Your Demand and supply diagram with tax images are ready. Demand and supply diagram with tax are a topic that is being searched for and liked by netizens now. You can Download the Demand and supply diagram with tax files here. Find and Download all free photos and vectors.

If you’re searching for demand and supply diagram with tax pictures information related to the demand and supply diagram with tax interest, you have pay a visit to the ideal blog. Our website frequently provides you with hints for refferencing the highest quality video and picture content, please kindly surf and locate more informative video content and graphics that fit your interests.

Demand And Supply Diagram With Tax. Plotting value and amount provide Market equilibrium Extra demand curves. Draw a supply-demand diagram for chocolate. A schematic heat demand-supply diagram for typical crude fractionation units like the one of Figure 1-1 is shown in Figure 3-1. On the diagram show the equilibrium before and after the imposition of a tax.

Understanding The Law Of Supply And Demand Economics Economic Science Basic Economics From pinterest.com

Understanding The Law Of Supply And Demand Economics Economic Science Basic Economics From pinterest.com

Taxes on supply and demand The VAT on the suppliers will shift the supply curve to the left symbolizing a reduction in supply similar to firms facing higher input costs. Use the diagram to find out the new equilibrium price and quantity. The supply curve may shift to the left because of. Thus with a a 20-cent tax. On the diagram show the equilibrium before and after the imposition of a tax. 4 Accept a diagram as an alternative to the last mark 2c Analyse using a demand and supply diagram the effect of an increase in demand for cars on the market for tyres.

C What is consumer surplus.

The supply-demand model combines two important concepts. In the diagram on the left demand is price inelastic. Demand and supply curves correctly labelled 1. AP is owned by the College Board which does not endorse this site or the above reviewStudy Questions1 Show supply demand with an equilibrium price and. Now identify areas corresponding to each of the following. In this diagram the supply curve shifts to the left.

Source: pinterest.com

Source: pinterest.com

Using a demand and supply diagram analyse the effect of introducing an indirect tax on a product on its equilibrium price and its equilibrium quantity. Price Quantity 0 S Price Quantity 0 S P Q The supply curve A random price and quantity shown on the supply. Each of these changes in demand will be shown as a shift in the demand curve. Calculate the revenue received by the firms. Taxes on supply and demand The VAT on the suppliers will shift the supply curve to the left symbolizing a reduction in supply similar to firms facing higher input costs.

Source: pinterest.com

Source: pinterest.com

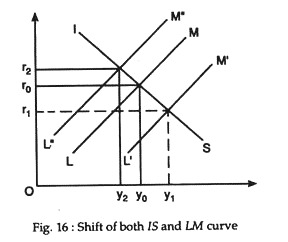

We may now consider a change in the conditions of demand such as a rise in the income of buyers. Here p 0 is the original equilibrium price and q 0 is the equilibrium quantity. While supply for the product has not changed all of the determinants of supply are the same producers incur higher cost which is why we will see a new equilibrium point further up the demand curve at a higher. A Show this in a demand and supply diagram. Total surplus before the tax.

Source: pinterest.com

Source: pinterest.com

Here p 0 is the original equilibrium price and q 0 is the equilibrium quantity. DEMAND SUPPLY AND ELASTICITY DIAGRAMS Price D Quantity 0 Price Quantity 0 D P Q Price Quantity 0 D1 D2 Price 0 D2 D1 An increase in demand A decrease in demand The demand curve A random price and quantity shown on the demand curve 1. The result is shown in Fig. - the wedge is driven between supply and demand from the top. As a result quantity decreases from Q1 to Q2 thus helping to reduce consumption as well as production of the goodservice.

Source: pinterest.com

Source: pinterest.com

If the government imposes a specific tax per unit of 3 plot the new supply curve on the original supply and demand diagram. Using a demand and supply diagram analyse the effect of introducing an indirect tax on a product on its equilibrium price and its equilibrium quantity. The imposition of the tax has caused the supply curve to shift to the left from SS to ST. Producer surplus after the tax. In the diagram on the left demand is price inelastic.

Source: pinterest.com

Source: pinterest.com

Producer surplus after the tax. First let us calculate the equilibrium price and equilibrium quantity that were before the imposed tax. Calculate the tax revenue received by the government indicate it on your diagram. DEMAND SUPPLY AND ELASTICITY DIAGRAMS Price D Quantity 0 Price Quantity 0 D P Q Price Quantity 0 D1 D2 Price 0 D2 D1 An increase in demand A decrease in demand The demand curve A random price and quantity shown on the demand curve 1. E Now assume that the governmentin an effort to discourage Spam production adds a 050 tax on Spam production.

Source: tr.pinterest.com

Source: tr.pinterest.com

This diagram shows a specific tax. The supply curve may shift to the left because of. Supply and Demand Shift Right. In this diagram the supply curve shifts to the left. It leads to a higher price and fall in quantity demand.

Source: pinterest.com

Source: pinterest.com

It helps us understand why and how prices change and what happens when the government intervenes in a market. Total surplus before the tax. Draw a supply-demand diagram for chocolate. This causes price to increase from P1 to P1. Use the diagram to find out the new equilibrium price and quantity.

Source: pinterest.com

Source: pinterest.com

D What is producer surplus. In this diagram supply and demand have shifted to the right. Cutting corporation tax to 17 percent. This causes price to increase from P1 to P1. Price Quantity 0 S Price Quantity 0 S P Q The supply curve A random price and quantity shown on the supply.

Source: pinterest.com

Source: pinterest.com

Supply and Demand Shift Right. Example of tax incidence. A tax of 6 causes the price to. Total surplus before the tax. The supply curve may shift to the left because of.

Source: id.pinterest.com

Source: id.pinterest.com

The demand-supply diagram a stream is represented by a curve. Taxes on supply and demand The VAT on the suppliers will shift the supply curve to the left symbolizing a reduction in supply similar to firms facing higher input costs. The tax incidence depends upon the relative elasticity of demand and supply. 16062020 The described provide and demand schedule and the excise tax imposed generates the availability and demand diagram featured beneath the place the yellow triangle represents the deadweight loss created by the imposition of the excise tax. Consumer surplus after the tax.

Source: pinterest.com

Source: pinterest.com

A Show this in a demand and supply diagram. The producer burden is the decline in revenue firms face after paying the tax. It is obvious that Q_D Q_S and we get. Draw a supply-demand diagram for chocolate. Now identify areas corresponding to each of the following.

Source: pinterest.com

Source: pinterest.com

Use the diagram to find out the new equilibrium price and quantity. DEMAND SUPPLY AND ELASTICITY DIAGRAMS Price D Quantity 0 Price Quantity 0 D P Q Price Quantity 0 D1 D2 Price 0 D2 D1 An increase in demand A decrease in demand The demand curve A random price and quantity shown on the demand curve 1. Cutting corporation tax to 17 percent. D What is producer surplus. In the diagram on the left demand is price inelastic.

Source: in.pinterest.com

Source: in.pinterest.com

It leads to a higher price and fall in quantity demand. Show the amount of deadweight loss created by this tax. As a result quantity decreases from Q1 to Q2 thus helping to reduce consumption as well as production of the goodservice. Calculate the revenue received by the firms. - the wedge is driven between supply and demand from the left-hand side.

Source: pinterest.com

Source: pinterest.com

It is obvious that Q_D Q_S and we get. AP is owned by the College Board which does not endorse this site or the above reviewStudy Questions1 Show supply demand with an equilibrium price and. Demand and supply curves correctly labelled 1. The producer burden is the decline in revenue firms face after paying the tax. Show the amount of deadweight loss created by this tax.

Source: pinterest.com

Source: pinterest.com

Use the diagram to find out the new equilibrium price and quantity. Example of tax incidence. We may now consider a change in the conditions of demand such as a rise in the income of buyers. Taxes have the ability to impact a consumers ability to afford a good but the type of tax impacts the change in demand. This diagram shows a specific tax.

Source: pinterest.com

Source: pinterest.com

6 marks Diagram showing a shift on the supply curve to the left and rise in price and fall in quantity. Price Quantity 0 S Price Quantity 0 S P Q The supply curve A random price and quantity shown on the supply. Show the amount of deadweight loss created by this tax. In new plant factories and technologies. The demand-supply diagram a stream is represented by a curve.

Source: pinterest.com

Source: pinterest.com

The imposition of the tax has caused the supply curve to shift to the left from SS to ST. 4 Accept a diagram as an alternative to the last mark 2c Analyse using a demand and supply diagram the effect of an increase in demand for cars on the market for tyres. First let us calculate the equilibrium price and equilibrium quantity that were before the imposed tax. The specific tax increases production costs for the firm and therefore supply decreases from S1 to S1tax. Supply and Demand Shift Right.

Source: pinterest.com

Source: pinterest.com

While supply for the product has not changed all of the determinants of supply are the same producers incur higher cost which is why we will see a new equilibrium point further up the demand curve at a higher. While supply for the product has not changed all of the determinants of supply are the same producers incur higher cost which is why we will see a new equilibrium point further up the demand curve at a higher. The producer burden is the decline in revenue firms face after paying the tax. E Now assume that the governmentin an effort to discourage Spam production adds a 050 tax on Spam production. Showing a subsidy on a demand and supply diagram is different from showing a tax because with a subsidy.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title demand and supply diagram with tax by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.