Your Decrease in money supply graph images are available in this site. Decrease in money supply graph are a topic that is being searched for and liked by netizens now. You can Get the Decrease in money supply graph files here. Get all royalty-free photos and vectors.

If you’re looking for decrease in money supply graph pictures information linked to the decrease in money supply graph topic, you have come to the right site. Our site frequently provides you with suggestions for downloading the maximum quality video and picture content, please kindly hunt and locate more informative video content and graphics that match your interests.

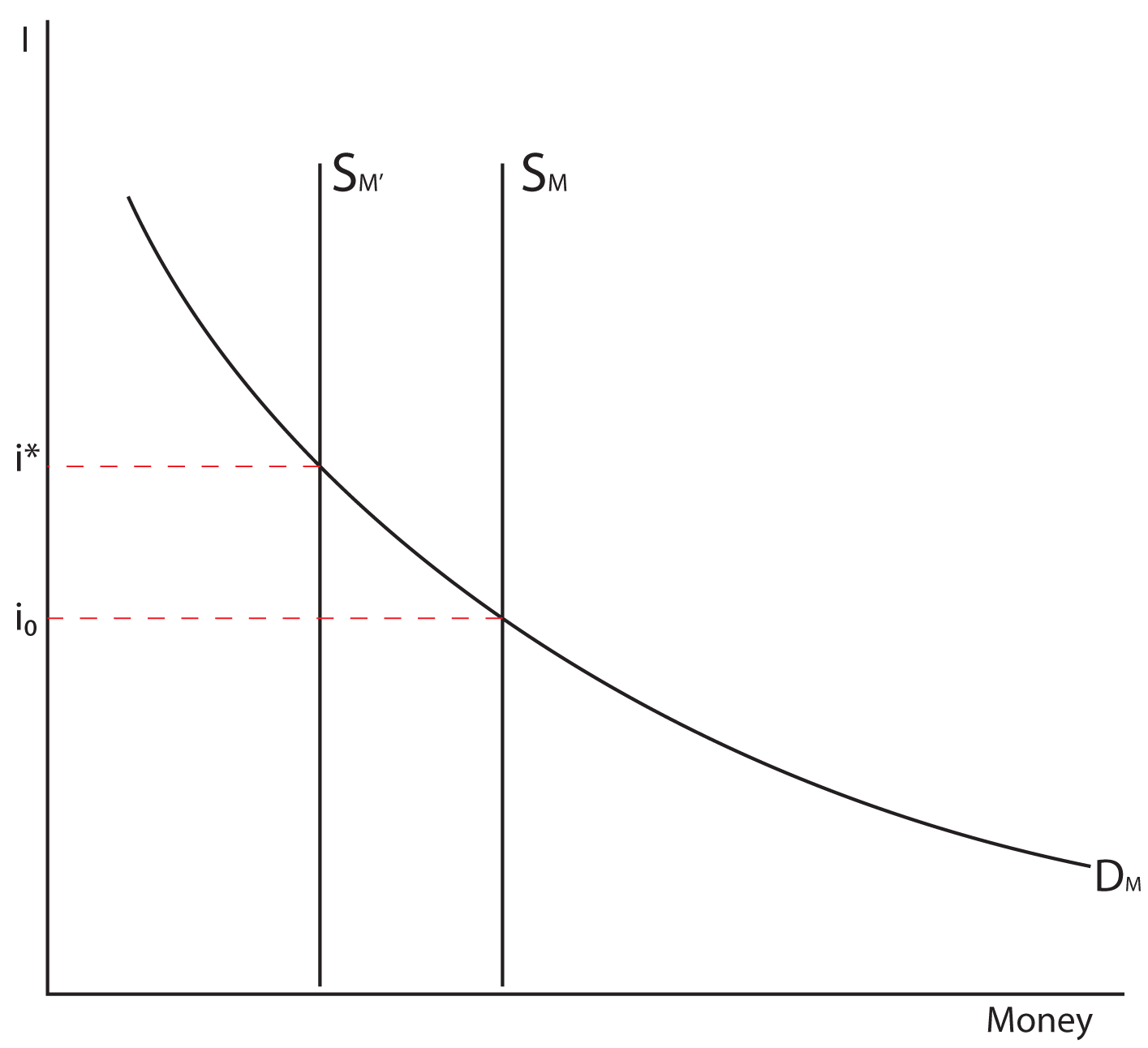

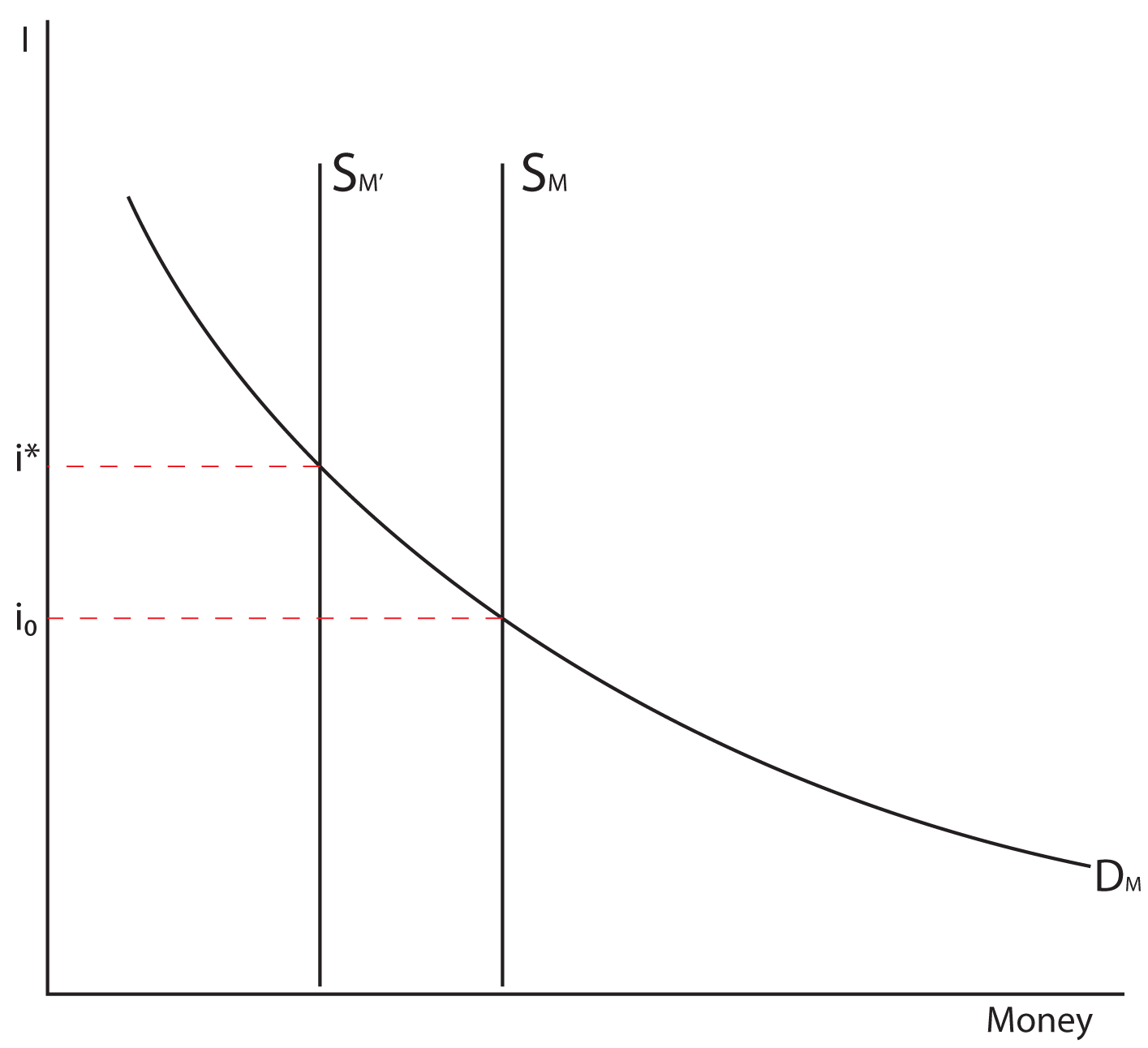

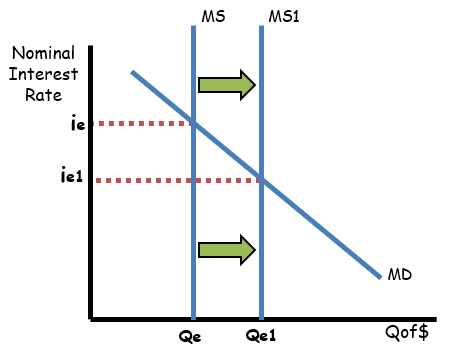

Decrease In Money Supply Graph. To keep output constant then it must decrease the money supply and increase interest rates further in order to offset the effect of the increase in investment demand. Initially this change decreases interest rates as seen on the money market graph. Then answer the multiple choice questions. Increase in demand decrease in supply.

Econ 151 Macroeconomics From courses.byui.edu

Econ 151 Macroeconomics From courses.byui.edu

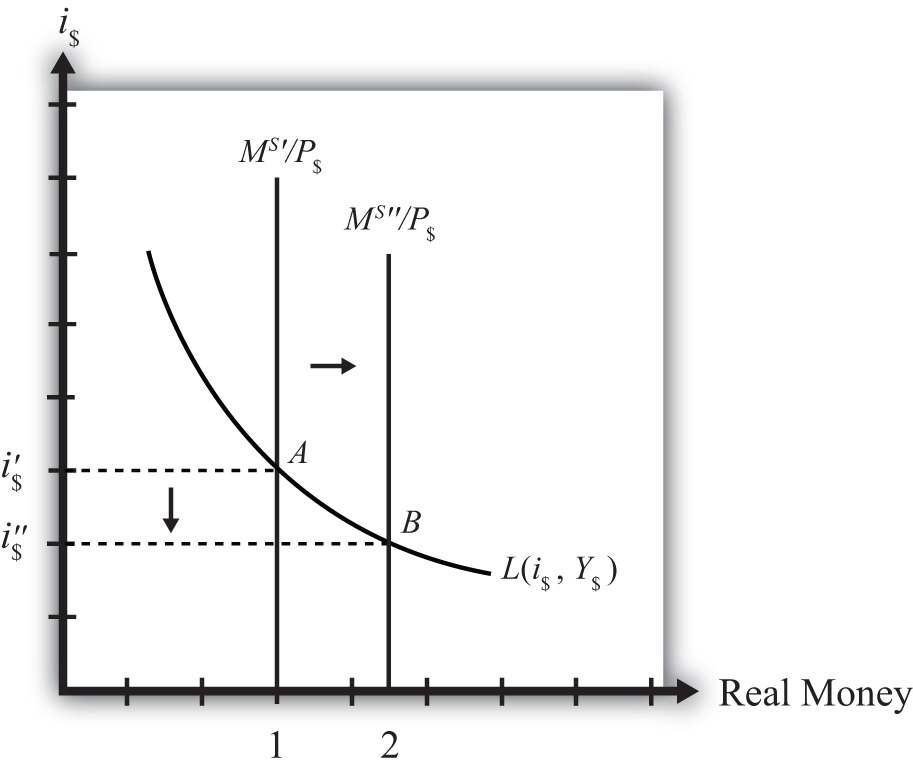

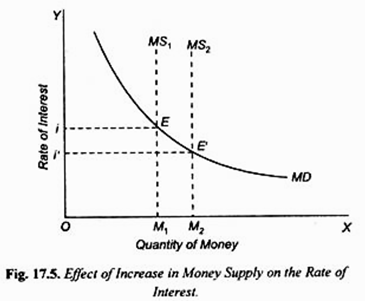

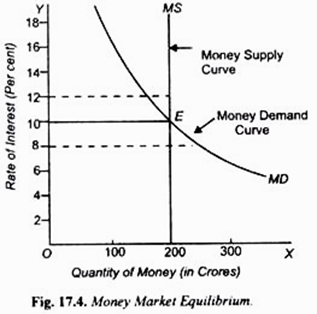

Decrease the supply of money and decrease aggregate demand Increase productivity and increase aggregate supply Refer to the graphs above in which the numbers in parentheses near the AD1 AD2 and AD3 labels indicate the levels of investment spending associated with each curve. Increase in demand decrease in supply. If the money supply increases decreases ceteris paribus the interest rate is lower higher at each level of Y or in other words the LM curve shifts right left. The equilibrium interest rate. Thus with an interest-sensitive money supply the slope of the LM curve is flatter than otherwise. This is shown in LM diagram of Fig.

In addition the decrease in the money supply will lead to a decrease in consumer spending.

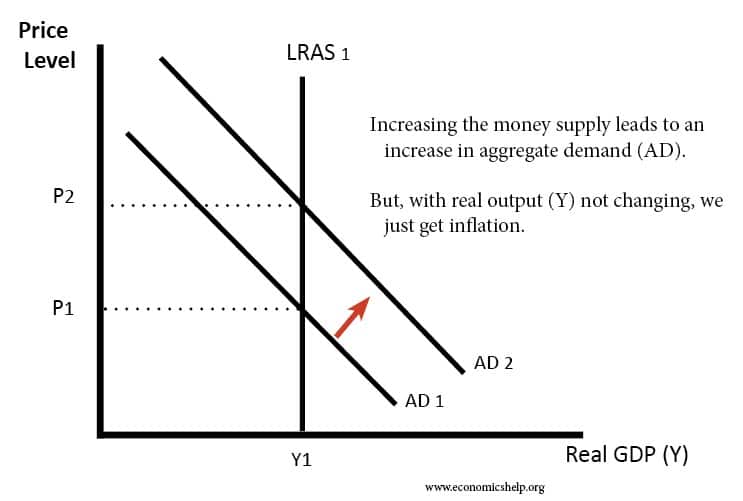

If there is an increase in supply with a given demand curve there will be excess supply in the market. Increased money supply causes reduction in interest rates and further spending and therefore an increase in AD. This is shown on the right-hand side of the diagram above. This is shown in LM diagram of Fig. The graph below depicts the market for money in the United States. So the interest rate falls rises and LM curves shifts up down by the amount of_____ But the fall in interest rate in turn has ramifications for the goods market.

A decrease in a countrys money supply causes its currency to appreciate. On the following graph shift the curve or drag the blue point along the curve or do both to show the long-run effects of the decrease in the money supply. Thus the interest elasticity of the money supply reduces the increase in i from i 1 i 0 to i 2 i 0 needed to maintain money market equilibrium with a given increase in Y from Y 0 to Y 1 in Fig. Due to the price fall the. Prices too far below 500 can increase demand and lead to a product shortage.

Source: study.com

Source: study.com

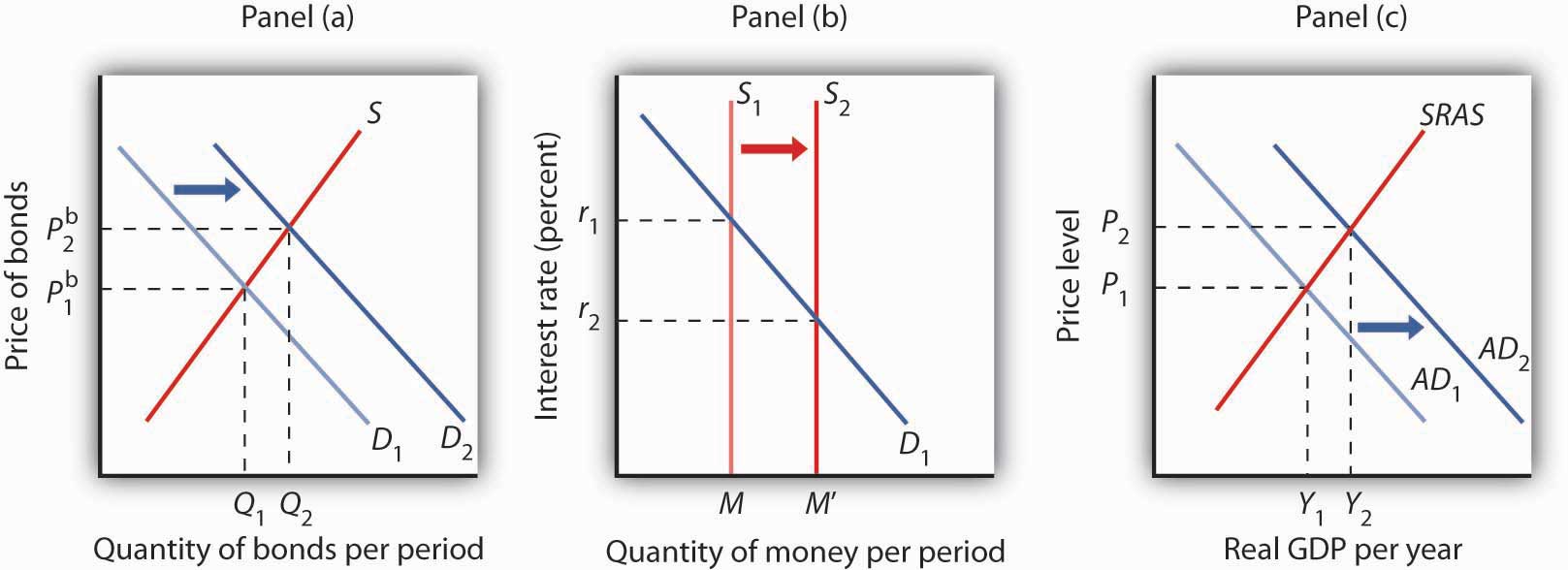

A decrease in the supply of a currency shifts the curve leftward causing the exchange rate and the value of the currency to rise. If there is an increase in supply with a given demand curve there will be excess supply in the market. That is because at any given level of output Y more money less money means a lower higher interest rate. The contractionary monetary policy means that the Fed sells bondsa rightward shift of the bond supply curve in Panel b which decreases the money supplyas shown by a leftward shift in the money supply curve in Panel c. Thus the interest elasticity of the money supply reduces the increase in i from i 1 i 0 to i 2 i 0 needed to maintain money market equilibrium with a given increase in Y from Y 0 to Y 1 in Fig.

Source: saylordotorg.github.io

Source: saylordotorg.github.io

This is shown in LM diagram of Fig. Money Supply M0 in the United States averaged 94566026 USD Million from 1959 until 2021 reaching an all time high of 6394800 USD Million in November of 2021 and a record low of 48400 USD Million in February of 1961. This increases the quantity of investment shown on the investment demand graph which increases aggregate demand. The equilibrium interest rate. If output remains unchanged then on the money market the money demand curve_____ and money supply curve _____.

Source: courses.byui.edu

Source: courses.byui.edu

The contractionary monetary policy means that the Fed sells bondsa rightward shift of the bond supply curve in Panel b which decreases the money supplyas shown by a leftward shift in the money supply curve in Panel c. In addition the decrease in the money supply will lead to a decrease in consumer spending. Conversely if the Fed wants to decrease the money supply it sells bonds from its account thus taking in cash and removing money from the. Thus with an interest-sensitive money supply the slope of the LM curve is flatter than otherwise. An overall decrease in price but a decrease in equilibrium in quantity.

Source: www2.harpercollege.edu

Source: www2.harpercollege.edu

In Panel b we see that the price of bonds falls and in Panel c that the interest rate rises. Suppose the money supply rises by. If output remains unchanged then on the money market the money demand curve_____ and money supply curve _____. Money Supply M0 in the United States averaged 94566026 USD Million from 1959 until 2021 reaching an all time high of 6394800 USD Million in November of 2021 and a record low of 48400 USD Million in February of 1961. The contractionary monetary policy means that the Fed sells bondsa rightward shift of the bond supply curve in Panel b which decreases the money supplyas shown by a leftward shift in the money supply curve in Panel c.

Source: economicsdiscussion.net

Source: economicsdiscussion.net

This decrease will shift the aggregate demand curve to the left. Initially this change decreases interest rates as seen on the money market graph. If the money supply increases decreases ceteris paribus the interest rate is lower higher at each level of Y or in other words the LM curve shifts right left. Changes in the Money Supply An increase in a countrys money supply causes its currency to depreciate. Conversely if the Fed wants to decrease the money supply it sells bonds from its account thus taking in cash and removing money from the.

Source: steemit.com

Source: steemit.com

Due to the price fall the. If the increase in demand is less than the decrease in supply the shift of the demand curve tends to be less than that of the supply curve. This decrease will shift the aggregate demand curve to the left. Assume that the Federal Reserve has complete control over the money supply. In addition the decrease in the money supply will lead to a decrease in consumer spending.

Source: economicsdiscussion.net

Source: economicsdiscussion.net

Changes in the money supply dont affect the interest rate at all. In addition the decrease in the money supply will lead to a decrease in consumer spending. Therefore the interest rate must increase to dissuade some people from holding money. Thus the interest elasticity of the money supply reduces the increase in i from i 1 i 0 to i 2 i 0 needed to maintain money market equilibrium with a given increase in Y from Y 0 to Y 1 in Fig. These statements are based on the policy experiment in which we.

Initially this change decreases interest rates as seen on the money market graph. This Demonstration shows the implications for the economy if the money supply is increased. If output remains unchanged then on the money market the money demand curve_____ and money supply curve _____. The contractionary monetary policy means that the Fed sells bondsa rightward shift of the bond supply curve in Panel b which decreases the money supplyas shown by a leftward shift in the money supply curve in Panel c. This decrease will shift the aggregate demand curve to the left.

Source: economicshelp.org

Source: economicshelp.org

8 O 5 INF LATION RATE Percent 1 0 0 3 6 9 15 18 12 UNEMPLOYMENT RATE Percent in the inflation rate and in the unemployment rate In the long run the decrease in the money supply. In Panel b we see that the price of bonds falls and in Panel c that the interest rate rises. Hence both equilibrium quantity and price rise. 41 Votes The decrease in the money supply is mirrored by an equal decrease in the nominal output otherwise known as Gross Domestic Product GDP. Prices too far below 500 can increase demand and lead to a product shortage.

Source: slideplayer.com

Source: slideplayer.com

If output remains unchanged then on the money market the money demand curve_____ and money supply curve _____. Aggregate Demand and Supply with Money Supply Increase. If the money supply increases decreases ceteris paribus the interest rate is lower higher at each level of Y or in other words the LM curve shifts right left. In Panel b we see that the price of bonds falls and in Panel c that the interest rate rises. The contractionary monetary policy means that the Fed sells bondsa rightward shift of the bond supply curve in Panel b which decreases the money supplyas shown by a leftward shift in the money supply curve in Panel c.

Source: economics.stackexchange.com

Source: economics.stackexchange.com

Assume that the Federal Reserve has complete control over the money supply. In this example the lines from the supply curve and the demand curve indicate that the equilibrium price for 50-inch HDTVs is 500. Prices too high above 500 can decrease demand and lead to a product surplus. If output remains unchanged then on the money market the money demand curve_____ and money supply curve _____. Thus with an interest-sensitive money supply the slope of the LM curve is flatter than otherwise.

Source: youtube.com

Source: youtube.com

The decrease in the money supply will lead to a decrease in consumer spending. In Panel b we see that the price of bonds falls and in Panel c that the interest rate rises. In this case the right shift of the demand curve is proportionately more than the leftward shift of the supply curve. Suppose the money supply rises by. Assume that the Federal Reserve has complete control over the money supply.

Source: snssri.org

Source: snssri.org

Due to excess supply the price of the product goes down. In Panel b we see that the price of bonds falls and in Panel c that the interest rate rises. If the increase in demand is less than the decrease in supply the shift of the demand curve tends to be less than that of the supply curve. Aggregate Demand and Supply with Money Supply Increase. This increases the quantity of investment shown on the investment demand graph which increases aggregate demand.

Source: financetrain.com

Source: financetrain.com

Suppose the money supply rises by. In this example the lines from the supply curve and the demand curve indicate that the equilibrium price for 50-inch HDTVs is 500. This Demonstration shows the implications for the economy if the money supply is increased. Prices too far below 500 can increase demand and lead to a product shortage. Module 29 explained that in the long run its a different story.

Source: college.cengage.com

Source: college.cengage.com

If the money supply increases decreases ceteris paribus the interest rate is lower higher at each level of Y or in other words the LM curve shifts right left. A decrease in a countrys money supply causes its currency to appreciate. When the Fed decreases the money supply the LM curve will shift up and to the left. SR Philips Curve INFLATION RATE Percent 2 1 1 SR Philips Curve In the short run an unexpected decrease in the money supply results in unemployment rate in the inflation rate and in the On the following graph shit the curve or drag the blue point along the curve or do both to show the long-run effects of the decrease in the money supply INFLATION RATE Percent 15 12 UNEMPLOYMENT. An overall decrease in price but a decrease in equilibrium in quantity.

Source: economicshelp.org

Source: economicshelp.org

Initially this change decreases interest rates as seen on the money market graph. Module 29 explained that in the long run its a different story. In Panel b we see that the price of bonds falls and in Panel c that the interest rate rises. That is because at any given level of output Y more money less money means a lower higher interest rate. The decrease in the money supply is mirrored by an equal decrease in the nominal output otherwise known as Gross Domestic Product GDP.

Source: 2012books.lardbucket.org

Source: 2012books.lardbucket.org

465 2909 Views. Aggregate Demand and Supply with Money Supply Increase. A decrease in the supply of a currency shifts the curve leftward causing the exchange rate and the value of the currency to rise. 8 O 5 INF LATION RATE Percent 1 0 0 3 6 9 15 18 12 UNEMPLOYMENT RATE Percent in the inflation rate and in the unemployment rate In the long run the decrease in the money supply. When the Fed decreases the money supply there is a shortage of money at the prevailing interest rate.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title decrease in money supply graph by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.