Your How to calculate price elasticity of demand derivative images are ready. How to calculate price elasticity of demand derivative are a topic that is being searched for and liked by netizens today. You can Find and Download the How to calculate price elasticity of demand derivative files here. Download all free photos.

If you’re looking for how to calculate price elasticity of demand derivative pictures information connected with to the how to calculate price elasticity of demand derivative topic, you have pay a visit to the right blog. Our site frequently gives you hints for seeing the highest quality video and picture content, please kindly search and find more informative video articles and graphics that match your interests.

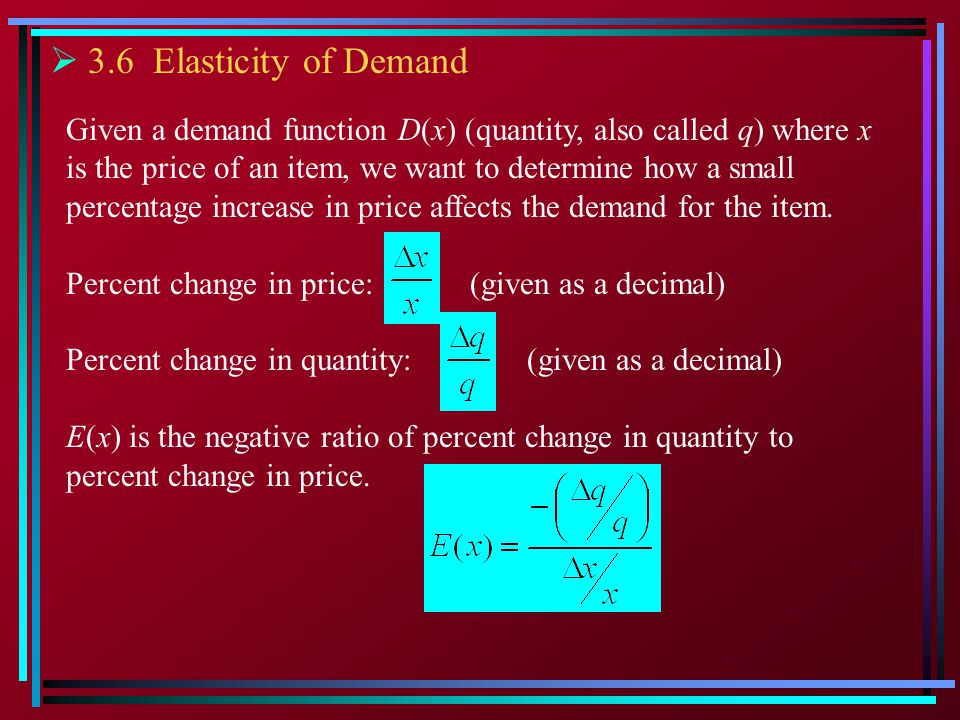

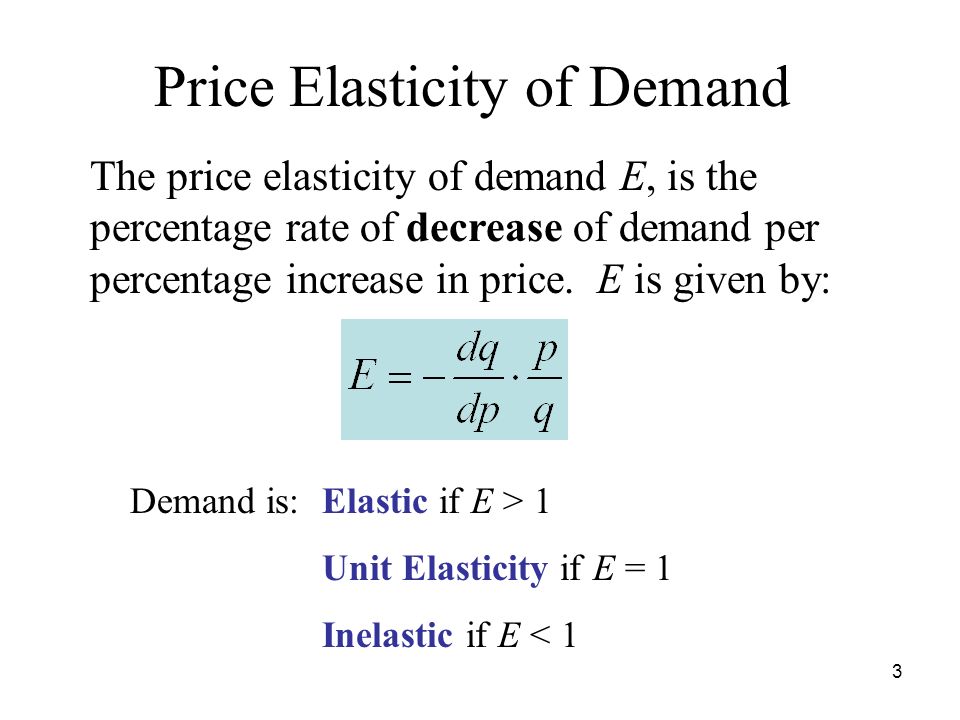

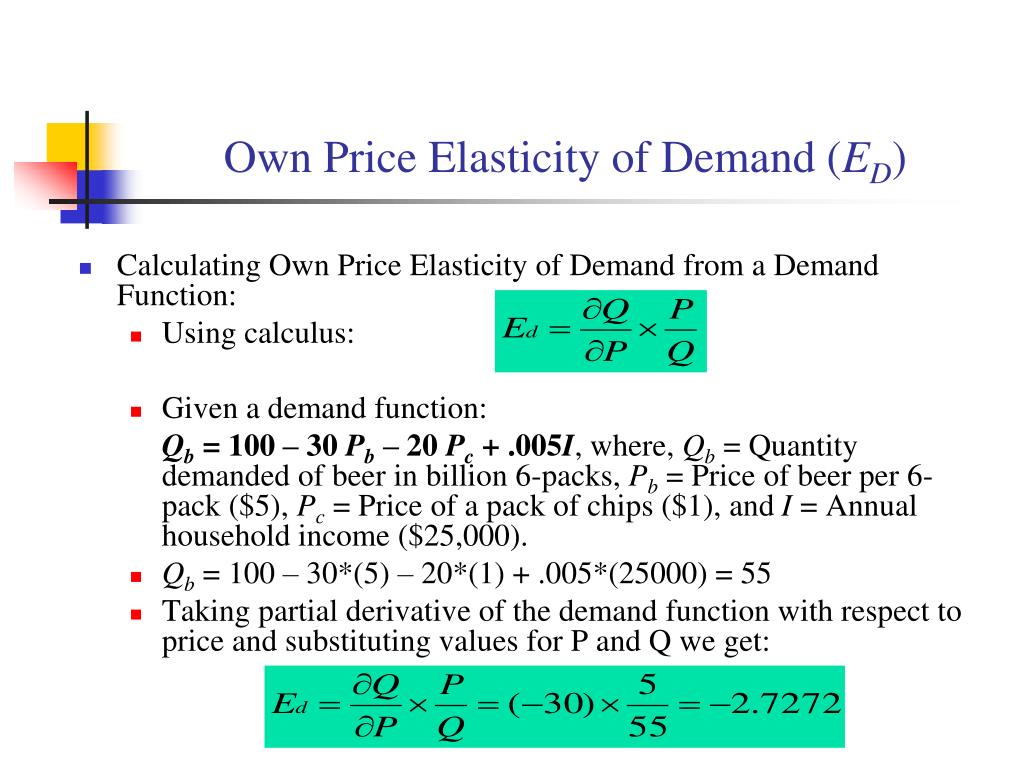

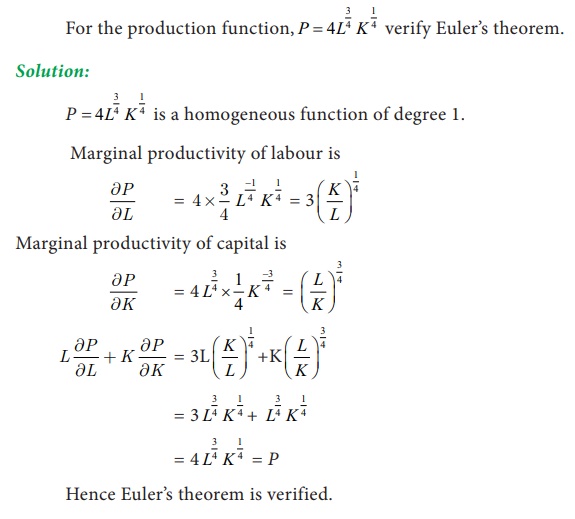

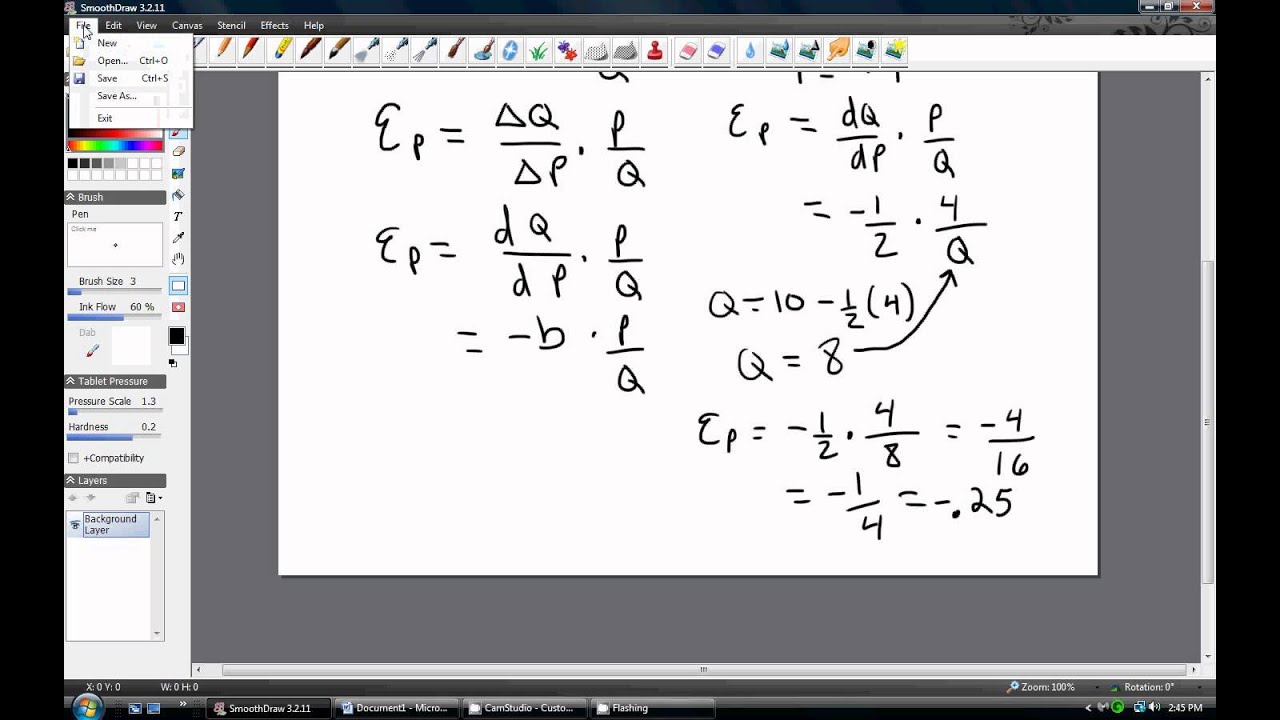

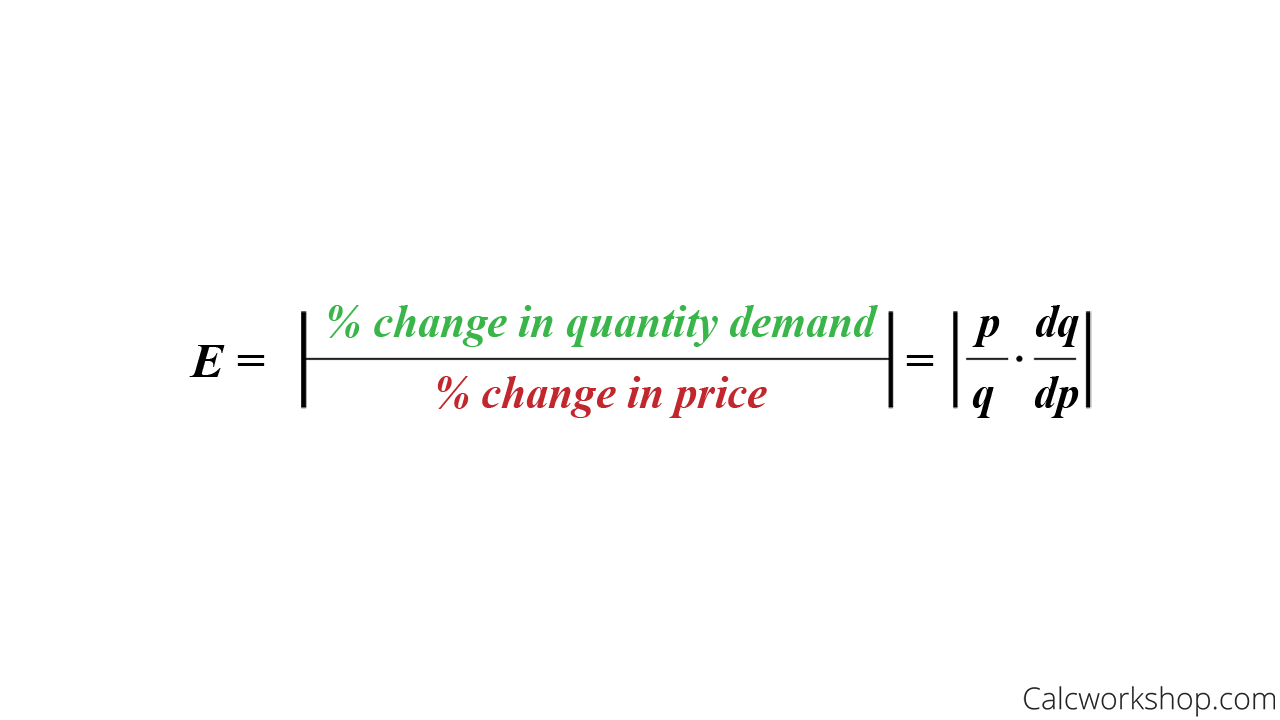

How To Calculate Price Elasticity Of Demand Derivative. When solving for an items price elasticity of demand the formula is. The formula for elasticity of demand involves a derivative which is why were discussing it here. Note that the law of demand implies that dqdp 0 and so ǫ will be a negative number. Price Elasticity of Demand Percentage Change in Quantity Sold Percent Change in Price While that looks a little confusing at first its easy once you understand all the terms.

Demand Elasticities Price Elasticity Cross Price Elasticity And Income Elasticity Youtube From youtube.com

Demand Elasticities Price Elasticity Cross Price Elasticity And Income Elasticity Youtube From youtube.com

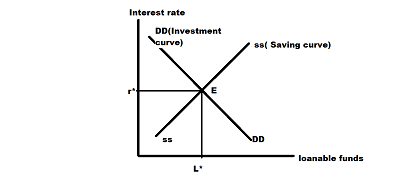

To define the elasticity it is more convenient to write the demand function in its direct form. Price Elasticity of Demand The formula for Elasticity measures how demand reacts to price changes. Here is the mathematical formula. To begin find the percentage change in the items price. Mathematically we can write g P f 1 P The derivative of the demand function is d Q d P g P. This means the particular prices and quantities dont matter and everything is treated as a percent change as Grove City College accurately states.

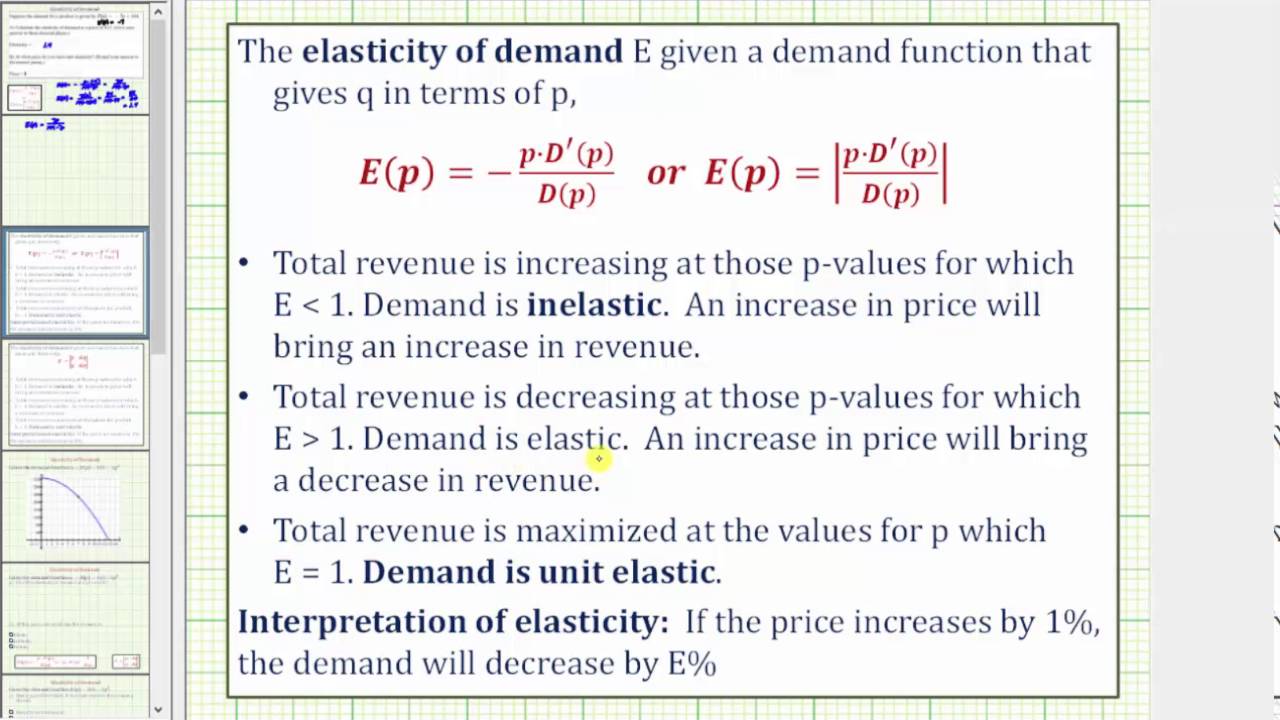

The price elasticity of demand which is often shortened to demand elasticity is defined to be the percentage change in quantity demanded q divided by the percentage change in price p.

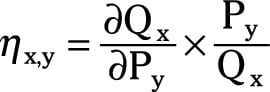

For p 6 and q 10 6 2 7 elasticity e 6 2 7 3 7. Now find out the price elasticity of demand for petrol in this. P1 and p2 of commodities A and B respectively. Where dZdY is the partial derivative of Z with respect to Y. The formula for elasticity of demand involves a derivative which is why were discussing it here. For p 6 and q 10 6 2 7 elasticity e 6 2 7 3 7.

Source: slideplayer.com

Source: slideplayer.com

Calculating the derivative fracdqdp-2p. The function g is the inverse function of f. Find the percentage change in price. Elasticity of Demand Given a demand function that gives q in terms of p so q D p the elasticity of demand is E p q d q d p p D p D p. Find the elasticity of demand when the price is 5 and when the price is 15.

Source: sfu.ca

Source: sfu.ca

2 MC 1 2 MC 1 2 2 MC p So the profit maximizing price will be two times the marginal cost. Elasticity of Z with respect to Y dZ dY YZ Well look at how to apply this to four different situations. When demand is inelastic and the price rises revenue. Calculating the derivative fracdqdp-2p. To see why imagine that demand is inelastic.

Source: slideplayer.com

Source: slideplayer.com

Consider a hypothetical situation where a 45 increase in petrol price has resulted in a decrease in its purchase by 22. Price Elasticity of Demand The formula for Elasticity measures how demand reacts to price changes. The price elasticity is a measure of how sensitive the quantity demand is to changes in the price. Let q f p1 p2 be the demand for commodity A which depends upon the prices. Please consider a donation to this channel.

Source: youtube.com

Source: youtube.com

The formula for the demand elasticity ǫ is. So if the price elasticity of demand is 2 the profit maximizing price is. Find the percentage change in price. Here is the mathematical formula. E Δ q q Δ p p d q d p p q where q q p is demand as a function of price.

We saw that we can calculate any elasticity by the formula. This Demonstration shows two ways to calculate the price elasticity of demand. In some contexts it is common to introduce a. So if the price elasticity of demand is 2 the profit maximizing price is. Where dZdY is the partial derivative of Z with respect to Y.

Source: youtube.com

Source: youtube.com

Here is the mathematical formula. Let q f p1 p2 be the demand for commodity A which depends upon the prices. The formula for elasticity of demand involves a derivative which is why were discussing it here. Where dZdY is the partial derivative of Z with respect to Y. In other words is negative.

Source: wn.com

Source: wn.com

How to Calculate the Arc Price Elasticity of Demand If the price of a product decreases from 10 to 8 leading to an increase in quantity demanded from 40 to 60 units then the price elasticity of. Partial elasticity of demand. This means the particular prices and quantities dont matter and everything is treated as a percent change as Grove City College accurately states. Please consider a donation to this channel. Elasticity of Z with respect to Y dZ.

Source: slideserve.com

Source: slideserve.com

We saw that we can calculate any elasticity by the formula. To people who value knowledge dummies is the platform that makes learning anything easy because it transforms the hard-to-understand into easy-to-use. Then find the price that will maximize revenue. For small changes in price Δq Δp q p can be approximated by the derivative dq dp d q d p. Let q f p1 p2 be the demand for commodity A which depends upon the prices.

Source: brainkart.com

Source: brainkart.com

Where dZdY is the partial derivative of Z with respect to Y. We saw that we can calculate any elasticity by the formula. To define the elasticity it is more convenient to write the demand function in its direct form. 2 MC 1 2 MC 1 2 2 MC p So the profit maximizing price will be two times the marginal cost. In other words is negative.

Source: wiki.ubc.ca

Source: wiki.ubc.ca

So if the price elasticity of demand is 2 the profit maximizing price is. This means the particular prices and quantities dont matter and everything is treated as a percent change as Grove City College accurately states. Find the percentage change in price. To begin find the percentage change in the items price. To see why imagine that demand is inelastic.

Source: dummies.com

Source: dummies.com

Note that the law of demand implies that dqdp 0 and so ǫ will be a negative number. We saw that we can calculate any elasticity by the formula. Note that the law of demand implies that dqdp 0 and so ǫ will be a negative number. Find the elasticity of demand when the price is 5 and when the price is 15. In some contexts it is common to introduce a.

Source: wiki.ubc.ca

Source: wiki.ubc.ca

Consider a hypothetical situation where a 45 increase in petrol price has resulted in a decrease in its purchase by 22. Lets start with a simple problem. To see why imagine that demand is inelastic. The formula for the demand elasticity ǫ is. The Elasticity of Demand is the percentage change in quantity divided by the percentage change in price.

Source: youtube.com

Source: youtube.com

The Elasticity of Demand is very important because it tells us how to optimize our revenue. This means that we can determine elasticity of demand E by substituting in the derivatives of q and p into the above formula. The formula for elasticity of demand involves a derivative which is why were discussing it here. When demand is inelastic and the price rises revenue. To people who value knowledge dummies is the platform that makes learning anything easy because it transforms the hard-to-understand into easy-to-use.

Source: calcworkshop.com

Source: calcworkshop.com

Elasticity of Z with respect to Y dZ. Find the percentage change in price. Where dZdY is the partial derivative of Z with respect to Y. We saw that we can calculate any elasticity by the formula. Thus we can calculate any elasticity through the formula.

Source: youtube.com

Source: youtube.com

To people who value knowledge dummies is the platform that makes learning anything easy because it transforms the hard-to-understand into easy-to-use. We calculate the own-price elasticity of demand by dividing the percentage change in quantity demanded of an item by the percentage change in price. Elasticity of Z with respect to Y dZ. Remember demand has an inverse relationship with prices. A few examples of calculating elasticity of demand using calculus About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new.

Source: youtube.com

Source: youtube.com

To see why imagine that demand is inelastic. Then find the price that will maximize revenue. We saw that we can calculate any elasticity by the formula. The point elasticity formula is only useful for data points close to each other in value. The formula for the demand elasticity ǫ is.

Source: freemathhelp.com

Source: freemathhelp.com

Find the elasticity of demand when the price is 5 and when the price is 15. To better understand how to calculate the price elasticity of demand take a look at the following examples. Therefore E p q dq dp p q d q d p. We calculate the own-price elasticity of demand by dividing the percentage change in quantity demanded of an item by the percentage change in price. Elasticity of Z with respect to Y dZ.

Source: youtube.com

Source: youtube.com

In other words is negative. Please consider a donation to this channel. E Δ q q Δ p p d q d p p q where q q p is demand as a function of price. What is the income elasticity of demand when income is 20000 and price is 5. To see why imagine that demand is inelastic.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how to calculate price elasticity of demand derivative by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.