Your Demand supply curve subsidy images are ready. Demand supply curve subsidy are a topic that is being searched for and liked by netizens now. You can Get the Demand supply curve subsidy files here. Find and Download all royalty-free images.

If you’re searching for demand supply curve subsidy images information related to the demand supply curve subsidy topic, you have visit the ideal site. Our website always gives you suggestions for seeing the highest quality video and picture content, please kindly search and find more enlightening video articles and graphics that match your interests.

Demand Supply Curve Subsidy. However when the demand curve is elastic the smaller the price fall and the smaller the subsidy gain for consumers as a result of a smaller price fall. We use Foreigns export supply and Homes import demand curves to determine the new world price. Using simultaneous equations calculate the equilibrium price and output. After VAT will be P 02Q 12 Effect of Subsidy on the supply curve.

Subsidies From economicsonline.co.uk

Subsidies From economicsonline.co.uk

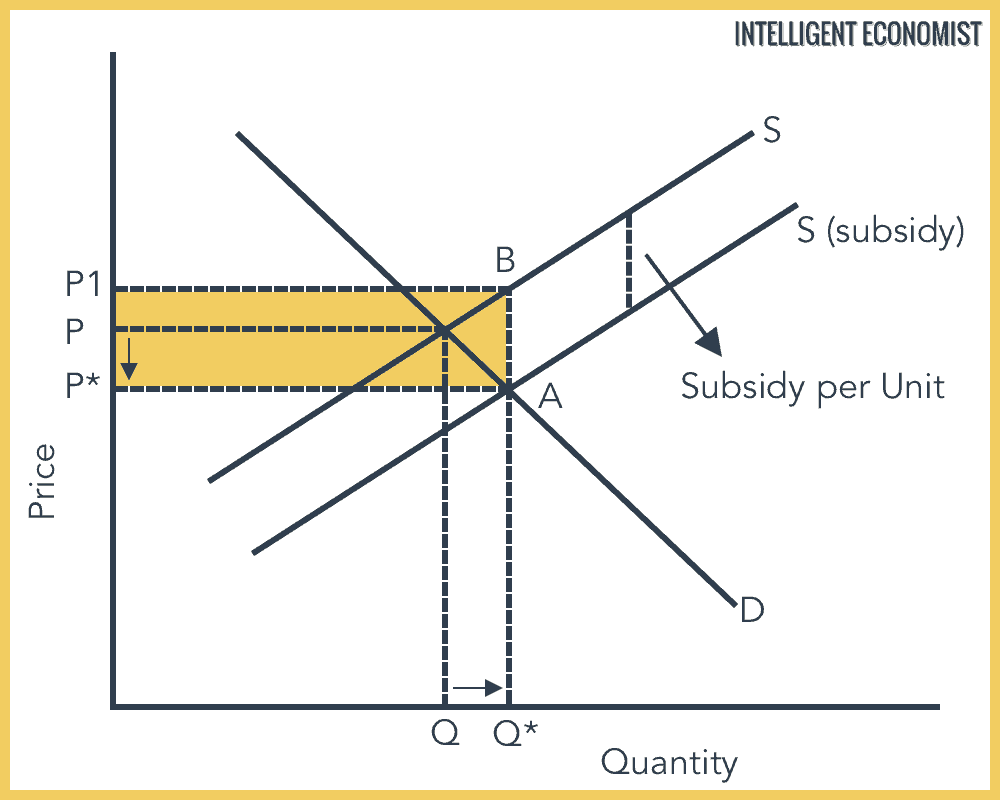

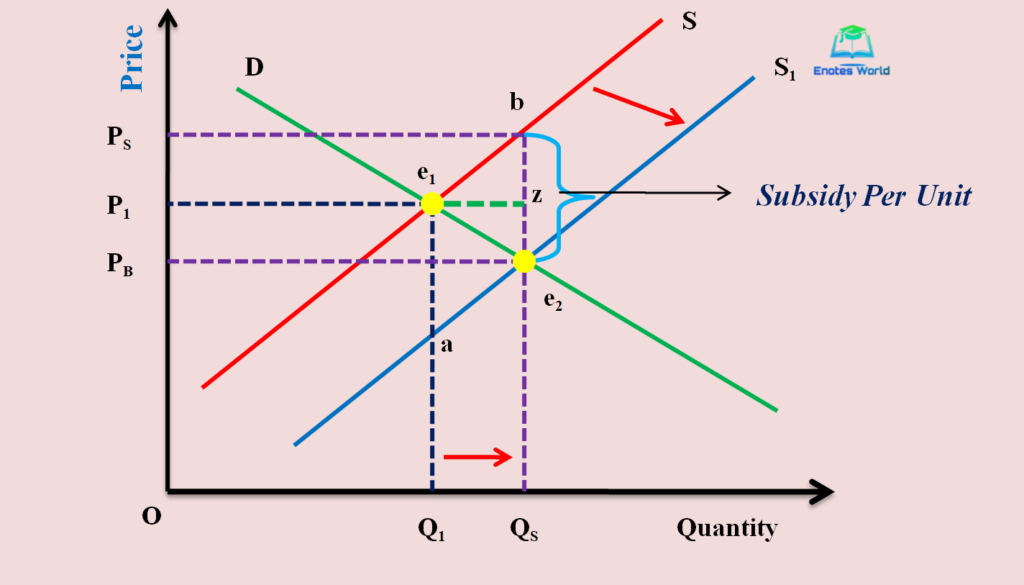

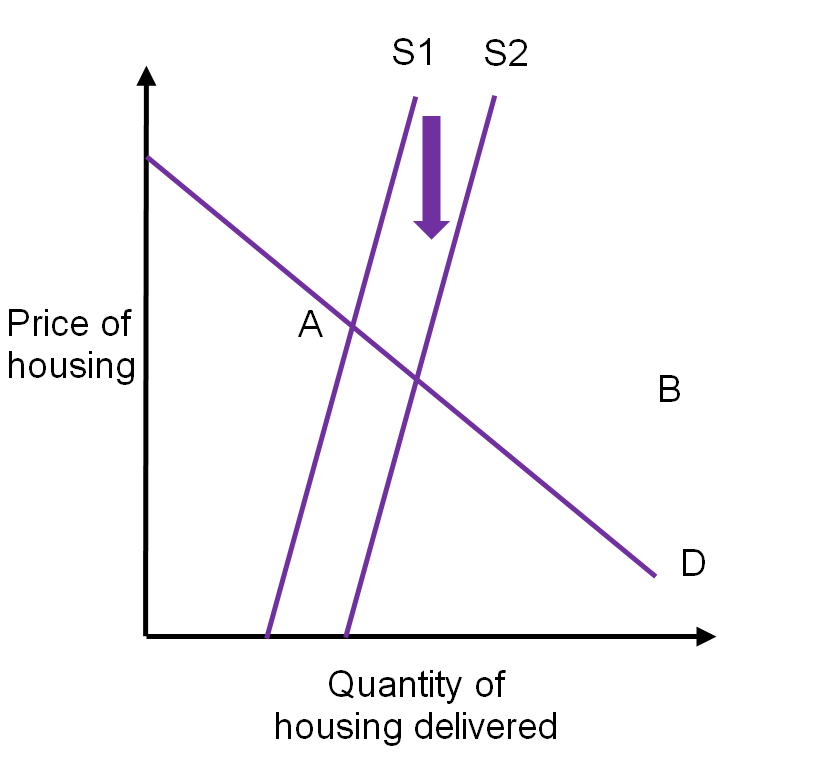

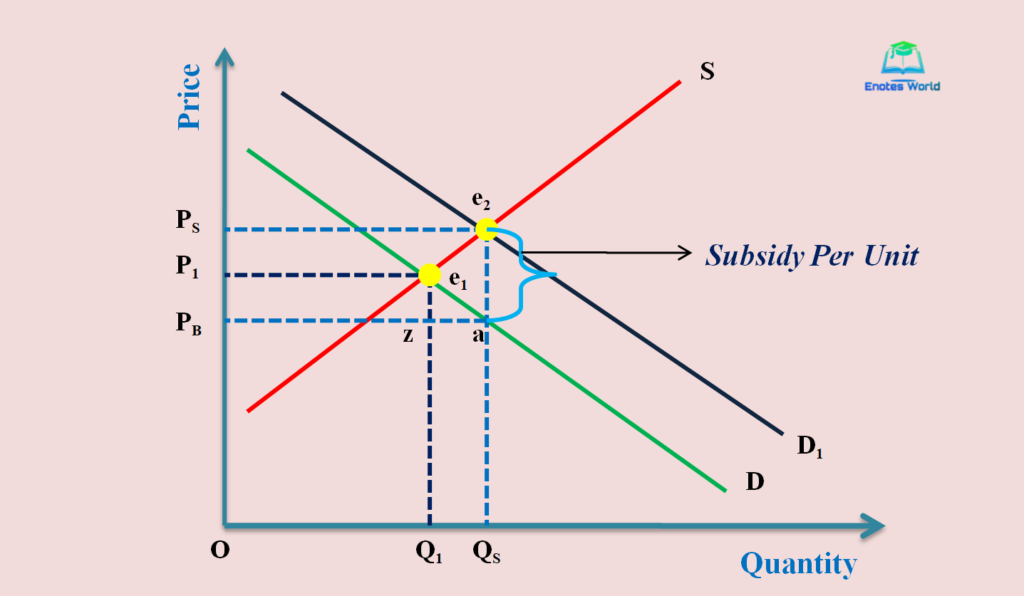

The effect of a subsidy is to shift the supply or demand curve to the right ie. Shows how much of a good consumers are willing to buy as the price per unit changes. An Indirect tax will shift the supply curve upwards by a certain percentage. Note that the demand curve in. More specifically the equilibrium with the subsidy is at the quantity where the corresponding price to the producer given by the supply curve is equal to the price that the consumer pays given by the demand curve plus the amount of the subsidy. More specifically the equilibrium with the subsidy is at the quantity where the corresponding price to the producer given by the supply curve is equal to the price that the consumer pays given by the demand curve plus the amount of the subsidy.

If the government gives a subsidy per unit of 3 plot the new supply curve on the original supply and demand diagram.

1 Consumer surplus is the difference between the height of the demand curve ie willingness to pay and. Conceptually you could pay the subsidy to each consumer in which case for any demanded quantity consumers would be able to pay a higher price demand shifts to the right. Because of the shape of the supply and demand curves this quantity is going to be greater than the. The Foreign supply of exports curve with a Foreign subsidy of 05 per unit becomes XS 40 401 05 PSet MD XS 80-40P -4060P 100P120 so new P World 120 due to subsidy. The equilibrium world price is 12 and the internal Foreign price is 18 12P105. An Indirect tax will shift the supply curve upwards by a certain percentage.

Source: intelligenteconomist.com

Source: intelligenteconomist.com

So in the standard scenario a subsidy shifts the curves to the right depending on who gets it. Plot these figures to give the demand and supply curves for the product. Subsidies shift the supply or demand curve to the right ie. A specific tax will shift the supply curve upwards by 5. The effect of a specific per unit subsidy is to shift the supply curve vertically downwards by the amount of the subsidy.

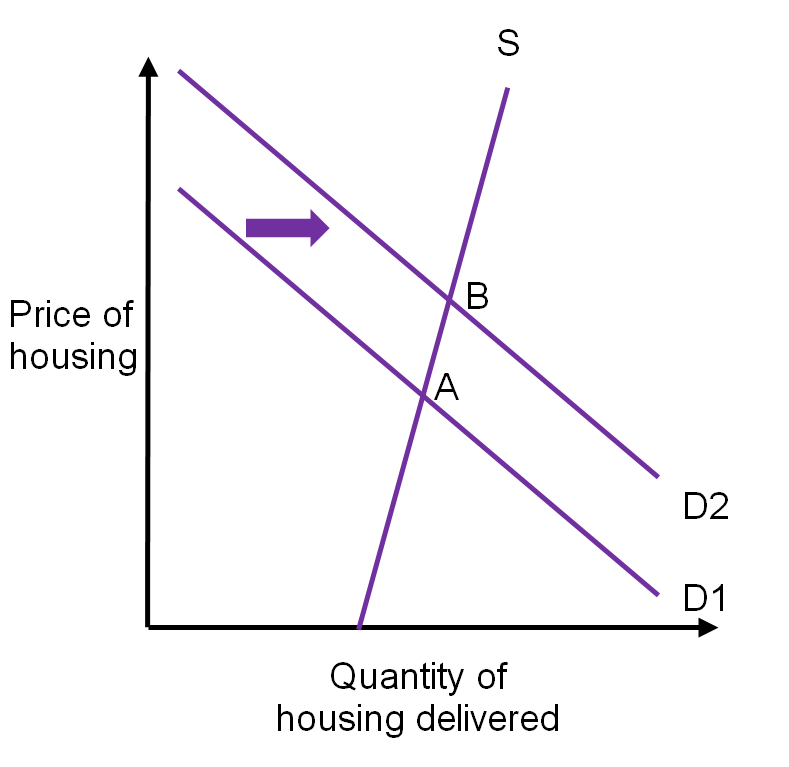

1 Consumer surplus is the difference between the height of the demand curve ie willingness to pay and. The Effects of Subsidies on the Supply Demand Curve. The abolition of a government subsidy f Weatherclimatic conditions negatively affecting market supply of primary commodities. Suppose we have a supply curve. When the government provides a supply-side subsidy to the producers of a product the supply curve shifts to the right and the demand curve remains the same.

Source: economywise.co.uk

Source: economywise.co.uk

The equilibrium with the subsidy is determined at the intersection of the demand curve and the supply curve with the subsidy S subsidy where the market-clearing. Cause a shift in the demand or the supply curves Government intervention in the price mechanism can. In the case of a consumer receiving a subsidy the price of a good decreases increasing demand which shifts the demand curve to the right. B they deserve the subsidy more. An Indirect tax will shift the supply curve upwards by a certain percentage.

Source: theigc.org

Source: theigc.org

Using simultaneous equations calculate the equilibrium price and output. The equilibrium world price is 12 and the internal Foreign price is 18 12P105. If the government gives a subsidy per unit of 3 plot the new supply curve on the original supply and demand diagram. After tax the supply curve will be. Subsidies are grants given to businesses or customers in order to boost sales.

Source: pinterest.com

Source: pinterest.com

Because they are being subsidized producersare encouraged to produce more of a product and are able to do so for less. D Consumers can never benefit more than sellers from a subsidy to sellers. Consumers may benefit more than sellers from a subsidy to sellers if. We use Foreigns export supply and Homes import demand curves to determine the new world price. The abolition of a government subsidy f Weatherclimatic conditions negatively affecting market supply of primary commodities.

Source: studypug.com

Source: studypug.com

If the subsidy is given to the buyers they can afford more than previous and as a result the demand curve shifts towards right. After tax the supply curve will be. These grants are used whenever there is a shortage in supply. 1 Consumer surplus is the difference between the height of the demand curve ie willingness to pay and. A specific tax will shift the supply curve upwards by 5.

Source: enotesworld.com

Source: enotesworld.com

The economic incidence of a subsidy indicates who is made better off. Increases supply or demand ie. The economic incidence of a subsidy indicates who is made better off. 2 Producer surplus is the difference between the price ie per unit revenue and the height of the supply curve ie marginal cost. The Foreign supply of exports curve with a Foreign subsidy of 05 per unit becomes XS 40 401 05 PSet MD XS 80-40P -4060P 100P120 so new P World 120 due to subsidy.

Source: economywise.co.uk

Source: economywise.co.uk

The effect of a subsidy is to shift the supply or demand curve to the right ie. So in the standard scenario a subsidy shifts the curves to the right depending on who gets it. Note that the demand curve in. C the demand curve is relatively less elastic than the supply curve. A the demand curve is relatively more elastic than the supply curve.

Source: theigc.org

Source: theigc.org

How to solve a supply and demand problem with a per-unit government subsidy. We use Foreigns export supply and Homes import demand curves to determine the new world price. We can write this relationship between quantity demanded and price as an equation. The Foreign supply of exports curve with a Foreign subsidy of 05 per unit becomes XS 40 401 05 PSet MD XS 80-40P -4060P 100P120 so new P World 120 due to subsidy. Suppose we have a supply curve.

Source: pinterest.com

Source: pinterest.com

A the demand curve is relatively more elastic than the supply curve. So in the standard scenario a subsidy shifts the curves to the right depending on who gets it. C the demand curve is relatively less elastic than the supply curve. In the case of a consumer receiving a subsidy the price of a good decreases increasing demand which shifts the demand curve to the right. In this case the new supply curve will be parallel to the original.

Source: economicsonline.co.uk

Source: economicsonline.co.uk

An Indirect tax will shift the supply curve upwards by a certain percentage. The abolition of a government subsidy f Weatherclimatic conditions negatively affecting market supply of primary commodities. 2 Producer surplus is the difference between the price ie per unit revenue and the height of the supply curve ie marginal cost. If the government gives a subsidy per unit of 3 plot the new supply curve on the original supply and demand diagram. A subsidy occurs when the government pays a firm directly or reduces the firms taxes if the firm carries out certain actions.

If a consumer is receiving the subsidy a lower price of a good resulting from the marginal subsidy on consumption increases demand shifting the demand curve to the right. An excise subsidy to producers shifts their supply curve downward vertically by the amount of the subsidy because the subsidy decreases the producers marginal cost of production. 1 Consumer surplus is the difference between the height of the demand curve ie willingness to pay and. Using simultaneous equations calculate the equilibrium price and output. Cause a shift in the demand or the supply curves Government intervention in the price mechanism can.

Source: ec2014marielouiseschnetz.wordpress.com

Source: ec2014marielouiseschnetz.wordpress.com

More specifically the equilibrium with the subsidy is at the quantity where the corresponding price to the producer given by the supply curve is equal to the price that the consumer pays given by the demand curve plus the amount of the subsidy. Because they are being subsidized producersare encouraged to produce more of a product and are able to do so for less. The equilibrium world price is 12 and the internal Foreign price is 18 12P105. A subsidy occurs when the government pays a firm directly or reduces the firms taxes if the firm carries out certain actions. Because of the shape of the supply and demand curves this quantity is going to be greater than the.

Source: enotesworld.com

Source: enotesworld.com

The Effects of Subsidies on the Supply Demand Curve. Subsidies are grants given to businesses or customers in order to boost sales. We use Foreigns export supply and Homes import demand curves to determine the new world price. The effect of a subsidy is to shift the supply or demand curve to the right ie. An Indirect tax will shift the supply curve upwards by a certain percentage.

Source: researchgate.net

Source: researchgate.net

The effect of a subsidy is to shift the supply or demand curve to the right ie. In the case of a consumer receiving a subsidy the price of a good decreases increasing demand which shifts the demand curve to the right. Because they are being subsidized producersare encouraged to produce more of a product and are able to do so for less. An Indirect tax will shift the supply curve upwards by a certain percentage. A subsidy occurs when the government pays a firm directly or reduces the firms taxes if the firm carries out certain actions.

More specifically the equilibrium with the subsidy is at the quantity where the corresponding price to the producer given by the supply curve is equal to the price that the consumer pays given by the demand curve plus the amount of the subsidy. The economic incidence of a subsidy indicates who is made better off. If the subsidy is given to the buyers they can afford more than previous and as a result the demand curve shifts towards right. The incidence of a subsidy. A subsidy occurs when the government pays a firm directly or reduces the firms taxes if the firm carries out certain actions.

Source: studypug.com

Source: studypug.com

Cause a shift in the demand or the supply curves Government intervention in the price mechanism can. If the subsidy is given to the buyers they can afford more than previous and as a result the demand curve shifts towards right. Using simultaneous equations calculate the equilibrium price and output. B they deserve the subsidy more. The effect of a subsidy is to shift the supply or demand curve to the right ie.

Source: sanandres.esc.edu.ar

Source: sanandres.esc.edu.ar

If a consumer is receiving the subsidy a lower price of a good resulting from the marginal subsidy on consumption increases demand shifting the demand curve to the right. A government subsidy on the other hand is the opposite of a tax. Shows how much of a good consumers are willing to buy as the price per unit changes. 1 Consumer surplus is the difference between the height of the demand curve ie willingness to pay and. If the subsidy is given to the buyers they can afford more than previous and as a result the demand curve shifts towards right.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title demand supply curve subsidy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.