Your Demand shock vs supply shock images are ready in this website. Demand shock vs supply shock are a topic that is being searched for and liked by netizens today. You can Download the Demand shock vs supply shock files here. Download all free photos and vectors.

If you’re searching for demand shock vs supply shock images information linked to the demand shock vs supply shock interest, you have pay a visit to the right blog. Our website always provides you with hints for refferencing the highest quality video and picture content, please kindly search and locate more informative video content and graphics that match your interests.

Demand Shock Vs Supply Shock. So the demand and supply shocks dovetail nicely. New buildings decrease nearby rents by 5 to 7. Economists often refer to this as the long run neutrality of money. Today demand is surging and supply is also growing but it just cant keep up with demand.

Demand Fall And Supply Rises By The Same Amount Law Of Demand Equilibrium Demand From pinterest.com

Demand Fall And Supply Rises By The Same Amount Law Of Demand Equilibrium Demand From pinterest.com

Other commodity prices tend to be positively correlated with the price of oil although the strength of this correlation is weaker in the case of an oil supply shock than in the case of a demand shock. Other demand shocks do not. Instead of computing how many workers may lose their jobs we can compute by how much paid wages will decrease. Demand shocks are factors that cause a temporary increase or decrease from the standard level of aggregate demand. 5 One can thus identify labor supply and demand shocks given data on hours and wages and values for the elasticities. Demand shocks can last from a few days to several years.

Lockdown measures preventing workers from doing their jobs can be seen as a supply shock.

Economists often refer to this as the long run neutrality of money. We study the local effects of new market-rate housing in low-income areas using microdata on large apartment buildings rents and migration. Demand shocks strongly affect prices for about 10 years while commodity supply shocks impact prices for roughly five years. Along with the loss of income which leads to the demand shock one needs to account for the widespread and long-lasting supply chain disruptions. Supply Shock Versus Demand Shock. Bloomberg has an excellent article on how the Global Economy Is Gripped by Rare Twin Supply-Demand Shock.

Source: pinterest.com

Source: pinterest.com

Worth checking out Bloombergs Odd Lots podcast as theyve done a number of episodes on the supply chain over the last year. But Chicago Booths Veronica Guerrieri says that what starts as a supply shock can become a demand shockand that the demand effects can grow larger than the supply shock that caused them. Bloomberg has an excellent article on how the Global Economy Is Gripped by Rare Twin Supply-Demand Shock. Both prices of transactions and quantity supplied and consumed will move in the same direction as the aggregate demand. We measure labor demand and supply shocks at the sector level around the COVID-19 outbreak by estimating a Bayesian structural vector autoregression on.

Source: pinterest.com

Source: pinterest.com

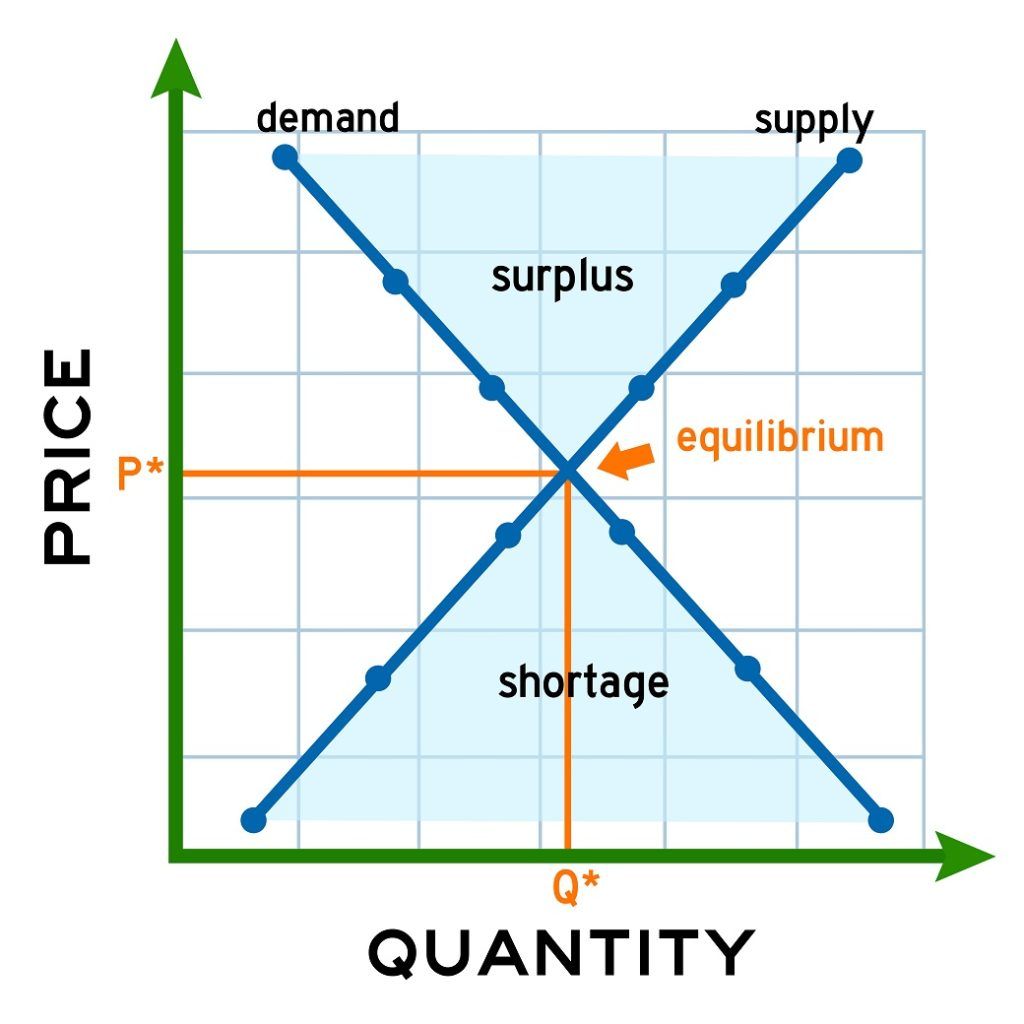

Macroeconomic implications of covid-19. Worth checking out Bloombergs Odd Lots podcast as theyve done a number of episodes on the supply chain over the last year. History demand shocks due to rapid industrialization have driven commodity price booms. Supply shocks move output and the price level in opposite directions while demand shocks generate price and output responses of the same sign. The Local Effects of New Housing in Low-Income Areas.

Source: pinterest.com

Source: pinterest.com

Guerrieri lorenzoni straub werning booth nwu harvard mit. The economic policy response to the COVID-19 pandemic requires understanding whether the crisis is a problem of supply or demand. Additionally monetary shocks lower the interest rate on impact. The Local Effects of New Housing in Low-Income Areas. Both prices of transactions and quantity supplied and consumed will move in the same direction as the aggregate demand.

Source: in.pinterest.com

Source: in.pinterest.com

New buildings decrease nearby rents by 5 to 7 percent relative to locations slightly farther away or developed later and they increase in-migration from low-income areas. The employment supply demand shock is computed similarly but using OSS ODS instead of OTS. Other commodity prices tend to be positively correlated with the price of oil although the strength of this correlation is weaker in the case of an oil supply shock than in the case of a demand shock. Aggregate demand shocks strongly predominate over supply shocks as driv-ers of price booms across a broad variety of commodities. The flatter steeper the supply curve is relative to the demand curve the weaker stronger the relative impact of a supply shock is on hours and the stronger weaker its impact is on real wages.

Source: pinterest.com

Source: pinterest.com

Lockdown measures preventing workers from doing their jobs can be seen as a supply shock. A perennial and fundamental macroeconomic question is whether financial crises are negative demand or supply shocks. What happened in the 70s truly was a supply shock. The core premise of their argument is that the surge in demand is not going to abate. The supply-side effect comes from the disruption of international supply chains aggravated by the fact that workers either through illness or social distancing cant do their jobs.

Source: pinterest.com

Source: pinterest.com

Demand shocks are factors that cause a temporary increase or decrease from the standard level of aggregate demand. The demand-side effect comes from the fact that idled workers have less money to spend and activities are curtailed by social distancing. Results are driven by a large supply effectwe. Additionally monetary shocks lower the interest rate on impact. Supply and demand shocks are.

Source: pinterest.com

Source: pinterest.com

Other demand shocks do not. Similarly a supply shock is distinct from a demand shock in that shocks to supply can have a long run effect on output but demand shocks are usually considered transient with zero effect on output in the long run. History demand shocks due to rapid industrialization have driven commodity price booms. Both prices of transactions and quantity supplied and consumed will move in the same direction as the aggregate demand. Economists often refer to this as the long run neutrality of money.

Source: in.pinterest.com

Source: in.pinterest.com

Demand shocks strongly affect prices for about 10 years while commodity supply shocks impact prices for roughly five years. As factories are shut down in China. Worth checking out Bloombergs Odd Lots podcast as theyve done a number of episodes on the supply chain over the last year. New buildings decrease nearby rents by 5 to 7. Supply Shock Versus Demand Shock.

Source: pinterest.com

Source: pinterest.com

Aggregate demand shocks strongly predominate over supply shocks as driv-ers of price booms across a broad variety of commodities. Both prices of transactions and quantity supplied and consumed will move in the same direction as the aggregate demand. New buildings decrease nearby rents by 5 to 7 percent relative to locations slightly farther away or developed later and they increase in-migration from low-income areas. Instead of computing how many workers may lose their jobs we can compute by how much paid wages will decrease. For each occupation we compute the total wage bill by multiplying the number of workers by the average wage.

Source: pinterest.com

Source: pinterest.com

Additionally monetary shocks lower the interest rate on impact. This perspective is inherently related to the concept of potential output. Supply Shock versus Demand Shock. Guerrieri lorenzoni straub werning booth nwu harvard mit. Economists often refer to this as the long run neutrality of money.

Source: pinterest.com

Source: pinterest.com

Both prices of transactions and quantity supplied and consumed will move in the same direction as the aggregate demand. Rare Supply-Demand Shocks. The employment supply demand shock is computed similarly but using OSS ODS instead of OTS. WP 20-07 - We study the local effects of new market-rate housing in low-income areas using microdata on large apartment buildings rents and migration. Demand shocks can last from a few days to several years.

Source: pinterest.com

Source: pinterest.com

COVID-19 has led to supply shortages of many basic essentials from paper products to hand sanitizer. Along with the loss of income which leads to the demand shock one needs to account for the widespread and long-lasting supply chain disruptions. Results are driven by a large supply effectwe. The demand-side effect comes from the fact that idled workers have less money to spend and activities are curtailed by social distancing. History demand shocks due to rapid industrialization have driven commodity price booms.

Source: pinterest.com

Source: pinterest.com

For each occupation we compute the total wage bill by multiplying the number of workers by the average wage. Can negative supply shocks cause demand shortages. Both prices of transactions and quantity supplied and consumed will move in the same direction as the aggregate demand. Demand shocks strongly affect prices for about 10 years while commodity supply shocks impact prices for roughly five years. The economic policy response to the COVID-19 pandemic requires understanding whether the crisis is a problem of supply or demand.

Source: pinterest.com

Source: pinterest.com

The supply-side effect comes from the disruption of international supply chains aggravated by the fact that workers either through illness or social distancing cant do their jobs. The supply-side effect comes from the disruption of international supply chains aggravated by the fact that workers either through illness or social distancing cant do their jobs. Instead of computing how many workers may lose their jobs we can compute by how much paid wages will decrease. A demand shock on the other hand reduces consumers ability or willingness to purchase goods and services at given prices. 5 One can thus identify labor supply and demand shocks given data on hours and wages and values for the elasticities.

Source: ar.pinterest.com

Source: ar.pinterest.com

Rare Supply-Demand Shocks. Instead of computing how many workers may lose their jobs we can compute by how much paid wages will decrease. But Chicago Booths Veronica Guerrieri says that what starts as a supply shock can become a demand shockand that the demand effects can grow larger than the supply shock that caused them. Can negative supply shocks cause demand shortages. WP 20-07 - We study the local effects of new market-rate housing in low-income areas using microdata on large apartment buildings rents and migration.

Source: pinterest.com

Source: pinterest.com

The coronavirus is delivering a one-two punch to the world economy laying it low for months to come and forcing investors to reprice equities and bonds to account for lower company earnings. Additionally monetary shocks lower the interest rate on impact. Similarly a supply shock is distinct from a demand shock in that shocks to supply can have a long run effect on output but demand shocks are usually considered transient with zero effect on output in the long run. A supply shock is any unexpected event that causes a dramatic change in future output. For each occupation we compute the total wage bill by multiplying the number of workers by the average wage.

Source: pinterest.com

Source: pinterest.com

A perennial and fundamental macroeconomic question is whether financial crises are negative demand or supply shocks. New buildings decrease nearby rents by 5 to 7 percent relative to locations slightly farther away or developed later and they increase in-migration from low-income areas. Demand shocks are factors that cause a temporary increase or decrease from the standard level of aggregate demand. WP 20-07 - We study the local effects of new market-rate housing in low-income areas using microdata on large apartment buildings rents and migration. Today demand is surging and supply is also growing but it just cant keep up with demand.

Source: pinterest.com

Source: pinterest.com

This is the first economic shock after the establishment of the modern monetary system that reduces both demand and supply simultaneously. Guerrieri lorenzoni straub werning booth nwu harvard mit. Supply and demand shocks are. Supply Shock versus Demand Shock. What happened in the 70s truly was a supply shock.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title demand shock vs supply shock by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.