Your How does tax affect supply and demand images are ready. How does tax affect supply and demand are a topic that is being searched for and liked by netizens now. You can Find and Download the How does tax affect supply and demand files here. Download all royalty-free photos.

If you’re searching for how does tax affect supply and demand pictures information linked to the how does tax affect supply and demand interest, you have pay a visit to the right site. Our website frequently gives you suggestions for refferencing the maximum quality video and picture content, please kindly search and locate more informative video content and graphics that match your interests.

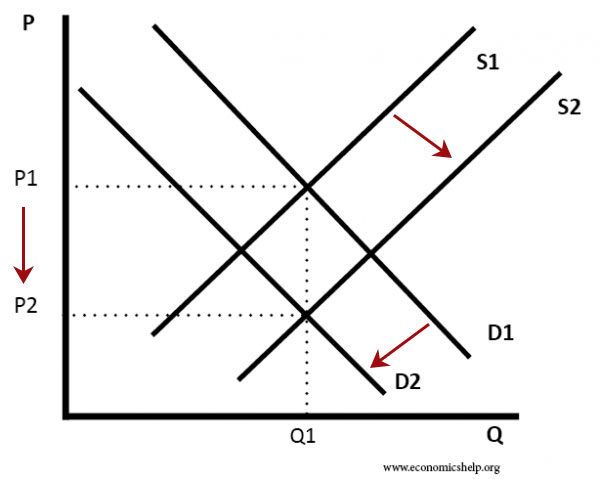

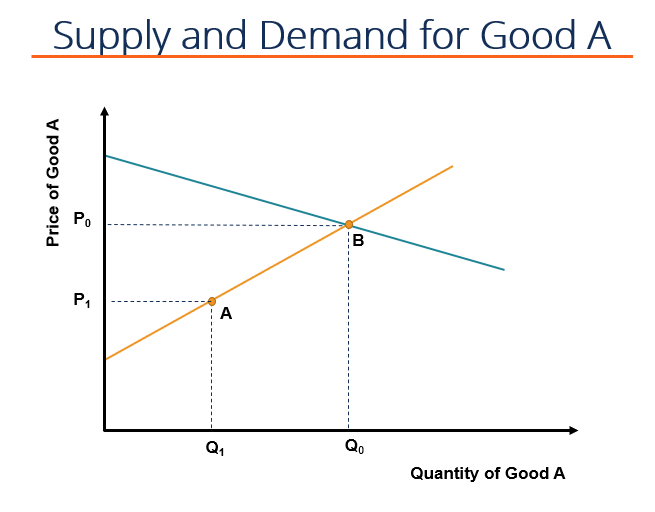

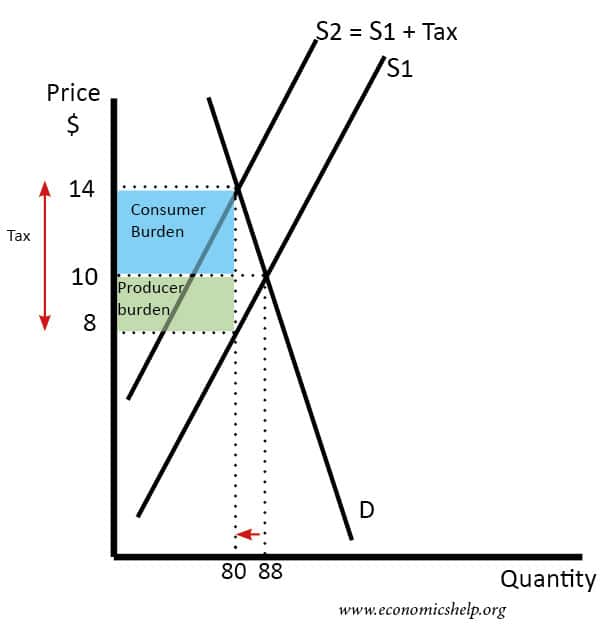

How Does Tax Affect Supply And Demand. Now we should express the price P without taxation through the new price level P_1 when the. One way to think about it is the supply curve from the consumers point of view is going to be shifted a dollar more than the supply curve from the producers point of view. Any tax on a business will affect its supply. When demand happens to be price inelastic and supply is price elastic the majority of the tax burden falls upon the consumer.

Supply And Demand Acqnotes From acqnotes.com

Supply And Demand Acqnotes From acqnotes.com

Similarly the price the seller obtains falls but by less than the tax. The tax paid by the. Fiscal policy affects aggregate demand through changes in government spending and taxation. If price rises by more than the amount of the tax there will be excess supply. How do taxes affect a supply curve. Any tax on a business will affect its supply.

In order to get them to produce it all youre going to have to pay at least 2 but then if the suppliers or producers are getting 2 the consumers are going to have to pay a dollar more for the tax.

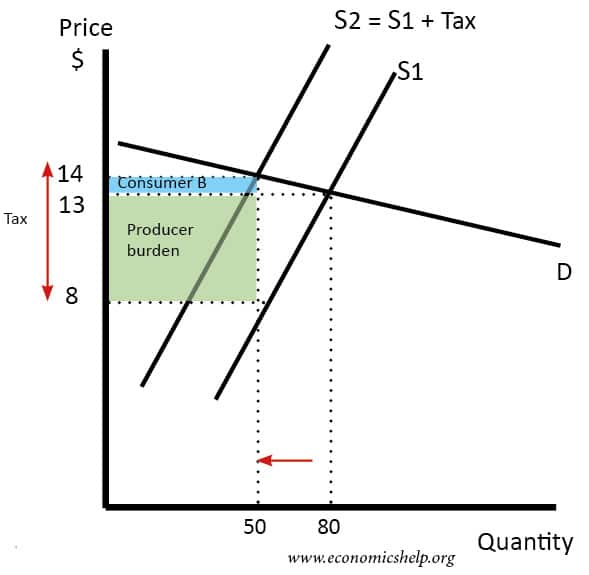

If the supply curve is relatively flat the supply is price elastic. In the graph above the total tax paid by the producer and the consumer is equal to P 0 P 2. This is why it really doesnt matter who pays the tax workers or firms because the end result will be the same. Similarly the price the seller obtains falls but by less than the tax. A tax increases the price a buyer pays by less than the tax. This video goes over some brief examples showing how a tax on sellers and then a tax on consumers will affect the efficient equilibrium in a supply and deman.

Taxes increase the costs of producing and selling items which the business may pass on to the consumer in the form of higher prices. If the supply curve is relatively flat the supply is price elastic. When demand happens to be price inelastic and supply is price elastic the majority of the tax burden falls upon the consumer. The effect of the tax on the supply-demand equilibrium is to shift the quantity toward a point where the before-tax demand minus the before-tax supply is the amount of the tax. How do taxes affect a supply curve.

Source: pinterest.com

Source: pinterest.com

The effect of the tax cut on the short-run aggregate supply SRAS curve depends on which model you use. This would have the same result as a tax on suppliers resulting in hire wages paid but lower wages received. How do taxes affect a supply curve. In some cases a government may impose a tax on a certain goodsuch as tobacco or alcoholwith the specific intention of reducing the quantity that is consumed. 2136 if price rises from P 0 to P 2 each of the firms would be eager to produce q 2 units instead of q 0.

Source: economicshelp.org

Source: economicshelp.org

Does taxes increase aggregate demand. The tax paid by the. Taxation shifts a supply curve to the left. When demand happens to be price inelastic and supply is price elastic the majority of the tax burden falls upon the consumer. The relative effect on buyers and sellers is known as the incidence of the tax.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

If the supply curve is relatively flat the supply is price elastic. The effect of the tax on the supply-demand equilibrium is to shift the quantity toward a point where the before-tax demand minus the before-tax supply is the amount of the tax. A tax increases the price a buyer pays by less than the tax. Tax increases If the government increases the tax on a good that shifts the supply curve to the left consumer prices rise and sellers prices fall. The tax paid by the.

Source: in.pinterest.com

Source: in.pinterest.com

This is why it really doesnt matter who pays the tax workers or firms because the end result will be the same. At a given level of demand taxations reduction of incentives will result in. If price rises by more than the amount of the tax there will be excess supply. In new plant factories and technologies. If you want help developing the intuition–or see some examples– of how taxes affect the supply and demand of goods and services potentially the labor.

Source: economicshelp.org

Source: economicshelp.org

In order to get them to produce it all youre going to have to pay at least 2 but then if the suppliers or producers are getting 2 the consumers are going to have to pay a dollar more for the tax. A tax increases the price a buyer pays by less than the tax. This would have the same result as a tax on suppliers resulting in hire wages paid but lower wages received. When demand happens to be price inelastic and supply is price elastic the majority of the tax burden falls upon the consumer. What factors affect the supply and demand of loanable funds.

Source: pinterest.com

Source: pinterest.com

This video goes over some brief examples showing how a tax on sellers and then a tax on consumers will affect the efficient equilibrium in a supply and deman. In the case of an indirect tax we need to modify our function of supply since the tax is collected from the sellers the demand function will not change. This would then cause an outward shift of aggregate demand ADCIGX-M. How do taxes affect a supply curve. The effect of the tax on the supply-demand equilibrium is to shift the quantity toward a point where the before-tax demand minus the before-tax supply is the amount of the tax.

In some cases a tax may cause a decrease in demand of products consumed primarily by individual consumers and an increase in demand of products consumed primarily by firms or government. Those factors influence employment and household income which then impact consumer spending and investment. The effect of the tax cut on the short-run aggregate supply SRAS curve depends on which model you use. This would have the same result as a tax on suppliers resulting in hire wages paid but lower wages received. In this case the tax will primarily affect the amount of supply leading to increased sales costs and reduced supply at any level and also transmission of the supply curve to t he left and up and.

Source: acqnotes.com

Source: acqnotes.com

If the supply curve is relatively flat the supply is price elastic. In this case the tax will primarily affect the amount of supply leading to increased sales costs and reduced supply at any level and also transmission of the supply curve to t he left and up and. Tax increases If the government increases the tax on a good that shifts the supply curve to the left consumer prices rise and sellers prices fall. A fall in corporation tax will increase the post-tax profits of businesses In theory this will increase funds available to fund capital investment eg. The relative effect on buyers and sellers is known as the incidence of the tax.

Source: pinterest.com

Source: pinterest.com

In the case of an indirect tax we need to modify our function of supply since the tax is collected from the sellers the demand function will not change. Tax increases If the government increases the tax on a good that shifts the supply curve to the left consumer prices rise and sellers prices fall. In new plant factories and technologies. In the graph above the total tax paid by the producer and the consumer is equal to P 0 P 2. In this case the tax will primarily affect the amount of supply leading to increased sales costs and reduced supply at any level and also transmission of the supply curve to t he left and up and.

Source: pinterest.com

Source: pinterest.com

Fiscal policy affects aggregate demand through changes in government spending and taxation. How do taxes affect a supply curve. Tax increases do not affect the demand curve nor do they increase supply or demand more or less. A fall in corporation tax will increase the post-tax profits of businesses In theory this will increase funds available to fund capital investment eg. In the model of aggregate demand and aggregate supply a tax rate increase will shift the aggregate demand curve to the left by an amount equal to the initial change in aggregate expenditures induced by.

Source: sanandres.esc.edu.ar

Source: sanandres.esc.edu.ar

While supply for the product has not changed all of the determinants of supply are the same producers incur higher cost which is why we will see a new equilibrium point further up the demand curve at a higher. The effect of the tax on the supply-demand equilibrium is to shift the quantity toward a point where the before-tax demand minus the before-tax supply is the amount of the tax. In this case the tax will primarily affect the amount of supply leading to increased sales costs and reduced supply at any level and also transmission of the supply curve to t he left and up and. This would then cause an outward shift of aggregate demand ADCIGX-M. 2136 if price rises from P 0 to P 2 each of the firms would be eager to produce q 2 units instead of q 0.

Source: id.pinterest.com

Source: id.pinterest.com

Any tax on a business will affect its supply. In the model of aggregate demand and aggregate supply a tax rate increase will shift the aggregate demand curve to the left by an amount equal to the initial change in aggregate expenditures induced by. Similarly the price the seller obtains falls but by less than the tax. Does taxes increase aggregate demand. This would have the same result as a tax on suppliers resulting in hire wages paid but lower wages received.

Source: pinterest.com

Source: pinterest.com

In this case the tax will primarily affect the amount of supply leading to increased sales costs and reduced supply at any level and also transmission of the supply curve to t he left and up and. Now we should express the price P without taxation through the new price level P_1 when the. How do taxes affect a supply curve. Tax increases If the government increases the tax on a good that shifts the supply curve to the left consumer prices rise and sellers prices fall. If you want help developing the intuition–or see some examples– of how taxes affect the supply and demand of goods and services potentially the labor.

Source: economicshelp.org

Source: economicshelp.org

Some of these factors for loanable funds include the same factors that affect demand or supply generally including technology improvements shift in consumer tastes substitution possibilities changes in income of consumers taxes etc. A tax increases the price a buyer pays by less than the tax. While supply for the product has not changed all of the determinants of supply are the same producers incur higher cost which is why we will see a new equilibrium point further up the demand curve at a higher. In order to get them to produce it all youre going to have to pay at least 2 but then if the suppliers or producers are getting 2 the consumers are going to have to pay a dollar more for the tax. In the model of aggregate demand and aggregate supply a tax rate increase will shift the aggregate demand curve to the left by an amount equal to the initial change in aggregate expenditures induced by.

Source: economicshelp.org

Source: economicshelp.org

In this case the tax will primarily affect the amount of supply leading to increased sales costs and reduced supply at any level and also transmission of the supply curve to t he left and up and. In this case the tax will primarily affect the amount of supply leading to increased sales costs and reduced supply at any level and also transmission of the supply curve to t he left and up and. A tax increases the price a buyer pays by less than the tax. At a given level of demand taxations reduction of incentives will result in. This would then cause an outward shift of aggregate demand ADCIGX-M.

In the case of an indirect tax we need to modify our function of supply since the tax is collected from the sellers the demand function will not change. Some of these factors for loanable funds include the same factors that affect demand or supply generally including technology improvements shift in consumer tastes substitution possibilities changes in income of consumers taxes etc. How do taxes affect a supply curve. Taxes on supply and demand The VAT on the suppliers will shift the supply curve to the left symbolizing a reduction in supply similar to firms facing higher input costs. The tax paid by the.

Source: pinterest.com

Source: pinterest.com

If you want help developing the intuition–or see some examples– of how taxes affect the supply and demand of goods and services potentially the labor. When demand happens to be price inelastic and supply is price elastic the majority of the tax burden falls upon the consumer. A tax increases the price a buyer pays by less than the tax. In order to get them to produce it all youre going to have to pay at least 2 but then if the suppliers or producers are getting 2 the consumers are going to have to pay a dollar more for the tax. Any tax on a business will affect its supply.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how does tax affect supply and demand by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.