Your Excise tax supply and demand graph images are available. Excise tax supply and demand graph are a topic that is being searched for and liked by netizens now. You can Find and Download the Excise tax supply and demand graph files here. Download all royalty-free images.

If you’re looking for excise tax supply and demand graph pictures information connected with to the excise tax supply and demand graph topic, you have pay a visit to the ideal blog. Our site always provides you with hints for seeing the maximum quality video and picture content, please kindly surf and locate more enlightening video content and graphics that match your interests.

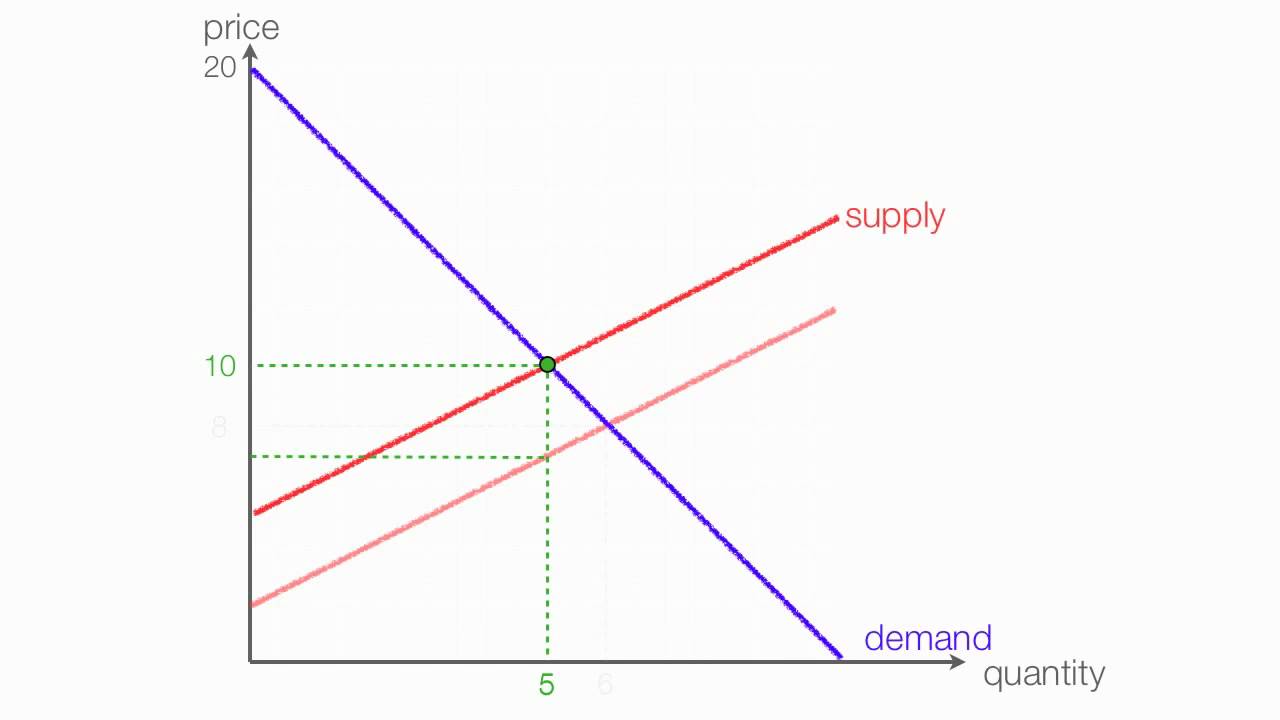

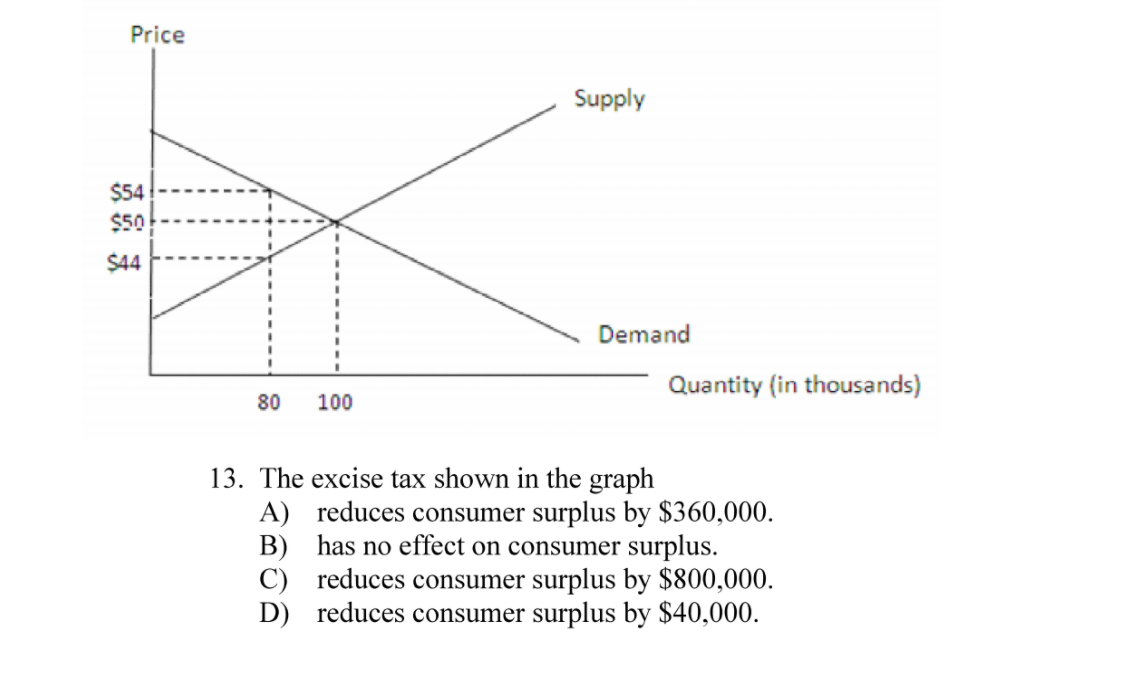

Excise Tax Supply And Demand Graph. In this case the. This Demonstration shows the effect of an excise tax on a perfectly competitive market. 101 THE INVISIBLE HAND EXCISE TAXES AND SUBSIDIES 399 In Case 2 the supply curve from ECON 51400 at Purdue University. 125 125 from each sold kilogram of potatoes.

Use The Figure Below To Answer The Following Question What Is The Amount Of Total Surplus For Society After The Government Imposes The Excise Tax On The Market A 32 B 100 From study.com

Use The Figure Below To Answer The Following Question What Is The Amount Of Total Surplus For Society After The Government Imposes The Excise Tax On The Market A 32 B 100 From study.com

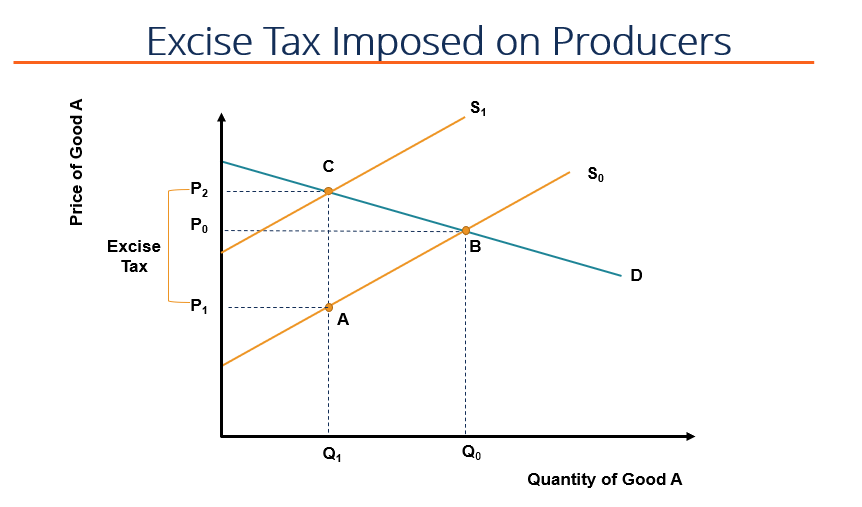

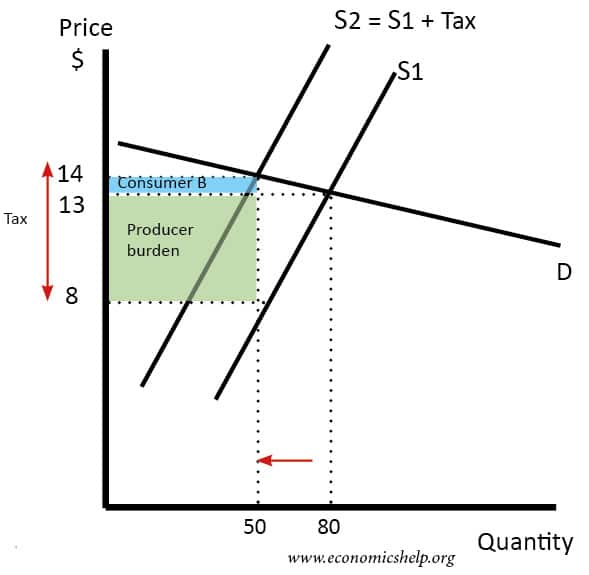

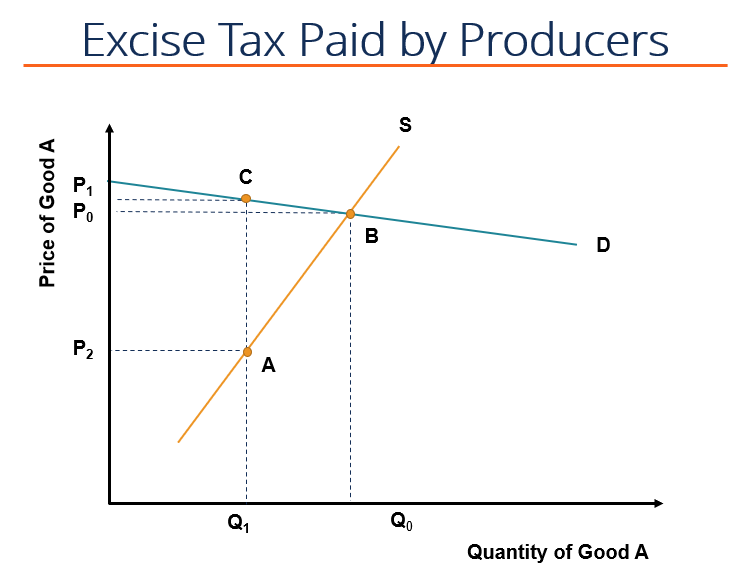

The hatched area under P1 and above the supply curve is producer surplus. When the tax is introduced the consumer surplus orange and producer. Tax On Supply And Demand Graph. The government decides to levy a tax. It is illustrated as the demand curve shifts from position D 0 to D 1. And plot the demand and supply curves if the government has imposed an indirect tax at a rate of.

To analyze a tax passed on completely to the consumers you.

The hatched area under P1 and above the supply curve is producer surplus. And the demand for a good is given by Q D 960 120 P D. It illustrates a concept based on select economic assumptions- it does not reflect a precise. It is illustrated as the demand curve shifts from position D 0 to D 1. 101 THE INVISIBLE HAND EXCISE TAXES AND SUBSIDIES 399 In Case 2 the supply curve from ECON 51400 at Purdue University. Using the graph below show the effect of this tax on tanning salon providers.

Source: quizlet.com

Source: quizlet.com

101 THE INVISIBLE HAND EXCISE TAXES AND SUBSIDIES 399 In Case 2 the supply curve from ECON 51400 at Purdue University. To analyze a tax passed on completely to the consumers you. How To Record Excise Tax Microeconomics Graph. In this case the. Tax incidence is the manner in which the tax burden is divided between buyers and sellers.

Source: ingrimayne.com

Source: ingrimayne.com

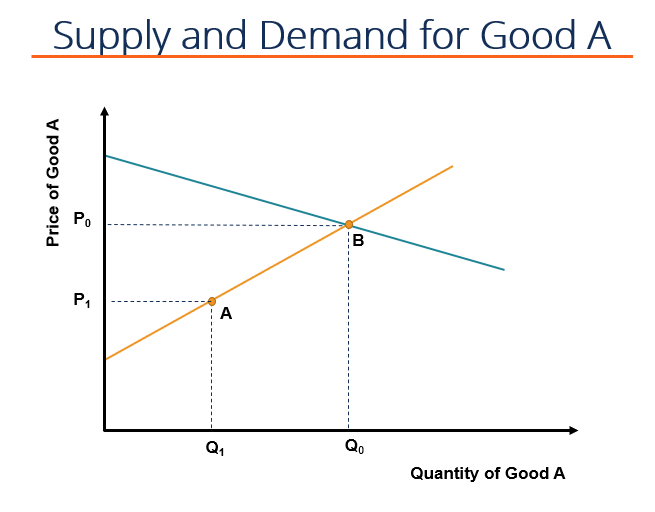

AP is owned by the College Board which does not endorse this site or the above reviewStudy Questions1 Show supply demand with an equilibrium price and. The tax would result in a much lower quantity sold instead of lower prices received. Tax On Supply And Demand Graph. 125 125 from each sold kilogram of potatoes. The supplier will supply less Good A if excise tax is imposed on the producer.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

If excise tax is imposed on consumers the consumers demand for Good A will decrease. The tax would result in a much lower quantity sold instead of lower prices received. Example breaking down tax incidence. Tax On Supply And Demand Graph. Here are a number of highest rated Tax On Supply And Demand Graph pictures upon internet.

Source: youtube.com

Source: youtube.com

Taxes on supply and demand The VAT on the suppliers will shift the supply curve to the left symbolizing a reduction in supply similar to firms facing higher input costs. Example breaking down tax incidence. AP is owned by the College Board which does not endorse this site or the above reviewStudy Questions1 Show supply demand with an equilibrium price and. This Demonstration shows the effect of an excise tax on a perfectly competitive market. The hatched area under P1 and above the supply curve is producer surplus.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Suppose the supply of a good is given by the equation Q S 360 P S 720. Taxes on supply and demand The VAT on the suppliers will shift the supply curve to the left symbolizing a reduction in supply similar to firms facing higher input costs. Your graph implies that both share the tax to some degree. And plot the demand and supply curves if the government has imposed an indirect tax at a rate of. This Demonstration shows the effect of an excise tax on a perfectly competitive market.

Source: study.com

Source: study.com

Use the tool provided New line to draw either a new supply or demand curve that reflects the. How To Record Excise Tax Microeconomics Graph. Hence the new equilibrium quantity after tax can be found from equating P Q3 4 and P 20 Q so Q3 4. This web-based personal project allows the user to graph supply and demand for the products of an industry. We identified it from honorable source.

Source: youtube.com

Source: youtube.com

In this video we break down how to identify consumer surplus producer. The tax would result in a much lower quantity sold instead of lower prices received. How To Record Excise Tax Microeconomics Graph. In this case the. Tax incidence is the manner in which the tax burden is divided between buyers and sellers.

Source: in.pinterest.com

Source: in.pinterest.com

This Demonstration shows the effect of an excise tax on a perfectly competitive market. How To Record Excise Tax Microeconomics Graph. It illustrates a concept based on select economic assumptions- it does not reflect a precise. And plot the demand and supply curves if the government has imposed an indirect tax at a rate of. Tax Example - Excise Tax on Cars - Given different excise taxes calculate changes to the consumer surplus producer surplus dead-weight loss and tax revenu.

Source: economics.stackexchange.com

Source: economics.stackexchange.com

How To Record Excise Tax Microeconomics Graph. This Demonstration shows the effect of an excise tax on a perfectly competitive market. And plot the demand and supply curves if the government has imposed an indirect tax at a rate of. And the demand for a good is given by Q D 960 120 P D. First let us calculate the.

Source: cstl-hcb.semo.edu

Source: cstl-hcb.semo.edu

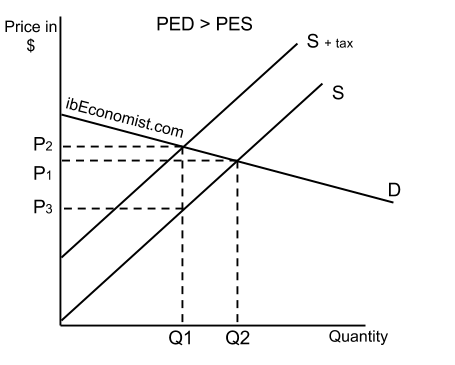

The tax incidence depends on the relative price elasticity of supply and demand. In that case you need a graph that allows for that. 101 THE INVISIBLE HAND EXCISE TAXES AND SUBSIDIES 399 In Case 2 the supply curve from ECON 51400 at Purdue University. To analyze a tax passed on completely to the consumers you. Hence the new equilibrium quantity after tax can be found from equating P Q3 4 and P 20 Q so Q3 4.

Source: ingrimayne.com

Source: ingrimayne.com

When the tax is introduced the consumer surplus orange and producer. Before you begin understand that the economic graph of supply and demand is a model. The supplier will supply less Good A if excise tax is imposed on the producer. When the tax is introduced the consumer surplus orange and producer. How To Record Excise Tax Microeconomics Graph.

Source: chegg.com

Source: chegg.com

In that case you need a graph that allows for that. The tax incidence depends on the relative price elasticity of supply and demand. Here are a number of highest rated Tax On Supply And Demand Graph pictures upon internet. It is illustrated as the demand curve shifts from position D 0 to D 1. Example breaking down tax incidence.

Source: chegg.com

Source: chegg.com

And the demand for a good is given by Q D 960 120 P D. How To Record Excise Tax Microeconomics Graph. The tax would result in a much lower quantity sold instead of lower prices received. Use the tool provided New line to draw either a new supply or demand curve that reflects the. Tax Example - Excise Tax on Cars - Given different excise taxes calculate changes to the consumer surplus producer surplus dead-weight loss and tax revenu.

Source: ibeconomist.com

Source: ibeconomist.com

Suppose the supply of a good is given by the equation Q S 360 P S 720. AP is owned by the College Board which does not endorse this site or the above reviewStudy Questions1 Show supply demand with an equilibrium price and. The government decides to levy a tax. Tax On Supply And Demand Graph. Taxes on supply and demand The VAT on the suppliers will shift the supply curve to the left symbolizing a reduction in supply similar to firms facing higher input costs.

Source: economicshelp.org

Source: economicshelp.org

In that case you need a graph that allows for that. This web-based personal project allows the user to graph supply and demand for the products of an industry. When the tax is introduced the consumer surplus orange and producer. The tax would result in a much lower quantity sold instead of lower prices received. We identified it from honorable source.

Source: pinterest.com

Source: pinterest.com

The tax incidence depends on the relative price elasticity of supply and demand. And the demand for a good is given by Q D 960 120 P D. Taxes on supply and demand The VAT on the suppliers will shift the supply curve to the left symbolizing a reduction in supply similar to firms facing higher input costs. Hence the new equilibrium quantity after tax can be found from equating P Q3 4 and P 20 Q so Q3 4. In this video we break down how to identify consumer surplus producer.

Source: in.pinterest.com

Source: in.pinterest.com

Before you begin understand that the economic graph of supply and demand is a model. The supplier will supply less Good A if excise tax is imposed on the producer. In that case you need a graph that allows for that. The tax incidence depends on the relative price elasticity of supply and demand. Tax incidence is the manner in which the tax burden is divided between buyers and sellers.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

It is illustrated as the demand curve shifts from position D 0 to D 1. With 4 tax on producers the supply curve after tax is P Q3 4. This web-based personal project allows the user to graph supply and demand for the products of an industry. To analyze a tax passed on completely to the consumers you. In this case the.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title excise tax supply and demand graph by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.