Your Calculating elasticity from regression coefficients images are ready. Calculating elasticity from regression coefficients are a topic that is being searched for and liked by netizens now. You can Get the Calculating elasticity from regression coefficients files here. Find and Download all royalty-free photos.

If you’re looking for calculating elasticity from regression coefficients images information connected with to the calculating elasticity from regression coefficients interest, you have come to the ideal blog. Our website frequently gives you hints for viewing the maximum quality video and image content, please kindly hunt and find more informative video content and graphics that fit your interests.

Calculating Elasticity From Regression Coefficients. Involves calculating the percentage change of price and quantity with respect to an average of the two points. In economics elasticity is a. Eg if Qd elasticity is -1 or cross price elasticity is 34 etc depending. To calculate Price Elasticity of Demand we use the formula.

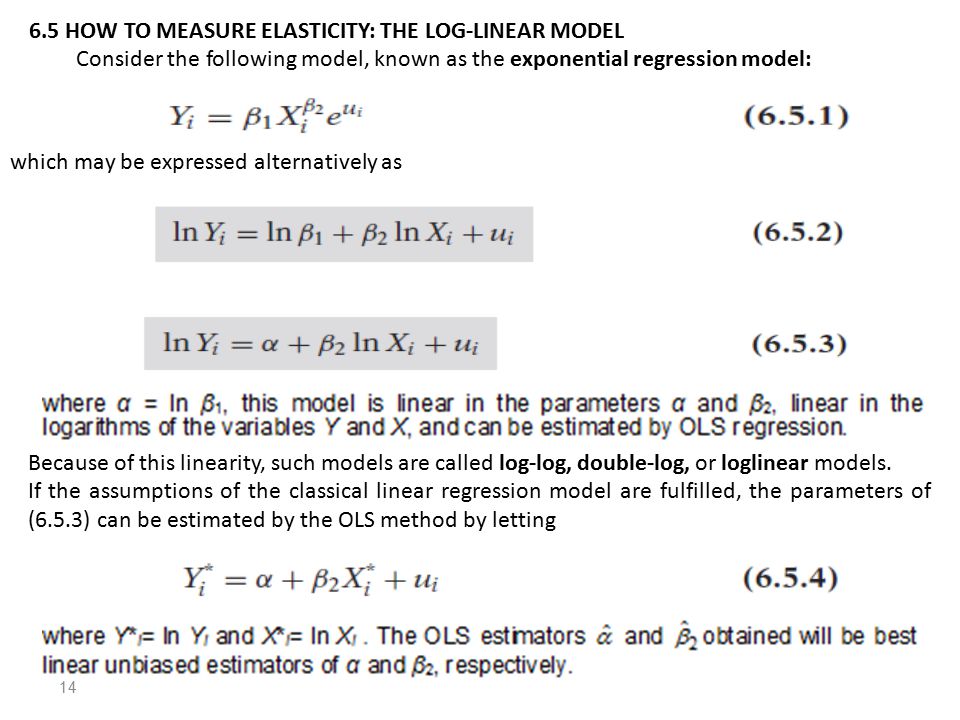

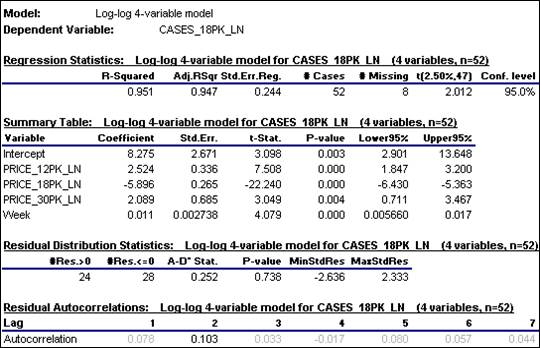

Linear Regression Model Ppt Video Online Download From slideplayer.com

Linear Regression Model Ppt Video Online Download From slideplayer.com

Elasticities have served economics for a. Remember that all OLS regression lines will go through the point of means. So if you would only care about semi-elasticity you will already get your result from your original model as in your case semi elasticity of wages with respect to age is beta_22beta_3age_i. Mathlog Ya b log X math and the elasticity is. A method of calculating elasticity between two points. Income Elasticity of Demand Income Elasticity of Demand Percentage change in quantity Percentage change in income Q A - Q BQ A Q B2 I A - I BI A I B2 Income elasticity I Q û I ûQ I û I û Q Income and Corn Income change 200 to 400 Corn quantity change 5 to 9 What is arc income elasticity of demand.

Income Elasticity of Demand Income Elasticity of Demand Percentage change in quantity Percentage change in income Q A - Q BQ A Q B2 I A - I BI A I B2 Income elasticity I Q û I ûQ I û I û Q Income and Corn Income change 200 to 400 Corn quantity change 5 to 9 What is arc income elasticity of demand.

Elasticities have served economics for a. At this point is the greatest weight of the data used to estimate the coefficient. Remember that all OLS regression lines will go through the point of means. Mathlog Ya b log X math and the elasticity is. Going back to the demand for gasoline. B What is the forecasted demand for hamburger when Ph is 100 Pc is 120 A is 5000 and I is 20000.

Source: researchgate.net

Source: researchgate.net

Assuming all of you variables are measured in log form. Last updated almost 4 years ago. This means that an increase in the price. That is x 2 x 1 is a vector of 0 s and a single 1 in. Therefore we have PE -1612 44330 -238.

Source: stats.stackexchange.com

Source: stats.stackexchange.com

X 2 β two fitted means where the design matrix row vectors x 1 and x 2 differ in that one dummy flips from 0 in x 1 to 1 in x 2. Eg if Qd elasticity is -1 or cross price elasticity is 34 etc depending. All the beta coefficients are already semi-elasticities as also pointed out by chan1142. Assume we have μ 1 exp. Qh 2052 - 200Ph 100Pc 0023A 00005I.

Source: slidetodoc.com

Source: slidetodoc.com

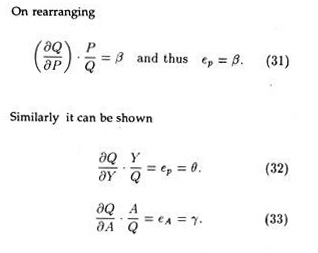

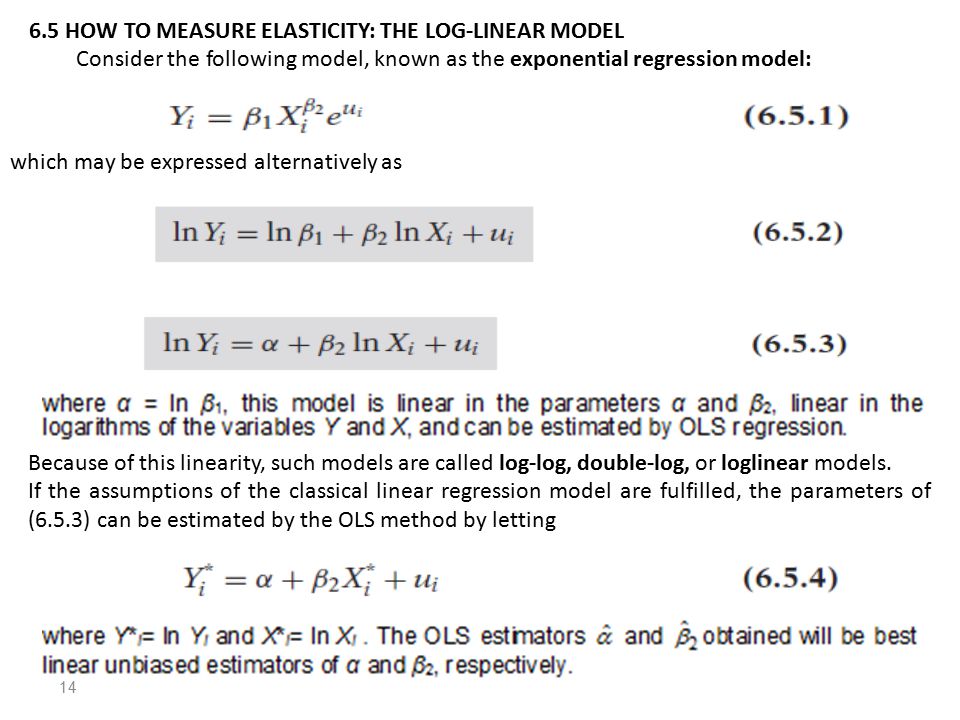

In log log model the coefficients such as b1 b2 show the elasticizes you can interpret the betas just like elasticity. Qh 2052 - 200Ph 100Pc 0023A 00005I. So if you would only care about semi-elasticity you will already get your result from your original model as in your case semi elasticity of wages with respect to age is beta_22beta_3age_i. Mathepsilon frac bY Xfrac X Y b math Depending on your regression equation the elasticity is therefore either the estimated coefficient double log the coefficient multiplied divided by the left-hand variable linear-log multiplied by the right-hand variable log-linear or the fraction of. This gives the formula dlog f dlog f dx_i —– —– —- dlog x_i dx_i dlog x_i Because dlog x_idx_i 1x_i we have.

Along a straight-line demand curve the percentage change thus elasticity changes continuously as the scale changes while the slope the estimated regression coefficient remains constant. Eg if Qd elasticity is -1 or cross price elasticity is 34 etc depending. Income Elasticity of Demand Income Elasticity of Demand Percentage change in quantity Percentage change in income Q A - Q BQ A Q B2 I A - I BI A I B2 Income elasticity I Q û I ûQ I û I û Q Income and Corn Income change 200 to 400 Corn quantity change 5 to 9 What is arc income elasticity of demand. Remember that all OLS regression lines will go through the point of means. Assume we have μ 1 exp.

Source: researchgate.net

Source: researchgate.net

E Elasticity Q Quantity Demanded P Price t time b0 constant b1 coefficient slope See the breakdown for elasticity here. B What is the forecasted demand for hamburger when Ph is 100 Pc is 120 A is 5000 and I is 20000. That is x 2 x 1 is a vector of 0 s and a single 1 in. Multiplying the slope times provides an elasticity measured in percentage terms. Price elasticity of demand is a measure used in economics to show the responsiveness or elasticity of the quantity demanded of a good or service to a change in its price when nothing but the price changesMore precisely it gives the percentage change in quantity demanded in response to a one percent change in price.

Source: slidetodoc.com

Source: slidetodoc.com

A How might we interpret the coefficients in the estimated regression. I attempt to estimate elasticities based on the equation e ME. Percentage change in the quantity supplied divided by the percentage change in price. To determine PQ we will use the mean Price 443 and mean Sales 30. X 1 β and μ 2 exp.

Source: slidetodoc.com

Source: slidetodoc.com

A 1 increase in x1 will result in y increase by the coefficient on your x1 variable measured on levels plus 2 times the coefficient of you x1 variable measured in squares holding x2 fixed. I attempt to estimate elasticities based on the equation e ME. Therefore we have PE -1612 44330 -238. Remember that all OLS regression lines will go through the point of means. Assuming all of you variables are measured in log form.

To calculate Price Elasticity of Demand we use the formula. This means that an increase in the price. All the beta coefficients are already semi-elasticities as also pointed out by chan1142. My question is when running a least squares regression using EViews would I run a regression with my Y. To calculate Price Elasticity of Demand we use the formula.

Source: economicsdiscussion.net

Source: economicsdiscussion.net

Price elasticity of demand is a measure used in economics to show the responsiveness or elasticity of the quantity demanded of a good or service to a change in its price when nothing but the price changesMore precisely it gives the percentage change in quantity demanded in response to a one percent change in price. Income Elasticity of Demand Income Elasticity of Demand Percentage change in quantity Percentage change in income Q A - Q BQ A Q B2 I A - I BI A I B2 Income elasticity I Q û I ûQ I û I û Q Income and Corn Income change 200 to 400 Corn quantity change 5 to 9 What is arc income elasticity of demand. To calculate Price Elasticity of Demand we use the formula. My income variable is represented by X 2. Remember that all OLS regression lines will go through the point of means.

Source: slideplayer.com

Source: slideplayer.com

My question is when running a least squares regression using EViews would I run a regression with my Y. Assuming all of you variables are measured in log form. Assume we have μ 1 exp. By Enrique Saldarriaga This post aims to show how elasticities can be estimated directly from linear regressions. Along a straight-line demand curve the percentage change thus elasticity changes continuously as the scale changes while the slope the estimated regression coefficient remains constant.

Source: slidetodoc.com

Source: slidetodoc.com

Price elasticity of demand is a measure used in economics to show the responsiveness or elasticity of the quantity demanded of a good or service to a change in its price when nothing but the price changesMore precisely it gives the percentage change in quantity demanded in response to a one percent change in price. Elasticities have served economics for a. As we might know from the Part 1 of this article price elasticity calculation is the following. PE ΔQΔP PQ ΔQΔP is determined by the coefficient -1612 in our regression formula. To determine PQ we will use the mean Price 443 and mean Sales 30.

Source: slidetodoc.com

Source: slidetodoc.com

Elasticity is calculated from the following functional formsY a bXlnY a blnXInY a bXIf this video helps please consider a donation. Remember that all OLS regression lines will go through the point of means. Last updated almost 4 years ago. In economics elasticity is a. This means that an increase in the price.

Last updated almost 4 years ago. B What is the forecasted demand for hamburger when Ph is 100 Pc is 120 A is 5000 and I is 20000. All the beta coefficients are already semi-elasticities as also pointed out by chan1142. In log log model the coefficients such as b1 b2 show the elasticizes you can interpret the betas just like elasticity. I am attempting to understand coefficient elasticity and have tried to hand calculate an elasticity by hand and then compare it to results produced by Statas margins eyex command.

Source: stats.stackexchange.com

Source: stats.stackexchange.com

In economics elasticity is a. Comments Hide Toolbars. Income Elasticity Example 085. Assume we have μ 1 exp. X 1 β and μ 2 exp.

Source: slideplayer.com

Source: slideplayer.com

Assuming all of you variables are measured in log form. Price elasticity of demand is a measure used in economics to show the responsiveness or elasticity of the quantity demanded of a good or service to a change in its price when nothing but the price changesMore precisely it gives the percentage change in quantity demanded in response to a one percent change in price. PE ΔQΔP PQ ΔQΔP is determined by the coefficient -1612 in our regression formula. A How might we interpret the coefficients in the estimated regression. Elasticities have served economics for a.

Source: people.duke.edu

Source: people.duke.edu

Multiplying the slope times provides an elasticity measured in percentage terms. Comments Hide Toolbars. Multiplying the slope times provides an elasticity measured in percentage terms. Below is my Stata do file followed by output. Mathepsilon frac bY Xfrac X Y b math Depending on your regression equation the elasticity is therefore either the estimated coefficient double log the coefficient multiplied divided by the left-hand variable linear-log multiplied by the right-hand variable log-linear or the fraction of.

Source: youtube.com

Source: youtube.com

I attempt to estimate elasticities based on the equation e ME. Mathepsilon frac bY Xfrac X Y b math Depending on your regression equation the elasticity is therefore either the estimated coefficient double log the coefficient multiplied divided by the left-hand variable linear-log multiplied by the right-hand variable log-linear or the fraction of. Price elasticity of demand is a measure used in economics to show the responsiveness or elasticity of the quantity demanded of a good or service to a change in its price when nothing but the price changesMore precisely it gives the percentage change in quantity demanded in response to a one percent change in price. To calculate Price Elasticity of Demand we use the formula. Therefore we have PE -1612 44330 -238.

Source: slideplayer.com

Source: slideplayer.com

To determine PQ we will use the mean Price 443 and mean Sales 30. All the beta coefficients are already semi-elasticities as also pointed out by chan1142. Assume we have μ 1 exp. Therefore we have PE -1612 44330 -238. Eg if Qd elasticity is -1 or cross price elasticity is 34 etc depending.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title calculating elasticity from regression coefficients by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.