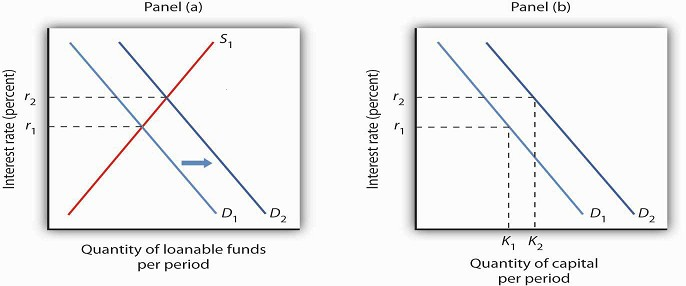

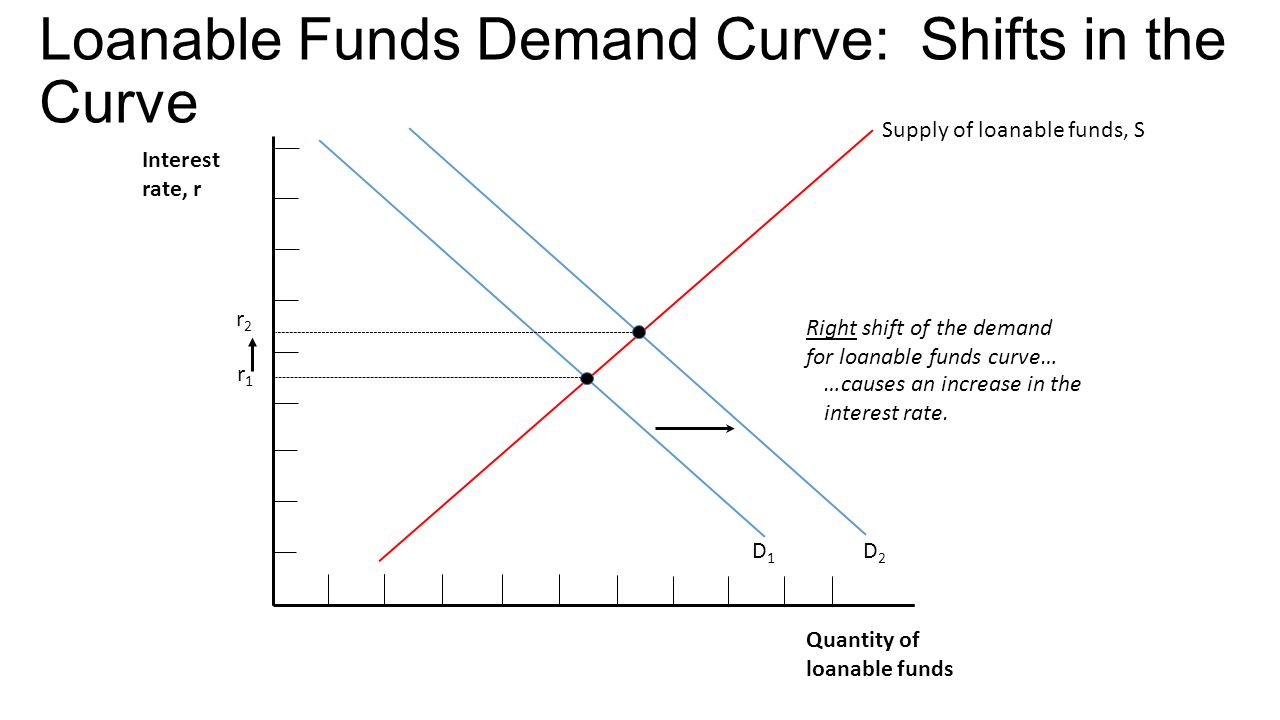

Panel a shows the result in the loanable funds marketa shift in the demand curve for loanable funds from D1 to D2 and an increase in the interest rate from r1 to r2. We use your LinkedIn profile and activity data to personalize ads and to show you more relevant ads. Raises personal income taxes and cuts spending. What makes this market different. A cut in T will increase C and reduce Y C G The consequent fall in the supply of loanable funds raises r and equilibrates the market for loanable funds.

Source: opentextbooks.org.hk

Source: opentextbooks.org.hk

The loanable funds market illustrates the interaction of borrowers and savers in the economy. The demand will shift to the left. An increase in the thriftinessthat is the desire to saveamong households will shift the supply of loanable funds to the right from the. 72 the curve S slopes from left. The loanable funds market describes the behavior of savers and borrowers.

The loanable funds market describes the behavior of savers and borrowers. Stocks with real time quotes. What happens to the real. Graphically show the impact of this new policy on the market for loanable funds. I Draw a graph of the market for loanable funds and indicate how it will be affected.

Source: khanacademy.org

Source: khanacademy.org

Loanable Funds Market. Interested in Investing in Stocks. Stocks with real time quotes. The loanable funds market illustrates the interaction of borrowers and savers in the economy. Ad 72 of retail CFD accounts lose money.

Source: slideplayer.com

Source: slideplayer.com

Ad 72 of retail CFD accounts lose money. At r2 the quantity of. What happens to the real. Be sure your graph is fully labeled. What makes this market different.

Source: econ101help.com

Source: econ101help.com

Ad 72 of retail CFD accounts lose money. The loanable funds market is like any other market with a supply curve and demand curve along with an equilibrium price and quantity. Loanable Funds Market. The demand will shift to the left. Interested in Investing in Stocks.

Source: freeeconhelp.com

Source: freeeconhelp.com

What makes this market different. Shift the appropriate curve on the graph to reflect this change. Ad 72 of retail CFD accounts lose money. If money demand decreases how are the rest of the graphs affected. Panel a shows the result in the loanable funds marketa shift in the demand curve for loanable funds from D1 to D2 and an increase in the interest rate from r1 to r2.

Source: youtube.com

Source: youtube.com

Graphically show the impact of this new policy on the market for loanable funds. Also provide a brief explanation for each step. The loanable funds market is a representation of decisions made by households and companies in relation to their lending and borrowing. Interested in Investing in Stocks. Be sure your graph is fully labeled.

Source: courses.lumenlearning.com

Source: courses.lumenlearning.com

Since r is now higher at a fixed. Also provide a brief explanation for each step. What makes this market different. We use your LinkedIn profile and activity data to personalize ads and to show you more relevant ads. The demand will shift to the left.

Source: slideplayer.com

Source: slideplayer.com

Unemployment rate is 6 and CPI is inc. Ad 72 of retail CFD accounts lose money. The market for loanable funds is a way of representing all of the potential savers and all of the potential. Since r is now higher at a fixed. Ad 72 of retail CFD accounts lose money.

Source: welkerswikinomics.com

Source: welkerswikinomics.com

At r2 the quantity of. Unemployment rate is 6 and CPI is inc. The loanable funds market describes the behavior of savers and borrowers. Interested in Investing in Stocks. It is a variation of a market model but what is being bought and sold is money that has been.

What makes this market different. For the borrower the interest rate represents. An increase in the thriftinessthat is the desire to saveamong households will shift the supply of loanable funds to the right from the. This change in the tax treatment of interest income from saving causes the equilibrium interest rate in the market for loanable. The market for loanable funds shows the interaction between borrowers and lenders that helps determine the market interest rate and the quantity of loanable funds exchanged.

Source: welkerswikinomics.com

Source: welkerswikinomics.com

By saving thus the firms may not enter the loanable-funds market but this influences the rate of interest by reducing the demand for loanable funds. By saving thus the firms may not enter the loanable-funds market but this influences the rate of interest by reducing the demand for loanable funds. In most emerging countries people save little as they. Loanable Funds Market. Then describe what happened to.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title loanable funds market graph shifts by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.