Your Hicksian model economics images are available in this site. Hicksian model economics are a topic that is being searched for and liked by netizens now. You can Find and Download the Hicksian model economics files here. Get all royalty-free photos.

If you’re looking for hicksian model economics pictures information connected with to the hicksian model economics interest, you have visit the right site. Our website always provides you with suggestions for seeing the maximum quality video and picture content, please kindly hunt and locate more enlightening video articles and graphics that match your interests.

Hicksian Model Economics. PARIKH1 Institute of Economics University of Oslo The hicksian model In a nutshell the Hicksian model2 can be described as follows if time is denoted by t say calender year. Sir John Hicks was a British economist. It net induced. He is considered one of the most important and influential economists of the twentieth century.

Figure 1 Hierarchical Diagram Of A Multiple Linear Regression Model With Three Linear Regression Regression Anova From pinterest.com

Figure 1 Hierarchical Diagram Of A Multiple Linear Regression Model With Three Linear Regression Regression Anova From pinterest.com

Given the marginal propensity to consume the simple multiplier is determined. The solution to this problem is called the Hicksian demand or compensated demand. Sir John Hicks was a British economist. In the paper Hicksian Income in the Conceptual Framework which is forthcoming in Abacus my co-authors Michael Bromwich and Richard Macve both at the London School of Economics and I provide an analytical and critical case study of the use of income theory in accounting policy making. Ii The saving and investment coefficients are such that an upward displacement from the equilibrium path will tend to cause a movement away from equilibrium though this movement. The Financial Accounting Standards Board FASB and the.

In the economics profession John Hicks is mainly known for his work during the 1930s.

A potentially useful nonparametric alternative is data envelopment. The use of elasticities of substitution between inputs is a standard method for addressing the effect of a change in the mix of inputs used for production from a technical or cost standpoint. Then the magnitude of multiplier and autonomous investment together determine the equilibrium path of income shown by the line LL. His book Value and. In the economics profession John Hicks is mainly known for his work during the 1930s. Hicksian Theory of Trade Cycle.

Source: pinterest.com

Source: pinterest.com

Hicksian Theory of Trade Cycle. The expenditure function is therefore given by ep1pNu min x1xN XN i1 pixi subject to ux1xN u xi 0 for all i. The Hicksian demand allows us to isolate the pure substitution effect in response to a price change. The accelerator is the ratio of change in consumption on investment. The most familiar of his many contributions in the field of economics were his statement of consumer demand theory in microeconomics and the ISLM model which summarised a Keynesian view of macroeconomics.

Source: pinterest.com

Source: pinterest.com

We call it compensated since it is derived following the idea that after a price change the consumer will be given enough wealth the compensation to maintain the same utility level she experienced before the price change. The solution to this problem is called the Hicksian demand or compensated demand. The expenditure function is therefore given by ep1pNu min x1xN XN i1 pixi subject to ux1xN u xi 0 for all i. It net induced. Notation for five variables.

Source: pinterest.com

Source: pinterest.com

Free Online Library. Just like Samuelsons model this theory is designed to focus some crucial. Gt private consumption. Then the magnitude of multiplier and autonomous investment together determine the equilibrium path of income shown by the line LL. Hicks presented in 1951 a theory of business cycles which is a modified version of the theory put forward by Paul Samuelson in 1939 known as Samuelson in 1939 known as Samuelsons multiplier-accelerator interaction theory of business cycles.

Source: pinterest.com

Source: pinterest.com

The Financial Accounting Standards Board FASB and the. He is considered one of the most important and influential economists of the twentieth century. By Southern Economic Journal. Sir John Hicks was a British economist. A potentially useful nonparametric alternative is data envelopment.

Source: pinterest.com

Source: pinterest.com

The Hicksian demand allows us to isolate the pure substitution eect in response to a price change. According to him the business cycles have historically occurred against the background of economic growth and. Hicksian Theory of Trade Cycle. Notation for five variables. HICKSIAN MODEL By RAGNAR FRISCH Assisted by ASHOK K.

Source:

Source:

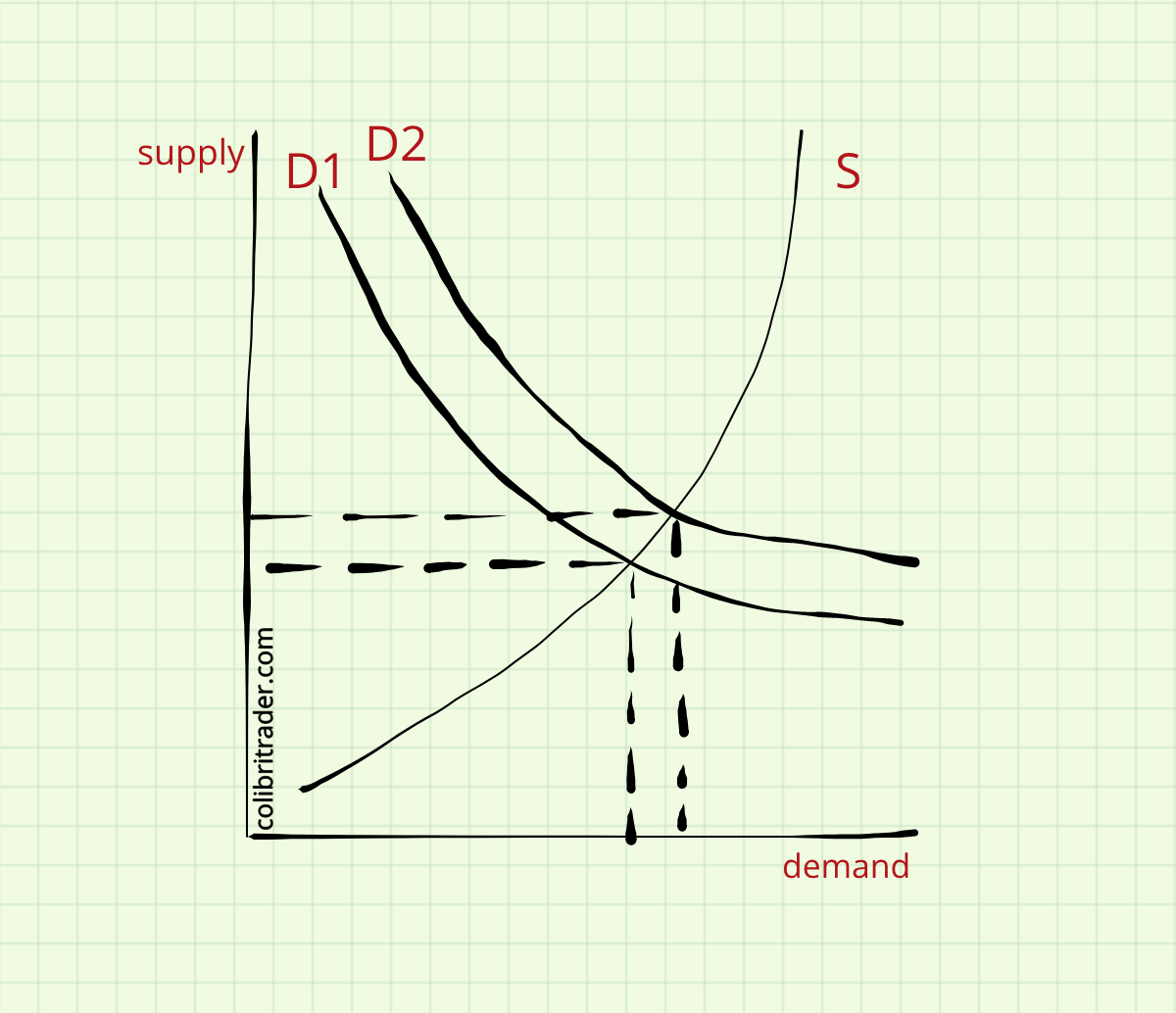

The use of elasticities of substitution between inputs is a standard method for addressing the effect of a change in the mix of inputs used for production from a technical or cost standpoint. Hicksian Marshallian Demand For a normal good the Hicksian demand curve is less responsive to price changes than is the uncompensated demand curve the uncompensated demand curve reflects both income and substitution effects the compensated demand curve reflects only substitution effects. The Hicksian demand allows us to isolate the pure substitution effect in response to a price change. Ii The saving and investment coefficients are such that an upward displacement from the equilibrium path will tend to cause a movement away from equilibrium though this movement. The use of elasticities of substitution between inputs is a standard method for addressing the effect of a change in the mix of inputs used for production from a technical or cost standpoint.

Source: pinterest.com

Source: pinterest.com

The use of elasticities of substitution between inputs is a standard method for addressing the effect of a change in the mix of inputs used for production from a technical or cost standpoint. Gt private consumption. During the 1950s Hicks used IS-LM to elucidate several issues as in his Trade Cycle book and his review of Don Patinkins Money Interest and. The Hicksian demand allows us to isolate the pure substitution eect in response to a price change. The Hicksian demand allows us to isolate the pure substitution effect in response to a price change.

Source: pinterest.com

Source: pinterest.com

Hicks presented in 1951 a theory of business cycles which is a modified version of the theory put forward by Paul Samuelson in 1939 known as Samuelson in 1939 known as Samuelsons multiplier-accelerator interaction theory of business cycles. The expenditure function is therefore given by ep1pNu min x1xN XN i1 pixi subject to ux1xN u xi 0 for all i. In the economics profession John Hicks is mainly known for his work during the 1930s. HICKSIAN MODEL By RAGNAR FRISCH Assisted by ASHOK K. During the 1950s Hicks used IS-LM to elucidate several issues as in his Trade Cycle book and his review of Don Patinkins Money Interest and.

Source: ar.pinterest.com

Source: ar.pinterest.com

By Southern Economic Journal. The accelerator is the ratio of change in consumption on investment. Up to 10 cash back The purpose of this paper is to describe the implications of the collective model of household behavior for the methods used to estimate the economic value of non-marketed environmental resources. After demonstrating how the separability restrictions inherent in the collective model allow individual preference and household income allocation choices to. This paper is aimed at tracing the further development of Hicks thinking focussing on his IS-LM apparatus.

Source: pinterest.com

Source: pinterest.com

JR Hicks attributed the theory of the business cycle by explaining the combined action of multiplier and accelerator. Hicksian Theory of Trade Cycle. PARIKH1 Institute of Economics University of Oslo The hicksian model In a nutshell the Hicksian model2 can be described as follows if time is denoted by t say calender year. Up to 10 cash back The purpose of this paper is to describe the implications of the collective model of household behavior for the methods used to estimate the economic value of non-marketed environmental resources. The use of elasticities of substitution between inputs is a standard method for addressing the effect of a change in the mix of inputs used for production from a technical or cost standpoint.

Source: pinterest.com

Source: pinterest.com

In the economics profession John Hicks is mainly known for his work during the 1930s. Hicksian or Compensated or Utility constant demand functions yield the amount of good x 1 purchased at prices p 1 and p 2 when income is just high enough to get utility level u0. Hicksian Theory of Trade Cycle. We call it compensated since it is derived following the idea that after a price change the consumer will be given enough wealth the compensation to maintain the same utility level she experienced before the price change. I In Hicksian analysis a progressive economy is assumed in which autonomous investment is increasing at a regular rate so that system is such which could remain in progressive equilibrium.

Source: pinterest.com

Source: pinterest.com

We call it compensated since it is derived following the idea that after a price change the consumer will be given enough wealth the compensation to maintain the same utility level she experienced before the price change. Ii The saving and investment coefficients are such that an upward displacement from the equilibrium path will tend to cause a movement away from equilibrium though this movement. After demonstrating how the separability restrictions inherent in the collective model allow individual preference and household income allocation choices to. The solution to this problem is called the Hicksian demand or compensated demand. Just like Samuelsons model this theory is designed to focus some crucial.

Source: pinterest.com

Source: pinterest.com

The expenditure function is therefore given by ep1pNu min x1xN XN i1 pixi subject to ux1xN u xi 0 for all i. Free Online Library. Hicksian Theory of Business Cycles Firm. After demonstrating how the separability restrictions inherent in the collective model allow individual preference and household income allocation choices to. The ISLM model or HicksHansen model is a two-dimensional macroeconomic tool that shows the relationship between interest rates and assets market also known as real output in goods and services market plus money market.

Source: pinterest.com

Source: pinterest.com

Hicksian Theory of Trade Cycle. Notation for five variables. The expenditure function is therefore given by ep1pNu min x1xN XN i1 pixi subject to ux1xN u xi 0 for all i. Gt private consumption. Hicksian Marshallian Demand For a normal good the Hicksian demand curve is less responsive to price changes than is the uncompensated demand curve the uncompensated demand curve reflects both income and substitution effects the compensated demand curve reflects only substitution effects.

Source: pinterest.com

Source: pinterest.com

Hicksian Theory of Business Cycles Firm. This paper is aimed at tracing the further development of Hicks thinking focussing on his IS-LM apparatus. Given the marginal propensity to consume the simple multiplier is determined. Most estimation methods use parametric production or cost functions or frontiers to estimate these elasticities. We call it compensated since it is derived following the idea that after a price change the consumer will be given enough wealth the compensation to maintain the same utility level she experienced before the price change.

Source: pinterest.com

Source: pinterest.com

His book Value and. The use of elasticities of substitution between inputs is a standard method for addressing the effect of a change in the mix of inputs used for production from a technical or cost standpoint. In the paper Hicksian Income in the Conceptual Framework which is forthcoming in Abacus my co-authors Michael Bromwich and Richard Macve both at the London School of Economics and I provide an analytical and critical case study of the use of income theory in accounting policy making. The intersection of the investment saving IS and liquidity preference money supply LM curves models general equilibrium where. Given the marginal propensity to consume the simple multiplier is determined.

Source: pinterest.com

Source: pinterest.com

Then the magnitude of multiplier and autonomous investment together determine the equilibrium path of income shown by the line LL. Hicksian Marshallian Demand For a normal good the Hicksian demand curve is less responsive to price changes than is the uncompensated demand curve the uncompensated demand curve reflects both income and substitution effects the compensated demand curve reflects only substitution effects. The expenditure function is therefore given by ep1pNu min x1xN XN i1 pixi subject to ux1xN u xi 0 for all i. In the paper Hicksian Income in the Conceptual Framework which is forthcoming in Abacus my co-authors Michael Bromwich and Richard Macve both at the London School of Economics and I provide an analytical and critical case study of the use of income theory in accounting policy making. It net induced.

Source: pinterest.com

Source: pinterest.com

We call it compensated since it is derived following the idea that after a price change the consumer will be given enough wealth the compensation to maintain the same utility level she experienced before the price change. The ISLM model or HicksHansen model is a two-dimensional macroeconomic tool that shows the relationship between interest rates and assets market also known as real output in goods and services market plus money market. The most familiar of his many contributions in the field of economics were his statement of consumer demand theory in microeconomics and the ISLM model which summarised a Keynesian view of macroeconomics. Lecture Notes 1 Microeconomic Theory Guoqiang TIAN Department of Economics Texas AM University College Station Texas 77843 gtiantamuedu August 2002Revised. Up to 10 cash back Summary.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title hicksian model economics by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.